ローカル(ヨーロッパ特化型)コンテンツ:ヨーロッパの買い手市場と売り手市場

レッスンの学習目標:

- Understand the differences between a Buyers’ Market and a Sellers’ Market in Europe, identifying how economic conditions, supply, and demand influence market dynamics and negotiation power.

- Explore the distinctions between Local and National Markets in Europe, examining how property values and market conditions can vary significantly within a country.

- Differentiate between the Residential and Commercial Markets in Europe, assessing how factors like economic hubs and tourism influence these sectors.

- Compare the New Home Market versus Previously Lived-In (Resale) Properties in Europe, understanding the advantages and challenges associated with each.

- Distinguish between Investment Properties and Properties for End Users in Europe, recognizing the different factors that appeal to investors and personal buyers.

8.1 Buyers' Market vs. Sellers' Market in Europe

Buyers’ Market

あ 買い手市場 occurs when the supply of real estate exceeds demand, giving buyers greater leverage in negotiations. In European cities like Madrid そして Athens, economic slowdowns or overbuilding can lead to buyers’ markets, where properties stay on the market longer and buyers can negotiate lower prices or better terms.

Sellers’ Market

あ 売り手市場 happens when demand for real estate exceeds supply, allowing sellers to raise prices and have the upper hand in negotiations. Cities like Berlin, Paris、 そして Amsterdam often experience sellers’ markets due to limited housing supply and high demand driven by population growth, economic stability, and immigration.

形: Deciphering Market Dynamics: Buyer’s vs. Seller’s Market

説明:

The infographic sheds light on the distinctive features of a buyer’s market and a seller’s market in the context of the housing industry. Each market type is likely illustrated with unique characteristics, potential outcomes, and recommended strategies.

重要なポイント:

- 市場動向の明確化: グラフィック表現は、買い手市場の買い手に有利な条件と売り手市場の売り手有利な条件を区別します。

- 強調表示された基準: 2 つの市場タイプを区別するために、在庫レベル、需要と供給のバランス、潜在的な価格戦略などの主要な指標が詳細に説明される場合があります。

- 戦略の洞察: インフォグラフィックは、一般的な市場状況に応じて、買い手または売り手のどちらかに合わせた実用的なアドバイスを提供する可能性があります。

- 教育概要: このビジュアルは不動産愛好家のための包括的なガイドとして機能し、不動産市場をより効果的にナビゲートするのに役立ちます。

情報の応用:

Recognizing whether it’s a buyer’s or seller’s market is paramount for real estate investors, agents, and potential homeowners. Graphics like this demystify complex market dynamics, helping stakeholders to strategize better and make well-informed decisions. From setting the right property price to understanding the best time to buy, such insights empower individuals to optimize their real estate endeavors.

8.2 Local vs. National Market in Europe

地方市場

の local real estate market refers to a specific city, town, or region. In Europe, local markets can vary dramatically within the same country. For instance, property prices in London can be far higher than in other parts of the U.K. Similarly, local market trends in Berlin may differ significantly from trends in Munich または Hamburg.

ナショナルマーケット

の national real estate market represents the overall property market trends across an entire country. In フランス, for example, the national market may reflect general housing trends, but individual local markets, such as Paris vs. Marseille, can differ in terms of supply, demand, and price movements.

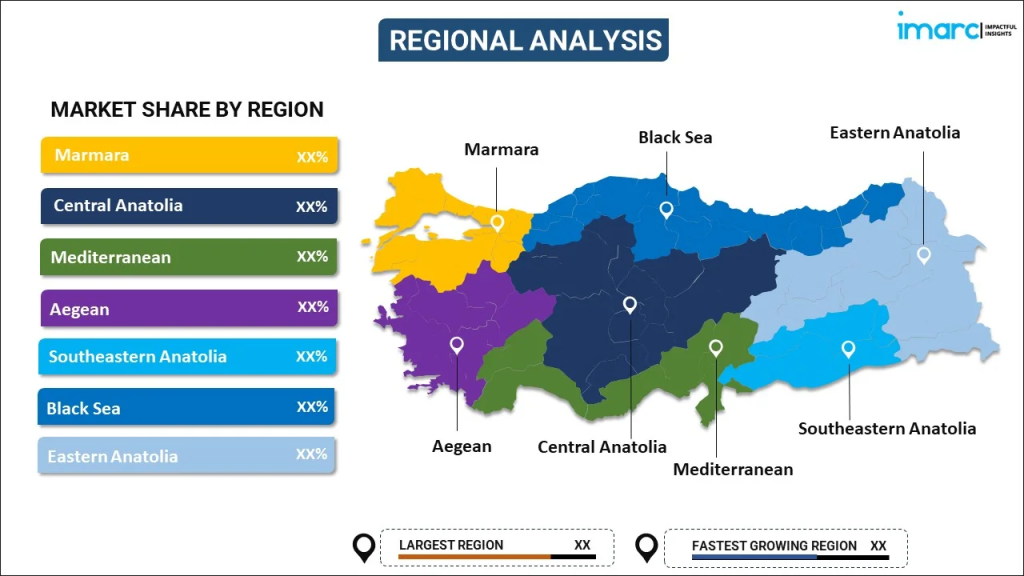

形: Regional Analysis of Turkey’s Real Estate Market

説明:

This map illustrates the market share of real estate regions in Turkey, highlighting key geographical divisions: Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea、 そして Eastern Anatolia. Each region is color-coded to represent its contribution to the real estate market, with markers indicating the largest region そしてその fastest-growing region. This analysis enables a clear understanding of Turkey’s regional real estate dynamics.

重要なポイント:

- の Marmara region, home to Istanbul, dominates the real estate market due to its economic significance.

- Central Anatolia そしてその Mediterranean regions follow as important contributors, driven by urban development and tourism.

- の fastest-growing region reflects areas with increasing infrastructure investments and economic opportunities.

- Regional diversity in Turkey showcases varied demand patterns influenced by factors like geography, population density, and economic activities.

- の Black Sea そして Eastern Anatolia regions hold smaller shares but may present untapped potential for investors.

情報の応用:

This regional breakdown is invaluable for real estate developers, investors, and policymakers aiming to understand the geographical distribution of opportunities and challenges in Turkey’s real estate market. By identifying key regions for growth and development, stakeholders can make informed decisions about market entry, resource allocation, and regional strategies.

8.3 Residential vs. Commercial Market in Europe

住宅市場

の residential real estate market includes properties purchased for personal use or rental purposes, such as single-family homes, apartments, and condominiums. In cities like Barcelona そして Rome, the residential market is heavily influenced by factors such as job growth, immigration, and tourism.

商業市場

の commercial real estate market includes properties used for business purposes, such as office buildings, retail spaces, and warehouses. Cities like Frankfurt そして London are known for strong commercial markets due to their status as global financial hubs. Commercial properties in these cities tend to have higher rental yields but can also require significant capital investments.

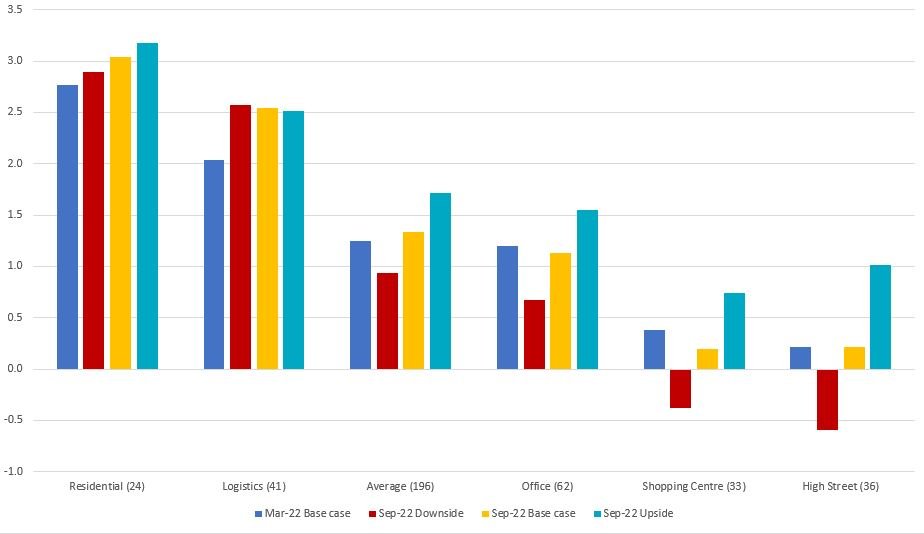

形: Projected Real Estate Performance in Europe by Sector (2022)

説明:

This bar chart compares real estate sector performance projections in Europe across six categories: Residential, Logistics, Average, Office, Shopping Centre, and High Street. The data is represented for March 2022 base case, September 2022 downside, September 2022 base case、 そして September 2022 upside scenarios. Key trends show that Logistics consistently outperforms other sectors in all scenarios, while High Street retail demonstrates challenges with negative projections in the downside scenario. The Residential sector remains stable across all projections.

重要なポイント:

- Logistics shows strong resilience and growth potential, reflecting the demand for warehousing due to e-commerce expansion.

- Residential real estate remains a stable investment across all scenarios, providing steady returns.

- Office spaces そして shopping centres face mixed outcomes, with performance varying significantly between the base case and downside scenarios.

- High Street retail is the most vulnerable sector, with negative projections under the downside scenario due to shifting consumer preferences.

- Upside scenarios suggest potential recovery or growth in several sectors, driven by economic stability and market adjustments.

情報の応用:

Investors and developers can use this data to identify resilient sectors like logistics and residential real estate, prioritizing investment in these areas for long-term returns. The chart also highlights sectors requiring cautious approaches, such as High Street retail, emphasizing the need for risk assessment and diversification strategies in uncertain market conditions.

8.4 New Home vs. Previously Lived-In (Resale) Properties in Europe

New Home Market

の new home market refers to newly built properties. In cities like Dublin そして Vienna, new construction homes are attractive to investors due to modern amenities and energy efficiency. However, new homes often come at a premium, and the location of new developments may be outside city centers.

Previously Lived-In Market

の previously lived-in market (resale properties) includes homes that have already been occupied. These properties can be more affordable than new construction, especially in well-established neighborhoods with existing infrastructure. In older European cities, such as Prague そして Brussels, many resale properties retain historical value, adding to their appeal.

8.5 Investment Property vs. Property for End User (Investor) in Europe

Investment Property

アン investment property is purchased with the intent to generate income through rentals or appreciation. In markets like Amsterdam そして Paris, investment properties are in high demand, particularly in areas popular with tourists or expatriates. Investors focus on rental yields, appreciation potential, and tax advantages.

Property for End User

あ property for an end user is typically purchased by the buyer for personal use. Buyers in cities like Zurich または Copenhagen might prioritize factors such as neighborhood amenities, school districts, and long-term livability. End users may be less concerned about rental income and more focused on building equity over time.

主なレッスン情報:

- で 買い手市場, properties may stay on the market longer, providing buyers with leverage to negotiate more favorable terms, particularly in cities experiencing economic slowdowns like Madrid and Athens.

- あ 売り手市場 is characterized by limited property supply and high demand, which can drive up prices and reduce negotiation leverage for buyers, common in cities like Berlin and Paris.

- の 住宅市場 is generally influenced by local economic factors such as job growth and immigration, while the 商業市場 relies more on global financial dynamics and corporate presence, especially in major cities like Frankfurt and London.

- New Homes often offer modern amenities and energy efficiency but may come at a higher price and be located further from city centers, whereas Resale Properties might offer more affordability and established neighborhoods.

- Investment Properties are typically focused on generating income and may be located in tourist-heavy or expatriate-friendly areas, whereas Properties for End Users are chosen based on personal use, emphasizing factors like neighborhood quality and proximity to schools.

閉会の辞:

Grasping the complex nature of Europe’s real estate market is essential for making informed investment decisions and strategic planning. This section equips you with the knowledge to navigate through various market conditions, whether you are buying, selling, or investing.