Capítulo 12: Gestión de deudas y crédito

Objetivos de aprendizaje de la lección:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Managing debt and credit wisely is fundamental to financial health and stability. This chapter covers various aspects of managing debt, understanding credit, and navigating financial challenges with in-depth explanations and examples.

12.1 Understanding Payment Methods and Their Impacts

Different payment methods come with their unique set of features, costs, and benefits. For instance, while credit cards offer convenience and rewards, they also pose risks of high interest and fees if balances are not paid off monthly. In contrast, debit cards y dinero provide control over spending but lack the protection and benefits that credit cards offer. Mobile payments blend convenience with potential rewards, yet depend on technology and may have security concerns. Each payment method’s choice reflects a trade-off between convenience, cost, security, and rewards.

Example: Sarah opts to use a credit card for her daily purchases to accumulate travel rewards but pays off her balance each month to avoid interest charges. This strategy leverages the benefits of credit cards while minimizing costs.

Forms of payment like checks, prepaid cards, buy now pay later, layaways, and rent to own offer consumers flexibility but come with distinct costs and benefits. For example, prepaid cards can be a budgeting tool but may involve activation or monthly fees. Buy now, pay later plans provide immediate possession of goods with deferred payment, yet interest or late fees can accumulate if not managed properly.

Example: Mark buys a laptop using a buy now, pay later plan. He enjoys the benefit of getting the laptop immediately but must be diligent in paying installments to avoid accruing interest.

Credit Cards

- Description: A credit card allows users to borrow funds up to a certain limit to pay for goods and services with the promise to repay the lender at a later date, often with interest if the balance is not paid in full each month.

- Costs & Risks: Interest on unpaid balances, potential for debt accumulation, risk of fraud.

- Benefits: Rewards and cashback, fraud protection, building credit history.

- Example: John uses his credit card for groceries and gas to earn 2% cashback. He pays the full balance each month to avoid interest charges, benefiting from rewards while building his credit score.

Debit Cards

- Description: Debit cards enable direct access to one’s bank account funds for making purchases or withdrawing cash. The amount spent is immediately deducted from the account balance.

- Costs & Risks: Direct withdrawal from bank account, limited fraud protection compared to credit cards.

- Benefits: Immediate transaction, spending limited to account balance, no interest rates.

- Real-Life Example: Sarah prefers using her debit card for daily coffee purchases. It helps her track spending more effectively since the money comes directly out of her checking account.

Dinero

- Description: Cash payments involve physical currency (bills and coins) used to purchase goods and services directly without the need for an intermediary financial institution.

- Costs & Risks: Risk of loss or theft, no electronic record for transactions.

- Benefits: Universally accepted, no transaction fees.

- Real-Life Example: Alex pays cash at local farmers’ markets where vendors may not accept cards, avoiding any additional transaction fees.

Checks

- Description: A check is a written, dated, and signed instrument that directs a bank to pay a specific sum of money to the bearer or the person/organization named in the check.

- Costs & Risks: Processing time, NSF (Non-Sufficient Funds) fees, risk of fraud.

- Benefits: Paper trail for transactions, control over payment timing.

- Real-Life Example: Emily writes a check each month to pay her rent. This provides a documented proof of payment that can be tracked via her bank statements.

Prepaid Cards

- Description: Prepaid cards are payment cards that are loaded with funds before use. Unlike credit cards, which provide a line of credit, prepaid cards allow you to spend only what is preloaded on the card. They can be reloaded with funds as needed.

- Costs & Risks: May come with activation fees, reloading fees, and monthly maintenance fees. There’s no direct impact on your credit score, and they offer limited fraud protection compared to credit cards.

- Benefits: Helps control spending by limiting it to the amount on the card, useful for budgeting, no bank account required, and can be used where debit or credit cards are accepted.

- Real-Life Example: A parent loading a prepaid card with a monthly allowance for a college student to manage daily expenses without the risk of accruing debt or overdrawing a bank account.

Buy Now Pay Later (BNPL)

- Description: BNPL services allow consumers to purchase items immediately and defer payment to future installments, often interest-free if paid on time.

- Costs & Risks: Interest or fees if payments are late, potential for overspending.

- Benefits: Deferred payments with no upfront cost, often interest-free periods.

- Real-Life Example: Kevin buys a new laptop using a BNPL service, splitting the total cost into four payments over two months, making the purchase more manageable without interest.

Layaways

- Description: Layaway plans enable consumers to pay for items in installments before taking them home. The retailer holds the item until it’s fully paid for.

- Costs & Risks: Cancellation fees, missed payments can result in loss of item without refund.

- Benefits: Guaranteed item availability, no credit check required, fixed payments.

- Real-Life Example: Linda puts a holiday gift on layaway, making small weekly payments. Once the final payment is made, she picks up the gift just in time for the holidays.

Rent to Own

- Description: Rent-to-own agreements allow consumers to rent items with the option to purchase them over time. These agreements often result in higher total costs but provide immediate access to goods.

- Costs & Risks: High total payment cost, risk of losing the item for missed payments.

- Benefits: Immediate use of the item, fixed payments, ownership at the end of the term.

- Real-Life Example: Tom acquires a new television through a rent-to-own agreement. Despite the higher overall cost, it allows him immediate access without a large upfront payment.

Different Forms of Payment Involve Costs or Fees

- Different payment methods (debit, credit, BNPL, prepaid cards, rent-to-own) often include hidden fees.

- Even when merchants don’t list card processing fees, they may be reflected in higher prices.

Ejemplo: BNPL might have hidden late fees; prepaid cards might have activation or monthly maintenance fees.

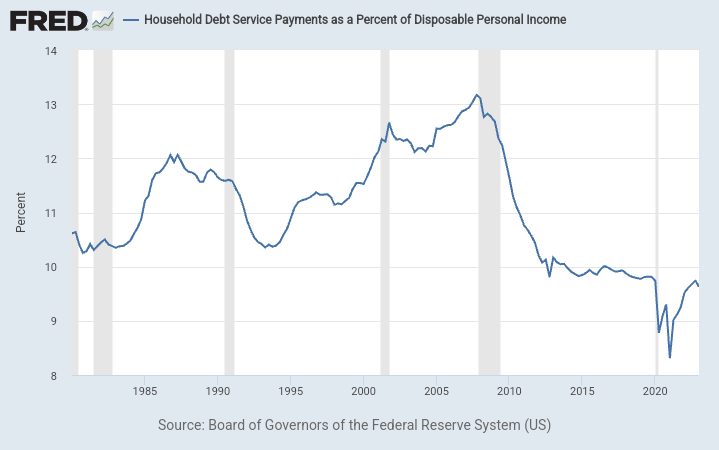

Cifra: Household Debt Service Payments as a Percent of Disposable Personal Income

Descripción:

The chart represents the Household Debt Service Ratio (DSR), which is the ratio of total required household debt payments to total disposable income. The DSR is divided into two components:

- Mortgage DSR (MDSP): This is the total quarterly required mortgage payments divided by total quarterly disposable personal income.

- Consumer DSR (CDSP): This represents total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income.

Together, the Mortgage DSR and the Consumer DSR sum up to the DSR. The data provides insights into the financial obligations of households in relation to their available income.

Conclusiones clave:

- The DSR provides a measure of households’ ability to manage their debt obligations.

- A rising DSR might indicate that households are taking on more debt relative to their disposable income.

- Conversely, a declining DSR suggests that households are either paying down debt or their disposable incomes are growing faster than their debt obligations.

Application of Information:

Understanding the Household Debt Service Ratio is crucial for policymakers, economists, and investors. It offers insights into the financial health of households, which can have broader implications for the economy. For instance, if households are heavily indebted, they might cut back on consumption, which can impact economic growth. Conversely, a low DSR might indicate that households have financial flexibility, which can be a positive sign for consumer spending and economic activity.

Predatory Lending Practices:

Be cautious of loans with terms that seem too good to be true, such as extremely high-interest rates, high fees, or conditions that make it difficult to pay off the debt. Payday loans, car title loans, and certain high-risk mortgages can fall into this category due to their costly terms and the high potential for leading borrowers into a cycle of debt.

Hidden Costs in Purchases

When purchasing goods, consumers often focus on the listed price, but additional costs can be embedded in the final price. For instance, credit card fees charged to merchants may be passed on to consumers through higher pricing, even if such fees aren’t itemized at the point of sale. This means while you’re not directly charged an extra fee, the product’s price includes the merchant’s cost of offering credit card payment options.

12.2 Credit Decisions and History

A strong credit score can open doors to better financial opportunities, such as lower interest rates and better loan terms. Follow these tips to build and maintain good credit:

Lenders assess creditworthiness partly through an individual’s credit history, which encapsulates their reliability in managing and repaying debt. Factors such as payment timeliness, the amount owed, and the length of credit history influence lending decisions. For example, a consistent record of late payments might lead a bank to reject a loan application due to perceived risk.

Example: After being denied a car loan, Tom reviews his credit report, identifies late payments, and begins to address them by setting up payment reminders, thereby taking steps to improve his creditworthiness.

Lenders’ Use of Credit History

- Lenders review credit reports to assess borrower risk.

- Factors like missed payments, total balances, and new credit inquiries affect credit scores.

- Lenders purchase scores from credit bureaus like Equifax, Experian, TransUnion.

- High number of open accounts or high utilization can hurt a score even if payments are made on time.

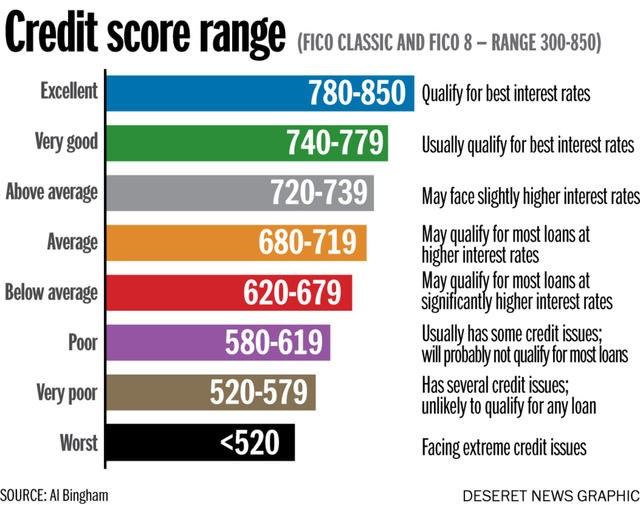

Cifra: Credit Score Ranges

Descripción:

While I cannot access the specified image, credit score ranges typically categorize scores into various brackets such as Poor, Fair, Good, Very Good, and Excellent. These categories help lenders assess the creditworthiness of an individual. A higher score generally indicates a lower risk for lenders, leading to better loan terms and interest rates for the borrower.

Conclusiones clave:

- Poor to Fair Scores: These scores might indicate missed payments, high credit utilization, or other negative factors. Borrowers in this range may face higher interest rates or even loan denials.

- Good to Very Good Scores: Reflect responsible credit behavior, timely payments, and a good mix of credit types. Borrowers are likely to receive favorable loan terms.

- Excellent Scores: Represent the pinnacle of creditworthiness. Individuals with these scores have a long history of timely payments, low credit utilization, and a diverse mix of credit.

Application of Information:

Understanding one’s credit score and the factors that influence it is crucial for financial well-being. A good credit score can lead to savings over time due to lower interest rates on loans and credit cards. It’s essential to monitor one’s credit report regularly, correct any inaccuracies, and adopt habits that positively impact the score, such as timely payments and maintaining a low credit utilization ratio.

12.3 Loan Applications and Credit Scores

The process of completing a loan application is a critical step in seeking financing, requiring detailed information about the borrower’s financial situation. Decisions on loans, including terms and interest rates, are significantly influenced by the applicant’s credit score—a numerical representation of their credit risk based on credit history.

A loan application requires thorough information about the applicant, including financial status and credit history. Factors like the loan amount, interest rate, term, and down payment significantly affect loan approvals and conditions.

Example 1: Alex applies for a car loan and learns that a higher down payment could lower his interest rate and monthly payments, making the car more affordable in the long run.

Example 2: Emily applies for a mortgage and discovers that her excellent credit score qualifies her for a lower interest rate, substantially reducing her long-term financial burden.

A credit score reflects a borrower’s credit risk. Actions like maintaining high balances or having excessive credit lines can negatively impact this score, affecting future credit availability.

Example: Sam discovers that closing some of his unused credit card accounts could improve his credit score by reducing his total available credit, which lenders perceive as a risk.

A high credit score, ranging from 300-850, signifies lower risk to lenders and can result in lower interest rates on loans. Maintaining a high score involves making timely payments, keeping credit utilization low, and managing a mix of credit types.

Conversely, missed payments, high debt levels, and frequent credit inquiries can negatively impact scores. Understanding these factors is crucial for financial health and accessing favorable loan terms.

Understanding Loan Applications

- Loan applications require: proof of income, credit history, requested loan amount, collateral (if secured loan).

- Factors in loan decisions include: amount of down payment, interest rate options (fixed or adjustable), term length, monthly payment ability.

- Ejemplo: Choosing a 5-year car loan instead of 7 years will mean higher monthly payments but lower total interest paid.

Consequences of Failing to Repay Loans

Failing to repay a loan can lead to dire consequences, including negative credit report entries, repossession of collateral, wage garnishment, and the inability to secure future loans.

Example: After defaulting on an auto loan, Lisa experiences the repossession of her car and a significant drop in her credit score, complicating her ability to finance future purchases.

Negative Effects of Loan Default

- Failing to repay loans can cause:

- Negative credit report entries (late payments, defaults)

- Repossession of collateral (e.g., cars, homes)

- Wage garnishment

- Higher future borrowing costs or outright denial of new credit

12.4 Managing and Recovering from Debt

Debt can escalate from a manageable part of one’s financial strategy to an overwhelming burden. When individuals face challenges in repaying debt, they have options such as negotiate directly with creditors or credit counseling services, which offer guidance and can negotiate with creditors.

Example: Facing mounting credit card debt, Jordan seeks assistance from a nonprofit credit counseling agency, which helps consolidate his debts and negotiate lower interest rates with creditors.

Credit counseling services offer guidance on managing debt, but their structures vary between non-profit and for-profit models. Non-profit agencies often provide services at a lower cost and may offer free educational resources. For-profit agencies, while potentially offering more personalized services, may charge higher fees. Consumers should evaluate the cost-effectiveness, services provided, and any associated fees before choosing a credit counseling service.

Bankruptcy is a legal process that provides relief to individuals and businesses that are unable to repay their debts. It’s a mechanism to help manage insolvency, but it comes with its own set of causes, consequences, and wider implications for the debtor and other stakeholders.

Example: Emily, facing insurmountable medical bills, opts for bankruptcy to eliminate her debts, understanding the long-term impact on her credit and the fresh start it provides.

Causes of Bankruptcy

Personal Bankruptcy:

- Overwhelming Debt: High levels of consumer debt, often from credit cards, medical bills, or personal loans, can lead to bankruptcy.

- Income Loss: Job loss, reduction in income, or unsuccessful self-employment ventures can make it impossible to meet financial obligations.

- Unexpected Expenses: Emergencies like medical crises or accidents can result in significant unplanned expenses.

Corporate Bankruptcy:

- Poor Cash Flow Management: Inadequate management of cash flow can lead to a company’s inability to cover its operational costs.

- Market Competition: Intense competition can reduce a company’s market share and revenues.

- Economic Downturns: Recessions can lead to decreased consumer spending, affecting a company’s profitability.

Consequences of Bankruptcy

For the Individual:

- Credit Score Impact: Bankruptcy significantly lowers credit scores, affecting one’s ability to borrow in the future.

- Asset Liquidation: In Chapter 7 bankruptcy, certain personal assets may be sold off to pay creditors.

- Public Record: Bankruptcy filings are public, which can affect personal reputation.

For Corporations:

- Asset Liquidation or Reorganization: Depending on the type of bankruptcy filed (Chapter 7 for liquidation or Chapter 11 for reorganization), a company may either cease operations or restructure its debt to continue operating.

- Stakeholder Impact: Shareholders may lose their investment, employees may lose their jobs, and creditors may not receive the full amount owed.

Implications

For the Debtor:

- Fresh Start: Bankruptcy can provide relief from debt and a chance to rebuild financially, though with constraints on obtaining new credit.

- Mandatory Counseling: Debtors are required to undergo credit counseling and debtor education as part of the bankruptcy process.

For Others:

- Creditors: May recover a portion of what is owed through the bankruptcy process, though often less than the full amount.

- Society: There’s a broader economic impact, as personal spending and business operations are affected. The stigma associated with bankruptcy can also impact societal perceptions of financial management.

Real-Life Example:

John Doe, after years of struggling with credit card debt and a sudden medical emergency, files for Chapter 7 bankruptcy. He experiences immediate relief from debt collection calls but has to surrender some of his assets. His credit score plummets, making future borrowing difficult and expensive. Meanwhile, his creditors receive only partial repayment through the asset liquidation process.

Bankruptcy Laws and Impacts

- Purpose of Bankruptcy Laws: Offer financial relief to individuals or companies who cannot meet their debt obligations.

- Effects:

- Assets: May be liquidated (Chapter 7) or restructured (Chapter 13).

- Employment: Some jobs may be affected (especially those requiring security clearance or financial responsibility).

- Future Credit: Significant credit score damage; difficulty obtaining loans.

- Assets: May be liquidated (Chapter 7) or restructured (Chapter 13).

- Liquidation vs. Reorganization:

- Chapter 7 = sell assets.

- Chapter 13 = payment plan to keep assets while repaying part of debt over time.

- Chapter 7 = sell assets.

- Purpose of Bankruptcy Laws: Offer financial relief to individuals or companies who cannot meet their debt obligations.

12.5 The Role of Government and Consumer Advocacy in Protection

Government agencies and consumer advocacy groups play pivotal roles in protecting consumers from fraud and unfair practices. They offer resources for education on rights and remedies for victims of fraud, emphasizing the importance of vigilance in personal finance management.

Consumer protection laws and agencies play vital roles in safeguarding against fraud and unfair practices. Awareness and understanding of one’s rights can help avoid or mitigate the effects of fraud.Various state and federal laws protect consumers against fraud and deceptive practices. The Federal Trade Commission (FTC) y Consumer Financial Protection Bureau (CFPB) are key agencies offering resources and enforcement against fraudulent activities.

Example: After encountering a fraudulent charge on her statement, Mia reports the issue to the Federal Trade Commission and follows their guidance to dispute the charge and secure her accounts.

Consumer Protection Laws and Agencies

- Agencies:

- Federal Trade Commission (FTC): Protects consumers from fraud, deception, and unfair business practices.

- Consumer Financial Protection Bureau (CFPB): Regulates financial products like loans and credit cards.

- Laws:

- Fair Credit Reporting Act (FCRA): Protects consumer credit information.

- Fair Debt Collection Practices Act (FDCPA): Protects against abusive debt collection.

- Equal Credit Opportunity Act (ECOA): Protects against discrimination in credit approval.

- Common Frauds: Online scams, redlining, phishing calls.

- Help for Victims:

- Report fraud to FTC or CFPB.

- Dispute inaccurate credit report entries.

- Contact local State Consumer Affairs offices.

- Report fraud to FTC or CFPB.

12.6 Mortgage Application Process

Applying for a mortgage requires understanding various factors like down payment, interest rates (fixed vs. variable), y insurance requirements. Failure to make mortgage payments can lead to foreclosure.

Ejemplo: Tom, applying for a mortgage, calculates that a larger down payment could secure a lower interest rate, making his monthly payments more affordable.

Down Payment: is an initial, upfront payment made by a buyer, typically expressed as a percentage of the total purchase price. This payment is made at the time of purchase or when entering into an agreement to purchase, such as a home or vehicle.

Ejemplo: For purchasing a home priced at $300,000, a 20% down payment would be $60,000. This reduces the loan amount needed from a financial institution, leading to lower monthly mortgage payments.

Tasas de interés

Fixed vs. Variable:

- Fixed Interest Rates: A fixed interest rate remains constant throughout the term of the loan, providing predictability in monthly payments. This rate doesn’t change with market conditions, making budgeting easier for borrowers.

- Example: If you secure a mortgage with a 5% fixed interest rate for 30 years, your interest rate will remain at 5% for the duration of the loan, regardless of changes in market interest rates.

- Example: If you secure a mortgage with a 5% fixed interest rate for 30 years, your interest rate will remain at 5% for the duration of the loan, regardless of changes in market interest rates.

- Variable Interest Rates: A variable or adjustable interest rate can fluctuate over the term of the loan based on changes in market interest rates. This means monthly payments can increase or decrease.

- Example: For a mortgage with a variable interest rate starting at 4%, if market rates increase, your rate may adjust to 5%, increasing your monthly payments. Conversely, if rates decrease, your payments could go down.

Effect of Interest Paid Over Time:

- For loans like mortgages, the interest paid can add up to be more than the principal amount borrowed over the loan term, especially with higher interest rates or longer terms.

Let’s consider an example scenario for calculating a mortgage payment:

- For a $250,000 home with a $50,000 down payment (20%), a loan amount of $200,000, at a 3.5% interest rate over 30 years, the monthly payment would primarily consist of principal and interest. You could use an online mortgage calculator to get the exact monthly payment, total interest paid, and an amortization schedule showing how payments are allocated towards principal and interest over time.

- In addition to the principal and interest, a mortgage payment may also include an escrow amount for property taxes, homeowners insurance, and possibly private mortgage insurance (PMI) if the down payment is less than 20%.

Regarding the impact of interest rates over time:

- Interés compuesto: Over the life of a loan, you’ll pay interest not just on the original principal but also on the accumulated interest. This can significantly increase the total amount you pay back.

- Amortization Table: This tool breaks down each payment by the amount going towards interest versus the principal. In the early years, a larger portion of each payment goes towards interest.

Insurance Requirements: are conditions set by lenders that borrowers must meet to protect the investment. These requirements often include purchasing insurance policies to cover potential losses, such as property damage or liability.

Examples:

- Home Insurance: For a home purchase, lenders typically require borrowers to have homeowners insurance. This protects against damage to the property and liability for injuries.

- Example: When buying a house, the lender will require you to secure homeowners insurance to cover potential damages from fires, storms, or burglaries.

- Private Mortgage Insurance (PMI): If the down payment is less than 20% of the home’s purchase price, lenders may require PMI. This insurance protects the lender if the borrower defaults on the loan.

- Example: For a home purchased with a 10% down payment, the lender might require PMI until the borrower’s equity in the home reaches 20%.

- Seguro de auto: For vehicle loans, lenders require comprehensive and collision insurance to protect against damage to the vehicle.

- Example: If you finance a car, the lender will require you to maintain auto insurance that covers damage to the car in case of an accident, theft, or natural disasters.

Mortgage Payments and Application Process

Failing to make mortgage payments can lead to foreclosure, where the lender takes possession of the property. To avoid such outcomes, it’s crucial for potential homeowners to understand the mortgage application process, which involves assessing one’s salary, credit history, down payment capacity, and choosing between fixed or variable interest rates. Proper planning and understanding of mortgage terms can prevent future financial distress.

12.7 Incorporating Debt Management into Financial Planning

Effective debt management involves understanding the types of debt, their implications for personal finance, and strategies for maintaining a balance that supports financial goals. Whether through leveraging favorable loan terms, utilizing tax-advantaged savings accounts, or navigating the complexities of bankruptcy, informed decision-making is key to financial stability and growth.

Example: To optimize his financial strategy, Leo assesses his debt-to-income ratio, prioritizes high-interest debt repayment, and contributes to a Roth IRA, balancing debt management with saving for the future.

This chapter emphasizes that managing debt and credit is not just about avoiding financial pitfalls but also about making strategic choices that align with one’s financial goals and circumstances. Through careful planning, informed decision-making, and utilization of available resources, individuals can navigate the challenges of debt and credit to achieve financial well-being.

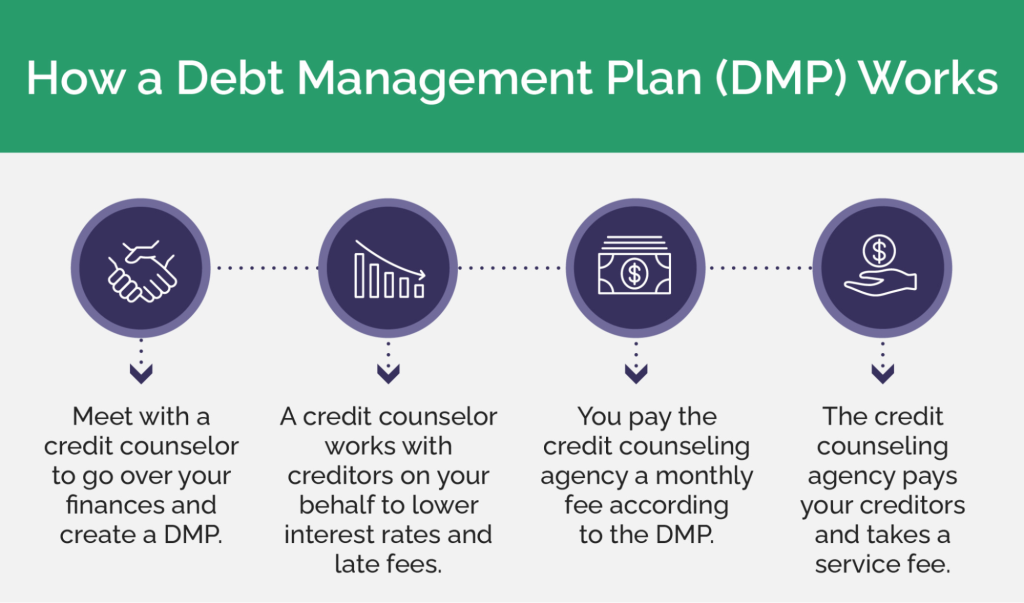

Cifra: How a Debt Management Plan (DMP) Works

Descripción:

This image illustrates the process of a Debt Management Plan (DMP), which is a structured program offered by credit counseling agencies to help people repay their debts. It visually breaks down the steps, showing how a consumer makes a single monthly payment to the agency, which then distributes the funds to various creditors. The goal is to simplify the repayment process and make getting out of debt more manageable.

Conclusiones clave:

- A Debt Management Plan (DMP) consolidates your various unsecured debts (like credit cards) into one single monthly payment made to a credit counseling agency.

- The credit counseling agency often works with your creditors to negotiate lower interest rates or the waiver of late fees, potentially saving you money.

- A DMP provides a structured pathway to becoming debt-free, typically over a period of three to five years.

- While enrolled in a DMP, you usually must agree not to take on new credit and may have to close the credit accounts included in the plan.

Application of Information:

- A DMP can be a good option if you are overwhelmed by high-interest debt from multiple sources and need a disciplined plan to regain control of your finances.

- It provides a clear, structured alternative to more severe options like bankruptcy and can help you rebuild good financial habits.

- When considering a DMP, it is essential to choose a reputable, non-profit credit counseling agency to ensure you receive trustworthy advice and fair terms.

Debt Management Assistance Options

- Sources of Assistance:

- Nonprofit Credit Counseling Agencies: Offer budgeting help, debt management plans, often at little/no cost.

- For-Profit Credit Counseling Companies: May offer similar services but often charge high fees.

- Comparison:

- Nonprofits often provide unbiased advice.

- For-profits can have higher costs and may prioritize profit over client interest.

- Plan Example: Jordan consolidates credit card debts into one lower-interest payment through a nonprofit agency.

Información clave de la lección:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.