제11장: 세무 계획 및 전략(CAD)

수업 학습 목표:

소개: This section introduces essential tax planning strategies in Canada, focusing on taxpayer rights, understanding different types of taxes, and advanced tax planning techniques to optimize financial outcomes.

- Understand Taxpayer Rights and Responsibilities: Gain knowledge of the Taxpayer Bill of Rights and the responsibilities of Canadian taxpayers, ensuring fair treatment and awareness of entitlements.

- Comprehend Various Types of Taxes: Learn about different taxes applicable in Canada, including income tax, sales tax, property tax, 그리고 custom duties, and their implications on personal finances.

- Apply Advanced Tax Strategies: Explore strategic tax planning techniques, including timing income and deductions, investment tax optimization, 그리고 estate tax planning to enhance financial benefits.

A. Tax Basics

A1. Taxpayer Rights and Responsibilities

Canadian taxpayers have rights outlined in the Taxpayer Bill of Rights. For instance, you have the right to receive entitlements and to pay no more and no less than what is required by law. Example: If a taxpayer believes they’ve been overcharged, they can file an objection, which the Canada Revenue Agency (CRA) must address promptly and professionally.

A2. Understanding Taxes and Contributions

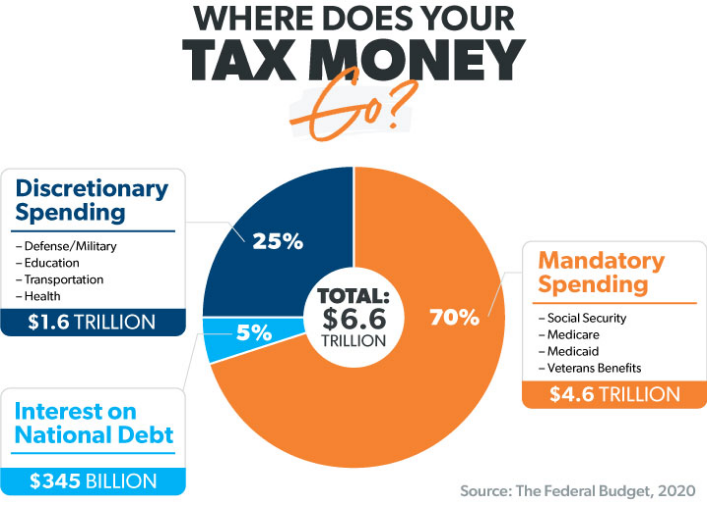

그림 제목: 귀하의 세금은 어디로 가나요?

원천: 램지 솔루션

설명: Ramsey Solutions의 기사는 2022년에 약 $4.9조에 달하는 IRS가 징수한 연방세 할당을 분석합니다. 이는 정부 부채에 대한 이자, 자격에 대한 의무 지출을 포함하여 다양한 정부 지출에 대한 세금 분배를 설명합니다. 사회보장, 메디케어, 메디케이드, 재향군인회 혜택과 같은 프로그램은 물론 국방, 교통, 교육, 건강 등을 다루는 재량 지출도 포함됩니다.

주요 시사점:

- 세금의 일부는 지불에 사용됩니다. 국가채무에 대한 이자.

- 의무지출 사회보장, 메디케어, 메디케이드와 같은 중요한 자격 프로그램이 포함됩니다.

재량적 지출 국방, 교통, 교육, 보건을 포함하여 의회가 매년 논의하는 예산 할당이 포함됩니다.

애플리케이션: 개인 금융에 대해 배우는 개인의 경우, 이 분류는 정부 예산 책정이 어떻게 이루어지는지, 그리고 세금이 어디에 지출되는지 이해하는 것의 중요성에 대한 통찰력을 제공합니다. 정치적 참여와 재정적 책임에 관한 결정을 내릴 수 있습니다. 상당한 자금을 받는 부문이 투자 기회를 제공할 수 있으므로 투자자의 경우 정부 지출 영역을 아는 것이 투자 전략의 지침이 될 수 있습니다. 이러한 할당을 이해하면 납세자가 자신의 기여가 국가 우선순위 및 서비스에 미치는 영향을 확인하는 데도 도움이 됩니다.

Different taxes apply to various aspects of life in Canada:

- Income Taxes: Earnings are taxed at federal and provincial levels. Example: A software developer in Ontario pays federal tax and a provincial tax.

- Sales Taxes: Goods and Services Tax (GST) is a federal tax, while the Harmonized Sales Tax (HST) combines GST with provincial sales tax in some provinces. Example: When purchasing a laptop in British Columbia, you pay 5% GST and an additional 7% PST.

- 재산세: Homeowners pay property taxes based on assessed property value. Example: A homeowner in Vancouver pays property tax to the City, which funds local services.

- Custom Duties and Excise Taxes: Special taxes on certain imports like cars or alcohol. Example: Importing a car from the US might incur excise taxes if it doesn’t meet Canadian standards.

- Tariffs: Taxes on imported goods. Example: A business importing electronics from China pays tariffs calculated as a percentage of their value.

- Duties and Fees: Specific types of taxes on goods like tobacco or services like legal document processing. Example: Importing a vintage wine collection may attract a customs duty.

- CPP (Canada Pension Plan): A mandatory pension plan to which employees and employers contribute. Example: An employee earning CAD 55,000 annually might contribute CAD 2,544.30 to CPP.

- Health Services Taxes: Additional taxes in some provinces for health care funding. Example: In Ontario, a high-income earner pays a health premium with their taxes.

- Motor Vehicle Licenses: Annual fees for the licensing of vehicles, varying by province and vehicle type. Example: Renewing the license for a mid-sized car in Alberta may cost about CAD 93 annually.

Natural Gas Taxes: Levied on the consumption of natural gas. Example: A household in Quebec may see a tax on their monthly natural gas utility bill.

B. Income Tax Essentials

B1. Who Charges Income Tax

Both the federal government and your provincial/territorial government charge income tax, and you must file tax returns separately for each. Example: A teacher in Quebec files a federal return with the CRA and a provincial return with Revenu Québec.

B2. Types and Groups of Income

Income includes money from employment, businesses, and investments. Example: A freelance graphic designer reports income from client payments, interest from savings accounts, and dividends from Canadian stocks.

B3. Tax Brackets and Rates

Canada’s progressive tax system means higher earnings are taxed at higher rates. Example: A doctor earning CAD 250,000 pays a higher marginal tax rate on income above CAD 150,000.

- Average Federal Tax Rate: The percentage of income that goes to federal tax. Example: If a person earns CAD 100,000 and pays CAD 18,000 in tax, their average tax rate is 18%.

- Marginal Federal Tax Rate: The tax rate paid on the last dollar earned, often the highest rate. Example: If the same person earns an additional CAD 10,000, it may be taxed at 29%, which is their marginal rate.

Here’s an illustrative table showcasing hypothetical tax rates:

Income Range (CAD) | Tax Rate (%) |

0 – 48,535 | 15 |

48,536 – 97,069 | 20.5 |

97,070 – 150,473 | 26 |

150,474 – 214,368 | 29 |

Above 214,368 | 33 |

*Note: These numbers are illustrative and not based on current tax brackets.

B4. Provincial/Territorial Income Tax

Provincial/territorial taxes vary and can significantly affect your take-home pay. Example: An engineer might consider the lower personal income tax rate when deciding to move from Nova Scotia to Alberta.

C. Reducing Taxable Income

C1. Tax Deductions

You can lower your taxable income with deductions for RRSP contributions, childcare expenses, and more. Example: A parent may claim CAD 8,000 in childcare expenses, reducing their taxable income from CAD 70,000 to CAD 62,000.

C2. RRSP Contributions

Contributions to an RRSP reduce your current taxable income and grow tax-deferred until withdrawal. Example: A contribution of CAD 5,000 to an RRSP may save you approximately CAD 1,500 in taxes if you’re in a 30% tax bracket.

C3. Other Registered Savings Plans

- TFSA contributions are made with after-tax dollars, but earnings and withdrawals are tax-free. Example: If you invest CAD 5,000 in a TFSA and it grows to CAD 7,000, the CAD 2,000 gain is not taxed

- Clawback: Refers to the government reclaiming benefits if your income exceeds a certain threshold. Example: Old Age Security payments may be subject to clawback for high-income seniors.

- RESPs (Registered Education Savings Plans): Allow savings for education to grow tax-free until the beneficiary withdraws for educational purposes. Example: Parents contribute to an RESP for their child’s future tuition, and the investment grows without being taxed with a percentage contribution matched by government grants and bonds.

- RDSPs (Registered Disability Savings Plans): Long-term savings plans to help Canadians with disabilities and their families save for the future. Example: The family of a child with a disability invests in an RDSP to secure their financial future, with contributions matched by government grants and bonds.

.

C4. Tax Credits

Credits like the Disability Tax Credit or the Canada Child Benefit can directly reduce the tax payable. Example: A family with a child with a disability might receive a non-refundable credit that reduces their tax bill by CAD 2,500.

C5. Tax Refunds

If tax deductions and credits lower your taxes paid below what was withheld by employers, you’re due a refund. Example: An overpayment of CAD 2,000 in income tax due to excessive payroll deductions would result in a CAD 2,000 refund.

C6. Taxes in Everyday Life

Understanding taxation allows for informed decisions about spending, saving, and investing. Example: A consumer decides to buy a fuel-efficient car partly because of the eco-friendly rebate and the reduced fuel taxes compared to a gas-guzzling model.

D. Advanced Tax Strategies

D1. Strategic Tax Planning

Involves timing income and deductions for optimal tax outcomes. Example: A contractor defers invoicing for a big job to the next tax year when expecting to be in a lower tax bracket.

D2. Investment Tax

Understanding the tax implications of investments can optimize after-tax returns. Example: An investor chooses to hold dividend-paying stocks outside of a TFSA to take advantage of the dividend tax credit.

D3. Estate Tax Planning

Managing the tax implications of one’s estate can maximize the value passed to heirs. Example: An individual buys a life insurance policy to cover potential estate taxes, ensuring their heirs receive the intended inheritance without tax erosion.

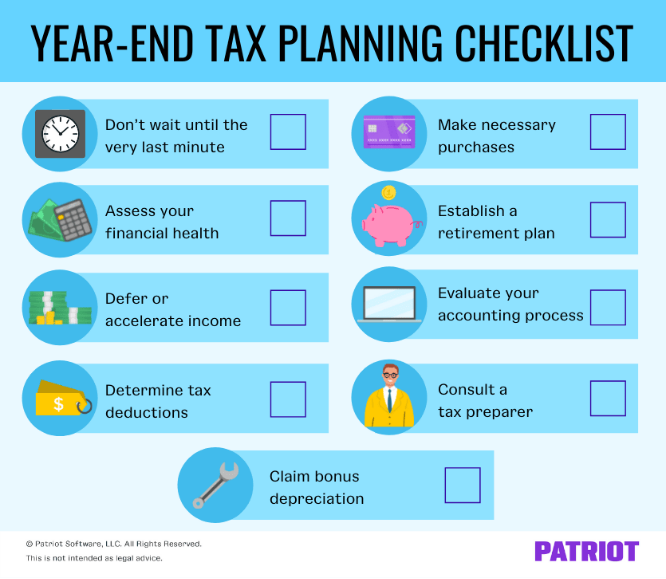

그림 제목: 연말세 계획 체크리스트

원천: 애국자 소프트웨어

설명:

이미지는 연말 세금 계획을 위한 체크리스트를 제공합니다.

- 마지막 순간까지 기다리지 마십시오. 연말이 끝나기 훨씬 전에 세금 계획을 시작하십시오.

- 귀하의 재정 상태를 평가하십시오: 재무제표를 검토하고 재무 상태를 이해하세요.

- 소득 연기 또는 가속화: 귀하의 세금 상황에 따라 소득을 연기하거나 가속화하는 것을 고려하십시오.

- 세금 공제 결정: 귀하가 청구할 수 있는 가능한 세금 공제를 모두 확인하십시오.

- 보너스 감가상각 청구: 해당되는 경우 세금 신고서에 보너스 감가상각을 청구하세요.

- 필요한 구매를 하세요: 공제를 청구하려면 연도가 끝나기 전에 필요한 사업 구매를 하십시오.

- 은퇴 계획을 세우십시오: 미래를 위해 저축하고 세금 혜택을 누릴 수 있는 은퇴 계획을 세우세요.

- 회계 프로세스를 평가하십시오. 귀하의 회계 프로세스가 효율적이고 정확한지 확인하십시오.

세무 대리인에게 문의하세요. 세금 절감 효과를 극대화하려면 전문가의 조언을 구하세요.

주요 내용:

- 효과적인 세금 계획을 위해서는 재무 건전성에 대한 조기 계획과 평가가 중요합니다.

- 세금 공제를 확인하고 필요한 구매를 하면 세금 책임을 줄이는 데 도움이 될 수 있습니다.

- 세무 대리인과 상담하고 회계 프로세스를 평가하면 정확한 세금 신고가 보장됩니다.

애플리케이션: 이 체크리스트는 소기업 소유자가 연말 세금을 계획할 수 있는 구조화된 접근 방식을 제공합니다. 이러한 단계를 따르면 사업주들은 납세 기간을 더 잘 준비하고 정확한 세금 신고를 보장하며 잠재적으로 납세 의무를 줄일 수 있습니다. 이는 연말 이전에 세금 계획의 모든 중요한 측면을 고려하고 해결하는 데 유용한 가이드입니다.

주요 수업 정보:

마무리 진술: Mastering tax planning and understanding various tax types and strategies are vital for financial optimization and compliance. This section equips you with the knowledge to navigate the Canadian tax system effectively and make informed financial decisions.

- Taxpayer Rights and Responsibilities: 이해하다 Taxpayer Bill of Rights, ensuring fair treatment and awareness of entitlements.

- Types of Taxes in Canada: 에 대한 학습 income tax, sales tax, property tax, 그리고 custom duties, and their implications on personal finances.

- Income Tax Essentials: Comprehend how both federal and provincial/territorial governments charge income tax, and understand Canada’s progressive tax system with specific tax brackets 그리고 요금.

- Advanced Tax Strategies: Apply strategic tax planning techniques, including timing income and deductions, investment tax optimization, 그리고 estate tax planning.