06

6월

개인 금융

~에 미분류

코멘트

현재 상태

등록되지 않음

가격

닫은

시작하다

이 강의는 현재 닫혀있습니다.

강의 콘텐츠

1장: 개인 금융 소개

2장: 금융 태도와 행동

3장: 소득과 경력 탐색

4장: 재정 계획 및 목표 설정

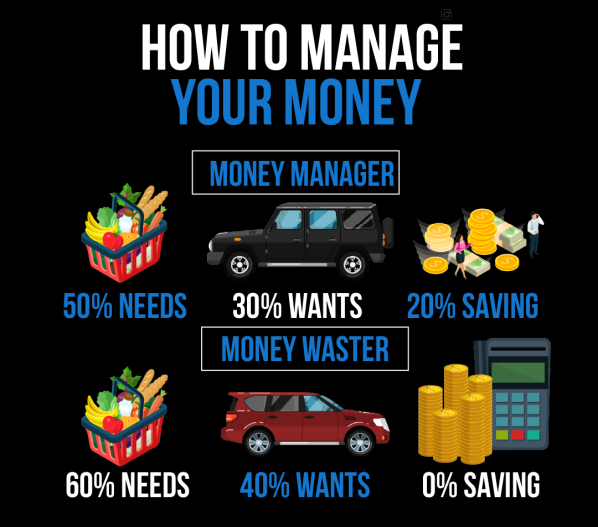

5장: 예산 및 비용 관리

제6장 소비자 의사결정