عالميًا: الأسهم الفردية - اختيار الرابحين والخاسرين

أهداف تعلم الدرس:

- Learn the benefits and risks of investing in individual stocks. You’ll understand how stock-picking gives you control and the potential for higher rewards, but also comes with more risk and the need for careful research.

- Understand what ETFs are and how they offer easy diversification. You’ll see how ETFs give access to many assets in one investment and why they’re a low-cost, flexible option for many investors.

- Explore mutual funds and how professional management can help or hurt performance. You’ll learn how mutual funds work, their advantages in access and management, and their drawbacks like higher fees and limited trading flexibility.

- Gain insights into index investing as a long-term strategy. You’ll understand why tracking a whole market index can provide steady growth, low fees, and lower risk over time.

- See how ETFs can be used for building a full portfolio. You’ll discover how ETFs allow easy access to different sectors and asset classes, helping you customize a low-cost, diversified investment strategy.

A. Individual Stocks: Picking the Winners and Losers

الأسهم الفردية allow investors to own a share of a single company. This approach can be highly rewarding but also carries significant risks, as the performance of a single stock can be volatile and unpredictable.

الايجابيات:

- إمكانات نمو عالية: Individual stocks can provide significant returns if a company performs well.

- Control over investments: Investors can choose specific companies they believe will outperform the market.

- توزيعات الأرباح: Many companies pay dividends, offering a steady income stream to shareholders.

سلبيات:

- High risk: Stock prices can be highly volatile, and poor company performance can lead to significant losses.

- يتطلب البحث: Successful stock picking requires extensive research and knowledge of the company, industry, and market conditions.

- Lack of diversification: Investing in individual stocks means you’re putting all your eggs in one basket, increasing the risk if the stock underperforms.

شكل: Investing in Individual Stocks

وصف:

This pie chart highlights the five key factors associated with investing in individual stocks: potential for higher returns, increased risk, research and analysis, تنويع، و choosing the best option. Each section represents an essential aspect investors should consider when making decisions about individual stocks.

الماخذ الرئيسية:

- إمكانية تحقيق عوائد أعلى is a significant advantage of investing in individual stocks.

- ارتفاع الخطر is inherent in individual stock investments, requiring careful management.

- Research and analysis are crucial to understanding individual stock performance and market conditions.

- تنويع helps reduce risk by balancing investments across different stocks.

- Selecting the best option involves evaluating stocks based on performance, risk, and market trends.

تطبيق المعلومات:

Investors can use this information to understand the benefits and challenges of investing in individual stocks. By focusing on research and diversification, they can manage risks بينما تهدف إلى عوائد أعلى. This framework aids in creating a balanced stock portfolio tailored to an investor’s تحمل المخاطر and financial goals.

B. Exchange-Traded Funds (ETFs): Harnessing the Power of Diversification

صناديق الاستثمار المتداولة are investment funds that trade on stock exchanges, offering exposure to a basket of securities. They can include stocks, bonds, commodities, or a combination of assets, making them a popular choice for diversification.

الايجابيات:

- تنويع: ETFs allow investors to own a broad range of assets, reducing risk by spreading exposure across multiple companies or sectors.

- السيولة: ETFs are traded throughout the day on exchanges, making them highly liquid and easy to buy or sell.

- Low costs: ETFs generally have lower expense ratios compared to mutual funds, making them cost-efficient.

- الشفافية: ETFs usually track a specific index or asset, making it easy for investors to understand what they’re investing in.

سلبيات:

- Market risk: While ETFs are diversified, they still reflect the overall market movements, so they can lose value if the entire market declines.

- Lower growth potential: Because ETFs are diversified, they may not offer the same growth potential as high-performing individual stocks.

- Trading fees: Frequent buying and selling of ETFs can incur trading fees, reducing overall returns.

Important Terms to Know:

- نسبة النفقات: The annual fee charged by an ETF to cover management and operational costs.

- متابعة الخطأ: The difference between the performance of the ETF and the index it tracks.

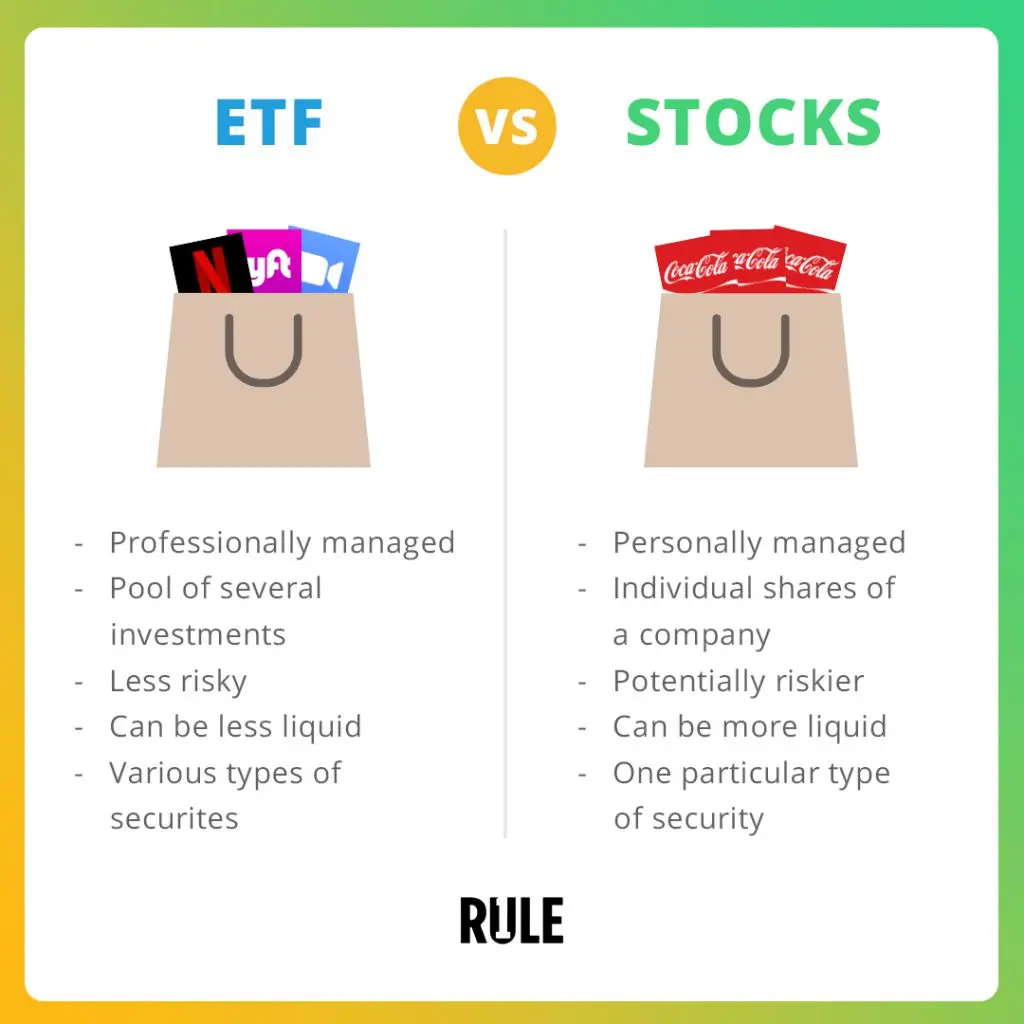

شكل: ETF vs. Stocks

وصف:

This image compares ETFs (Exchange-Traded Funds) و مخازن. ETFs represent a professionally managed pool of various investments, making them less risky and more diversified, although they can be less liquid. In contrast, stocks are personally managed investments in individual companies, offering potential for higher gains but with greater risks and better liquidity.

الماخذ الرئيسية:

- صناديق الاستثمار المتداولة are diversified, professionally managed, and generally less risky, but they may offer lower liquidity compared to stocks.

- مخازن involve investing in specific companies, offering potentially higher returns with higher risks و better liquidity.

- ETFs contain various securities, while stocks focus on one company at a time.

تطبيق المعلومات:

فهم الاختلافات بين صناديق الاستثمار المتداولة و مخازن helps investors make informed decisions based on their تحمل المخاطر and investment goals. Those seeking diversification and lower risks may prefer ETFs, while investors aiming for potentially higher returns might focus on individual stocks.

C. Mutual Funds: Letting the Pros Manage Your Money

صناديق الاستثمار pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are actively managed by professional fund managers who aim to outperform the market.

الايجابيات:

- الإدارة المهنية: Mutual funds are managed by experienced professionals who make investment decisions on behalf of investors.

- تنويع: Like ETFs, mutual funds invest in a variety of assets, reducing risk through diversification.

- Access to a wide range of assets: Mutual funds provide exposure to a wide range of securities, including stocks, bonds, and other assets that may be difficult for individual investors to access.

سلبيات:

- رسوم أعلى: Mutual funds typically have higher expense ratios due to active management, which can reduce overall returns.

- Less flexibility: Mutual funds are bought and sold at the end of the trading day, so investors cannot take advantage of intraday price movements.

- Underperformance risk: Actively managed funds do not always outperform the market, and in some cases, they can underperform passive investments like ETFs.

Important Terms to Know:

- Net Asset Value (NAV): The per-share value of the mutual fund, calculated at the end of each trading day.

- Load Fees: A commission or sales charge applied when buying or selling mutual fund shares.

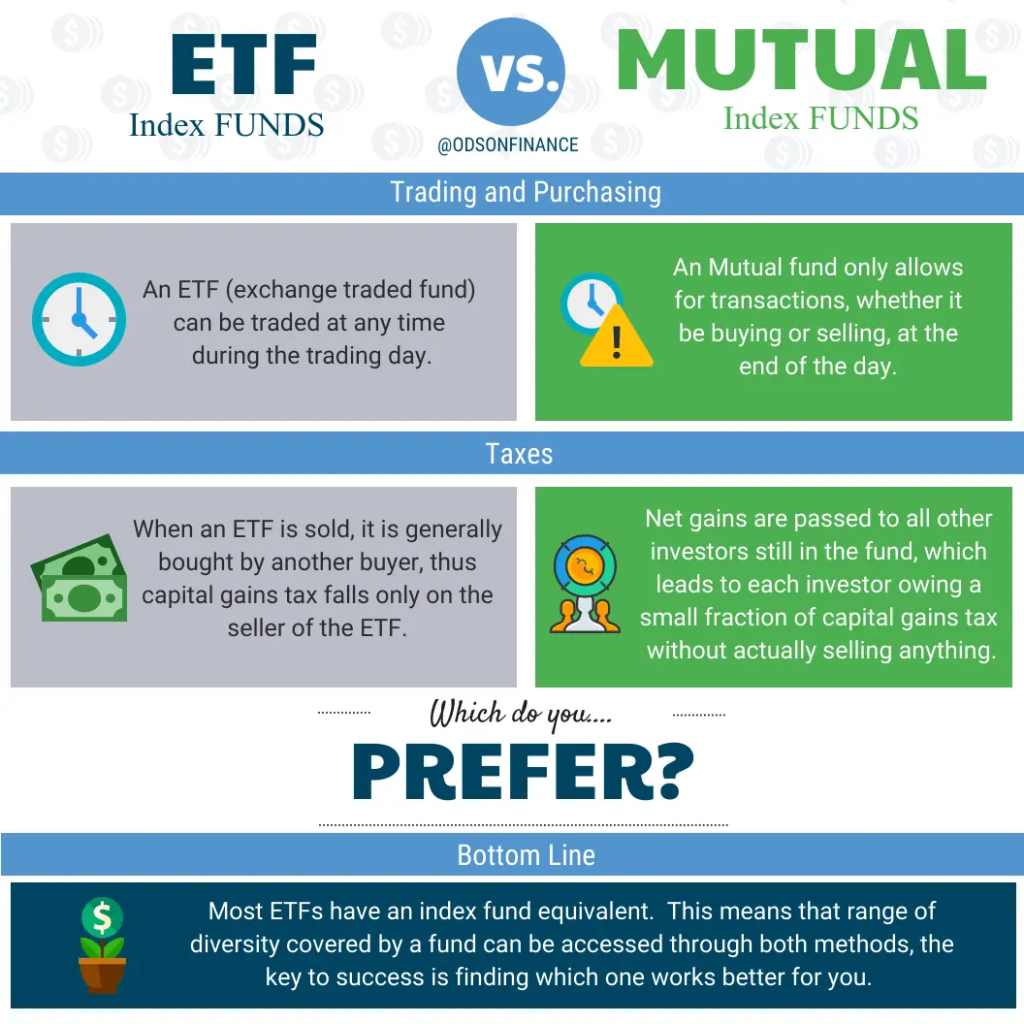

Difference Between a Mutual Fund and ETF:

- مرونة التداول: ETFs trade throughout the day like stocks, while mutual funds are only traded once per day at the closing NAV.

- يكلف: ETFs generally have lower fees and are passively managed, while mutual funds often have higher fees due to active management.

- أسلوب الإدارة: ETFs are typically passively managed, tracking an index, while mutual funds are usually actively managed by professionals.

شكل: ETF Index Funds vs. Mutual Index Funds

وصف:

This image compares صناديق الاستثمار المتداولة (Exchange-Traded Funds) and Mutual Index Funds. ETFs can be traded at any time during the trading day, while Mutual Index Funds only allow transactions at the end of the day. Regarding الضرائب, selling an ETF incurs a ضريبة الأرباح الرأسمالية for the seller, whereas net gains in Mutual Funds are distributed among all investors, leading to a small fraction of capital gains tax even without selling.

الماخذ الرئيسية:

- صناديق الاستثمار المتداولة offer flexibility in trading, while صناديق الاستثمار restrict transactions to the end of the day.

- ضريبة الأرباح الرأسمالية on ETFs is only applicable to the seller, whereas Mutual Fund investors might incur taxes without selling.

- Both have index fund equivalents offering similar exposure.

تطبيق المعلومات:

فهم الاختلافات بين صناديق الاستثمار المتداولة و Mutual Index Funds helps investors choose based on trading flexibility, الآثار المترتبة على الضرائب، و أهداف الاستثمار. Those seeking active trading opportunities might prefer ETFs, while investors who are less concerned with daily trading might opt for Mutual Funds.

D. The Power of Index Investing: Steady Growth and Peace of Mind

Index investing involves investing in a portfolio that tracks a specific index, such as the ستاندرد آند بورز 500 أو ال مؤشر فوتسي 100. This strategy allows investors to match the performance of the broader market, providing steady growth over time without the need for active management.

الايجابيات:

- Low fees: Index funds and ETFs typically have very low fees compared to actively managed funds, as they simply replicate an index.

- Steady growth: Index investing offers long-term growth by tracking the overall market, which tends to increase in value over time.

- Reduced risk: By investing in a wide array of companies, index investing reduces the risk associated with individual stock performance.

E. ETFs for Portfolio Investing: Accessing Multiple Indexes with Ease

صناديق الاستثمار المتداولة designed for portfolio investing provide easy access to multiple indexes, sectors, or asset classes. This allows investors to build a diversified portfolio with minimal effort, using ETFs that target specific markets or strategies.

الايجابيات:

- تنويع المحفظة: Investors can gain exposure to multiple asset classes and sectors using different ETFs, creating a balanced portfolio.

- Customizable strategy: ETFs provide the flexibility to invest in specific sectors, geographies, or asset classes based on the investor’s goals.

- Cost-efficient: ETFs typically have lower fees than mutual funds, making them an attractive option for building a diversified portfolio.

سلبيات:

- Market volatility: While ETFs offer diversification, they are still subject to overall market fluctuations, meaning they can lose value during downturns.

- متابعة الخطأ: Some ETFs may not perfectly match the performance of the index they are designed to replicate, which could impact returns.

شكل: 2020 Winners and Losers

وصف:

This table shows the 2020 performance of various equity sectors and corresponding فئات الأصول. It ranks the sectors based on their returns, with تكنولوجيا leading at 43.9%, ، تليها قاموس للمستهلك في 33.3%. The table also highlights the U.S. Large Growth asset class as a top performer with 38.5% return. At the bottom, العقارات و طاقة posted significant negative returns of -22.9% و -33.7%, ، على التوالى.

الماخذ الرئيسية:

- تكنولوجيا و قاموس للمستهلك were the top-performing sectors in 2020.

- U.S. Large Growth و U.S. Mid Cap Growth were the strongest asset classes.

- العقارات و طاقة faced the largest declines among sectors.

- The best returns were generally in growth-oriented sectors and asset classes.

تطبيق المعلومات:

This data helps investors understand which sectors and asset classes performed well or poorly during 2020, potentially guiding future investment strategies. It can also assist in analyzing market trends during economic downturns or recoveries. Understanding these trends allows investors to make more informed asset allocation decisions based on أداء القطاع و إمكانات النمو.

خاتمة

Mastering the art of diversification involves understanding various investment vehicles like الأسهم الفردية, صناديق الاستثمار المتداولة, mutual funds، و index investing. Each vehicle has its own pros and cons, and the best choice depends on the investor’s risk tolerance, investment goals, and time horizon. الأسهم الفردية offer high growth potential but come with greater risk, while صناديق الاستثمار المتداولة و mutual funds provide diversification at a lower cost. Index investing offers steady, long-term growth, while portfolio investing with ETFs provides the flexibility to customize and balance investments across various sectors and asset classes.

معلومات الدرس الرئيسية:

- الأسهم الفردية offer the chance for عوائد عالية و أرباح الأسهم, but come with high risk, especially if the company performs poorly. Picking the right stocks takes time, research, and understanding of the market.

- صناديق الاستثمار المتداولة يمد تنويع, السيولة، و low costs. They allow you to invest in many companies or sectors at once, reducing your risk. However, market risk still applies, and frequent trading may lead to extra fees.

- صناديق الاستثمار are managed by professionals and give you access to a wide range of assets. But they often come with higher fees, less trading flexibility, and don’t always perform better than simpler investments like ETFs.

- Index investing helps you follow the performance of a market over time. It offers steady growth, low fees، و less risk by investing in many companies at once instead of trying to pick winners.

- ETFs for portfolio investing allow you to build a diversified investment plan using different types of ETFs for specific goals, like investing in sectors, countries, ، أو asset types. They are cost-effective and customizable but can still face market ups and downs.

- Past performance data, like the 2020 sector results, can help investors understand which areas of the market perform well during certain times. For example, تكنولوجيا و قاموس للمستهلك led in growth, while طاقة و العقارات saw losses. These trends help with future investment planning.

كلمة الختام:

Knowing the differences between stocks, ETFs, mutual funds, and index investing allows you to build a smart and personalized investment plan. These tools can help you balance مخاطرة, نمو، و التكاليف based on your goals and comfort level.