الفصل الحادي عشر: التخطيط الضريبي والاستراتيجيات (الولايات المتحدة الأمريكية)

أهداف تعلم الدرس:

مقدمة: Understanding your tax responsibilities and implementing effective tax strategies is crucial for optimizing financial outcomes. This section guides you through the various types of taxes, key tax forms, and advanced tax planning techniques.

- Understand Tax Responsibilities: Learn the obligations of taxpayers in the United States to contribute to federal, state, and local governments, ensuring funding for public services.

- Comprehend Types and Impact of Taxes: Gain insight into different types of taxes, including income tax, sales tax, property tax, و capital gains tax, and how they affect your financial situation.

- Utilize Tax Forms and Payments: Understand the purpose and correct usage of key tax forms like Form 1040 و W-4 to accurately calculate tax liabilities and manage withholdings.

- Implement Advanced Tax Strategies: Explore advanced tax planning techniques, such as timing income and deductions, investment tax optimization, و estate tax planning to minimize tax liability.

A. Tax Responsibilities

Understanding your tax responsibilities is crucial. Every taxpayer in the United States is obligated to contribute to federal, state, and local governments. This ensures that public services such as road maintenance, public education, and emergency services can be funded and maintained.

- Example: Emma, a graphic designer, earns a salary on which federal income tax is deducted. This deduction helps fund national defense, which provides security for all citizens, including her.

B. Types and Impact of Taxes

Different types and amounts of taxes are levied based on income sources, amount of income, and spending habits. For example, a sales tax is considered regressive as it takes a larger percentage of income from low-income earners.

Different types of income are taxed differently to promote fairness, incentivize certain behaviors, and support various government services. For instance, long-term capital gains are taxed at a lower rate to encourage saving and investment.

- Example: James, who earns $50,000 a year, pays a higher percentage of his income on sales taxes compared to Olivia, who earns $150,000, when they both buy the same $1,000 television.

Earned Income:

Earned income, such as wages or salaries, is subject to federal income tax rates that range from 10% to 37%, depending on the tax bracket the individual falls into.

Federal income taxes fund national programs and services, while state income taxes fund state-level programs.

Payroll taxes, such as Social Security and Medicare taxes, fund their respective programs at the federal level.

- Alice earns a salary of $80,000 and falls into the 22% federal income tax bracket. If Alice receives $2,000 in qualified dividends and a long-term capital gain of $3,000, these would be taxed at a maximum rate of 15%, assuming she is not in the highest income bracket. Her salary would be taxed at the various rates leading up to 22%, but her investment income would be taxed less, enhancing the overall efficiency of her tax strategy.

- Bob, an independent contractor, earns $50,000, which he reports on Schedule C. His income is subject to self-employment tax, which includes both the employee and employer portions of Social Security and Medicare taxes, as well as income tax. Bob might choose to contribute to a SEP IRA, which could reduce his taxable income and provide retirement savings.

Unearned Income:

Income derived from investments, such as dividends, interest, or capital gains.

Interest Income:

Interest income, typically from savings accounts or investments like bonds, is taxed as ordinary income at the same rates as earned income.

Capital Gains:

Capital gains are the profits from the sale of assets like stocks or real estate. Short-term capital gains (for assets held less than a year) are taxed as ordinary income, while long-term capital gains have lower tax rates, generally 0%, 15%, or 20%, depending on your income level.

Tax Rate Comparison:

Unearned income like capital gains can have different tax rates compared to earned income, often leading to a lower tax liability for investments held long-term.

Sales Tax:

Sales tax applies to most goods and some services. Essential items like groceries and prescription medications are often exempt to reduce the tax burden on necessities.

Sales taxes are usually imposed at the state and local levels and fund state and local government operations.

الضرائب العقارية:

Property taxes are typically collected by local governments and fund local services like public schools and emergency services.

Earning income vs. Capital Gains

Earned income is usually taxed at a marginal rate, meaning that as income increases, the rate of taxation also increases through tax brackets. This progressive tax system is designed to ensure that those who have higher incomes contribute a larger percentage to the tax base.

Capital gains, on the other hand, are typically taxed at a lower rate to encourage investment in businesses and the stock market. This preferential rate applies to long-term investments held for more than one year, reflecting the belief that long-term investment contributes to economic growth.

Dividends from stocks can be qualified or non-qualified, with qualified dividends benefiting from lower tax rates similar to long-term capital gains.

- 1. Earned Income Scenario:

- Person: Jane, a software developer

- Annual Salary: $85,000

- Federal Income Tax Rate: 24% for her tax bracket

- State Tax Rate: 5% (in her state)

- FICA Taxes: 7.65% (combined Social Security and Medicare)

- Scenario: Jane’s take-home pay is affected by these various taxes, which are automatically withheld from her paycheck. If she contributes to a 401(k) or traditional IRA, she might lower her taxable income and hence pay less in income taxes.

- 2. Capital Gains Scenario:

- Person: Alex, an investor

- Stock Sale Gain: $20,000 (held for more than a year)

- Federal Capital Gains Tax Rate: 15% (for his income level)

- State Tax Rate: None (in his state)

- Scenario: Alex sells shares he has held for over a year. His profit from the sale, known as a long-term capital gain, is taxed at 15% instead of his regular income tax rate, which would be higher.

C. Tax Forms and Payments

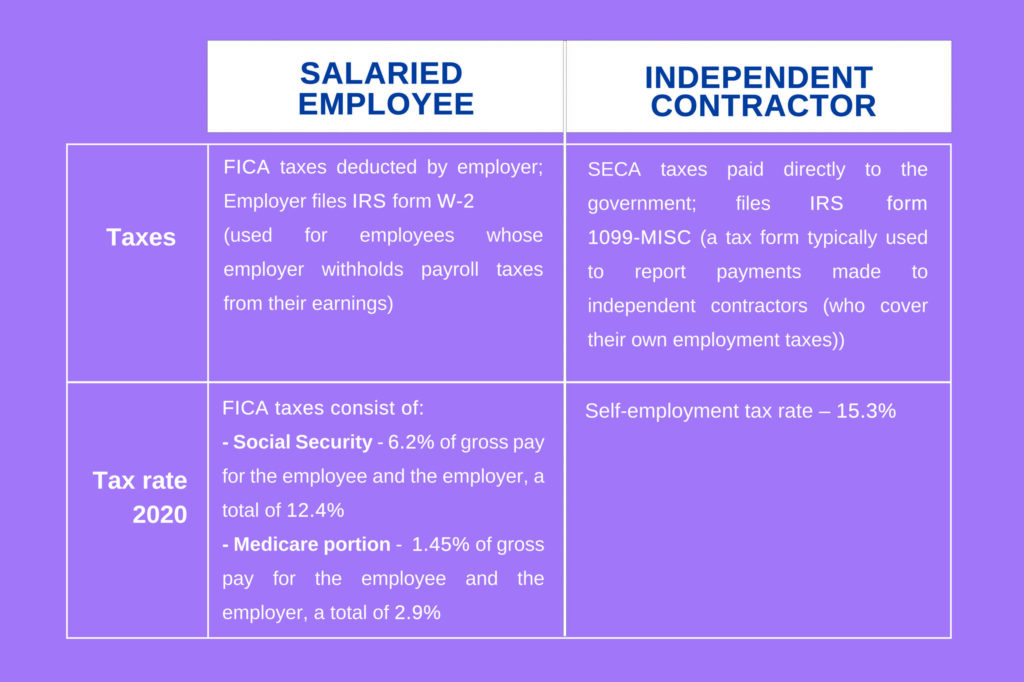

عنوان الشكل: Salaried Employees vs. Independent Sales Reps: Which is Best for Your Global Enterprise?

وصف: The infographic likely compares the benefits and challenges of hiring salaried employees versus independent sales representatives for global enterprises. It may outline key factors such as cost, flexibility, control, and scalability, providing insights into how each option fits different business needs and objectives.

الماخذ الرئيسية:

- Cost-effectiveness can vary significantly between salaried employees and independent sales reps, with the latter often requiring less upfront investment.

- Flexibility and scalability are typically higher with independent sales reps, allowing businesses to adjust more rapidly to market changes.

- Control over brand representation and sales tactics is generally stronger with salaried employees.

- The choice between the two depends on the company’s strategic goals, budget, and market dynamics.

طلب: Understanding the pros and cons of each employment model is crucial for businesses expanding globally. Companies must assess their operational needs, growth strategies, and the level of control desired over sales processes to make an informed decision. This analysis is particularly useful for HR professionals, business strategists, and decision-makers planning to scale their operations internationally or optimize their sales force.

Tax forms such as the 1040 allow individuals to calculate federal income tax. Whether one will receive a refund or needs to make an additional payment depends on their withholdings and credits over the tax year.

- Example: After filling out his Form 1040, Jacob realizes that he has overpaid his taxes due to excessive withholdings and is eligible for a refund.

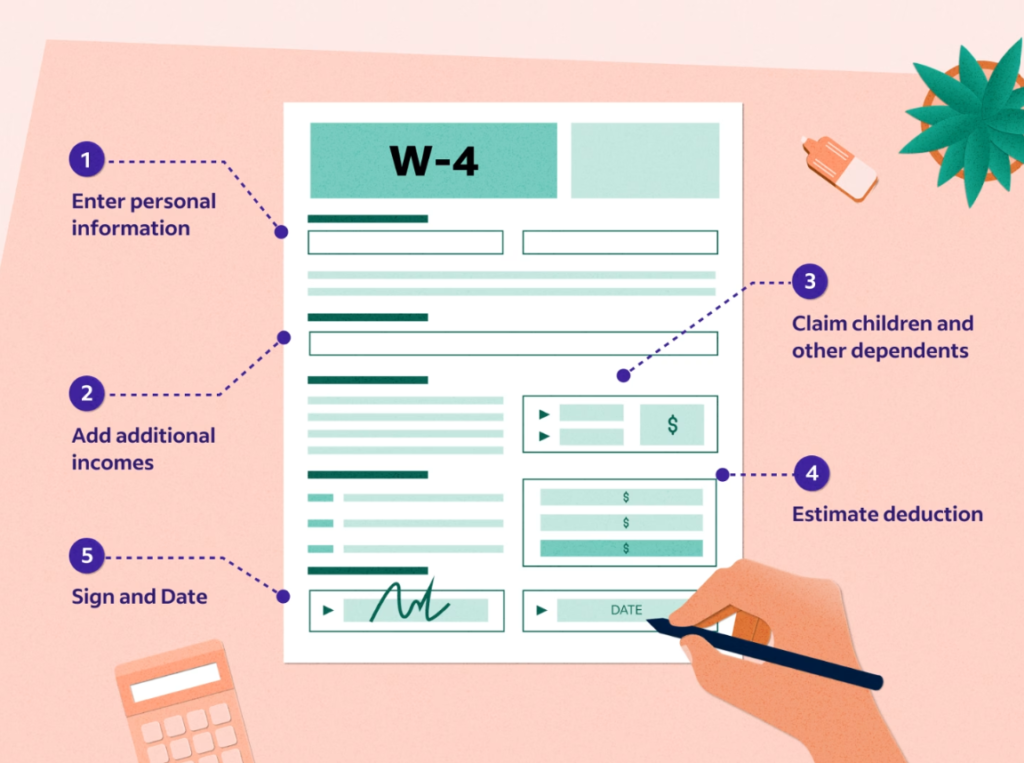

Form W-4:

When starting a job, employees fill out Form W-4 to inform employers how much tax to withhold from their paycheck. This form takes into account the employee’s filing status, multiple jobs, and any deductions or credits they expect to claim.

Example: Alice might adjust her W-4 at her salaried job to ensure the right amount of tax is withheld, avoiding underpayment penalties or a large tax bill at year-end.

عنوان الشكل: Understanding What to Claim on Your W-4 Form

مصدر: Indeed

وصف: The infographic likely provides a visual guide on how to fill out a W-4 form, which is essential for determining the amount of federal income tax withheld from your paycheck. It may include sections on personal information, multiple jobs or spouse’s income, dependents, other adjustments, and a final declaration. The goal is to help employees claim the correct withholding amount to avoid owing taxes or receiving a large refund at the end of the tax year.

الماخذ الرئيسية:

- The W-4 form is crucial for setting your tax withholding to match your tax liability.

- Claiming allowances has been replaced with a more straightforward approach to account for credits and deductions.

- Accurately reporting income and deductions can help achieve a balanced tax situation, avoiding underpayment or overpayment.

- The form includes sections for additional income, deductions, and extra withholding to tailor the withholding amount closely to your tax obligation.

طلب: Properly filling out a W-4 can significantly impact your financial planning by ensuring that your paycheck reflects your actual tax obligations as closely as possible. It’s particularly important for those with multiple jobs, significant non-wage income, or various deductions and credits. Understanding how to navigate this form can help employees manage their tax burden more effectively, leading to better financial health and planning.

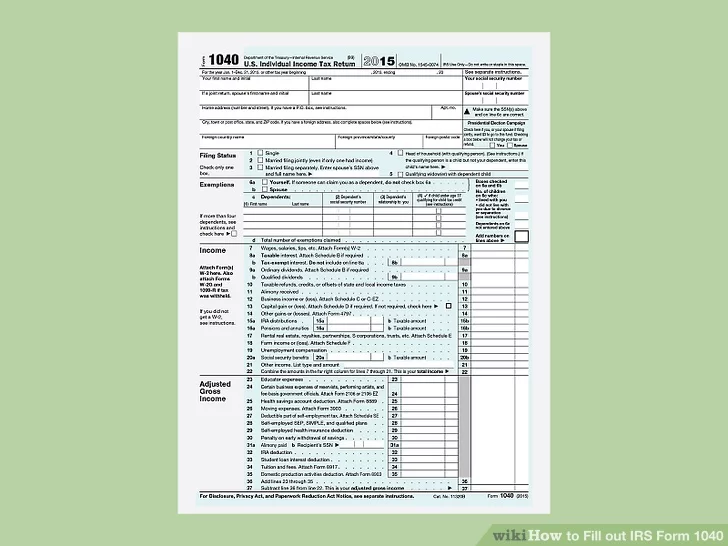

Form 1040:

عنوان الشكل: Step-by-Step Guide to Filling Out IRS Form 1040

مصدر: wikiHow

وصف: The infographic likely offers a visual step-by-step guide on how to correctly fill out IRS Form 1040, which is the standard federal income tax form used to report an individual’s gross income. It might include sections on personal information, income details, deductions to claim, and how to calculate the tax owed or refund due. The aim is to simplify the process of tax filing for individuals by breaking down each part of the form into manageable steps.

الماخذ الرئيسية:

- IRS Form 1040 is essential for reporting yearly income, calculating taxes owed, and claiming deductions and credits.

- Accurate completion of the form ensures compliance with tax laws and can help maximize legal deductions and credits.

- Understanding each section of the form can reduce errors and the likelihood of audits.

طلب: Properly filling out IRS Form 1040 is crucial for all taxpayers. This knowledge helps in navigating the complexities of tax laws and regulations, ensuring that individuals pay the correct amount of taxes. It’s particularly beneficial for those looking to understand their tax obligations better, plan for tax season, and avoid common pitfalls in tax preparation.

At the end of the tax year, individuals complete Form 1040 to calculate their actual tax liability. Based on the total tax owed and what has already been paid through withholdings or estimated tax payments, a taxpayer will either receive a refund or owe additional tax.

Example: An independent contractor reports income on Schedule C, and taxes are not withheld, requiring them to make estimated tax payments quarterly.

Example: Bob’s 1040 would include his Schedule C income, and he would need to calculate self-employment tax in addition to his income tax.

Involuntary vs. Voluntary Deductions

Involuntary Deductions: These are mandatory and include federal, state, and local taxes, Social Security, and Medicare.

Voluntary Deductions: These are optional and include contributions to retirement accounts and charitable donations.

Payroll Taxes:

Payroll taxes are automatically withheld from an employee’s paycheck and include contributions to Social Security and Medicare.

Tax Credit vs. Tax Deduction:

A tax credit reduces tax liability dollar for dollar, while a deduction reduces taxable income. Tax credits can be refundable or non-refundable.

- Deduction Example: If Alice has a deductible expense of $1,000, and she’s in the 22% tax bracket, this deduction saves her $220 in taxes ($1,000 * 22%).

- Credit Example: If Bob qualifies for a $1,000 tax credit, it reduces his tax liability dollar for dollar, so he pays $1,000 less in taxes regardless of his tax bracket.

Examples of Tax Credits:

- Child Tax Credit (refundable)

- American Opportunity Tax Credit (partially refundable)

- Lifetime Learning Credit (non-refundable

D. Local Taxation

Local taxes fund city or county-specific projects. Property taxes, for example, can differ from one county to another and often fund local schools and public works.

- Example: Sarah pays a higher property tax rate than her cousin in the next county because her county has recently undertaken extensive road improvements.

E. Calculating Taxes

Calculating taxes involves understanding various factors, including the amount of income and the types of purchases made. Federal income tax is progressive, meaning it increases with higher income levels, while sales taxes are the same rate for everyone, regardless of income.

- Example: Noah, a freelance photographer, pays a higher marginal tax rate on his income than his assistant because he is in a higher income bracket.

Tax Example for Income and Spending

Income Source | Amount | Federal Tax Rate | State Tax Rate | Sales Tax Paid |

Salary | $60,000 | 22% | 6% | $600 |

اهتمام | $500 | 22% | 6% | N/A |

مكاسب رأس المال | $2,000 | 15% | 0% | N/A |

Example: John earns a $60,000 salary, has $500 in interest income, and sold stocks for a $2,000 profit. His total tax liability will be calculated based on these amounts, with adjustments for his spending and applicable state taxes.

F. Tax Benefits and Incentives

Tax benefits like deductions and credits reduce tax liability and can significantly affect personal finances. Credits directly reduce the amount of tax owed, while deductions reduce taxable income.

- Example: Mia contributes to her 401(k) plan, which reduces her taxable income now, providing her with immediate tax benefits.

G. Tax-Affected Investments

Investments are subject to different tax treatments based on holding periods and types of income. Long-term capital gains, for example, are taxed at lower rates than short-term gains.

- Example: Carlos sold stocks he held for more than a year, benefiting from the long-term capital gains tax rate, which is lower than the rate for short-term gains.

H. Taxpayer’s Filing Obligations

All employed individuals must report their income annually to the IRS, often resulting in either a tax refund for overpayment or a payment due if not enough tax was withheld.

- Example: Lila, a teacher, files her taxes and discovers that due to various educational credits, she’s owed a refund from the IRS.

I. Local Tax Differences

Local taxes, such as those for school funding or infrastructure, vary by municipality, reflecting the unique needs and decisions of each community.

- Example: Mark lives in a city with high property taxes because the city prioritizes public school funding.

Tax Credits and Deductions

Understanding and utilizing tax credits and deductions can lead to significant savings. For instance, educational credits can lower tax bills for students, while mortgage interest deductions can benefit homeowners.

- Example: Zoe, a recent college graduate, claims an education credit on her taxes, reducing her tax liability for the tuition she paid during the year.

J. Pre-Tax Savings

Pre-tax contributions to retirement accounts reduce current taxable income and defer taxes until funds are withdrawn, often at a lower tax rate during retirement.

IRA:

- Traditional IRAs: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal.

- Example: Andre contributes to a traditional IRA, which lowers his current taxable income, potentially placing him in a lower tax bracket.

- If Bob has a traditional IRA, his contributions may lower his current taxable income, but he’ll pay taxes on withdrawals in retirement.

- Roth IRAs: Contributions are made with after-tax dollars, but earnings and withdrawals are tax-free.

- Example: If Bob has a traditional IRA, his contributions may lower his current taxable income, but he’ll pay taxes on withdrawals in retirement.

Traditional vs. Roth IRA: If Alice is looking to reduce her taxable income now, she might contribute to a traditional IRA, whereas if she expects to be in a higher tax bracket in retirement, she might choose a Roth IRA for tax-free growth and withdrawals.

Education Savings Accounts:

- Education Savings Accounts: These accounts offer tax advantages for saving for education expenses.

- Tax Advantages Comparison: Alice considers opening a 529 plan for her child’s education. The contributions are not federally tax-deductible, but earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free.

Planning for Taxes:

Tax planning is essential. It requires understanding the intricate details of the tax code and how different types of income and deductions affect one’s tax liability. Strategic planning can optimize one’s tax position, possibly leading to substantial savings over time.

معلومات الدرس الرئيسية:

Closing statement: Mastering tax planning and understanding various tax types and strategies are vital for financial optimization and compliance. This section equips you with the knowledge to navigate the U.S. tax system effectively and make informed financial decisions.

- Tax Responsibilities: Taxpayer obligations support public services through contributions to federal, state, and local governments.

- أنواع الضرائب: Different types of income, including earned income و unearned income, are taxed at various rates to support fairness and incentivize certain behaviors.

- Key Tax Forms: Forms like 1040 و W-4 are essential for calculating tax liabilities, managing withholdings, and ensuring accurate tax payments.

- Advanced Tax Strategies: Techniques such as timing income and deductions, optimizing tax on investments, and planning for estate taxes can significantly reduce overall tax liability and enhance financial planning.