საბაზრო კაპიტალიზაცია და საწარმოს ღირებულება

ძირითადი სასწავლო მიზნები:

Introduction: Venture into the world of საბაზრო კაპიტალიზაცია და საწარმოს ღირებულება to enhance your

ability in evaluating and comparing companies within the same industry, gauging their relative size and

value.

1. Market Capitalization Mastery: გაგება market capitalization as a metric representing

the total value of a company’s outstanding shares of stock.

2. Enterprise Value Understanding: Dive into enterprise value, a more comprehensive

measure considering market cap, the company’s debt, and its cash holdings.

3. Comparative Analysis Skills: Develop skills in using both market capitalization და

enterprise value for comparing companies within the same industry and gauging their

relative size and value.

შესავალი

Market capitalization and enterprise value are two essential metrics used to assess the size and value of a company. Both can be used for investment analysis and to compare companies within an industry. In this chapter, we will explore the meaning, differences, and applications of market capitalization and enterprise value in investment analysis.

23.1 Market Capitalization

Market capitalization (market cap) is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the company’s stock price by the number of shares outstanding.

\(\textbf{Market Capitalization Formula:}\)

\[ \displaystyle \text{Market Cap} = \text{Stock Price} \times \text{Shares Outstanding} \]

\(\textbf{Legend:}\)

\(\text{Market Cap}\) = Market capitalization

\(\text{Stock Price}\) = Current price of a single share

\(\text{Shares Outstanding}\) = Total number of outstanding shares

მაგალითი:

Company B has 1,000,000 shares outstanding

The current market price of Company B’s stock is $50.00

\(\textbf{Market Cap Calculation:}\)

\[ \displaystyle \text{Market Cap} = \$50.00 \times 1,000,000 = \$50,000,000 \]

\(\textbf{Legend:}\)

\(\text{Market Cap}\) = Market capitalization

\(\$50.00\) = Current price of a single share

\(1,000,000\) = Total number of outstanding shares

23.2 Enterprise Value

Enterprise value (EV) is a more comprehensive measure of a company’s total value. It considers not only the market capitalization but also the company’s debt and cash holdings.

EV = Market Cap + Total Debt – Cash and Cash Equivalents

\(\textbf{Enterprise Value (EV) Formula:}\)

\[ \displaystyle \text{EV} = \text{Market Cap} + \text{Total Debt} – \text{Cash and Cash Equivalents} \]

\(\textbf{Legend:}\)

\(\text{EV}\) = Enterprise Value

\(\text{Market Cap}\) = Market capitalization

\(\text{Total Debt}\) = Total debt

\(\text{Cash and Cash Equivalents}\) = Cash and cash equivalents

მაგალითი:

Company B’s market cap is $50,000,000Total Debt = $10,000,000

Cash and Cash Equivalents = $5,000,000

\(\textbf{Enterprise Value Calculation:}\)

\[ \displaystyle \text{Enterprise Value} = \$50,000,000 + \$10,000,000 – \$5,000,000 = \$55,000,000 \]

\(\textbf{Legend:}\)

\(\text{Enterprise Value}\) = Enterprise Value

\(\$50,000,000\) = Market capitalization

\(\$10,000,000\) = Total debt

\(\$5,000,000\) = Cash and cash equivalents

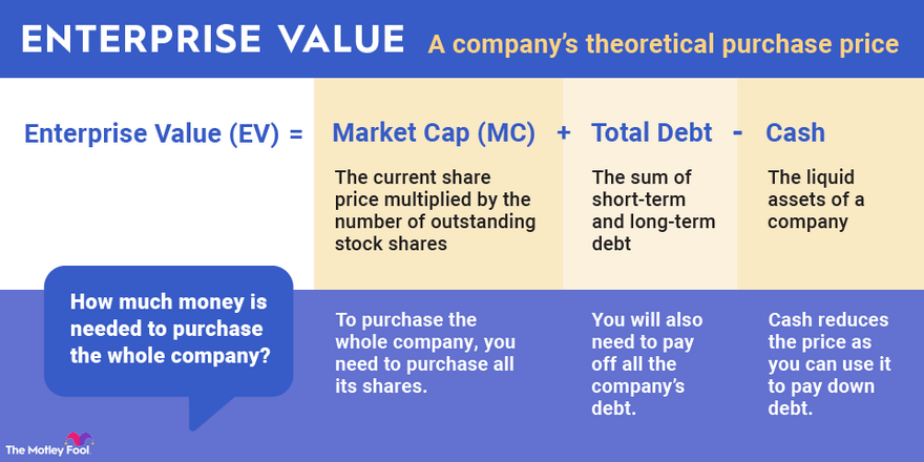

Figure title: Calculating Enterprise Value

წყარო: ჭრელი სულელი

აღწერა: This figure demystifies the formula for calculating Enterprise Value, an essential metric that provides a more complete valuation of a company than market capitalization alone.

ძირითადი დასკვნები:

- Enterprise Value Formula: Market Cap + Total Debt – Cash gives you a full picture of a company’s total value.

- Beyond Market Cap: While market capitalization only considers equity (stock), Enterprise Value also incorporates debt and subtracts cash and equivalents.

- Investor’s Perspective: This measure can be particularly useful when comparing companies with different capital structures or debt levels.

აპლიკაცია: Enterprise Value is a critical metric for investors who are interested in the total value of a business, allowing for more accurate company comparisons and investment choices.

23.3 Differences between Market Capitalization and Enterprise Value

Market capitalization only considers the value of a company’s equity, whereas enterprise value takes into account the company’s debt and cash holdings. As a result, enterprise value provides a more comprehensive picture of a company’s overall value.

23.4 Using Market Capitalization and Enterprise Value in Investment Analysis

Market capitalization and enterprise value can be used to compare companies within the same industry and determine their relative size and value. Investors can use these metrics to identify potential investment opportunities by looking for companies that appear undervalued compared to their peers.

მაგალითი:

Company C has a market cap of $75,000,000 and an enterprise value of $80,000,000.

Company D has a market cap of $100,000,000 and an enterprise value of $110,000,000.

By comparing these metrics, an investor may conclude that Company C is relatively undervalued compared to Company D.

In summary, understanding key financial data points, market capitalization, and enterprise value is crucial for investors who want to make informed decisions and identify potential investment opportunities. By analyzing these metrics, investors can gain insights into a company’s financial health, performance, and growth potential.

ძირითადი დასკვნები:

Closing Statement: The knowledge of საბაზრო კაპიტალიზაცია და საწარმოს ღირებულება is pivotal in

dissecting a company’s financial stature in comparison to its peers. As you gain proficiency in these

metrics, you unravel a more precise layer of company valuation and comparative analysis, sharpening

your investment acumen.

1. Market Capitalization provides a quick glance at a company’s equity value based on its

current stock price and the number of shares outstanding.

2. Enterprise Value offers a more holistic view of a company’s worth, including its debt and

cash positions.

3. Investors can use both these metrics to find undervalued companies in the market, enhancing

their investment decision-making process.

4. Recognizing the difference between market capitalization and enterprise value is vital for

accurate company valuation and comparison.