Global: Market Capitalization and Enterprise Value

Lesson Learning Objectives:

- Understand the concept of Market Capitalization, how it is calculated, and its role in categorizing companies into large-cap, mid-cap, and small-cap. This knowledge is crucial for gauging a company’s size and its comparative scale within the industry.

- Learn about Enterprise Value (EV) and how it provides a more comprehensive measure of a company’s total value by including debt and cash. This measure is essential for deeper financial analysis, especially in mergers and acquisitions.

- Differentiate between Market Capitalization and Enterprise Value, recognizing how each metric serves different purposes in investment analysis. This distinction is vital for making informed investment decisions and for understanding the financial health and true worth of a company.

- Explore how these financial metrics are applied in real-world scenarios, such as in the evaluation of company size, investment analysis, and strategic decision-making. This practical application reinforces the theoretical knowledge and aids in better investment planning.

Introduction

When evaluating a company, two of the most important metrics investors use are market capitalization and enterprise value. These measures provide insight into a company’s size, value, and financial health, helping investors assess its worth in the marketplace. Understanding the differences between these two metrics is crucial for making informed investment decisions. This section introduces market capitalization and enterprise value, explains their differences, and demonstrates how to use them in investment analysis.

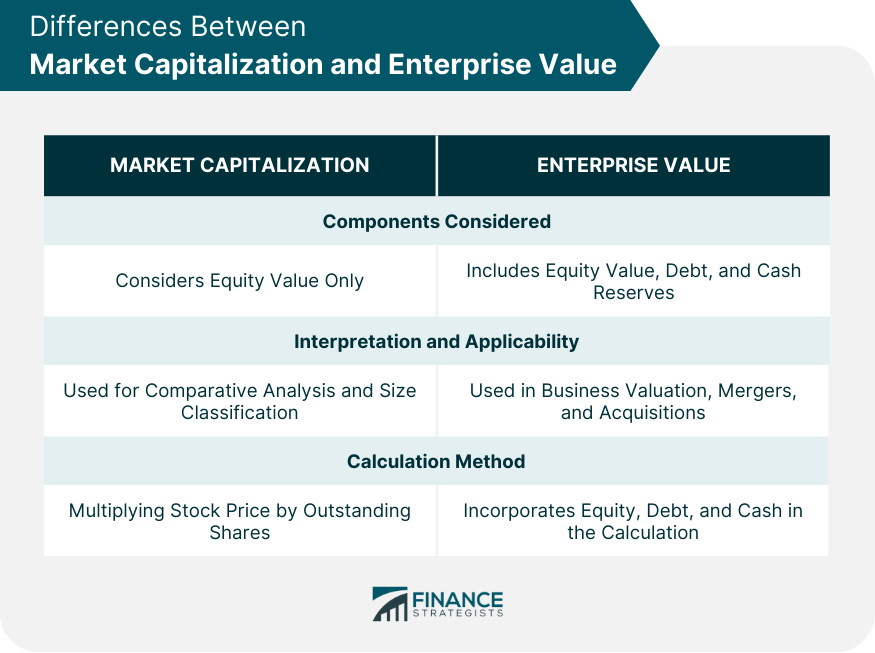

Figure: Differences Between Market Capitalization and Enterprise Value

Description:

This table presents a comparison between Market Capitalization and Enterprise Value, highlighting three main areas of distinction: components considered, interpretation and applicability, and calculation method. Market Capitalization considers only the equity value, making it useful for comparative analysis and sizing a company. It is calculated by multiplying the stock price by outstanding shares. Enterprise Value, on the other hand, provides a broader view by incorporating equity value, debt, and cash reserves, and is more applicable in business valuation, mergers, and acquisitions.

Key Takeaways:

- Market Capitalization represents the total equity value and is widely used for stock comparison.

- Enterprise Value provides a more comprehensive measure of a company’s value by including debt and cash reserves.

- The calculation of Market Capitalization is straightforward, while Enterprise Value requires incorporating additional factors like debt and cash.

Application of Information:

Investors can use Market Capitalization to understand the size of a company in terms of equity, while Enterprise Value offers a more accurate picture of the total value, particularly useful in mergers and acquisitions. Understanding the difference helps in evaluating financial health and making better investment decisions.

A. Market Capitalization

Market capitalization, often referred to as “market cap,” is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the current stock price by the total number of shares outstanding. Market capitalization is a quick way to gauge the size of a company and its relative importance in the market.

- Formula: Market Capitalization = Stock Price × Total Shares Outstanding.

For example, if a company has 1 million shares outstanding and its current stock price is $50, its market capitalization is $50 million. Investors use market capitalization to categorize companies into different classes:

- Large-cap: Companies with a market cap over $10 billion.

- Mid-cap: Companies with a market cap between $2 billion and $10 billion.

- Small-cap: Companies with a market cap below $2 billion.

Market capitalization reflects a company’s equity value but does not consider its debt or cash reserves. While it’s a useful measure of size, it provides only a partial view of the company’s total value.

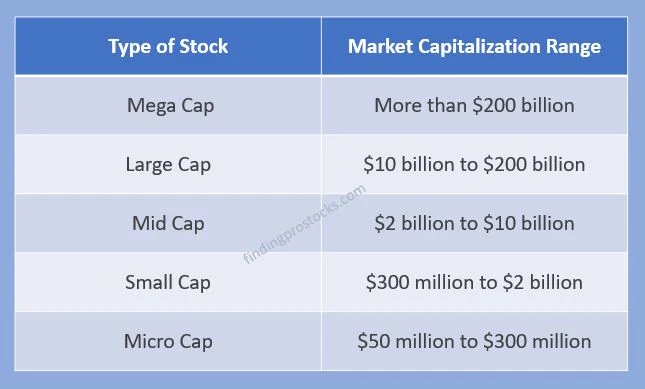

Figure: Type of Stock by Market Capitalization Range

Description:

This table categorizes different types of stocks based on their market capitalization. The types are divided into Mega Cap, Large Cap, Mid Cap, Small Cap, and Micro Cap, with corresponding ranges of market capitalization values. Mega Cap stocks have a market cap of over $200 billion, while Large Cap stocks fall between $10 billion and $200 billion. Mid Cap stocks range from $2 billion to $10 billion, Small Cap stocks from $300 million to $2 billion, and Micro Cap stocks from $50 million to $300 million.

Key Takeaways:

- Mega Cap stocks represent the largest companies, generally stable with extensive global influence.

- Large Cap stocks are established companies with significant market share.

- Mid Cap stocks have potential for growth, balancing risk and return.

- Small Cap stocks are typically younger companies, offering higher growth potential but increased volatility.

- Micro Cap stocks are often the smallest companies, involving the highest risk but potential for high returns.

Application of Information:

Understanding market capitalization categories can help investors assess a company’s size, stability, and growth potential. This information is crucial for portfolio diversification, allowing investors to align their investments with risk tolerance and financial goals.

B. Enterprise Value

Enterprise value (EV) is a more comprehensive measure of a company’s total value, as it includes not only the market capitalization but also the company’s debt and subtracts cash on hand. Enterprise value represents the amount of money required to buy the entire company, including both its equity and its debt obligations, making it a better indicator of the company’s true value.

- Formula: Enterprise Value = Market Capitalization + Total Debt – Cash and Cash Equivalents.

Enterprise value accounts for all the capital invested in a company, giving investors a clearer picture of its worth, especially when comparing companies with different capital structures. For instance, two companies may have similar market capitalizations, but if one has substantial debt and the other does not, their enterprise values will differ significantly.

For example, if a company has a market cap of $50 million, $10 million in debt, and $5 million in cash, the enterprise value would be:

- EV = $50 million (market cap) + $10 million (debt) – $5 million (cash) = $55 million.

By factoring in debt and cash, enterprise value gives a more accurate representation of what it would cost to acquire the company.

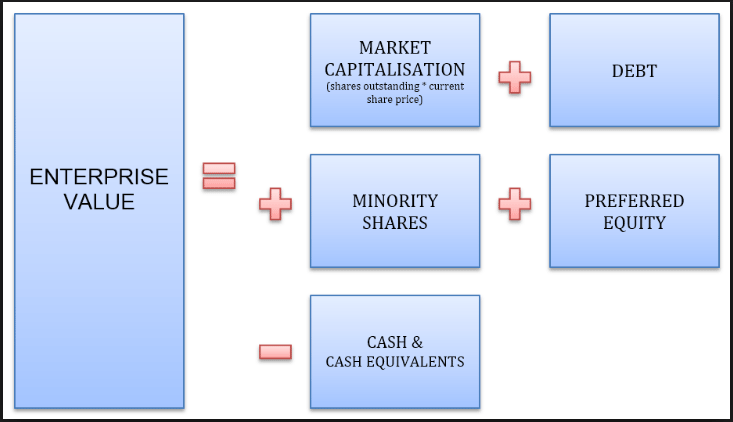

Figure: Enterprise Value Formula

Description:

This figure illustrates the formula for calculating Enterprise Value (EV), which represents a company’s total value. The formula includes Market Capitalization (total shares outstanding multiplied by current share price), Debt, Minority Shares, and Preferred Equity. It subtracts Cash & Cash Equivalents from the total. This approach gives a more comprehensive understanding of a company’s valuation by considering debt and available cash, beyond just market capitalization.

Key Takeaways:

- Enterprise Value provides a holistic measure of a company’s value, considering both equity and debt.

- Market Capitalization only represents equity value, while EV adjusts for cash, debt, and other components.

- Debt and preferred equity add to a company’s valuation, while cash is subtracted as it can be used to pay off debt.

- EV is often used in mergers and acquisitions to assess a company’s total worth.

Application of Information:

Understanding Enterprise Value helps investors evaluate a company’s overall value, including debt obligations, making it useful for valuation and comparison purposes. It provides insights into a company’s capital structure, allowing investors to make informed decisions in scenarios like acquisitions, takeovers, or when considering a company’s financial health.

C. Differences between Market Capitalization and Enterprise Value

While both market capitalization and enterprise value provide insights into a company’s size and value, they serve different purposes in investment analysis.

- Market Capitalization only considers the company’s equity value, making it a simple metric to understand but limited in scope. It does not factor in the company’s debt or cash reserves, which can have a significant impact on its true value.

- Enterprise Value offers a more complete picture of a company’s worth by including debt and subtracting cash. This makes EV a better metric when comparing companies with different capital structures or evaluating potential acquisitions.

For instance, if two companies have the same market capitalization but one has significant debt, the company with higher debt will have a larger enterprise value. This is important for investors looking to understand the company’s total value, including its liabilities.

D. Using Market Capitalization and Enterprise Value in Investment Analysis

Both market capitalization and enterprise value are essential tools in investment analysis, but they are used for different purposes.

- Market Capitalization: Investors use market capitalization to categorize companies and compare their relative sizes. Large-cap companies are often seen as more stable and less risky, while small-cap companies may offer higher growth potential but come with greater risk. Market capitalization is also used in calculating stock market indices like the S&P 500.

- Enterprise Value: EV is particularly useful when analyzing a company for mergers and acquisitions (M&A) or for comparing companies with varying amounts of debt. It provides a clearer picture of a company’s total value, especially when you want to understand the cost to acquire a company or compare it with another company that has a different capital structure. EV is often used in valuation ratios like EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization), which helps compare companies on a more apples-to-apples basis.

For example, if you are comparing two companies in the same industry, one with a lot of debt and one without, enterprise value provides a more accurate comparison than market capitalization alone.

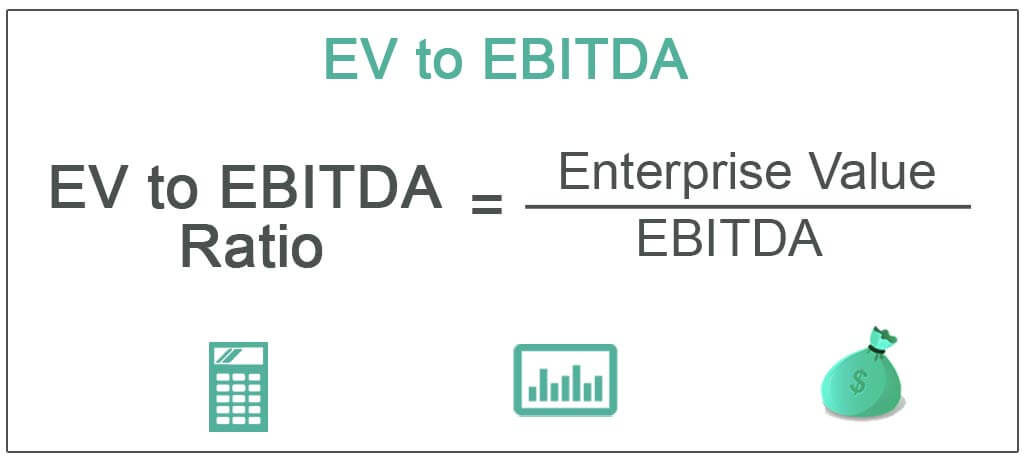

Figure: EV to EBITDA Ratio

Description:

The figure shows the calculation of the EV to EBITDA Ratio, which is a widely used financial metric to assess a company’s valuation. It is calculated by dividing the Enterprise Value (EV) by the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). This ratio is often used to compare the value of different companies, considering both their operating earnings and their capital structure.

Key Takeaways:

- EV to EBITDA helps investors evaluate a company’s valuation, considering both equity and debt.

- It provides insights into how much investors are willing to pay for each unit of EBITDA, a measure of core profitability.

- It is frequently used in mergers and acquisitions to determine if a company is undervalued or overvalued.

- A lower EV/EBITDA ratio can indicate that a company is more attractive or potentially undervalued, while a higher ratio suggests overvaluation or higher growth expectations.

Application of Information:

The EV to EBITDA Ratio is useful for comparing companies of different sizes within the same industry. It helps investors identify undervalued investment opportunities and determine the profitability potential of a business relative to its valuation. It is especially valuable for private equity and venture capital investors, as it offers a clear view of a company’s earnings potential without the impact of financing or accounting decisions.

Conclusion

Market capitalization and enterprise value are both critical tools for understanding a company’s size and worth, but they serve different functions. Market capitalization offers a straightforward view of a company’s equity value, while enterprise value gives a more comprehensive measure that includes debt and cash, making it a better indicator of the company’s total value. By using both metrics, investors can gain a deeper understanding of a company’s financial standing, compare it with peers, and make more informed investment decisions.

Key Lesson Information:

- Market Capitalization is a basic yet essential metric for estimating the size of a company by multiplying its stock price by its total outstanding shares. This measurement helps categorize companies into different market cap classes (large-cap, mid-cap, small-cap).

- Enterprise Value (EV) offers a holistic view of a company’s valuation by incorporating debt and cash, making it a crucial metric for comprehensive financial analysis and better reflective of a company’s total market value.

- The comparison between Market Capitalization and Enterprise Value highlights their unique roles in financial analysis, with market cap focusing on equity value and EV providing a broader perspective by including debt and cash holdings.

- Understanding these concepts aids investors in making informed decisions, particularly in scenarios involving mergers, acquisitions, or when assessing the financial stability and growth potential of a company.

Closing Statement:

Grasping the concepts of Market Capitalization and Enterprise Value equips investors with the necessary tools to perform accurate company valuations and make informed investment decisions. This knowledge is foundational for anyone involved in financial markets, ensuring a comprehensive understanding of company valuation beyond just stock prices.