Kapitel 7: Sparen und Notgroschen

Lernziele der Lektion:

Einführung: Das Verständnis verschiedener Finanzprodukte und der Bedeutung des Sparens ist für ein effektives persönliches Finanzmanagement unerlässlich. Dieses Kapitel befasst sich mit unterschiedlichen Arten von Bankkonten, der Wichtigkeit von Notfallfonds und den Auswirkungen von Inflation und Zinssätzen auf Ersparnisse. Darüber hinaus werden die Grundlagen von Finanzinstituten und die effektive Verwaltung und Vermehrung persönlicher Finanzen behandelt.

- Understand Types of Accounts: Erfahren Sie mehr über checking accounts, savings accounts,

money market accounts, Und certificates of deposit (CDs). Each account type serves different financial needs, offering varying access to funds and interest rates. - Build an Emergency Fund: Recognize the importance of having an Notfallfonds Zu

cover unexpected expenses. Understand how to calculate the appropriate amount needed and strategies for building this fund. - Impact of Inflation and Interest Rates: Erfahren Sie mehr Inflation Und Zinssätze affect savings. Understanding these factors helps in making informed decisions about saving and

investing. - Financial Institutions and Services: Understand the differences between credit unions Und

commercial banks and how to choose the right financial institution for your needs.

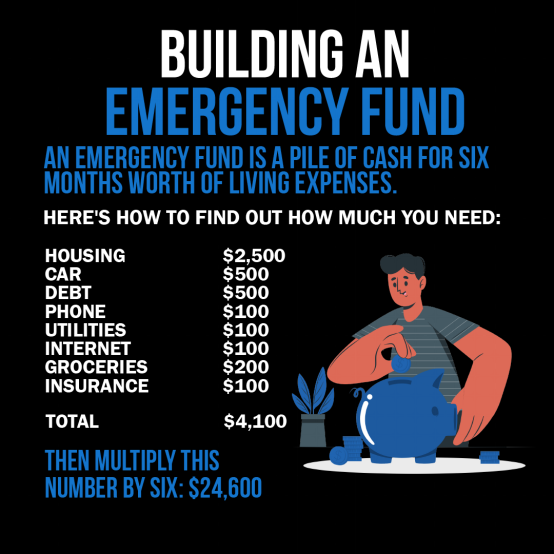

Figur: The infographic is a guide on “Building an Emergency Fund,” which it defines as a reserve of cash sufficient to cover six months’ worth of living expenses. It breaks down various monthly expenses such as housing, car, debt, phone, utilities, internet, groceries, and insurance, totaling $4,100. To calculate the size of an emergency fund, it advises multiplying this monthly total by six, resulting in $24,600. This visual serves as a practical tool for individuals to estimate the amount they need to save to be financially secure in case of unexpected events. For practical use, users should tally their own monthly expenses, follow the provided formula to determine their emergency fund target, and then create a savings plan to build up to that amount over time.

Quelle: Benutzerdefinierte Infografik

Einführung in Spar- und Finanzprodukte

Das Verständnis verschiedener Finanzprodukte und der Bedeutung des Sparens ist für ein effektives persönliches Finanzmanagement unerlässlich. Dieses Kapitel befasst sich mit unterschiedlichen Arten von Bankkonten, der Wichtigkeit von Notfallfonds und den Auswirkungen von Inflation und Zinssätzen auf Ersparnisse. Darüber hinaus werden die Grundlagen von Finanzinstituten und die effektive Verwaltung und Vermehrung persönlicher Finanzen behandelt.

Types of Accounts and Financial Services

Finanzinstitute bieten eine Reihe von Konten und Dienstleistungen an, die jeweils auf spezifische finanzielle Bedürfnisse zugeschnitten sind:

- Girokonten: Wird für tägliche Transaktionen verwendet. Sie werden üblicherweise mit einer Debitkarte geliefert und bieten unbegrenzte Ein- und Auszahlungen an.

- Vorteile: Einfacher Zugriff auf Guthaben, Zugriff mit Debitkarte, Online-Rechnungszahlung.

- Nachteile: In der Regel werden nur geringe oder gar keine Zinsen verdient.

- Sparkonten: Aimed at short-term savings over time. Offer interest on the stored funds.

- Vorteile: Zinsen erhalten, geringes Risiko.

- Nachteile: Begrenzte Abhebungsmöglichkeiten, möglicherweise niedrigere Zinssätze im Vergleich zu anderen Sparprodukten.

- Geldmarktkonten (MMAs): Eine Mischung aus Giro- und Sparkonten, in der Regel mit höheren Zinssätzen und höheren Mindestguthabenanforderungen.

- Vorteile: Höhere Zinssätze, Scheckausstellungsrecht.

- Nachteile: Hohe Mindestguthabenanforderungen, begrenzte Transaktionsmöglichkeiten.

- Einlagenzertifikate (CDs): Fixed-term savings account with a guaranteed interest rate.

- Vorteile: Höhere Zinssätze im Vergleich zu Sparkonten, feste Renditen.

- Nachteile: Strafgebühren bei vorzeitiger Auszahlung, das Geld ist bis zum Ablauf der Laufzeit nicht verfügbar.

Kontoeröffnung und -verwaltung: Die Eröffnung eines Bankkontos erfordert in der Regel die Angabe persönlicher Daten, der Sozialversicherungsnummer und eine Ersteinzahlung. Zur Kontoführung gehören die Überwachung des Kontostands, Ein- und Auszahlungen sowie das Verständnis von Gebühren wie Mindestguthabenanforderungen und Überziehungsgebühren.

Kontokomponenten: Die Kontonummer identifiziert Ihr Konto eindeutig, während die Bankleitzahl Ihre Bank identifiziert – unerlässlich für Direkteinzahlungen und die Einrichtung von automatischen Zahlungen.

Kreditgenossenschaften vs. Geschäftsbanken: Credit unions typically offer lower fees and better interest rates but might have fewer branches and services. Commercial banks offer a broader range of services but may charge higher fees.

Bewertung von Finanzprodukten für Studierende

Studierende sollten Folgendes beachten: Giro- und Sparkonten mit niedrigen Gebühren, einfachem Zugang zu Geldern und Bildungsangeboten zur Unterstützung bei der Verwaltung ihrer Finanzen. Vorteile Dazu gehört das Erlernen des Umgangs mit Geld und das Erhalten von Zinsen auf Ersparnisse. Nachteile Dies kann die Einhaltung von Mindestguthabenanforderungen oder die Berücksichtigung potenzieller Gebühren beinhalten.

Online Banking and Account Management

Online-Banking bietet bequemen Zugriff auf Finanzdienstleistungen wie Kontoeröffnung, Kontostandsabfrage und Geldtransfers. Wichtige Aspekte sind das Verständnis der Mindestguthabenanforderungen, monatlichen Gebühren, Überziehungsgebühren und Zinssätze. Es ist unerlässlich, die Kontostände regelmäßig zu überprüfen und zu verwalten, um sicherzustellen, dass die Transaktionen gedeckt sind und Gebühren vermieden werden.

Zinssätze und Ersparnisse

Steigt die Kreditnachfrage, bieten Banken möglicherweise höhere Zinsen auf Einlagen an, um mehr Sparer zu gewinnen und ihnen so die Mittel für die Kreditvergabe zur Verfügung zu stellen. Umgekehrt sinkt die Kreditnachfrage in einem gesättigten Kreditmarkt oder bei einem wirtschaftlichen Abschwung, und Banken senken unter Umständen die Zinsen auf Sparkonten.

Mobile Zahlungskonten im Vergleich zum traditionellen Bankwesen

Mobile Zahlungskonten bieten Komfort und Benutzerfreundlichkeit, bringen aber in der Regel keine Zinsen ein, wodurch das Potenzial für Sparwachstum im Vergleich zu traditionellen Konten geringer ist. Sparkonten, die Zinsen bieten. Kryptowährungskonten Sie bieten zwar eine hohe Volatilität und ein hohes Renditepotenzial, sind aber nicht staatlich abgesichert, im Gegensatz zur Sicherheit und dem stetigen Wachstumspotenzial staatlich abgesicherter Sparkonten.

Impact of Spending vs. Saving

Die Entscheidung zwischen sofortigem Konsum und Sparen für die Zukunft ist ein weit verbreitetes Dilemma. Sofortige Bedürfnisbefriedigung kann zu Bedauern führen, wenn sie das Erreichen wichtigerer finanzieller Ziele, wie den Kauf eines Eigenheims oder die Sicherung eines komfortablen Ruhestands, verhindert.

Szenario 1: Emily kauft sich spontan einen teuren Laptop, angelockt von dessen fortschrittlichen Funktionen. Monate später bereut sie, das Geld nicht für eine Weiterbildung gespart zu haben, die ihre Karriere hätte voranbringen können. Dies unterstreicht, wie wichtig es ist, langfristige finanzielle Ziele über kurzfristige Befriedigung zu stellen.

Szenario 2: Nachdem Jake einen Bonus erhalten hat, bucht er sofort einen teuren Urlaub. Obwohl er ihn genießt, wünscht er sich später, er hätte einen Teil des Geldes für Notfälle zurückgelegt, als sein Auto unerwartet repariert werden muss. Dies verdeutlicht, wie wichtig es ist, das Gleichgewicht zwischen dem Genuss des Augenblicks und der Vorsorge für die Zukunft zu wahren.

Inflation and Interest Rates

Figure title: The Impact of Inflation on the Dollar’s Value Over Time

Quelle: Investopedia

Beschreibung: The infographic likely illustrates how inflation erodes the purchasing power of the dollar over time, showing that a fixed amount of money will buy fewer goods and services in the future compared to today. It may use visual elements like graphs or charts to compare the value of a dollar at different points in time, underlining the concept of “time value of money.” The visual representation helps viewers understand that as inflation increases, the real value of money decreases.

Die zentralen Thesen:

- Inflation reduces the purchasing power of money, meaning what you can buy with a dollar today may not be the same tomorrow.

- The time value of money is a crucial concept in finance, emphasizing that a dollar today is worth more than a dollar in the future due to inflation.

- Understanding inflation is essential for financial planning and investment strategies to protect against the loss of money’s value over time.

Anwendung: This information is vital for investors and individuals planning their finances. By understanding the impact of inflation, users can make informed decisions about saving, investing, and spending. Investments that have the potential to outpace inflation, such as stocks or inflation-protected securities, can help preserve the purchasing power of capital over time. This knowledge encourages proactive financial planning to ensure long-term financial security and growth.

Inflation mindert mit der Zeit den Wert des Geldes und damit die Kaufkraft von Ersparnissen. Der Nominalzins berücksichtigt die Inflation nicht, während der Realzins (Nominalzins minus Inflationsrate) das tatsächliche Wachstum der Ersparnisse angibt. Sparer sollten einen Nominalzins anstreben, der die Inflation übersteigt, um den Wert ihrer Ersparnisse zu erhalten.

Zinssatz = Nominalzins – Inflationsrate

Beispiel: Beträgt der Nominalzins eines Sparkontos 3% und die Inflationsrate 2%, so ergibt sich ein effektiver Realzins von 1%. Inflationsbereinigt wächst die Kaufkraft des Geldes auf diesem Konto innerhalb eines Jahres also nur um 1%. Dies unterstreicht, wie wichtig es ist, Spar- oder Anlageoptionen zu wählen, die die Inflation übertreffen, um langfristig tatsächlich Vermögen aufzubauen.

Inflation Protection and I Bonds

Anleihen dienen dem Schutz vor Inflation, da ihre Zinssätze sich an die Inflation anpassen. Steigt die Inflation, erhöht sich auch der Zinssatz für Anleihen. Dadurch bleibt die Kaufkraft der Ersparnisse langfristig erhalten, anders als bei herkömmlichen Festgeldanlagen, wo feste Zinssätze in Zeiten hoher Inflation zu negativen Realrenditen führen können.

Zukunftswert und Diskontierung

Figure title: Calculating the Future Value of a Single Cash Flow

Quelle: Finance Train

Beschreibung: The infographic likely demonstrates the formula for calculating the future value of a single cash flow, which is a fundamental concept in finance. This formula helps in understanding how much an investment made today will grow to at a future date, considering a specific rate of interest. The formula is typically represented as FV = PV(1 + r)^n, where FV is the future value, PV is the present value, r is the interest rate, and n is the number of periods.

Die zentralen Thesen:

- Die Formel für den zukünftigen Wert (FV) ist entscheidend für die Berechnung, wie Investitionen im Laufe der Zeit wachsen.

- Das Verständnis dieser Formel ermöglicht es Anlegern, den Wert von Investitionen in der Zukunft abzuschätzen.

- Zu den Variablen in der Formel gehören der Barwert (PV), der Zinssatz (r) und die Anzahl der Perioden (n), die jeweils eine entscheidende Rolle bei der Berechnung spielen.

Anwendung: This concept is essential for anyone involved in financial planning, investment analysis, or saving for future goals. By applying this formula, individuals can make informed decisions about their investments, understanding how different rates of interest and time periods affect the growth of their money. It encourages strategic investment and helps in setting realistic expectations for investment returns, which is fundamental for long-term financial planning and wealth accumulation.

Mithilfe einer Tabellenkalkulation berechnen wir, dass ein 10-Jähriger monatlich 1.200 € sparen muss, um sich ein Jahr Studiengebühren leisten zu können, die in acht Jahren auf 1.200 € geschätzt werden. Bei einem jährlichen Zinssatz von 51 % beträgt der Zinssatz 1.200 €. Dieses Beispiel veranschaulicht die Diskontierung des zukünftigen Geldwertes unter Berücksichtigung der Zinsen, um zu ermitteln, wie viel heute gespart werden muss, um zukünftige finanzielle Ziele zu erreichen.

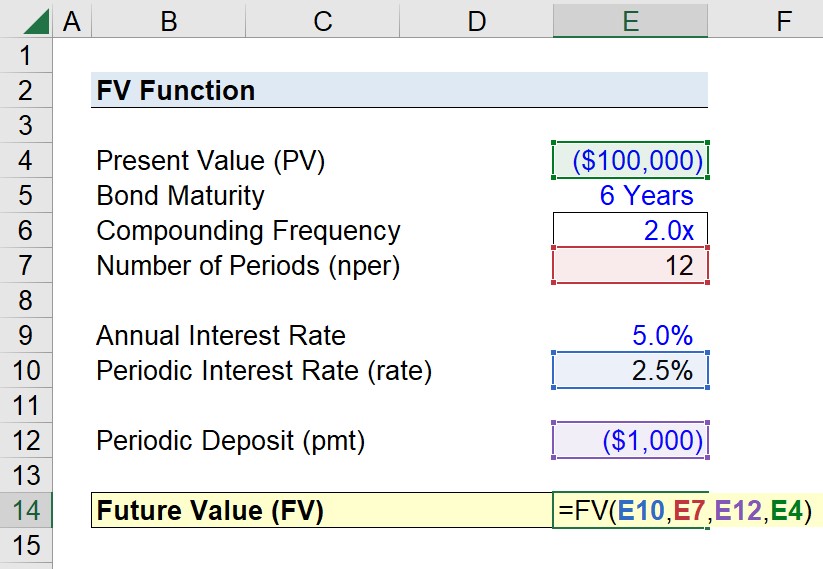

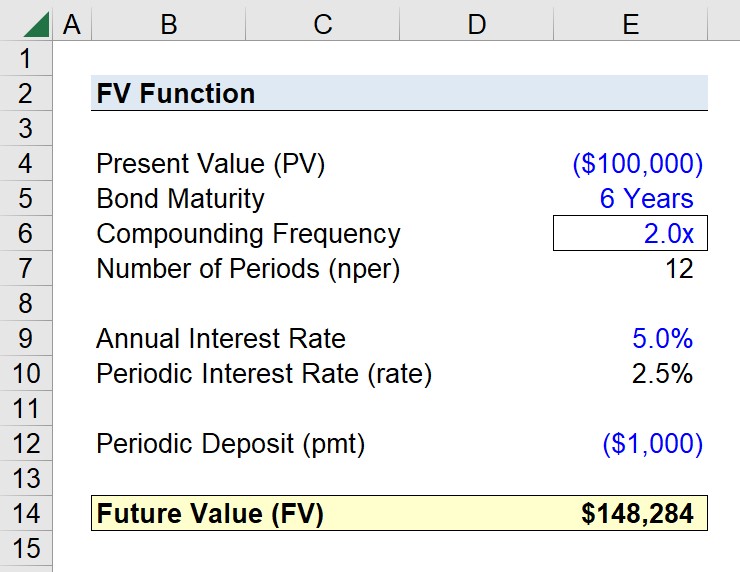

Figure title: Using the FV Function in Excel to Calculate Future Value

Quelle: Wall-Street-Vorbereitung

Beschreibung: The infographic likely demonstrates how to use the FV function in Excel to calculate the future value of an investment, considering a constant interest rate over a number of periods. The FV function is a powerful tool in Excel for financial analysis, allowing users to input variables such as rate, number of periods, payments, present value, and type (whether payments are made at the beginning or end of periods) to compute the future value of an investment.

Die zentralen Thesen:

- Die Funktion FV in Excel ist unerlässlich für die Berechnung des zukünftigen Wertes von Investitionen.

- Zu den wichtigsten Eingangsgrößen für die FV-Funktion gehören Zinssatz, Anzahl der Perioden, periodische Zahlungen, Barwert und Zahlungszeitpunkt.

- Das Verständnis der Anwendung der FV-Funktion kann die Fähigkeiten im Bereich der Finanzmodellierung und Investitionsanalyse erheblich verbessern.

Anwendung: This knowledge is crucial for finance students, financial analysts, and anyone involved in investment planning or analysis. By mastering the FV function, users can quickly assess the potential future value of investments, aiding in decision-making processes. It’s particularly useful for evaluating the growth of savings accounts, retirement funds, or any investment over time, providing a clear picture of financial futures.

Down Payments and Loans

Eine Anzahlung bei einem Kredit, wie beispielsweise eine Anzahlung nach § 20% für ein Haus, reduziert die Gesamtkreditsumme, was zu niedrigeren monatlichen Raten und oft günstigeren Zinssätzen führt. Dadurch wird der Kreditnehmer für Kreditgeber attraktiver und die Kreditkosten können sich im Laufe der Zeit deutlich reduzieren.

Emergency Funds and Financial Planning

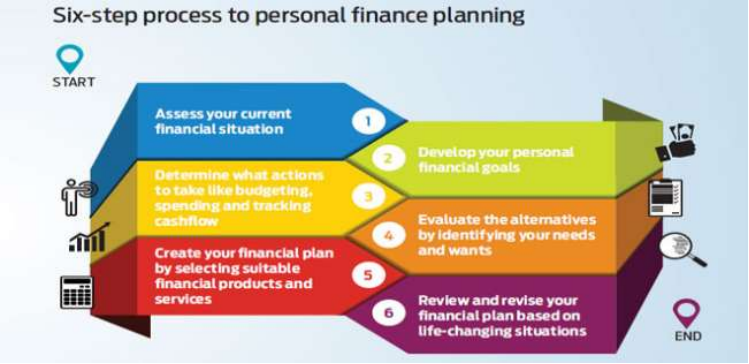

Abbildungstitel: Sechs-Schritte-Prozess zur persönlichen Finanzplanung

Quelle: Outlook Money

Beschreibung:

Die Abbildung stellt einen sechsstufigen Prozess für die persönliche Finanzplanung vor. Er beginnt mit der Beurteilung der aktuellen finanziellen Situation, einschließlich Vermögen und Verbindlichkeiten, und geht weiter mit der Festlegung finanzieller Ziele, der Erstellung eines Aktionsplans, der Bewertung von Anlageoptionen, der Umsetzung des Plans und der regelmäßigen Überprüfung und Anpassung der Strategie.

Die zentralen Thesen:

- Beurteilung der aktuellen Finanzen is crucial as a starting point for planning

- Zielsetzung involves assigning value and timelines to short, medium, and long-term financial aspirations

- Ein Aktionsplan must consider one’s risk tolerance and align investment choices accordingly

- Investitionsmöglichkeiten sollten mit konkreten Zielen verknüpft und nach steuerlichen Gesichtspunkten und Eignung ausgewählt werden.

- Regelmäßige Investitionen trägt zur Gewohnheitsbildung und zum reibungslosen Erreichen finanzieller Ziele bei.

Regelmäßige Überprüfungen sicherstellen, dass die Investitionen planmäßig verlaufen und gegebenenfalls Anpassungen vorgenommen werden können.

Anwendung:

Eine Bestandsaufnahme der eigenen finanziellen Situation ist die Grundlage jeder guten Finanzplanung. Indem man seinen finanziellen Standpunkt kennt, lassen sich realistische Ziele setzen, Verbesserungspotenziale erkennen und ein Plan für finanzielle Stabilität und Wachstum entwickeln. Dieser Schritt stellt sicher, dass die weitere Planung realistisch ist und auf die individuellen finanziellen Gegebenheiten zugeschnitten ist.

Ein Notfallfonds ist für die finanzielle Stabilität unerlässlich und bietet ein Sicherheitsnetz für unerwartete Ausgaben. Die Erstellung und Pflege eines Budgets mit Rücklagen für kurz- und langfristige Ersparnisse sichert die Vorbereitung auf unvorhergesehene Lebensereignisse und den Fortschritt beim Erreichen finanzieller Ziele.

Beispiel: Marias Auto hat eine Panne und muss teuer repariert werden. Sie passt ihr Budget an, um die Ausgaben für Freizeitaktivitäten zu reduzieren und Gelder aus ihren Kategorien Unterhaltung und Restaurantbesuche für die Reparaturkosten umzuschichten. Gleichzeitig verringert sie vorübergehend ihre Einzahlungen auf ihr Sparkonto.

Gehalt und Abzüge verstehen

Bruttogehalt ist der Gesamtverdienst eines Mitarbeiters vor jeglichen Abzügen. Nettogehalt, Das Nettogehalt, auch Lohn oder Gehalt genannt, ist der Betrag, der nach Steuern, Krankenversicherung und anderen Abzügen übrig bleibt. Das Verständnis dieses Unterschieds ist für eine genaue Budgetplanung unerlässlich.

Financial Institutions and Services

Finanzinstitute wie Banken, Kreditgenossenschaften und Online-Plattformen bieten verschiedene Produkte wie Giro- und Sparkonten sowie Finanzplanungsdienstleistungen an. Die Wahl des richtigen Instituts und der passenden Dienstleistungen ist entscheidend für ein effektives Geldmanagement und das Erreichen finanzieller Ziele.

Beispiel für Kontoverwaltung:

Um ein Girokonto effektiv zu verwalten, sollten Sie regelmäßig die Transaktionen prüfen und mit Ihren persönlichen Aufzeichnungen abgleichen, um die Richtigkeit sicherzustellen. Mobile-Banking-Apps können die Übersicht vereinfachen und helfen, Überziehungsgebühren zu vermeiden.

Abschluss:

Understanding and utilizing different financial accounts and services, managing savings versus spending decisions, and planning for the future with emergency funds are foundational elements of sound financial health. Recognizing the impact of external factors like inflation and staying informed about the roles of various financial institutions empowers individuals to make decisions that align with their financial goals and needs.

Wichtige Unterrichtsinformationen:

Schlusserklärung: Understanding and utilizing different financial accounts and services, managing

savings versus spending decisions, and planning for the future with emergency funds are foundational

elements of sound financial health. Recognizing the impact of external factors like inflation and staying

informed about the roles of various financial institutions empowers individuals to make decisions that

align with their financial goals and needs.

1. Types of Accounts: Different financial accounts serve various purposes. Checking accounts

are for daily transactions with easy access to funds. Savings accounts offer interest on stored funds for short-term savings. Money market accounts (MMAs) provide higher interest rates

with check-writing privileges. Certificates of deposit (CDs) offer fixed-term savings with

higher interest rates but penalize early withdrawal.

2. Building an Emergency Fund: An emergency fund should cover six months of living expenses, providing a financial safety net for unexpected events. To calculate the required

amount, total monthly expenses and multiply by six. Start by setting small savings goals and

gradually increase the amount saved.

3. Impact of Inflation and Interest Rates: Inflation reduces the purchasing power of money over time, making it essential to seek savings or investment options that outpace inflation. The

real interest rate (nominal interest rate minus inflation rate) reflects the actual growth of savings. For example, if the nominal interest rate is 3% and inflation is 2%, the real interest rate is 1%.

4. Financial Institutions and Services: Credit unions often offer lower fees and better interest rates compared to commercial banks but may have fewer branches and services. Evaluate financial products for low fees, easy access to funds, and additional services like financial

education.