글로벌: 부동산 및 주택 소유의 핵심 개념

수업 학습 목표:

소개:

This section explores the 주택 구매 과정 그리고 financial elements involved, such as real estate contracts, mortgages, and comparing different payment options. Learning these steps helps users understand the legal, financial, and contractual aspects of real estate, supporting informed decisions and investment potential.

- Understand the key steps of the homebuying process, including preparing financially, working with realtors, obtaining pre-approval for mortgages, and making offers. This knowledge ensures users can effectively navigate the market.

- Learn the basics of mortgages, such as interest rates, fixed vs. variable rates, and payment schedules. Knowing these aspects helps users choose the best mortgage for their financial situation.

- Recognize the significance of real estate contracts, covering terms, contingencies, and legal obligations. This will enable users to manage risks and obligations during a property purchase.

- Explore different mortgage payment strategies, understanding the impact of larger down payments, accelerated payments, and refinancing. This allows users to optimize repayment and reduce total interest paid over time.

소개

Real estate and homeownership are significant aspects of personal finance, offering both opportunities for long-term investment and financial stability. This chapter covers essential concepts such as understanding real estate contracts, mortgage basics, and how to compare different mortgage payment options. Whether purchasing a home or investing in property, understanding the legal, financial, and contractual elements of real estate transactions is key to making informed decisions. By navigating these processes effectively, individuals can maximize their investment potential and achieve their homeownership goals.

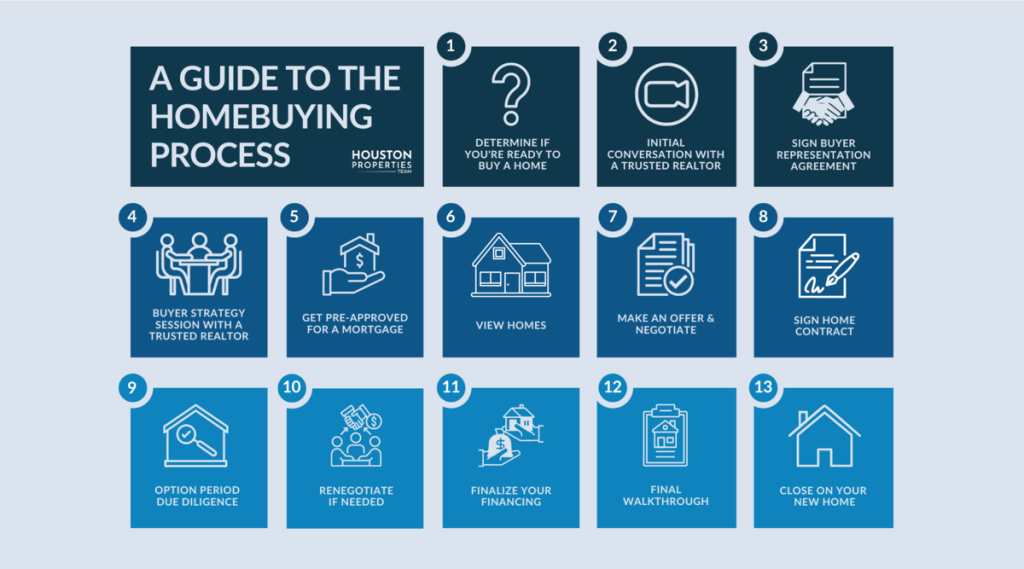

수치: 주택 구매 과정 안내

설명:

The image outlines the steps involved in purchasing a home, beginning with determining readiness to buy and progressing through conversations with a realtor, pre-approval for a mortgage, viewing homes, and making an offer. It also covers due diligence, contract negotiations, finalizing financing, and ending with the final walkthrough and closing on the home. This guide helps potential buyers understand the key actions needed to navigate the homebuying process effectively.

주요 시사점:

- Initial preparation involves assessing readiness, consulting with a realtor, and getting pre-approved for a mortgage.

- Engaging with realtors and going through viewings helps in finding suitable homes.

- Making offers and negotiating contracts are critical steps to securing a home purchase.

- Final steps include due diligence, finalizing finances, and a walkthrough before officially closing the deal.

정보의 응용:

Understanding the homebuying process is essential for first-time buyers and anyone looking to navigate the market efficiently. By following these steps, buyers can make informed decisions and avoid common pitfalls, ensuring a smoother journey from start to finish in purchasing their home.

A. 계약 이해

When entering into any real estate transaction, it’s crucial to fully understand the terms of the contract. A real estate contract is a legally binding agreement between the buyer and seller that outlines the terms of the property transaction. It is essential to carefully review and understand all aspects of the contract, as it can have long-term financial and legal implications.

- Key Components of a Real Estate Contract:

- 구매 가격: The agreed-upon price for the property.

- Contingencies: These are conditions that must be met for the contract to be binding, such as the buyer securing financing or the property passing an

inspection. - Closing Date: The date by which the sale is finalized, and ownership is transferred.

- Earnest Money Deposit: A deposit made by the buyer to show serious intent to purchase, typically held in escrow until closing.

- Title: Ensures that the seller has the legal right to transfer ownership and that the property is free from liens or disputes.

- 구매 가격: The agreed-upon price for the property.

- Reading the Fine Print: Real estate contracts often contain complex legal language. It’s important to review the fine print and seek clarification on terms you do not understand. Hiring a lawyer or real estate agent to explain the contract and negotiate terms on your behalf can prevent costly mistakes.

- Signing a Mortgage Contract: If you’re financing your home through a mortgage, the mortgage contract is another critical document to understand. It outlines the terms of the loan, including the 이자율, repayment schedule, and any penalties for late payments.

- 예: A buyer in Canada should be aware of key contractual terms such as the amortization period (length of time over which the mortgage is repaid) and whether the interest rate is fixed 또는 variable.

- 예: A buyer in Canada should be aware of key contractual terms such as the amortization period (length of time over which the mortgage is repaid) and whether the interest rate is fixed 또는 variable.

수치: Key Elements of a Real Estate Contract

설명:

The image illustrates the nine key components of a real estate contract, including elements such as the parties involved, property description, and purchase price. It also emphasizes the importance of details like payment terms, contingencies, conditions, and signatures. Understanding each of these elements is crucial for ensuring a smooth transaction and clarifying responsibilities for all parties.

주요 시사점:

- Parties involved, property description, and payment terms are essential to outline clearly who is responsible and what is being bought.

- Earnest money deposits act as a show of commitment by the buyer.

- Contingencies and conditions allow for adjustments or exit options if certain conditions are not met.

- Title provisions and closing date ensure the legal transfer of ownership at a specified time.

- Signatures and witnesses provide legal acknowledgment and binding consent for the agreement.

정보의 응용:

Knowing the key elements of a real estate contract helps buyers, sellers, and realtors understand the essential clauses needed for a legally binding agreement. It ensures that all aspects of the transaction are covered, minimizing risks and avoiding potential conflicts.

B. Mortgage Basics

For most people, purchasing a home involves obtaining a 저당—a loan used to finance the purchase of property. Understanding how mortgages work and the different types available is essential for making informed decisions.

- Types of Mortgages:

- Fixed-Rate Mortgages: With a fixed-rate mortgage, the 이자율 remains the same for the entire loan term. This provides stability, as monthly payments remain predictable, even if interest rates in the broader market rise.

- Variable-Rate Mortgages: In contrast, with a variable-rate mortgage (also called an adjustable-rate mortgage), the interest rate can fluctuate based on changes in the broader market. This means monthly payments may increase or decrease over time.

- Interest-Only Mortgages: Some mortgages allow borrowers to pay only the interest for an initial period, after which the principal payments begin. While this can reduce initial monthly payments, it often results in higher payments later.

- Fixed-Rate Mortgages: With a fixed-rate mortgage, the 이자율 remains the same for the entire loan term. This provides stability, as monthly payments remain predictable, even if interest rates in the broader market rise.

- Mortgage Term and Amortization: The mortgage term is the period over which the mortgage agreement is in effect, often ranging from 5 to 30 years. The amortization period is the total time it will take to fully repay the loan if regular payments are made.

- 예: A homebuyer in the United States might take out a 30-year fixed-rate mortgage, meaning they will repay the loan over 30 years at a consistent interest rate. In contrast, a buyer in the UK might opt for a two-year fixed rate with a longer amortization period.

- 예: A homebuyer in the United States might take out a 30-year fixed-rate mortgage, meaning they will repay the loan over 30 years at a consistent interest rate. In contrast, a buyer in the UK might opt for a two-year fixed rate with a longer amortization period.

- Down Payments: Most mortgage loans require the buyer to make a 계약금—a portion of the purchase price paid upfront. Larger down payments reduce the overall loan amount and can result in lower interest rates.

- 예: In many countries, such as Australia and Canada, a 20% down payment is often required to avoid paying additional mortgage insurance.

- 예: In many countries, such as Australia and Canada, a 20% down payment is often required to avoid paying additional mortgage insurance.

- Private Mortgage Insurance (PMI): In cases where buyers cannot make a substantial down payment (often less than 20% of the home’s value), lenders may require them to pay Private Mortgage Insurance (PMI). PMI protects the lender in case the borrower defaults on the loan.

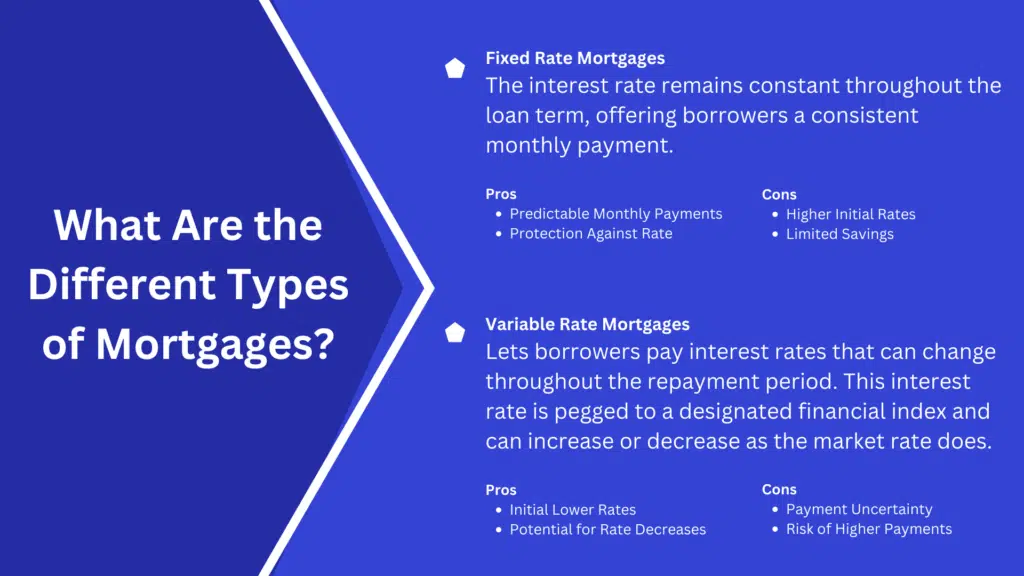

Figure: What Are the Different Types of Mortgages?

설명:

The image compares two main types of mortgages: Fixed Rate Mortgages 그리고 Variable Rate Mortgages. Fixed rate mortgages offer a consistent interest rate throughout the loan term, providing predictable monthly payments. In contrast, variable rate mortgages have interest rates that can fluctuate based on market changes, leading to varying payment amounts over time.

주요 시사점:

- Fixed Rate Mortgages provide stable monthly payments but can come with higher initial rates.

- Variable Rate Mortgages may start with lower rates but carry the risk of increased payments if rates rise.

- Fixed rate loans offer protection against rising interest rates, making budgeting easier.

- Variable rate loans allow for the possibility of lower rates if market conditions are favorable.

정보의 응용:

Understanding the differences between fixed and variable rate mortgages helps borrowers choose the right type of loan based on their financial situation. Those who prefer stable payments may opt for fixed rates, while others willing to take on more 위험 for potential savings might consider variable rates.

C. Comparing Mortgage Payments

One of the most important factors to consider when choosing a mortgage is how different loans affect monthly payments. Understanding how 이자율, 대출 조건, 그리고 down payments impact mortgage payments allows buyers to budget effectively and make informed choices.

- Impact of Interest Rates: The 이자율 has a significant effect on the total amount paid over the life of the mortgage. Higher interest rates result in larger monthly payments, while lower rates reduce the cost of borrowing. For this reason, borrowers are often encouraged to shop around for the best rates or lock in favorable rates when market conditions are favorable.

- 예: A buyer with a 30-year fixed-rate mortgage at 4% interest will have lower monthly payments compared to a buyer with the same loan amount but at 5% interest. The long-term savings can be substantial.

- 예: A buyer with a 30-year fixed-rate mortgage at 4% interest will have lower monthly payments compared to a buyer with the same loan amount but at 5% interest. The long-term savings can be substantial.

- Effect of Loan Terms: The length of the loan, or the 대출 기간, also plays a crucial role in determining monthly payments. A longer loan term results in lower monthly payments but increases the total interest paid over time. Conversely, a shorter loan term increases monthly payments but reduces the overall interest costs.

- 예: A 15-year mortgage has higher monthly payments than a 30-year mortgage but allows the borrower to pay off the loan faster and save on interest.

- 예: A 15-year mortgage has higher monthly payments than a 30-year mortgage but allows the borrower to pay off the loan faster and save on interest.

- Down Payment Size: A larger 계약금 reduces the size of the mortgage and, therefore, lowers monthly payments. Additionally, larger down payments often lead to more favorable loan terms and can eliminate the need for Private Mortgage Insurance (PMI).

- 예: A buyer who puts down 25% on a $300,000 home will borrow $225,000, resulting in smaller monthly payments compared to a buyer who puts down 10% and borrows $270,000.

- 예: A buyer who puts down 25% on a $300,000 home will borrow $225,000, resulting in smaller monthly payments compared to a buyer who puts down 10% and borrows $270,000.

- Comparison Tools: Many financial institutions offer mortgage calculators that allow buyers to compare different mortgage options, adjusting for factors like loan amount, interest rates, and loan terms. These tools can help buyers assess which mortgage option best suits their financial situation and long-term goals.

- 예: A homebuyer in France may use a mortgage calculator to compare the monthly payments on a 20-year fixed-rate mortgage versus a 15-year variable-rate mortgage, factoring in different interest rate scenarios.

- 예: A homebuyer in France may use a mortgage calculator to compare the monthly payments on a 20-year fixed-rate mortgage versus a 15-year variable-rate mortgage, factoring in different interest rate scenarios.

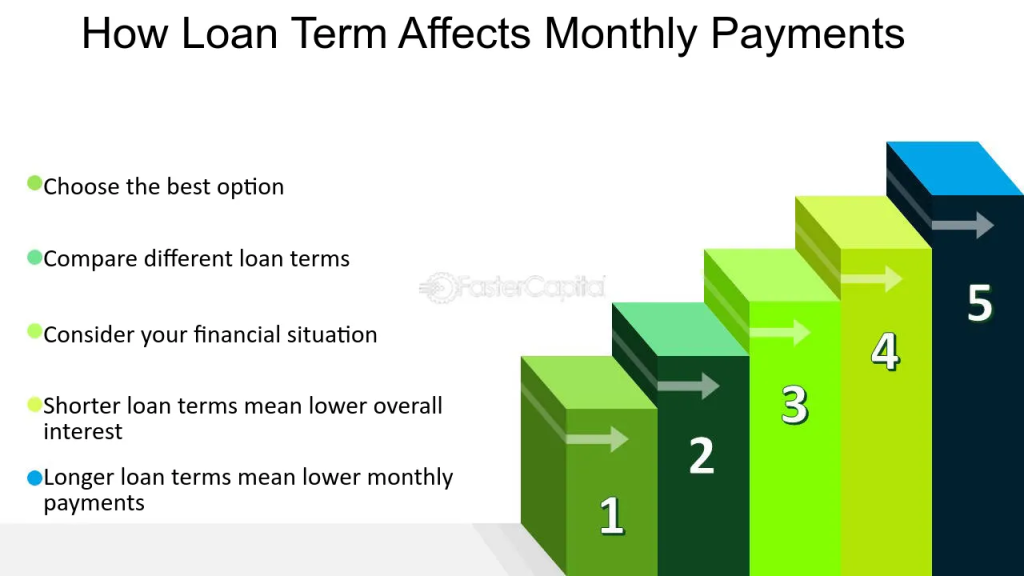

Figure: How Loan Term Affects Monthly Payments

설명:

The image illustrates how different loan terms impact monthly payments. Shorter loan terms generally lead to higher monthly payments but lower total interest costs, while longer terms reduce monthly payments but increase overall interest. The graphic emphasizes the importance of considering one’s financial situation, comparing loan terms, and choosing the best option based on these factors.

주요 시사점:

- Shorter loan terms result in lower total interest paid over time but higher monthly payments.

- Longer loan terms can reduce monthly payments, making them more manageable.

- It is crucial to compare different loan terms to find the most suitable option.

- Financial planning is essential to determine which loan term aligns with your budget and goals.

정보의 응용:

Understanding the effect of loan terms on monthly payments helps borrowers make informed decisions when taking out a loan. It is useful to compare options, weigh the benefits of lower total interest against the need for affordable monthly payments, and choose the term that best fits one’s financial situation.

수치: How Interest Rates Impact Your Monthly Payments

설명:

The figure explains how interest rates affect monthly loan payments. Higher interest rates lead to higher monthly payments, while lower interest rates result in lower payments. Additionally, loan terms also play a role, with longer terms typically resulting in lower monthly payments.

주요 시사점:

- Higher interest rates mean increased monthly payments.

- Lower interest rates lead to lower monthly payments, making loans more affordable.

- Loan terms also influence payments; longer terms generally lower monthly payments.

정보의 응용:

Understanding how interest rates and loan terms affect monthly payments can help borrowers make informed decisions. This knowledge is essential for choosing a loan with manageable payments and planning personal finances effectively.

주요 수업 정보:

- Preparing for homebuying involves assessing your readiness, working with realtors, and getting pre-approved for a mortgage. This preparation helps establish a clear plan for finding a suitable home and managing finances.

- Understanding mortgage options is essential to choosing the right loan. Key factors include comparing fixed vs. variable rates, interest rates, and payment terms. Knowing the differences helps users select a mortgage that aligns with their financial goals.

- Real estate contracts are critical documents that outline the terms and conditions of a home purchase. They specify payment terms, contingencies, and the buyer’s and seller’s responsibilities, ensuring all parties understand their obligations.

- Effective mortgage repayment strategies can help reduce debt faster. Paying more than the minimum, making extra payments, or refinancing for better rates are ways to save on interest and achieve homeownership sooner.

- Navigating the homebuying process requires a clear understanding of each step, from making an offer to finalizing the deal. Following these steps reduces the risk of errors and improves the overall buying experience.

마무리 진술:

Mastering the homebuying process, understanding mortgages, and utilizing effective payment strategies are vital to achieving financial stability and investment growth through real estate. These insights empower users to make well-informed decisions and maximize the benefits of homeownership.