Chapter 3: Navigating Income and Careers

Lesson Learning Objectives:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Introduction

The journey through income and careers is a multifaceted exploration of how individuals align their work life with financial goals and personal values. This chapter delves into the decisions surrounding job choices, the impact of education and training on career paths, and the dynamic nature of labor markets and entrepreneurship.

3.1 Choosing Jobs and Careers

When individuals consider potential careers or job opportunities, they weigh both potential income and non-income factors. Non-income factors such as job satisfaction, work-life balance, independence, risk, and location often play a crucial role in this decision-making process. Similarly, income factors such as salary, benefits, job stability, and opportunities for advancement are major considerations when evaluating different paths. The balance between financial rewards and personal fulfillment highlights the complex interplay between our professional choices and life values.

Income Factors:

- Salary and Wages: The base income an individual earns for their work, which can significantly impact lifestyle choices, savings, and long-term financial security.

Example: Kevin chooses a corporate finance job that offers a higher starting salary over a nonprofit role he was passionate about, intending to build savings quickly and later transition to mission-driven work. - Bonuses and Incentives: Additional income opportunities beyond regular pay, such as performance bonuses, commission, or profit sharing.

Example: Maria takes a sales position with a lower base salary but high commission potential, believing her strong skills will maximize her income. - Benefits and Perks: Health insurance, retirement plans (like 401(k) matches), paid leave, tuition reimbursement, and other non-cash compensation add substantial financial value.

Example: Sam chooses an employer offering excellent health insurance and a generous 401(k) match, recognizing the long-term financial benefits beyond salary. - Job Stability and Security: Consistent, predictable income without the fear of frequent layoffs or contract termination supports financial planning and peace of mind.

Example: After considering several startups, Olivia accepts a government job offering strong job security and a steady paycheck, despite slightly lower pay. - Opportunities for Advancement: The potential for promotions, raises, and professional growth affects future income potential and career satisfaction.

Example: Noah chooses an entry-level marketing role at a growing company known for rapid internal promotions, betting on higher earnings within a few years.

Non-Income Factors:

- Job Satisfaction: Finding purpose and fulfillment in one’s work can outweigh the lure of a higher salary.

- Job Satisfaction: Finding purpose and fulfillment in one’s work can outweigh the lure of a higher salary.

- Independence refers to the autonomy one has in their job, such as the ability to make decisions, set schedules, and choose projects.

- Risk involves the potential for job loss, income variability, and the financial uncertainty associated with self-employment or entrepreneurial ventures.

- Example: An IT consultant values independence, choosing projects that align with personal interests, albeit with the risk of inconsistent income. Conversely, a public school teacher might have less independence in choosing what to teach but enjoys more job security.

- Example: An IT consultant values independence, choosing projects that align with personal interests, albeit with the risk of inconsistent income. Conversely, a public school teacher might have less independence in choosing what to teach but enjoys more job security.

- Family and Location: Family considerations might involve choosing a job that allows for flexible hours or proximity to loved ones. Location refers to the geographical area of employment, impacting lifestyle, cost of living, and availability of employment opportunities.

- Example: Jane declined a high-paying job offer in another state to stay close to her family, prioritizing her children’s stability. Meanwhile, Alex moved to a city with a higher cost of living for a job that offered career advancement in technology.

- Example: Jane declined a high-paying job offer in another state to stay close to her family, prioritizing her children’s stability. Meanwhile, Alex moved to a city with a higher cost of living for a job that offered career advancement in technology.

- Diverse Income Sources: Today’s workforce is increasingly exploring varied ways to earn income, including full-time employment, part-time work, self-employment, investment income, and passive income streams. This diversification reflects a strategic approach to financial stability and personal satisfaction.

Income Types

- Full-Time Employee: Employment with a company or organization on a permanent basis, typically with a fixed salary and benefits.

- Risks: Job security can be affected by economic downturns or company restructuring.

- Rewards: Steady income, employee benefits (health insurance, retirement plans).

- Example: Sarah works as a full-time software engineer, enjoying health benefits and a stable salary, but faces the risk of layoffs.

- Part-Time Employee: Employment with reduced hours compared to full-time positions, often without the full range of employee benefits.

- Risks: Lower income, limited job security, and often no benefits.

- Rewards: Flexibility, the opportunity to pursue education or other interests concurrently.

- Example: Mike is a part-time retail worker, allowing him time for college studies, though he lacks health insurance through his employer.

- Self-Employment: Working for oneself rather than an employer, offering services or running a business.

- Risks: Income variability, responsibility for own taxes and benefits.

- Rewards: Independence, control over workload and clients, potential for higher earnings.

- Example: Linda runs her own graphic design business, enjoying the freedom to choose projects but managing the stress of irregular income.

- Investment Income: Earnings from investments, such as stocks, real estate, or other assets. Allocating money in the expectation of some benefit in the future.

- Risks: Potential for loss of capital, market volatility.

- Rewards: Passive income through interest, dividends, or capital gains.

- Example: Raj invests in the stock market, earning dividends and experiencing the ups and downs of market changes.

- Passive Income: Income received on a regular basis, requiring minimal to no effort to maintain, such as rental income or royalties.

- Risks: Dependent on market conditions, potential for income interruption.

- Rewards: Steady income stream without direct labor.

- Example: Emily rents out a property, receiving monthly rent payments without day-to-day management responsibilities.

Intangible Benefits:

Non-cash benefits, such as flexible work hours, telecommuting options, positive work environment, and career advancement opportunities, can significantly impact career choices, often leading individuals to trade higher income for a better quality of life.

Trade-offs: Choosing a job with lower pay but substantial intangible benefits can lead to greater overall satisfaction and work-life balance, underscoring the importance of weighing both income and non-income factors in career decisions.

3.2 Understanding Compensation and Benefits in the Workplace

Compensation is not just about the paycheck at the end of the month. It encompasses wages, salaries, commissions, tips, bonuses, and a plethora of employee benefits like health insurance, retirement savings plans, and education reimbursement programs. Understanding the multifaceted nature of compensation is crucial for both employees navigating their career paths and employers aiming to attract top talent.

Exploring Compensation and Benefits

- Forms of Compensation: Compensation extends beyond the basic salary to include variable components such as commissions for sales roles, tips in service industries, and performance-related bonuses. These variable components can significantly impact an employee’s total earnings and financial stability.

- Employee Benefits: Companies often offer comprehensive benefit packages to enhance their attractiveness as employers. These can include health insurance, retirement savings plans like 401(k)s, and perks such as education reimbursement. These benefits not only provide security and support for employees but also demonstrate an employer’s investment in their workforce’s wellbeing and future.

Evaluating Total Compensation

In addition to base pay, workers receive compensation in the form of various benefits, which can be either contributory (shared cost between employer and employee) or non-contributory (fully employer-funded). These benefits can include:

- Health insurance plans

- Retirement savings options such as 401(k)s and pensions

- Educational reimbursement for tuition or training

- Flexible spending accounts (FSAs) for health and childcare

Action Step: When evaluating job offers, individuals should calculate the total value of compensation, not just the salary. For example, two jobs may offer similar pay, but one might include a retirement plan with a generous employer match, making it more financially advantageous.

Delving Deeper into Employee Benefits

- Researching Potential Income and Benefits: It’s vital for job seekers and employees to research and understand the potential income and benefits package offered by employers. This could involve comparing packages from various companies, government agencies, or non-profit organizations to find the best fit for their needs and values.

- The Importance of Evaluating Employee Benefits: Evaluating benefits in addition to wages and salaries is essential when choosing between job opportunities. Benefits such as health insurance, retirement plans, and flexible working arrangements can have substantial long-term implications for an individual’s financial health and work-life balance.

- Contributory vs. Non-Contributory Benefits: Understanding the difference between contributory (Employees and employers share the cost of benefits, such as retirement savings plans.) and non-contributory (Employers fully cover the cost of benefits, such as some health insurance plans. This distinction affects the overall value of a compensation package and can influence job choice decisions.

- The Value of Employer-Sponsored Plans: Participating in employer-sponsored retirement and healthcare plans is highly beneficial. These plans often come with employer contributions, which can significantly enhance an employee’s savings and financial security. Understanding these benefits and how to maximize them is a key aspect of financial planning and career development.

Compensation in the workplace is a complex topic that extends far beyond the surface level of salaries and hourly wages. It includes a variety of financial and non-financial rewards designed to compensate employees for their time, skills, and contributions to the company. By thoroughly understanding and evaluating all components of compensation, individuals can make informed decisions about their careers and financial futures, ensuring alignment with their long-term goals and values.

3.3 Education and Training Decisions

People’s willingness to pursue further education or training is influenced by their assessment of immediate costs versus future benefits. This calculation varies significantly among individuals, depending on their life circumstances and future outlook. Some may view the cost of college as an investment in their future earning potential, while others might opt for vocational training to enter the workforce more quickly. The decision often hinges on personal goals, financial situations, and the perceived value of additional education in a changing labor market.

- Barriers to Education and Training: Despite the potential benefits, many face barriers to accessing further education, including financial constraints, lack of information, or personal responsibilities. Overcoming these barriers requires careful planning, support, and sometimes, creative solutions like online learning or part-time programs.

Comparing Educational Pathways

Evaluating the return on investment of college education versus technical training involves considering the costs, potential income, and employment opportunities each path offers. While college degrees often lead to higher lifetime earnings, technical schools can offer quicker entry into the workforce and less debt.

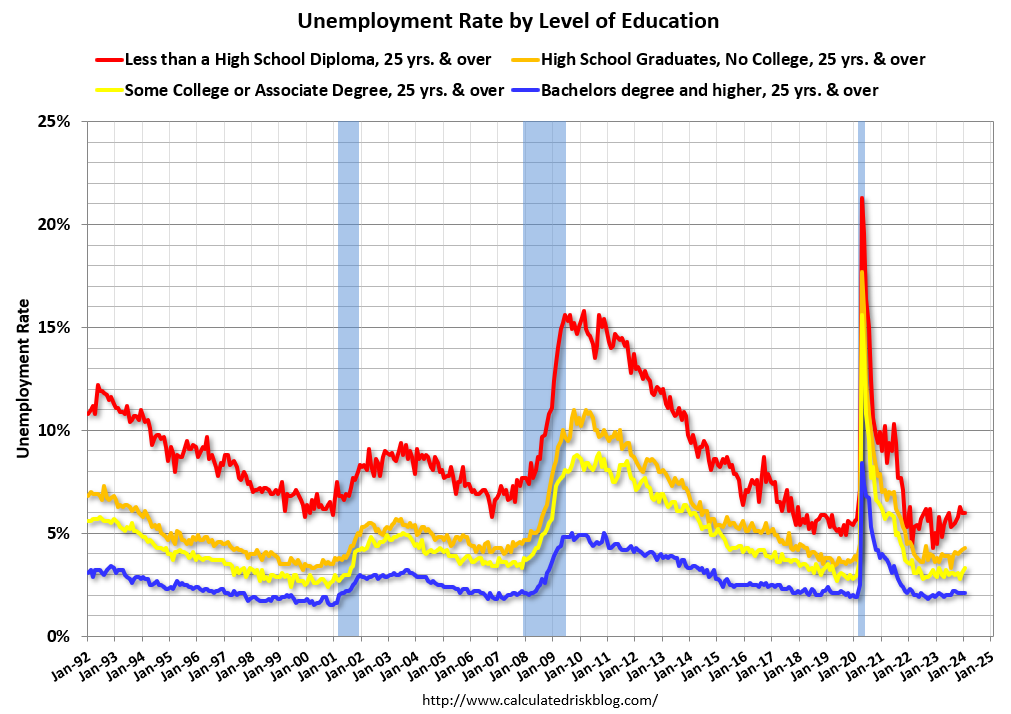

- Unemployment Rates: Generally, higher education levels correlate with lower unemployment rates, underscoring the value of investing in education. Individuals with college degrees tend to experience lower unemployment compared to those with high school diplomas or less. This is partly due to the increased demand for skilled labor and the flexibility higher education provides in a dynamic job market.

Figure: Unemployment Rates by Education Level in January 2024

Description:

The figure likely illustrates the unemployment rates segmented by different levels of educational attainment as of January 2024. Although the specific details are not accessible, such graphs typically show unemployment rates decreasing with higher levels of education, demonstrating the protective effect of education against unemployment.

Key Takeaways:

- Higher education levels generally correlate with lower unemployment rates.

- The data may highlight significant disparities in unemployment based on educational attainment.

- Trends over time could indicate changes in the labor market’s valuation of education.

Application of Information:

Understanding the relationship between education and unemployment rates is crucial for policymakers, educators, and individuals making career and education decisions. For investors and analysts, this data can inform sectors likely to experience growth or contraction based on workforce education levels. It underscores the importance of investing in education to mitigate unemployment risks and suggests areas for targeted job creation and workforce development initiatives.

- Example: During an economic downturn, Alex, with a bachelor’s degree in engineering, finds it easier to secure employment than Jamie, who only completed high school, highlighting the protective effect of higher education against unemployment.

Vocational Training vs. College Education

High school students assessing vocational training might value the quicker entry into the workforce, lower education costs, and direct skill acquisition for specific trades. However, they might also consider the potential limitations in career advancement and salary growth compared to those with a college degree.

College Education:

- Benefits: Broader educational foundation, higher potential for career flexibility, typically higher lifetime earnings.

- Costs: tuition, potential for significant student debt, longer time commitment before entering the workforce.

- Return on Investment (ROI): Can be high, especially for degrees in demand, but varies significantly by field of study and market conditions.

Example: Jordan evaluates a four-year college degree in computer science against a two-year technical program in web development. While the college route offers broader career options and potentially higher earnings, the technical program allows quicker entry into a growing job market with less debt.

Vocational Training:

- Benefits: Shorter duration, focused skill development for specific trades, quicker entry into the labor market.

- Costs: Tuition (generally lower than four-year colleges), some risk of limited career flexibility.

- ROI: Often favorable due to lower costs and the ability to start earning sooner, but depends on the demand for specific skills.

Example: Emma opts for a vocational program in dental hygiene, attracted by the short training period and good starting salaries, though mindful of the ceiling on advancement opportunities without further education.

Career Pathways Beyond College

Various career paths do not require traditional college degrees, including skilled trades, technology certifications, entrepreneurship and creative professions. These pathways can offer rewarding careers without the financial and time investment of a four-year degree.

Examples:

- A certified electrician or plumber can achieve significant earnings with vocational training.

- IT certifications can open doors to careers in cybersecurity, network administration, and software development.

- Starting a business in a niche market can lead to financial success and personal fulfillment.

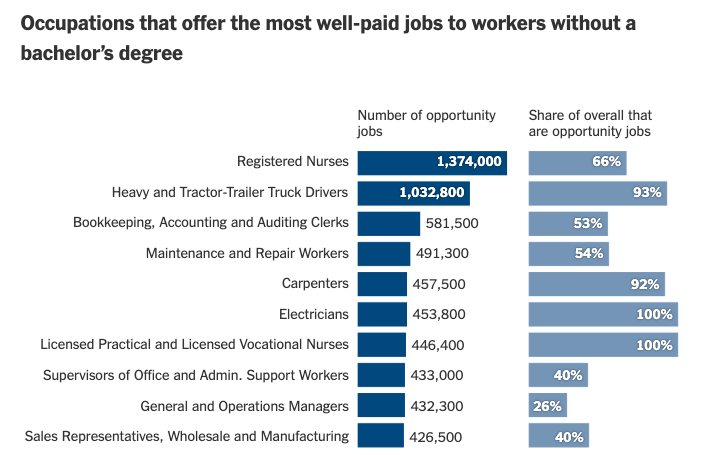

Figure: Most Plentiful Well-Paying Jobs That Don’t Require a Bachelor’s Degree

Description:

The figure likely showcases a list of jobs that are abundant and offer good pay without necessitating a bachelor’s degree. These positions might span various industries, highlighting the value of vocational training, certifications, and associate degrees. The graph or chart probably illustrates job counts, median salaries, or growth projections, emphasizing the opportunities outside traditional four-year college paths.

Key Takeaways:

- Vocational training and certifications can lead to lucrative careers.

- There is a high demand for skilled labor in certain sectors that do not require a bachelor’s degree.

- Diverse opportunities exist across industries for those without a four-year college degree.

- Investing in specific skills or trades can offer a significant return in terms of employment and salary.

Application of Information:

This information is invaluable for individuals considering their career paths, educators guiding students, and policymakers focusing on workforce development. It highlights the importance of alternative education paths and the need for skills-based training. For investors and businesses, understanding these trends can inform decisions related to workforce development, education technology, and industry investments.

3.4 Informed Decisions on Education, Job, and Career

Making informed decisions about education and career paths involves evaluating the benefits and costs of different options. This evaluation includes considering the return on investment of college education versus technical training, the unemployment rates associated with various levels of education, and exploring career pathways that do not require college degrees. Such analysis helps individuals align their career choices with their financial goals and personal values.

Labor Market Dynamics

Wages and salaries are primarily determined by the labor market, reflecting the demand and supply for specific skills and professions. Factors influencing these dynamics include worker productivity, education, skills, and economic conditions. As technology evolves and economic conditions shift, individuals must adapt to changes in employment opportunities and income levels.

- Example: In the healthcare industry, a specialized surgeon earns significantly more than a general practitioner due to higher education requirements, specific skills, and demand for their specialty.

- Economic Conditions: Factors such as recessions or technological advancements can lead to changes in employment rates and wages. For instance, an increase in demand for mobile applications can raise wages for software developers.

- Recession Example: During the 2008 financial crisis, many industries saw layoffs, but sectors like mobile app development experienced growth, leading to increased demand and higher wages for software developers.

Figure: Examining Labor Market Dynamics and Their Influence on Industry Trends

Description:

The figure likely illustrates the complex interplay between labor market dynamics and industry trends, possibly through graphs, charts, or conceptual diagrams. It may highlight how factors such as technological advancements, demographic shifts, and economic policies affect employment rates, job creation, and the demand for specific skills across various industries.

Key Takeaways:

- Technological advancements significantly impact labor demand, creating new opportunities while rendering some jobs obsolete.

- Demographic shifts, including aging populations and migration patterns, influence labor supply and the types of jobs in demand.

- Economic policies and global events can rapidly alter labor market dynamics, affecting industry trends and workforce planning.

- The importance of lifelong learning and skills development in adapting to changing labor market requirements.

Application of Information:

This analysis is crucial for policymakers, educators, businesses, and workers to understand and adapt to the evolving labor market. It underscores the need for flexible education systems, responsive workforce development programs, and strategic business planning to navigate the challenges and opportunities presented by labor market dynamics. For individuals, it highlights the importance of continuous learning and adaptability in securing employment and advancing in their careers.

3.5 Understanding Wages, Salaries, and the Impact of Productivity and Skills

Compensation encompasses wages, salaries, commissions, and may include benefits like health insurance and retirement savings plans. Evaluating these comprehensive packages is vital when choosing between job opportunities.

Businesses value worker productivity highly, often offering higher wages to more productive employees. Productivity can be influenced by skills, experience, and work ethic, affecting income potential within the same job roles.

Example: In a manufacturing firm, employees who consistently exceed production targets may receive higher wages or bonuses compared to their peers, reflecting the business’s incentive to reward productivity.

Types of Jobs and Careers Influenced by Worker’s Productivity and Skills

In the landscape of employment, certain careers starkly illustrate how wages and salaries are closely tied to an individual’s productivity and skills. For instance:

- Technology and Software Development: In this rapidly evolving sector, highly skilled developers, programmers, and engineers command premium salaries, reflective of their ability to innovate and drive technological advancements.

- Healthcare Professionals: Surgeons, physicians, and specialized medical practitioners receive compensation that reflects their extensive training, skill level, and the critical nature of their work.

- Sales Professionals: In many sales roles, particularly those with commission-based structures, earnings directly correlate with productivity in terms of sales volume and revenue generated.

- Legal Professionals: Lawyers and legal consultants with specialized expertise or high success rates in litigation often have higher earning potential, underscoring the value of their skills and experience.

- Creative Industries: Artists, writers, and designers may see income variability based on the demand for their unique talents and the success of their work in the market.

Variability in Wages and Salaries

Wages and salaries vary significantly across different jobs and even among workers within the same role due to several factors:

- Skill Level and Education: Higher levels of education and specialized skills generally lead to better-paying opportunities, as they signify the worker’s ability to perform complex tasks.

- Experience: Experienced professionals often command higher wages as they bring a proven track record and potentially a higher degree of efficiency and expertise to their roles.

- Industry and Market Demand: Sectors with higher demand for skilled workers, such as technology and healthcare, tend to offer higher wages to attract and retain talent.

- Geographical Location: Differences in the cost of living and the economic conditions across regions can significantly influence wage levels.

3.6 Persistence of Race and Gender Pay Gaps

Despite advancements towards equality, race and gender pay gaps persist due to a complex interplay of factors:

- Discrimination and Bias: Prejudices in hiring, promotion, and compensation decisions can lead to systemic disparities in earnings for women and racial minorities.

- Occupational Segregation: Historical and social factors have led to the concentration of certain genders and races in lower-paying occupations, perpetuating wage disparities.

- Access to Education and Training: Inequalities in access to quality education and career development opportunities can limit earning potential for certain groups.

- Negotiation and Representation: Differences in negotiation practices and representation in high-paying roles also contribute to ongoing disparities in wages.

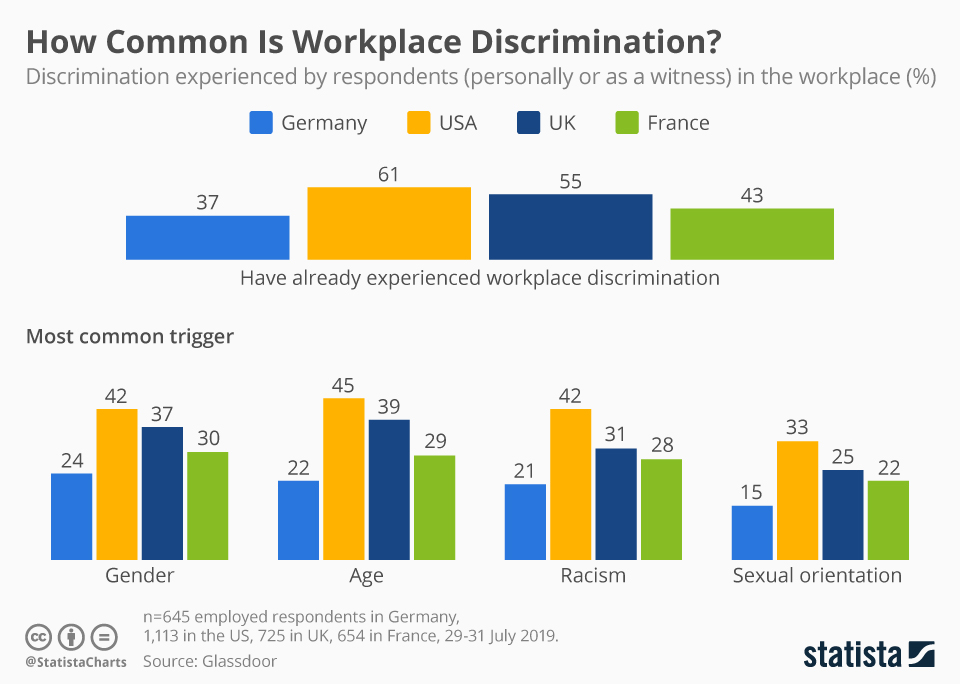

Figure: Discrimination Experienced by Respondents in the Workplace

Description:

The figure likely presents statistical data on various forms of discrimination experienced by respondents in the workplace. This could include categories such as age, gender, race, disability, and sexual orientation among others. The graph or chart probably quantifies the percentage of respondents who have experienced each type of discrimination, providing insights into the prevalence and distribution of workplace discrimination issues.

Key Takeaways:

- Workplace discrimination is a prevalent issue affecting a significant portion of the workforce across various dimensions, including gender, race, and age.

- Certain forms of discrimination may be more common than others, highlighting specific areas for policy and organizational focus.

- The data underscores the importance of diversity and inclusion initiatives in combating discrimination and fostering an equitable work environment.

Application of Information:

This information is crucial for HR professionals, policymakers, and organizational leaders to understand the scope and specifics of discrimination within the workplace. It emphasizes the need for comprehensive anti-discrimination policies, training programs, and a culture that promotes diversity and inclusion. For individuals, it highlights the importance of awareness and advocacy in addressing and preventing discrimination.

3.7 Entrepreneurship as a Career Choice

Entrepreneurship attracts individuals willing to take risks for the potential of significant rewards. Successful entrepreneurs often exhibit creativity, resilience, and a strong work ethic.

Benefits:

- Autonomy in decision-making.

- Potential for substantial financial rewards.

- Personal satisfaction from building something valuable.

Costs:

- High risk and potential for financial loss.

- Responsibility for all aspects of the business.

- Tax implications, including self-employment tax.

3.8 The Gig Economy

The gig economy offers opportunities for self-employment and flexible work arrangements, appealing to those seeking independence or supplemental income. The gig economy represents a significant shift in how people view employment and income generation. Gig work, including freelance, contract, and part-time roles, offers flexibility and diversity in income sources. While it provides flexibility, it also comes with challenges such as income instability, responsibility for taxes, and lack of traditional job benefits.

The gig economy encompasses a wide range of freelance, contract, and part-time roles across various industries. Here are some examples, including traditional roles like cab driving or delivery services, as well as other popular gig economy jobs:

Ride-Sharing Driver

- Platforms: Uber, Lyft

- Description: Individuals use their vehicles to offer rides to passengers via a mobile app. Drivers have the flexibility to choose their working hours and locations.

- Benefits: Flexible schedule, independence, and the opportunity to earn tips.

- Challenges: Variable income, wear and tear on the vehicle, and the need to manage fuel and maintenance costs.

Delivery Services

- Platforms: DoorDash, Uber Eats, Postmates

- Description: Delivery drivers pick up and deliver food, groceries, or other items to customers’ doorsteps. The work involves navigating local areas to make timely deliveries.

- Benefits: Flexible hours, potential for multiple small gigs in a day, and tips from satisfied customers.

- Challenges: Inconsistent earnings, vehicle maintenance, and sometimes challenging customer service situations.

Freelance Writing and Content Creation

- Platforms: Upwork, Freelancer, Fiverr

- Description: Writers and content creators produce articles, blog posts, marketing copy, and more for various clients. This can range from creative writing to technical documentation.

- Benefits: Ability to work from anywhere, choose projects of interest, and set your rates.

- Challenges: Finding consistent work, managing client expectations, and fluctuating income.

Graphic Design and Multimedia Services

- Platforms: 99designs, Fiverr, Behance

- Description: Graphic designers create visual content for clients, including logos, website designs, and marketing materials. Multimedia services might include video editing, animation, and web development.

- Benefits: Creative freedom, potential for high-value projects, and a broad client base.

- Challenges: Competition for projects, project-based income variability, and the need for continuous skill development.

Online Tutoring and Teaching

- Platforms: VIPKid, Tutor.com, Teachable

- Description: Educators and experts offer tutoring services or create online courses in their subject area expertise. This can range from academic subjects to skills like music or coding.

- Benefits: Flexible scheduling, the reward of helping students learn, and the opportunity to reach a global audience.

- Challenges: Dependence on platform policies, potential for irregular student engagement, and the need to market oneself to attract students.

Task and Handyman Services

- Platforms: TaskRabbit, Handy

- Description: Individuals offer services such as furniture assembly, home repairs, or errand running. These tasks are often one-off jobs requested by local clients.

- Benefits: Flexibility in choosing tasks, setting rates, and working in different locations.

- Challenges: Irregular job availability, physical demands of the work, and managing client expectations.

Virtual Assistance

- Platforms: Belay, Upwork, Zirtual

- Description: Virtual assistants provide administrative, technical, or creative assistance to clients remotely. Tasks can include scheduling, email management, social media, and more.

- Benefits: Work-from-home flexibility, diverse tasks, and the potential for stable, long-term client relationships.

- Challenges: Juggling multiple clients, the need for a broad skill set, and possible expectations of availability during clients’ working hours.

These examples illustrate the diversity within the gig economy, offering opportunities across various skill sets and interests. While gig work provides flexibility and independence, it also requires careful management of finances, time, and client relationships to be successful.

3.9 Retirement and Social Security

Planning for retirement involves understanding the various sources of income available, including Social Security, employer-sponsored retirement plans, and personal investments. Early planning and diversified income strategies are essential for securing financial stability in retirement.

3.10 The Power of Intangible Benefits

Not all benefits are monetary. Intangible job benefits—like remote work, flexible hours, supportive management, or opportunities for advancement—can have profound impacts on job satisfaction and career longevity. Students and job seekers should consider:

- How a job aligns with lifestyle needs and values

- The availability of professional development and promotions

- Workplace culture and environment

Real-World Tradeoff: A lower-paying position with excellent work-life balance and growth potential may ultimately offer greater lifetime career satisfaction than a high-paying but stressful job.

3.11 Barriers to Higher Education and Training

Though higher education can lead to increased earning potential, many face barriers including:

- Financial constraints and debt aversion: College tuition, fees, textbooks, and living expenses can be overwhelming, especially for students from low-income families. Even with financial aid, the fear of taking on student loans (“debt aversion”) discourages many from pursuing higher education, as they are wary of long-term repayment burdens.

- Lack of access to quality post-secondary options: Not everyone has nearby access to reputable universities, trade schools, or community colleges. In rural or underserved areas, students may face limited program choices or lower-quality institutions, affecting the value of their education.

- Personal responsibilities, such as childcare or needing to work while in school: Many students balance school with other life demands, like raising children or holding one or more jobs. These responsibilities make it harder to attend traditional in-person classes full-time, extend the time to complete degrees, or even lead to dropping out altogether.

Strategic Advice:

Students should research scholarships, community college transfer programs, and online training opportunities to reduce cost and increase flexibility.

- Research Scholarships and Grants:

Many scholarships are available based on merit, financial need, or background. They can significantly reduce costs without adding debt. - Consider Community College Transfer Programs:

Starting at a lower-cost community college and transferring to a four-year university can cut the cost of a bachelor’s degree by tens of thousands of dollars. - Explore Online and Flexible Training Programs:

Online programs often offer lower tuition and allow students to study on their own schedules, making it easier to work or handle personal responsibilities while completing education.

3.12 Earnings and the Labor Market

Earnings vary significantly based on factors such as:

- Education and credentials: Generally, the more education or specialized training someone has, the higher their earning potential. For example, individuals with a bachelor’s degree typically earn more than those with only a high school diploma.

- Market demand for skills: Certain careers (like technology, healthcare, and skilled trades) pay more because they are in high demand. Conversely, fields with a surplus of workers often offer lower wages and fewer opportunities.

- Productivity and job performance: Workers who produce more value for their employers—whether through efficiency, creativity, or leadership—are often rewarded with higher salaries, promotions, or bonuses.

- Geographic location: Wages vary by region. Urban areas or states with a high cost of living (like New York or California) generally offer higher salaries to offset expenses, while rural or lower-cost areas often have lower wage scales.

- Race and gender disparities: Systemic issues and discrimination continue to contribute to wage gaps. On average, women and people of color earn less than their white male counterparts, even after accounting for education and experience. Advocacy for equity, transparency in pay, and anti-discrimination policies aim to address these disparities, but they remain persistent factors in the labor market.

Key Concept: Labor market conditions and economic trends affect job availability and wage levels. Industries like technology or healthcare often pay more due to skill shortages.

Gig Work and Small Business

Gig employment and entrepreneurship are rising in popularity. However, both come with risks:

- Lack of benefits and job security

- Variable income

- Tax implications, like self-employment tax

Still, these paths can offer autonomy and income potential. Students should weigh stability vs. flexibility and understand that success often depends on self-discipline, innovation, and market awareness.

3.13 Career Planning and Application Materials

Crafting a Résumé and Cover Letter

A well-prepared résumé and cover letter are essential tools for securing employment. These documents not only summarize your skills, experiences, and qualifications but also communicate your professionalism and attention to detail.

Résumé Tips:

- Highlight relevant skills and accomplishments

- Include education, certifications, and volunteer experiences

- Use clear formatting and action-oriented language (e.g., “organized,” “led,” “developed”)

- Tailor each résumé to match the job description

Cover Letter Tips:

- Address it to a specific person or department whenever possible

- Express why you’re interested in the position and how your skills align

- Include a brief overview of your relevant experiences and your enthusiasm for the role

Example Scenario: Jordan is applying for a marketing internship. He customizes his résumé to emphasize his experience with social media analytics and highlights his marketing coursework. His cover letter discusses his passion for creative storytelling and eagerness to apply classroom knowledge in a real-world setting.

Actionable Practice:

- Students should develop a sample résumé and cover letter for a job or internship of their interest during high school.

- Revisit and revise these documents each year to reflect new experiences, such as part-time jobs, volunteer work, or academic achievements.

Sample Résumé: Jordan – Marketing Internship Applicant

Jordan Mitchell

123 Elm Street • Anytown, USA 12345

jordan.mitchell@email.com • (555) 555-1234

LinkedIn: linkedin.com/in/jordan-mitchell

Portfolio: jordancreates.com (if applicable)

Objective

Creative and driven high school student with hands-on experience in social media analytics and a strong foundation in marketing principles. Seeking a marketing internship to apply classroom knowledge in real-world campaigns and further develop strategic communication skills.

Education

Lincoln High School, Anytown, USA

Expected Graduation: June 2026

GPA: 3.8/4.0

Relevant Coursework:

- Principles of Marketing

- Digital Media Strategies

- Business & Entrepreneurship

Experience

Student Marketing Coordinator – FBLA

Club

Lincoln High School | September 2023 – Present

- Led social media campaigns to promote school events, increasing attendance by 25%

- Analyzed Instagram insights to adjust posting schedules and content types for optimal engagement

- Designed digital posters and stories using Canva and Adobe Express

Volunteer Social Media Assistant – Community Garden Project

Summer 2023

- Managed weekly Facebook updates and created Instagram reels to highlight community efforts

- Collaborated with the team to create a branding style guide for future volunteers

Skills

- Social media analytics (Instagram Insights, Meta Business Suite)

- Content creation and design (Canva, Adobe Express)

- Copywriting for digital platforms

- Strong verbal and written communication

- Basic knowledge of SEO and email marketing

Extracurricular Activities

- Future Business Leaders of America (FBLA), Marketing Event Team

- Yearbook Club – Photo Editor

- JV Cross Country Team

Sample Cover Letter: Jordan – Marketing Internship

Jordan Mitchell

123 Elm Street

Anytown, USA 12345

jordan.mitchell@email.com

April 23, 2025

Hiring Manager

BrightWave Marketing Solutions

456 Innovation Avenue

Anytown, USA 12345

Dear Hiring Manager,

I am writing to express my interest in the Marketing Internship position at BrightWave Marketing Solutions. As a high school junior passionate about creative storytelling and digital communication, I’m eager to bring my enthusiasm and growing skill set to a dynamic and forward-thinking marketing team.

In my current role as Student Marketing Coordinator for my school’s FBLA chapter, I’ve had the opportunity to lead social media campaigns and analyze platform engagement data to improve content reach. I also recently volunteered with a local community garden project, where I managed their Instagram presence and contributed to creating a cohesive brand identity. These experiences have taught me how to blend creativity with strategy—skills I’m excited to deepen in a professional setting.

What excites me most about BrightWave is your commitment to innovation and community storytelling. I would love to contribute to campaigns that connect with people and create impact. This internship represents a perfect opportunity for me to apply what I’ve learned in marketing coursework and explore the field through hands-on projects.

Thank you for considering my application. I would welcome the opportunity to discuss how I can contribute to your team. My résumé is attached, and I am available for an interview at your convenience.

Sincerely,

Jordan Mitchell

Revising a Career Plan

As students progress through school and gain new experiences, it’s important to continuously revisit and refine their career plans to reflect updated:

- Interests and values

- Skills and qualifications

- Evolving industry trends

- Financial and lifestyle goals

This reflective process helps ensure that students are not only pursuing a viable career path but also one that aligns with their long-term personal and financial aspirations.

Exercise: Reassess your career plan annually. Identify any new interests or experiences and determine how they affect your career trajectory. Adjust education and training goals accordingly.

Conclusion

Navigating income and careers is a complex process influenced by a multitude of factors, including personal values, economic conditions, and the evolving nature of work. By understanding these dynamics and making informed decisions, individuals can align their career paths with their financial and personal goals, ultimately achieving a fulfilling professional life.

This chapter underscores the importance of strategic planning, continuous learning, and adaptability in the face of changing economic landscapes and labor markets. Whether through pursuing education, embracing entrepreneurship, or adapting to gig work, the key to navigating income and careers lies in making informed choices that reflect one’s values, goals, and the realities of the modern workforce.

Key Lesson Information:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.