글로벌: 금융 지식 향상 및 정보에 기반한 의사 결정을 위한 핵심 전략

수업 학습 목표:

소개:

This section covers the strategies needed to enhance financial literacy and make informed decisions. Understanding how to stay updated on financial trends, use digital tools, and collaborate with financial professionals is crucial for effective personal finance management.

- Stay Informed About Personal Finance: Learn how to regularly access reliable financial news, follow economic indicators, and participate in financial education programs. Staying informed allows individuals to understand how economic changes, tax policies, and new financial tools can affect their personal finances and decision-making.

- Use Financial Tools and Software: Discover the benefits of using digital tools like budgeting apps, investment platforms, 그리고 tax software to manage personal finances. By using these tools, individuals can plan their budgets, monitor investments, and handle tax filing efficiently, leading to better financial outcomes.

- Work with Financial Professionals: Explore when and why to seek guidance from financial professionals, such as 재정 고문, investment specialists, 또는 tax experts. This helps users make confident decisions in complex financial situations, such as retirement planning, investment diversification, or large purchases.

- Build Financial Confidence: Understand the importance of continuous learning and evaluation in financial decision-making. By combining insights from digital tools, 교육, 그리고 professional advice, users can develop the skills needed to set realistic financial goals and achieve them.

A. Staying Informed About Personal Finance

Personal finance is a dynamic field, with new products, regulations, and trends emerging regularly. Staying informed is crucial for making sound financial decisions, whether related to saving, investing, or managing debt. Individuals must take proactive steps to keep up with financial news, economic trends, and changes in personal finance tools or government policies.

- Regularly Accessing Reliable Financial News: Keeping up with financial news from reliable sources is essential for understanding how economic shifts—such as interest rate changes or market trends—can impact personal finance. Reputable websites, news channels, and financial blogs provide up-to-date information on global markets, interest rates, inflation, and financial products.

- 예: A consumer might regularly read financial publications like the Financial Times, The Wall Street Journal, 또는 Bloomberg to stay updated on global market trends and economic policies.

- 예: A consumer might regularly read financial publications like the Financial Times, The Wall Street Journal, 또는 Bloomberg to stay updated on global market trends and economic policies.

- Following Economic Indicators: Being aware of key economic indicators, such as inflation rates, unemployment figures, 그리고 GDP 성장, helps individuals understand the broader economic environment and how it could affect their personal finances.

- 예: If inflation is rising, a consumer may adjust their budget to account for increasing costs of goods and services or explore investment opportunities that protect against inflation, such as inflation-linked bonds.

- 예: If inflation is rising, a consumer may adjust their budget to account for increasing costs of goods and services or explore investment opportunities that protect against inflation, such as inflation-linked bonds.

- Participating in Financial Education Programs: Many organizations, government bodies, and non-profits offer financial education programs designed to help individuals improve their financial literacy. Participating in these programs allows individuals to deepen their understanding of personal finance and make more informed financial decisions.

- 예: The OECD International Network on Financial Education (INFE) offers global resources to improve financial education across countries.

수치: Staying Informed in Personal Finance

설명:

The figure highlights key aspects that are essential for staying informed in the field of personal finance. It includes Market Trends, Tax Legislation, Personal Finance Tools, Educational Resources, 그리고 Understanding Financial Products. Each component plays a role in helping individuals manage their finances effectively by ensuring they have access to the latest information, tools, and resources.

주요 시사점:

- 시장 동향 provide insights into the direction of the economy, helping people make informed financial decisions.

- Tax Legislation knowledge is critical for understanding how different financial actions affect taxes.

- Personal Finance Tools offer practical assistance in budgeting, saving, and managing investments.

- Educational Resources enhance understanding and keep users informed of new financial products and strategies.

- Understanding Financial Products enables individuals to choose the best options for their financial goals.

정보의 응용:

Staying informed in 개인 금융 helps individuals make better financial decisions by understanding the impact of external factors like taxes and market trends. Regularly using finance tools and resources ensures continuous learning and adaptation to financial changes.

B. 금융 도구 및 소프트웨어 활용

In today’s digital world, numerous 금융 도구 및 소프트웨어 are available to help individuals manage their finances more effectively. These tools assist with budgeting, saving, investing, and tracking expenses, making it easier to make informed financial decisions.

- Budgeting Tools: Digital budgeting tools, such as Mint, YNAB (You Need a Budget), 그리고 PocketGuard, help individuals track their income, expenses, and savings goals. By visualizing spending patterns, users can make adjustments to their budgets to achieve financial goals like reducing debt or increasing savings.

- 예: A user of Mint can link their bank accounts and credit cards to the app, which then categorizes their spending automatically, helping them identify areas where they can cut back and save more.

2. Investment Platforms and Calculators: Online platforms like E*TRADE, Robinhood, 그리고 Vanguard make investing accessible to individuals, while investment calculators help users understand potential returns based on investment amounts, interest rates, and time horizons. These tools are essential for 포트폴리오 관리 and long-term financial planning.

- 예: A user of Vanguard can use the platform’s investment tools to simulate different retirement scenarios, adjusting variables like the amount saved, investment returns, and retirement age.

- 예: A user of Vanguard can use the platform’s investment tools to simulate different retirement scenarios, adjusting variables like the amount saved, investment returns, and retirement age.

3. Debt Management Tools: For individuals managing debt, tools like Debt Payoff Planner 그리고 Tally help track debt repayment schedules, calculate interest, and offer strategies for paying off loans faster. These tools can also provide reminders for upcoming payments to avoid late fees.

4. Tax Software: Platforms such as TurboTax, H&R Block, 그리고 TaxSlayer help individuals navigate the complexities of tax filing, allowing them to calculate deductions, credits, and refunds. Using tax software ensures accuracy and maximizes tax savings.

예: A freelancer might use TurboTax to file taxes efficiently by tracking deductions and expenses related to their business, maximizing potential tax refunds

5. Robo-Advisors: Robo-advisors, 와 같은 Betterment, Wealthfront, 그리고 Schwab Intelligent Portfolios, use algorithms to provide automated financial advice and portfolio management. These tools are ideal for individuals who want to invest without needing to manually manage their portfolios.

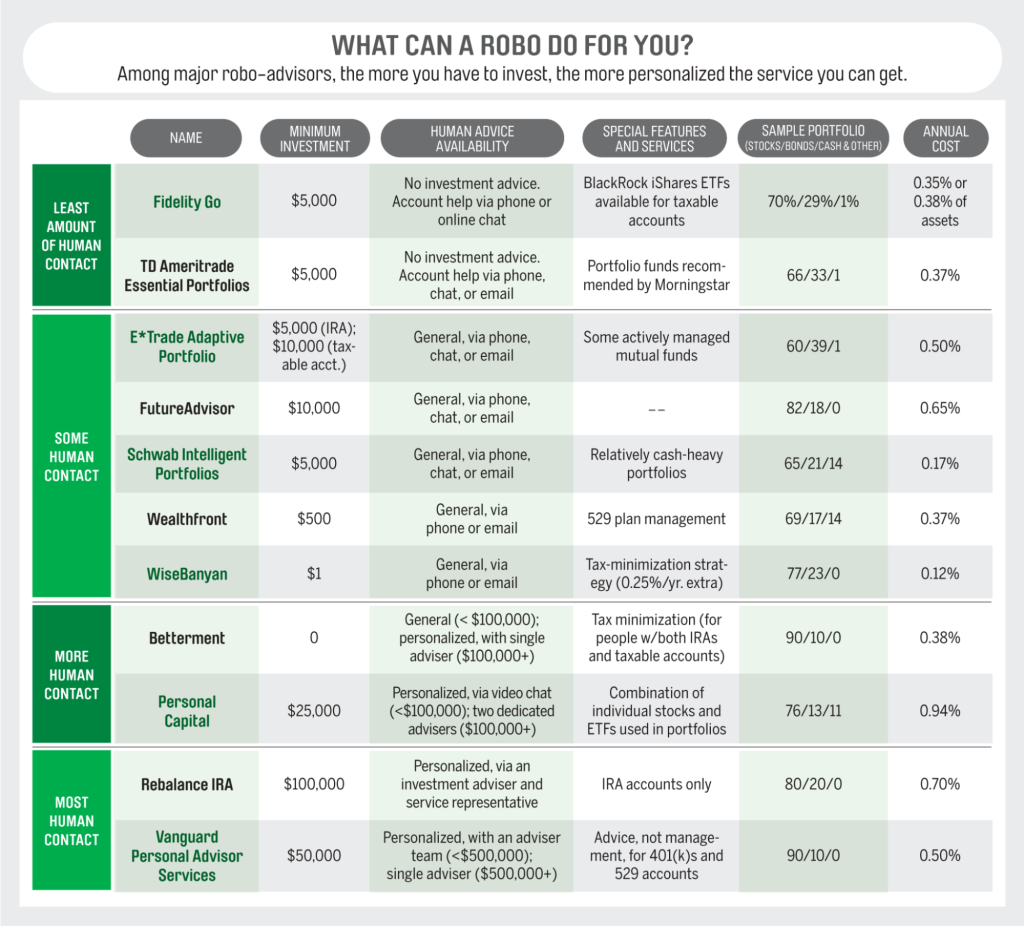

Figure: What Can a Robo Do For You?

설명:

The figure compares various robo-advisors, detailing information about minimum investment, human advice availability, special features and services, sample portfolio allocation (stocks/bonds/cash & other), and annual cost. The list is categorized based on the level of human contact offered, ranging from the least to the most human interaction. Each row provides specific details about the services of well-known robo-advisors, helping users understand the differences in cost, investment strategies, and service features.

주요 시사점:

- Robo-advisors vary in the level of human interaction they offer, from no contact to personalized advisory services.

- Minimum investments differ, with some platforms like WiseBanyan requiring as little as $1, while others need higher amounts, such as $100,000 for Rebalance IRA.

- Costs and features also vary, with annual fees ranging from 0.12% to 0.94%, depending on the services and portfolio management.

- Portfolio allocations indicate the focus on different asset classes, helping users choose based on risk tolerance and investment goals.

- Special features like tax-minimization strategies and IRA management help tailor investment plans to individual needs.

정보의 응용:

This information is helpful for 투자자들 to evaluate and compare different robo-advisors based on their investment goals 그리고 budget. By understanding the differences in services, costs, and strategies, users can make informed decisions on selecting a platform that best suits their 재정 계획 needs.

C. 금융 전문가와 협력하기

While digital tools are useful, there are times when individuals should seek the guidance of 금융 전문가 for more complex financial decisions, such as tax planning, investment strategies, and estate planning.

- When to Work with Financial Professionals: Financial professionals, such as financial planners, investment advisors, 그리고 tax advisors, offer tailored advice that can help individuals navigate significant life events like buying a home, saving for retirement, or managing a large inheritance.

- 예: A financial planner can help a young couple develop a savings plan for their child’s education while also preparing for their own retirement by balancing short-term and long-term goals.

- 예: A financial planner can help a young couple develop a savings plan for their child’s education while also preparing for their own retirement by balancing short-term and long-term goals.

- Choosing the Right Financial Professional: It’s important to choose a qualified and trustworthy financial professional. Consumers should verify credentials, such as Certified Financial Planner (CFP) 또는 Chartered Financial Analyst (CFA), and ensure that the professional’s services align with their financial needs.

- Independent vs. Non-Independent Advisors: Independent advisors are obligated to provide unbiased advice and act in their client’s best interest. Non-independent advisors may receive commissions for promoting specific financial products, which could influence their recommendations. Consumers should understand the difference and choose accordingly.

- 예: A high-net-worth individual might choose to work with a CFA-certified investment advisor to diversify their portfolio and minimize tax liabilities across multiple jurisdictions.

- Independent vs. Non-Independent Advisors: Independent advisors are obligated to provide unbiased advice and act in their client’s best interest. Non-independent advisors may receive commissions for promoting specific financial products, which could influence their recommendations. Consumers should understand the difference and choose accordingly.

- Using Hybrid Financial Advice Models: In addition to traditional advisors, many individuals now turn to hybrid models that combine human advisors with digital tools. Platforms like Personal Capital 또는 Vanguard Personal Advisor Services offer a blend of automated portfolio management and personalized human advice, providing a more cost-effective solution for individuals seeking ongoing financial support.

- Discussing Financial Goals and Concerns: Whether working with a financial planner or an investment advisor, it is important for individuals to be clear about their financial goals, concerns, and risk tolerance. Open communication ensures that the advisor can provide the best advice tailored to the individual’s unique situation.

- 예: A retiree working with a financial advisor may prioritize income stability 그리고 capital preservation over aggressive growth, and the advisor can design an investment portfolio accordingly.

- 예: A retiree working with a financial advisor may prioritize income stability 그리고 capital preservation over aggressive growth, and the advisor can design an investment portfolio accordingly.

Figure: How to Choose the Right Financial Advisor for You

설명:

The figure outlines eight key factors to consider when choosing a financial advisor. These include evaluating the advisor’s credentials and experience, 보상 structure, and investment philosophy. Other aspects to consider are the services offered, the advisor’s clientele, accessibility, communication style, 그리고 personality. This comprehensive approach helps users make informed decisions when selecting a financial advisor.

주요 시사점:

- Credentials and experience are crucial for assessing an advisor’s reliability and expertise.

- Compensation models (e.g., fee-only, commission-based) impact the cost and potential conflicts of interest.

- Investment philosophy should align with the investor’s financial goals and risk tolerance.

- Accessibility and communication style ensure smooth interactions and ease of reaching the advisor when needed.

- Considering the advisor’s clientele and personality can help determine if they are a good fit for one’s unique financial situation.

정보의 응용:

This guide helps investors assess and compare different advisors by focusing on factors that matter most to their financial goals. It allows users to make 정보에 근거한 결정 about selecting an advisor who can provide suitable investment advice 그리고 personalized support, ensuring a good match between the investor’s needs and the advisor’s services.

주요 수업 정보:

- Staying Informed: Regularly accessing reliable financial news, tracking economic indicators, and engaging in financial education programs helps individuals make informed financial decisions. Staying updated on market trends, tax changes, and economic shifts is essential for adapting financial plans accordingly.

- Using Digital Financial Tools: Tools like Mint, Vanguard, 그리고 TurboTax make managing personal finances easier by providing insights into spending, investments, and taxes. By regularly using these tools, individuals can improve budgeting, enhance investment strategies, and ensure accurate tax filing.

- 금융 전문가와 협력: Consulting with financial advisors for significant financial decisions, such as buying a home or planning for retirement, offers tailored guidance. Choosing between independent 그리고 non-independent advisors helps ensure objective advice, enhancing financial outcomes.

- Combining Digital and Human Advice: Hybrid models, such as Personal Capital 또는 Vanguard Personal Advisor Services, offer a mix of digital tools and human support, providing personalized and cost-effective financial management solutions. This approach combines automation with professional insights, helping users meet their financial goals.

- Building Financial Confidence: Using a mix of 금융 교육, digital tools, and professional advice empowers individuals to manage their finances confidently. This combination supports informed decisions, effective goal-setting, and long-term financial growth.

마무리 진술:

Applying these strategies to enhance financial literacy and decision-making enables users to manage personal finances with greater confidence. By staying informed, using digital tools, and seeking professional guidance, individuals can make well-informed financial choices and work towards achieving their financial goals.