Chapter 13: Retirement Planning (USA)

أهداف تعلم الدرس:

مقدمة: Retirement planning in the United States involves understanding the multifaceted sources of retirement income and the role of Social Security in retirement planning. This chapter explores key aspects of retirement planning, including Social Security, other income sources, and strategies to ensure financial stability during retirement.

- Understand Social Security: Learn about Social Security funding, the benefits provided, and how to maximize your monthly benefit amounts based on retirement age and earnings history.

- Diversify Retirement Income: Explore various sources of retirement income, including employer-sponsored retirement plans, personal investments, and continued employment earnings, to build a stable financial future.

- Plan for Retirement: Gain insights into effective retirement planning strategies, such as starting to save early, maximizing employer contributions, and understanding the benefits and limitations of Social Security.

- Seek Professional Advice: Understand the importance of consulting with financial advisors to optimize your retirement strategy and protect against potential fraud.

Retirement planning in the United States involves understanding the multifaceted sources of retirement income and the role of Social Security in retirement planning. Here’s an exploration of key aspects related to retirement planning in the U.S., including Social Security and other income sources.

A. Understanding Social Security

Social Security Funding: Social Security is funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Both employees and employers contribute to this fund, which then provides benefits to retirees, disabled individuals, and survivors of deceased workers.

Benefits Provided: Social Security offers a safety net to retirees, providing a monthly income based on their earnings during their working years. The amount of benefit received depends on the age at retirement and the individual’s earnings record.

Example Activity: Design a promotional flyer highlighting the benefits of Social Security. The flyer could illustrate how early retirement at 62 might result in lower benefits compared to full retirement age benefits, and how delaying benefits up to age 70 can increase the monthly benefit amount. Include visuals or charts to display the difference in benefits for various income levels.

B. Diversifying Retirement Income

عنوان الشكل: استراتيجيات الادخار للتقاعد

مصدر: كذبة موتلي

- وفر 15% سنويًا: تهدف إلى توفير ما لا يقل عن 15% من دخلك سنويًا.

- توفير لأكبر النفقات: إعطاء الأولوية للادخار لتغطية النفقات الكبيرة التي ستحدث أثناء التقاعد.

- وفر أكثر من 15% سنويًا: إذا أمكن، قم بتوفير أكثر من 15% الموصى به لبناء صندوق تقاعد أكبر.

- تعظيم حسابات التقاعد الخاصة بك: استفد بشكل كامل من حسابات التقاعد مثل 401(k)s وIRAs.

- استثمر على المدى الطويل الآن: ركز على الاستثمارات طويلة الأجل لتنمية مدخراتك التقاعدية.

- الاستفادة من مساهمات اللحاق بالركب: إذا كان عمرك 50 عامًا أو أكثر، فقم بتقديم مساهمات تعويضية إلى حسابات التقاعد الخاصة بك.

- ميزانية التقاعد الطويل: خطط لمدخراتك مع الأخذ في الاعتبار فترة التقاعد الطويلة.

- احصل على مساعدة في التخطيط للتقاعد: اطلب المشورة المهنية للتأكد من أنك على الطريق الصحيح نحو تقاعد آمن.

الماخذ الرئيسية:

- يعد توفير جزء كبير من دخلك سنويًا أمرًا بالغ الأهمية لتقاعد مريح.

- الاستثمار طويل الأجل وتعظيم مساهمات حساب التقاعد يمكن أن يؤدي إلى نمو صندوق التقاعد الخاص بك بشكل كبير.

- إن وضع ميزانية للتقاعد الطويل والحصول على مشورة مهنية بشأن التخطيط للتقاعد يمكن أن يساعد في ضمان الأمن المالي أثناء التقاعد.

طلب: توفر هذه الاستراتيجيات نهجا منظما نحو الادخار للتقاعد. باتباع هذه الإرشادات، يمكن للأفراد العمل على بناء صندوق تقاعد كبير يدعمهم خلال سنوات تقاعدهم. من الضروري البدء في الادخار والاستثمار مبكرًا، والاستفادة من حسابات التقاعد، والتفكير في طلب المشورة المهنية لضمان تقاعد جيد التخطيط وآمن ماليًا.

Different Sources of Retirement Income:

- Social Security: A foundational source of income for many retirees, providing benefits based on your earnings history.

- Employer-sponsored Retirement Plans: Such as 401(k)s and pensions, which are crucial for building a retirement nest egg.

- Personal Investments: Including IRAs, stocks, bonds, and other investment vehicles.

- Continued Employment Earnings: Part-time work or consulting in retirement can supplement income.

Multiple Income Sources in Retirement: Relying solely on Social Security may not be sufficient for a comfortable retirement. A diversified income strategy incorporating employer-sponsored plans and personal investments can offer a more stable financial future.

Employer-Sponsored Retirement Plans: Participating in these plans is critical. Many employers offer a match to your contributions, which is essentially free money for your retirement fund. Maximizing your contribution to receive the full employer match can significantly impact your retirement savings.

Average Social Security Benefit: As of recent data, the average monthly Social Security benefit for retired workers is about $1,543. However, this amount varies based on your earnings history and the age you begin to collect benefits.

C. Planning for Retirement

To ensure a comfortable retirement, it’s essential to:

- Start saving early to take advantage of compound interest.

- Diversify your retirement income sources to reduce risk and increase financial security.

- Understand the benefits and limitations of Social Security and plan accordingly to maximize your benefits.

- Engage in employer-sponsored retirement plans and strive to contribute enough to get the full employer match.

- Consider personal investments and savings plans like IRAs to build additional retirement savings.

خاتمة

Retirement planning in the USA should include a comprehensive strategy that combines Social Security, employer-sponsored plans, personal investments, and possibly continued employment earnings. Understanding how Social Security is funded and the benefits it provides is crucial, as is the importance of diversifying retirement income to ensure financial stability in your golden years.

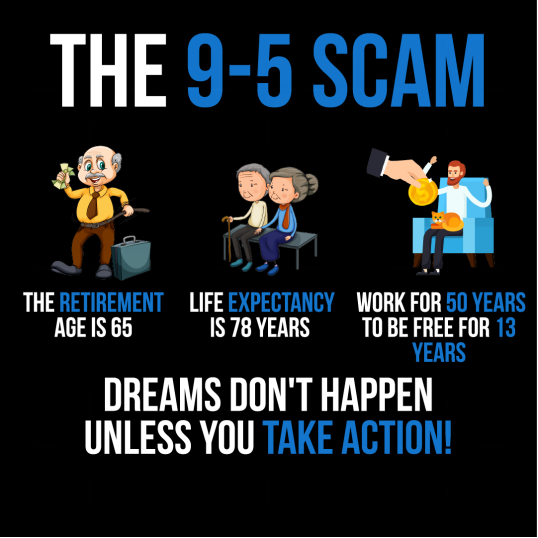

شكل: يقدم الرسم البياني الذي يحمل عنوان "The 9-5 Scam" نظرة نقدية لحياة العمل التقليدية. وتشير إلى أنه مع متوسط عمر متوقع يبلغ 78 عامًا وسن التقاعد 65 عامًا، فإن الشخص يعمل لمدة 50 عامًا فقط ليكون حرًا لمدة 13 عامًا. الرسالة "الأحلام لا تتحقق إلا إذا اتخذت إجراءً!" يشير إلى أن الاعتماد فقط على وظيفة 9-5 قد لا يكون الطريق الأكثر فعالية لتحقيق أحلام الفرد. هذه الصورة هي دعوة للأفراد لاتخاذ خطوات استباقية نحو أهدافهم، مما قد يعني ضمنا السعي وراء مصادر دخل بديلة أو استراتيجيات التقاعد المبكر. للاستخدام العملي، يجب على المستخدمين أن يأخذوا بعين الاعتبار أهدافهم الحياتية والمالية طويلة المدى واستكشاف طرق مختلفة لتحقيقها بما يتجاوز نموذج التوظيف التقليدي.

المصدر: رسم بياني مخصص

Figure: A symbolic representation of retirement savings with a golden egg nestled securely, suggesting the importance of building a financial nest egg for the future. Source:

مصدر: صراع الأسهم

يساعدك وجود خطة تقاعد مدروسة جيدًا على بناء بيضة عش توفر لك الأمان المالي وراحة البال خلال سنوات التقاعد.

معلومات الدرس الرئيسية:

كلمة الختام: Retirement planning in the USA should include a comprehensive strategy that combines Social Security, employer-sponsored plans, personal investments, and possibly continued employment earnings. Understanding how Social Security is funded and the benefits it provides is crucial, as is the importance of diversifying retirement income to ensure financial stability in your golden years.

- Social Security: Funded through payroll taxes, Social Security provides a monthly income based on your earnings history. Early retirement at 62 results in lower benefits compared to full retirement age, while delaying benefits up to age 70 can increase the monthly amount.

- Diversifying Retirement Income: Relying solely on Social Security may not be sufficient. A diversified income strategy, including employer-sponsored retirement plans, personal investments, and continued employment, can offer greater financial security.

- Employer-Sponsored Retirement Plans: Participating in these plans, such as 401(k)s, is essential. Maximize your contributions to receive the full employer match, significantly impacting your retirement savings.

- Planning for Retirement: Start saving early, engage in employer-sponsored plans, and consider personal investments like IRAs. Seek professional advice to navigate the complexities of retirement planning and avoid potential fraud.