Global: Langfristige Finanzstrategien

Lesson Learning Objectives:

Einführung:

This section focuses on setting long-term financial strategies, guiding users to establish SMART goals, create financial plans, understand the role of philanthropy, and improve credit health. By mastering these skills, users can build strong foundations for financial success and personal growth.

- Understand SMART Goals: Learn how to set Specific, Measurable, Achievable, Relevant, Und Time-bound goals to ensure financial objectives are clear and actionable. Knowing this framework helps users create practical financial plans that are easy to track and adjust.

- Create and Implement a Financial Plan: Gain insights into developing a financial plan, from assessing current financial status to setting goals, creating strategies, and regularly reviewing progress. This will equip users with tools to manage their money effectively over time, allowing for both short-term Und long-term financial growth.

- Explore Philanthropy: Discover how incorporating philanthropy into financial planning not only supports personal values but can also provide tax benefits in certain countries. Users will understand how to allocate a budget for charitable giving without compromising other financial goals.

- Enhance Credit Health: Learn how credit reports Und scores influence financial decisions, such as loan approvals and interest rates. Users will understand the steps to improve credit scores and manage debt, which is crucial for gaining access to better financial opportunities.

A. SMART Goals in Financial Planning

Setting SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound) is a critical part of effective financial planning. SMART goals help individuals clearly define their financial objectives, break them into actionable steps, and set realistic timelines. For example, instead of saying “I want to save money,” a SMART goal would be: “I will save $5,000 over the next 12 months by saving $416 each month.”

- Specific: Clearly define the financial goal (e.g., save for a down payment on a house).

- Measurable: Quantify the goal (e.g., save $20,000).

- Achievable: Ensure the goal is realistic based on current income and expenses.

- Relevant: Align the goal with long-term financial plans (e.g., owning a home fits into broader life goals).

- Time-bound: Set a deadline for achieving the goal (e.g., within three years).

Using the SMART framework ensures that financial goals are well-defined and actionable, leading to better long-term financial outcomes.

Figure: Save Money with SMART Goals

Beschreibung:

This figure outlines how to save money using the SMART goals method. The acronym SMART stands for Specific, Measurable, Achievable, Relevant, Und Time-bound. It details how setting a specific savings goal, tracking progress, ensuring the goal is realistic, understanding its relevance (e.g., for retirement), and setting a timeline can help individuals systematically save money.

Wichtige Erkenntnisse:

- Specific: Define a clear amount of money you want to save.

- Measurable: Track your progress regularly to see how much you’re saving.

- Achievable: Ensure the goal is realistic based on your financial situation.

- Relevant: The goal should contribute to a meaningful financial objective, like retirement.

- Time-bound: Set a deadline, such as accumulating $100,000 by a certain year.

Application of Information:

Individuals can apply this SMART goal-setting framework to their personal savings by ensuring that their financial targets are clear and achievable. For investors, this method is useful to monitor financial progress and adjust savings plans accordingly, helping them reach their long-term financial goals more effectively.

B. Creating and Implementing a Financial Plan

A well-structured financial plan is essential for achieving both short-term Und long-term financial goals. The process of creating a financial plan involves several key steps:

- Assess your financial situation: Take an inventory of assets, liabilities, income, and expenses.

- Set financial goals: Identify both short-term goals (e.g., building an emergency fund) and long-term goals (e.g., retirement savings).

- Develop strategies: Determine how to allocate resources to meet these goals (e.g., budgeting, investing, saving).

- Implement the plan: Start making changes in spending, saving, and investing to align with the plan.

- Review and adjust: Regularly revisit the plan and make adjustments as needed, based on changes in income, life circumstances, or financial priorities.

Implementing a financial plan requires discipline Und consistency. Automating contributions to savings or retirement accounts can help individuals stick to their plan and achieve their goals.

Figur: 6 Steps For Prioritizing Financial Goals

Beschreibung:

This figure illustrates six essential steps to help individuals prioritize their financial goals. The steps include: (1) Listing down essential needs, (2) Creating an emergency savings fund, (3) Planning for retirement, (4) Securing the right insurance, (5) Paying off high-interest debt, and (6) Investing for both short- and long-term goals. These steps are meant to guide individuals on how to manage their finances in a structured way.

Wichtige Erkenntnisse:

- List your needs: Prioritize basic living expenses first before other financial goals.

- Emergency savings: Build an emergency fund to prepare for unexpected expenses.

- Retirement planning: Secure your future by focusing on retirement savings early.

- Insurance: Ensure adequate coverage for unexpected health or life events.

- Debt repayment: Pay off high-interest debt to avoid financial strain.

- Investment planning: Invest for both short-term and long-term goals to grow your wealth.

Application of Information:

These steps provide a roadmap for anyone looking to organize and manage their finances effectively. For investors, it highlights the importance of balancing immediate needs with long-term goals, ensuring a holistic approach to financial planning. By following these steps, individuals can create a solid financial foundation and set themselves up for long-term success.

C. Philanthropy and Charitable Giving

For many individuals, philanthropy Und charitable giving are integral components of their financial plan. Charitable donations not only contribute to causes they care about but can also provide tax benefits in certain countries. When planning charitable giving, it’s important to:

- Set a budget: Determine how much of your income you can allocate to charitable donations without affecting other financial goals.

- Choose causes: Focus on organizations or causes that align with your personal values and financial ability.

- Understand the tax benefits: Many countries offer tax deductions oder credits for charitable donations, which can reduce taxable income.

Philanthropy can also take the form of setting up foundations oder donor-advised funds, which allow for long-term charitable contributions while potentially growing the initial donation through investments.

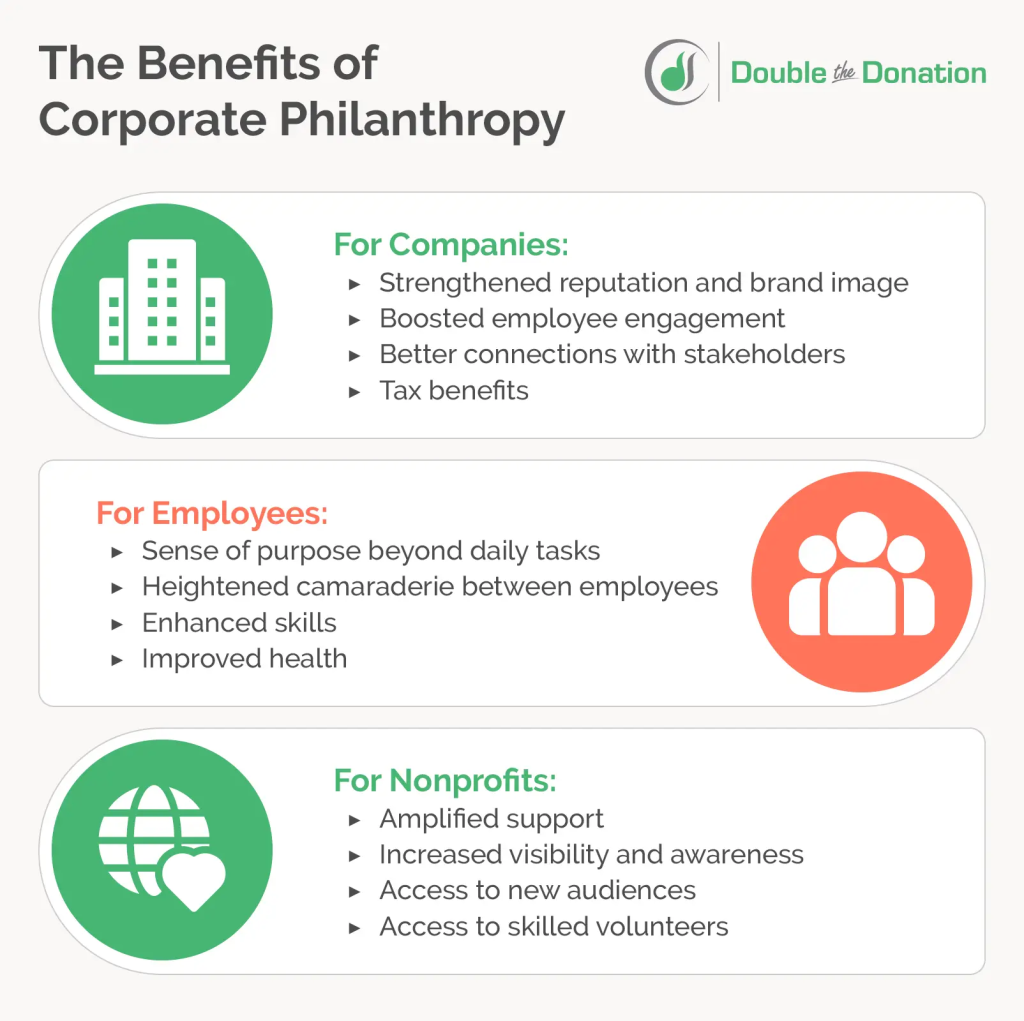

Figur: The Benefits of Corporate Philanthropy

Beschreibung:

This figure highlights the multiple benefits that corporate philanthropy provides to three key groups: companies, employees, Und nonprofits. For companies, philanthropy enhances reputation, employee engagement, and stakeholder relations while offering tax benefits. Employees gain a sense of purpose, improved camaraderie, enhanced skills, and health benefits. Nonprofits receive amplified support, increased visibility, and access to skilled volunteers and new audiences.

Wichtige Erkenntnisse:

- Companies benefit from improved brand image, employee engagement, and tax advantages.

- Employees experience increased purpose, teamwork, and skill enhancement.

- Nonprofits gain greater support, visibility, and skilled volunteer access.

- Philanthropy strengthens relationships between businesses and stakeholders.

- It can boost both internal employee satisfaction and external brand recognition.

Application of Information:

Corporate philanthropy serves as a strategic tool for companies to boost their public image while contributing to employee well-being and social good. Investors and businesses can leverage this data to improve corporate social responsibility (CSR) initiatives, enhance stakeholder relations, and cultivate a more engaged workforce, making the company more attractive to both employees and customers.

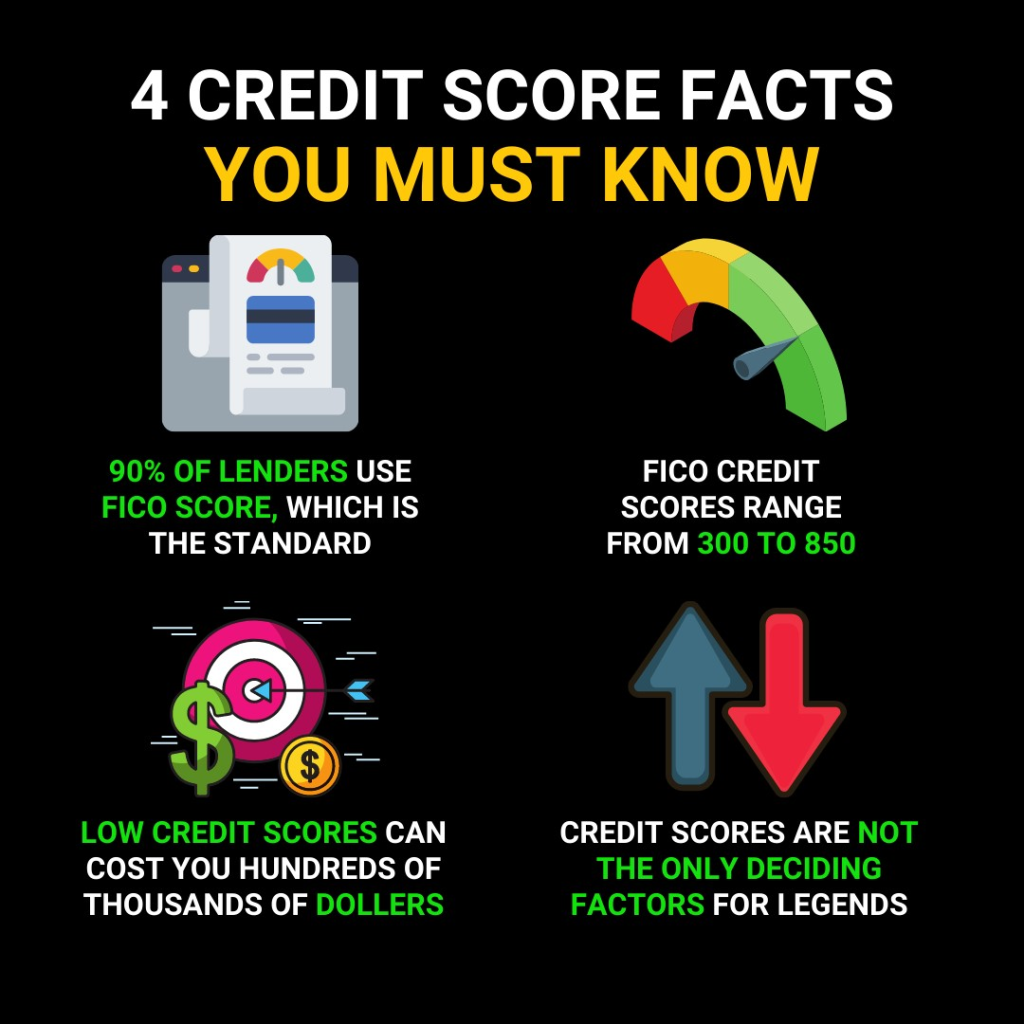

D. Credit Reports and Scores

Credit reports Und credit scores play a crucial role in financial planning, as they affect an individual’s ability to obtain loans, mortgages, or credit cards. A credit report contains detailed information about debt, payment history, Und credit usage, while a credit score is a numerical representation of creditworthiness.

- Improving credit score: Paying bills on time, keeping credit card balances low, and reducing overall debt can improve credit scores.

- Checking credit report: Regularly checking credit reports helps ensure there are no errors or fraudulent activity that could negatively impact the score.

- Understanding the impact of credit scores: A high credit score can lead to lower interest rates and better loan terms, while a low credit score may result in higher costs for borrowing.

Monitoring credit reports from major reporting agencies and understanding how to improve or maintain a good credit score are essential steps in long-term financial planning.

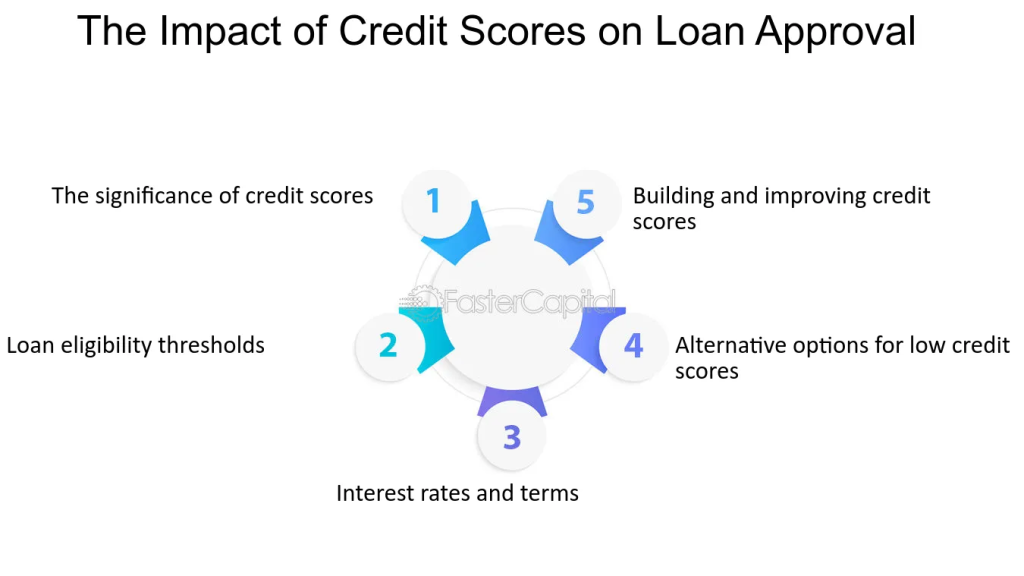

Figure: The Impact of Credit Scores on Loan Approval

Beschreibung:

This figure explains the key areas where credit scores influence loan approval. It highlights five main factors: the significance of credit scores, loan eligibility thresholds, the impact on interest rates and terms, alternative options for low credit scores, and the importance of building and improving credit scores. Each factor plays a crucial role in determining whether an individual is approved for a loan and the conditions of the loan.

Wichtige Erkenntnisse:

- Credit scores are essential in determining loan approval and impact interest rates.

- Higher credit scores usually lead to better loan terms, such as lower interest rates.

- There are loan eligibility thresholds tied directly to credit scores, limiting access to credit for those with lower scores.

- Alternative loan options exist for individuals with low credit scores, but they often come with higher costs.

- Improving and maintaining a good credit score is key to obtaining favorable loan terms.

Application of Information:

Verstehen der importance of credit scores helps individuals improve their financial standing to gain access to better loans with favorable terms. This data is critical for investors and those seeking loans, as it highlights the need to monitor and improve credit scores for financial success.

Wichtige Unterrichtsinformationen:

- SMART Goals provide clear direction for financial planning. By setting Specific, Measurable, Achievable, Relevant, Und Time-bound goals, users can establish realistic objectives and track progress toward their financial targets. This approach promotes disciplined savings and investment habits, leading to better long-term results.

- A well-structured financial plan is essential for balancing both short-term and long-term financial needs. Implementing strategies like budgeting, saving, investing, and regular plan reviews helps users stay on track, adapting to changes in income or life circumstances. This ensures financial stability over time.

- Philanthropy can be part of financial success. Setting a charitable giving budget allows users to contribute to meaningful causes while potentially receiving tax benefits. By aligning philanthropy with personal values, users can enhance both their financial plans and social impact.

- Credit reports and scores affect financial access. Maintaining a high credit score can lead to better loan terms, lower interest rates, and more financial opportunities. Regularly monitoring credit reports for errors and making timely payments are key actions for improving credit health.

- Financial strategies should be adaptable to life changes, such as income fluctuations, family growth, or unexpected events. Regularly reviewing and adjusting financial plans ensures that users can manage both planned goals and unforeseen expenses effectively.

Schlusserklärung: Understanding and implementing long-term financial strategies like SMART goals, structured financial planning, philanthropy, and credit management can significantly enhance financial health and personal growth. These skills not only support stability but also empower users to make informed, confident financial decisions throughout their lives.