06

Ιούν

Προσωπικά Οικονομικά

σε Χωρίς κατηγορία

Σχόλια

Τρέχουσα κατάσταση

Δεν έχει εγγραφεί

Τιμή

Κλειστό

Ξεκίνα

Αυτό το σειρά μαθημάτων είναι προς το παρόν κλειστό

Περιεχόμενο Σειρά μαθημάτων

Κεφάλαιο 1: Εισαγωγή στα Προσωπικά Οικονομικά

Κεφάλαιο 2: Οικονομικές στάσεις και συμπεριφορές

Κεφάλαιο 3: Πλοήγηση Εισοδήματος και Καριέρες

Κεφάλαιο 4: Χρηματοοικονομικός προγραμματισμός και καθορισμός στόχων

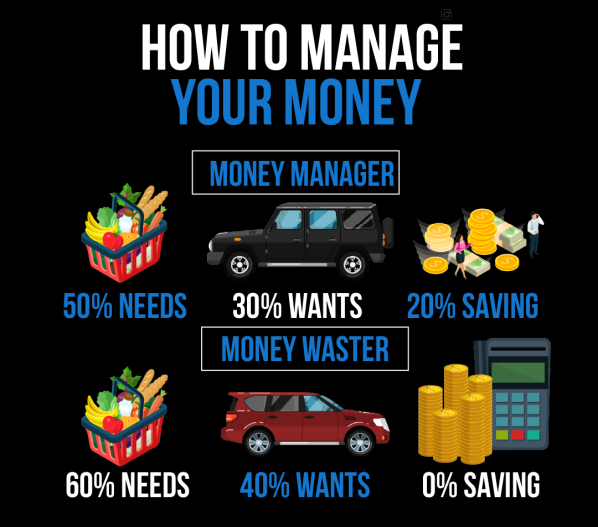

Κεφάλαιο 5: Προϋπολογισμός και Διαχείριση Εξόδων

Κεφάλαιο 6: Λήψη Αποφάσεων Καταναλωτή