वैश्विक दुनिया भर में शेयर बाज़ार कैसे काम करते हैं

पाठ सीखने के उद्देश्य:

- परिचय: This section introduces you to how stock markets operate globally, emphasizing the role of major stock exchanges like the New York Stock Exchange (NYSE), NASDAQ, Tokyo Stock Exchange (TSE), और Hong Kong Stock Exchange (HKEX). Understanding these will help you grasp the global nature of financial markets.

- Learn about the benefits of investing in stocks, जैसे कि wealth building, लाभांश आय, and protection against मुद्रा स्फ़ीति. These factors are crucial for understanding why stocks are a preferred investment choice for many around the world.

- Understand the inherent जोखिम involved with stock investing, including the potential for significant losses. This knowledge is essential for managing expectations and developing effective risk management strategies.

- Explore the different types of investors that participate in the stock markets, such as retail investors, संस्थागत निवेशक, और professional investors. Recognizing the differences and regulatory environments applicable to each can guide your interactions with the market.

A. How Stock Markets Work Across the World

The शेयर बाजार is a global financial network where shares of publicly listed companies are issued and traded. It provides companies with the capital they need to grow and gives investors the chance to own a portion of these companies. Prices in the stock market are determined by supply and demand, as well as the performance of individual companies and broader economic factors.

Some of the major stock exchanges globally include:

- New York Stock Exchange (NYSE): The largest stock exchange in the world by market capitalization, listing major companies like Apple, गूगल, और Coca-Cola.

- NASDAQ: Known for its tech-heavy listings, NASDAQ includes companies like Amazon और Tesla

. - Tokyo Stock Exchange (TSE): The largest stock exchange in Asia, home to companies like Toyota और Sony.

- Hong Kong Stock Exchange (HKEX): A major player in Asia, connecting global investors to large Chinese firms such as Alibaba और Tencent.

B. Why Investors Choose Stocks

Investing in stocks offers a unique opportunity for wealth creation, but it also comes with risks. Here are some universal reasons people around the world invest in stocks:

- Building Wealth Over Time: Investors purchase stocks hoping to benefit from the growth of the companies they invest in. Over the long term, stocks have outperformed other asset classes such as bonds and savings accounts.

- Dividend Income: Many companies distribute a portion of their profits to shareholders in the form of dividends, providing a consistent source of income for investors.

- मुद्रास्फीति बचाव: Stocks can help protect against inflation, as companies generally adjust their prices in response to inflationary pressures, helping their value keep pace.

- Risk of Loss: While stocks can offer high returns, they also come with the risk of losing money, particularly if a company underperforms or the broader market experiences volatility.

The decision to invest in stocks depends on an individual’s financial goals, risk tolerance, and investment timeline.

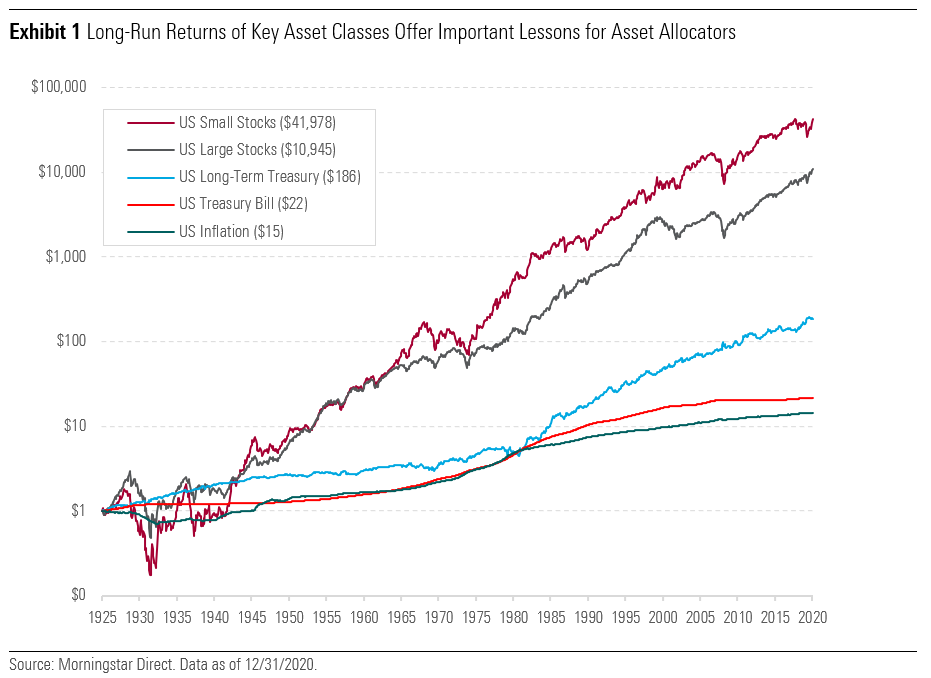

आकृति: Long-Run Returns of Key Asset Classes

विवरण:

The graph illustrates the long-term performance of major asset classes from 1925 to 2020. It shows how US Small Stocks, US Large Stocks, US Long-Term Treasury, US Treasury Bill, और US Inflation have grown over time. The Y-axis represents the value of a $1 investment over time on a logarithmic scale, while the X-axis represents the years. This visual emphasizes how different asset classes have yielded varying returns over the years, with US Small Stocks achieving the highest returns and US Inflation showing minimal growth.

चाबी छीनना:

- US Small Stocks have historically offered the highest returns among asset classes.

- US Large Stocks also provided substantial returns but were lower than small stocks.

- US Long-Term Treasuries demonstrated moderate growth, while US Treasury Bills showed limited growth.

- मुद्रा स्फ़ीति had the lowest impact on investment value, indicating minimal real growth over time.

- Long-term investing in equities appears to outperform other asset classes.

सूचना का अनुप्रयोग:

This data helps users understand the importance of asset allocation and how investing in equities over the long term can yield higher returns compared to fixed-income securities. It is useful for investors to see how different asset classes perform over time, reinforcing the idea of विविधता और long-term growth potential in a portfolio.

C. Investor Types

Around the world, investors fall into different categories based on their level of experience, investment size, and regulatory requirements. Understanding these types helps explain how different investors participate in the market.

- Retail Investors: These individual investors buy and sell stocks for their own personal portfolios. They typically invest smaller amounts than institutional investors and often rely on online trading platforms for access to the market.

- Institutional Investors: These are large entities, such as pension funds, hedge funds, और insurance companies, that manage significant sums of money on behalf of others. They have access to sophisticated financial instruments and often have more influence in the market due to the size of their investments.

3. Professional Investors: With extensive knowledge of the markets, professional investors manage large portfolios and have fewer regulatory restrictions compared to retail investors. However, they must still comply with global market regulations to ensure fairness and transparency.

These categories are crucial in ensuring that each group operates within the appropriate level of market regulation and that investors engage in investments suited to their knowledge and experience.

आकृति: Retail vs. Institutional Investors

विवरण:

The image compares retail investors और संस्थागत निवेशक across several factors such as the amount of money invested, trading frequency, trading scale, and access to resources. It highlights that retail investors generally trade smaller amounts with limited frequency and have less access to information. In contrast, institutional investors trade large volumes, frequently manage trades for others, and have access to exclusive research and resources.

चाबी छीनना:

- Retail investors invest their own money, often in smaller amounts and less frequently.

- Institutional investors trade large volumes on behalf of clients and have access to exclusive resources.

- Trading volume and frequency are significantly higher for institutional investors.

- Knowledge and research access are more limited for retail investors compared to institutional investors.

सूचना का अनुप्रयोग:

के बीच अंतर को समझना खुदरा और संस्थागत निवेशक helps users comprehend market dynamics and the roles each group plays in trading. This knowledge is crucial for beginners to determine where they fit in the investment landscape and how they might strategize differently from larger institutions.

मुख्य पाठ जानकारी:

- The global stock market is an extensive network where companies gain capital and investors have the opportunity to own shares. Major exchanges like the NYSE और NASDAQ play significant roles in this ecosystem, influencing global economic trends.

- Investing in stocks offers the potential for substantial returns over time, with लाभांश providing a steady income stream. However, it also comes with risks of capital loss, especially during economic downturns or company-specific failures.

- Long-term performance of different asset classes shows that equities generally offer higher returns compared to more conservative investments like treasury bills and bonds, as evidenced by historical data from 1925 to 2020.

- Retail investors typically engage with the market on a much smaller scale than संस्थागत निवेशक, who manage large portfolios and have significant market influence. Understanding these dynamics is crucial for personal investment planning and navigating market interactions.

बंद बयान:

By understanding how stock markets function globally, the reasons behind stock investments, and the various investor types, you equip yourself with the knowledge to make informed decisions and strategically engage with the world of finance. This foundation is vital for anyone looking to participate effectively in the global market.