Local: analyzing European companies

Lesson Learning Objectives:

- Learn about the income statement under IFRS. You will understand how revenues, expenses, and net income are reported, along with the inclusion of other comprehensive income (OCI). This helps investors assess a company’s profitability and financial performance.

- Understand the balance sheet under IFRS. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity, offering insights into the company’s financial position. Learn about the distinctions between current and non-current items and how they reflect a company’s liquidity and solvency.

- Explore the cash flow statement under IFRS. The cash flow statement outlines how cash is generated and used across operating, investing, and financing activities. You will learn how this statement helps assess a company’s liquidity and its ability to generate cash to fund operations and investments.

- Gain insights into the overall structure and application of IFRS in European financial reporting. Understanding IFRS helps ensure transparency and comparability, making it easier to analyze financial statements and make informed investment decisions across borders.

Introduction

Understanding the core financial concepts is essential for any investor. Financial statements provide critical insights into a company’s financial health and performance, helping investors evaluate profitability, liquidity, and growth potential. This section will introduce the fundamental financial statements—income statement, balance sheet, and cash flow statement—and explain how to analyze these documents. We will also discuss key financial data points that investors use to assess a company’s performance.

22.1 Financial Statements

When analyzing European companies, it’s essential to understand that their financial statements are typically prepared according to the International Financial Reporting Standards (IFRS), a global accounting framework that ensures transparency and comparability across borders. In Europe, IFRS is mandatory for all publicly listed companies, providing investors with consistent and clear financial information. This section introduces how financial statements in Europe adhere to IFRS, ensuring high-quality reporting.

IFRS and Income Statement

Under IFRS, the income statement (also called the statement of comprehensive income) follows a structured approach, similar to financial statements globally, but with some unique European nuances. The income statement provides detailed insight into a company’s revenues, costs, and overall profitability.

- Revenue Recognition: Under IFRS, revenue is recognized when control of a product or service is transferred to the customer. European companies must adhere to these rules, ensuring that revenues are reported accurately based on performance obligations, not just when payments are received.

- Operating Expenses: Expenses are classified by either their nature (e.g., wages, materials) or their function (e.g., cost of sales, administrative expenses). This flexibility allows European companies to present their income statements in a way that best reflects their operational structure.

- Other Comprehensive Income: IFRS emphasizes the importance of other comprehensive income (OCI), which includes gains or losses not reflected in the net income, such as foreign exchange differences or revaluation of financial instruments. This is particularly relevant for European companies operating in multiple currencies.

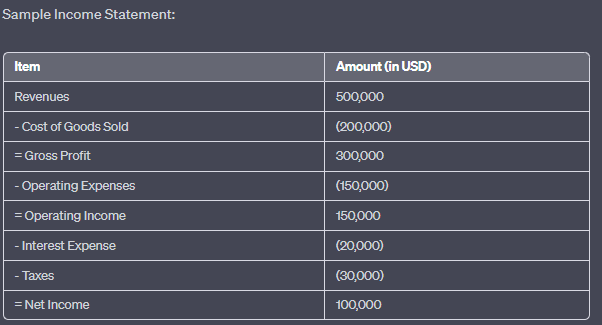

Figure: Sample Income Statement

Description:

The image presents a sample income statement, breaking down the financial performance of a company over a specific period. It starts with the total revenues and subtracts various expenses to arrive at the net income. The statement showcases the following items:

Revenues: $500,000

Cost of Goods Sold: $(200,000)

Gross Profit: $300,000

Operating Expenses: $(450,000)

Operating Income: $150,000

Interest Expense: $(20,000)

Taxes: $(30,000)

Net Income: $100,000

Key Takeaways:

- Revenues: The total amount of money brought in by the company before any expenses.

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold.

- Gross Profit: The profit a company makes after deducting COGS from its total revenues.

- Operating Expenses: The costs associated with the day-to-day operations of the business.

- Operating Income: The profit from business operations (before interest and taxes).

- Interest Expense: The cost of borrowing funds.

- Taxes: The amount paid to the government based on the company’s taxable income.

- Net Income: The total profit of the company after all expenses have been deducted from revenues.

Application of Information:

An income statement is a fundamental financial document that provides investors and stakeholders with insights into a company’s profitability over a specific period. By analyzing the income statement, one can understand the company’s revenue streams, cost structure, and overall financial health. This data is crucial for making informed investment decisions and assessing the company’s operational efficiency.

22.2 IFRS and Balance Sheet (Statement of Financial Position)

The balance sheet, known under IFRS as the statement of financial position, provides a snapshot of a company’s assets, liabilities, and equity. IFRS requires companies to clearly differentiate between current and non-current items to offer a transparent view of a company’s financial health.

- Asset Classification: European companies report assets as either current or non-current. Current assets include items like cash, receivables, and inventory, while non-current assets encompass long-term investments such as property, plant, and equipment (PPE), as well as intangible assets like goodwill.

- Liabilities: Under IFRS, liabilities are also divided into current (due within a year) and non-current. European companies must report their obligations, including debt, leases, and pensions, in this format, providing clear insights into their short-term and long-term obligations.

- Shareholders’ Equity: The shareholders’ equity section under IFRS is structured to show both contributed capital (from shareholders) and retained earnings (profits that have been reinvested into the business). European firms must also disclose other reserves, including revaluation reserves and foreign currency translation adjustments.

- Asset Classification: European companies report assets as either current or non-current. Current assets include items like cash, receivables, and inventory, while non-current assets encompass long-term investments such as property, plant, and equipment (PPE), as well as intangible assets like goodwill.

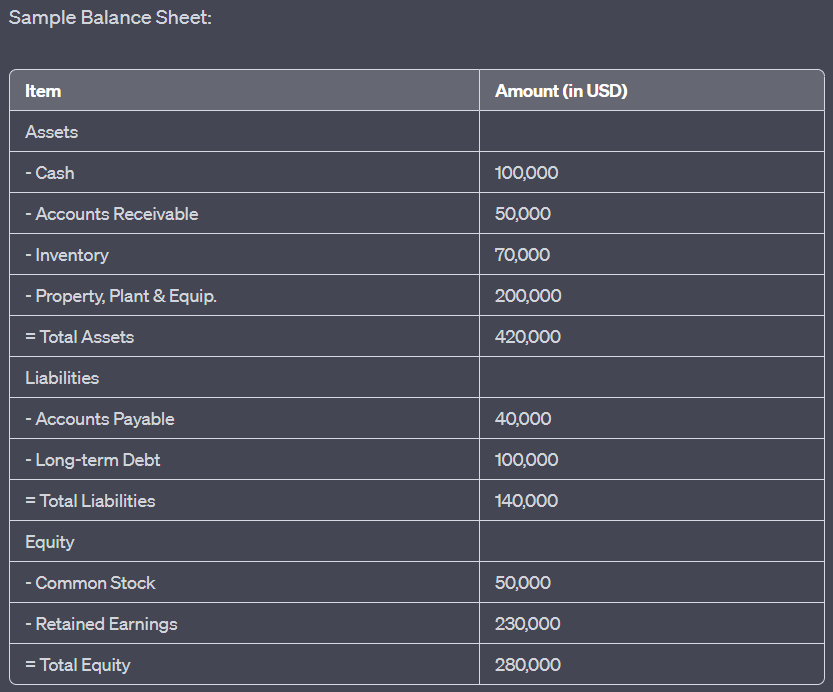

Figure: Sample Balance Sheet

Description:

The image displays a sample balance sheet, which provides a snapshot of a company’s financial position at a specific point in time. It categorizes the company’s resources (assets) and the claims against those resources (liabilities and equity). The balance sheet showcases the following items:

- Assets: Totaling $420,000, including Cash ($400,000), Accounts Receivable ($50,000), Inventory ($70,000), and Property, Plant & Equipment ($200,000).

- Liabilities: Totaling $140,000, comprising Accounts Payable ($40,000) and Long-term Debt ($400,000).

- Equity: Totaling $280,000, with Common Stock ($50,000) and Retained Earnings ($230,000).

Key Takeaways:

- Assets: Resources owned by the company that have economic value.

- Liabilities: Obligations the company owes to external entities.

- Equity: Represents the ownership interest in the company, including funds invested by shareholders and accumulated profits.

- The fundamental accounting equation: Assets = Liabilities + Equity.

\(\textbf{Accounting Equation:}\)

\[ \displaystyle \text{Assets} = \text{Liabilities} + \text{Equity} \]

\(\textbf{Legend:}\)

\(\text{Assets}\) = Total assets

\(\text{Liabilities}\) = Total liabilities

\(\text{Equity}\) = Total equity

Application of Information:

A balance sheet is a foundational financial statement that offers insights into a company’s financial health. By analyzing the balance sheet, stakeholders can assess the company’s liquidity, solvency, and overall financial stability. This information is vital for investors, creditors, and other stakeholders to make informed decisions related to the company’s financial position

22.3 IFRS and Cash Flow Statement

The cash flow statement under IFRS follows a similar structure to other global standards but places particular emphasis on transparency in how cash is generated and used by the company. European companies use this statement to report cash flows from operating, investing, and financing activities.

- Operating Activities: IFRS allows for flexibility in reporting cash flows from operating activities, either through the direct method (showing cash receipts and payments) or the indirect method (starting with net income and adjusting for non-cash items). Most European companies opt for the indirect method.

- Investing and Financing Activities: Cash flows related to investments in assets or securities and activities such as issuing shares or repaying debt are reported here. European companies must clearly distinguish these transactions to show how they are funding their growth and managing their financial obligations.

- Foreign Exchange Impacts: Given that many European companies operate across multiple countries and currencies, IFRS requires the inclusion of cash flow impacts due to changes in foreign exchange rates, providing investors with a clearer understanding of how currency movements affect a company’s cash position.

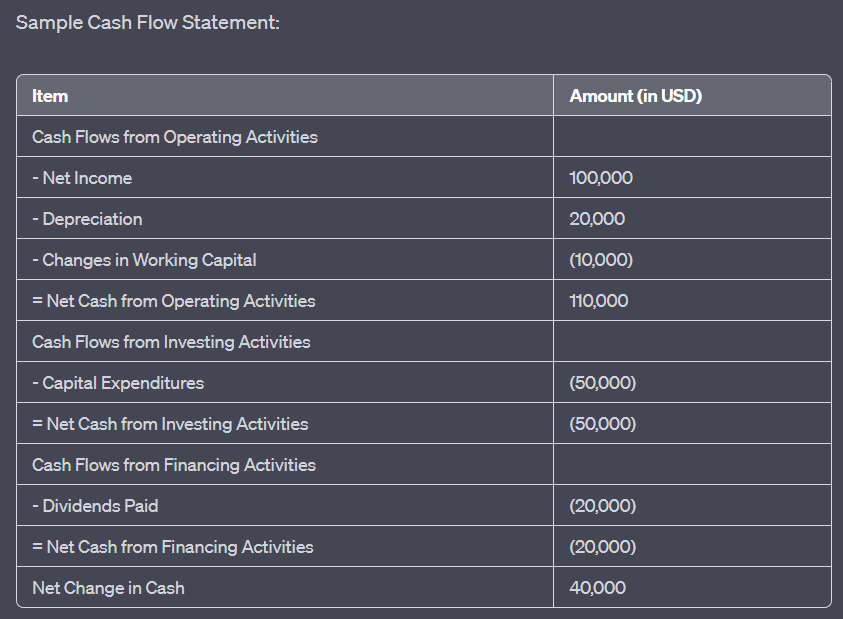

Figure: Sample Cash Flow Statement

Description:

The image illustrates a sample cash flow statement, which provides a detailed account of the cash inflows and outflows for a company over a specific period. The statement is segmented into three main categories: Operating Activities, Investing Activities, and Financing Activities. The key items include:

Cash Flows from Operating Activities: Net Income ($100,000), Depreciation ($20,000), and Changes in Working Capital (-$10,000), resulting in a Net Cash from Operating Activities of $110,000.

Cash Flows from Investing Activities: Capital Expenditures (-$50,000), leading to a Net Cash from Investing Activities of -$50,000.

Cash Flows from Financing Activities: Dividends Paid (-$20,000), resulting in a Net Cash from Financing Activities of -$20,000.

The overall Net Change in Cash is $40,000.

Key Takeaways:

- Operating Activities: Reflects the cash generated or used in the core business operations.

- Investing Activities: Represents cash used for investments in assets or received from the sale of assets.

- Financing Activities: Showcases the cash flows from or to external financing sources, like lenders and shareholders.

- The Net Change in Cash provides a snapshot of the overall increase or decrease in the company’s cash position over the period.

Application of Information:

The cash flow statement is an essential financial tool that offers insights into a company’s liquidity and its ability to generate and use cash effectively. By analyzing the cash flow statement, stakeholders can understand how a company manages its cash resources, which is crucial for assessing its financial health and making informed investment decisions.

Conclusion

In Europe, financial statements are prepared according to IFRS, ensuring a high level of consistency, transparency, and comparability across countries and industries. The income statement, balance sheet, and cash flow statement under IFRS provide investors with the detailed information needed to assess the financial health of European companies. IFRS’s global standards ensure that European companies’ financial reports meet international expectations, making it easier for investors to analyze and compare firms operating in different regions.

Key Lesson Information:

- The income statement shows a company’s profitability. The income statement provides a breakdown of a company’s revenues, cost of goods sold (COGS), operating expenses, and net income. By analyzing this statement, investors can evaluate how efficiently a company is generating profits and managing costs. Revenue recognition under IFRS ensures accurate reporting based on performance obligations.

- The balance sheet offers a snapshot of a company’s financial position. It categorizes a company’s assets, liabilities, and equity. By examining these elements, investors can assess a company’s liquidity (ability to meet short-term obligations), solvency (ability to meet long-term obligations), and financial health. The fundamental accounting equation of assets = liabilities + equity is key to understanding this statement.

- The cash flow statement tracks how cash is used. The statement divides cash flows into operating, investing, and financing activities. By analyzing this statement, investors can understand how the company generates cash from its operations, how it funds investments, and how it manages external financing. Positive cash flow from operating activities signals a strong cash position.

Closing Statement:

Financial statements under IFRS provide essential insights into a company’s financial health and performance. By analyzing the income statement, balance sheet, and cash flow statement, investors can make well-informed decisions based on transparency, consistency, and detailed reporting, helping them assess the company’s profitability, liquidity, and long-term sustainability.