Global: Įvadas į finansines koncepcijas visiems regionams

Pamokos mokymosi tikslai:

- Įvadas: This section introduces you to the fundamentals of financial concepts that apply globally, including the basics of stocks and how they function within the financial system. Grasping these basics is essential for anyone looking to make informed financial decisions.

- Understand the role of akcijos in personal finance, including capital appreciation ir dividends as the primary ways to earn returns. This knowledge is crucial for new investors aiming to enter the stock market.

- Learn the structure and function of primary markets where securities are first issued. Knowing how these markets operate helps in understanding the investment environment and the role of various financial players.

- Naršyti successful investing strategies such as diversifikacija ir rizikos valdymas, which are universally applicable regardless of the investor’s country. This will help in building a resilient investment portfolio.

- Understand the core principles of stock market operations, including market fundamentals ir behavioral factors that influence stock prices. This knowledge is vital for predicting market movements and making strategic investment choices.

A. Introduction to Financial Concepts for All Regions

Understanding your finances is one of the most empowering skills you can develop. This course will take you on a journey through the world of financial literacy, focusing on akcijos and other financial topics, equipping you with the knowledge you need to make informed financial decisions. Whether you are a complete beginner or someone with basic knowledge, you’ll find the tools and concepts here useful for navigating the complexities of personal finance.

Akcijos are a central part of this learning process, representing ownership in a company and offering one of the most accessible ways to invest and build wealth. Investing in stocks provides returns in two main ways:

- Capital appreciation, which is the increase in the stock price over time.

- Dividends, which are payments made by companies to shareholders, representing a share of the company’s profits.

Stock markets exist worldwide, with similar operating principles. However, each region’s stock market is influenced by various local factors such as government policies, currency fluctuations, and regulations. In the United States, for example, large stock exchanges like the New York Stock Exchange (NYSE) ir NASDAQ operate under the regulation of the Securities and Exchange Commission (SEC), ensuring fairness and transparency.

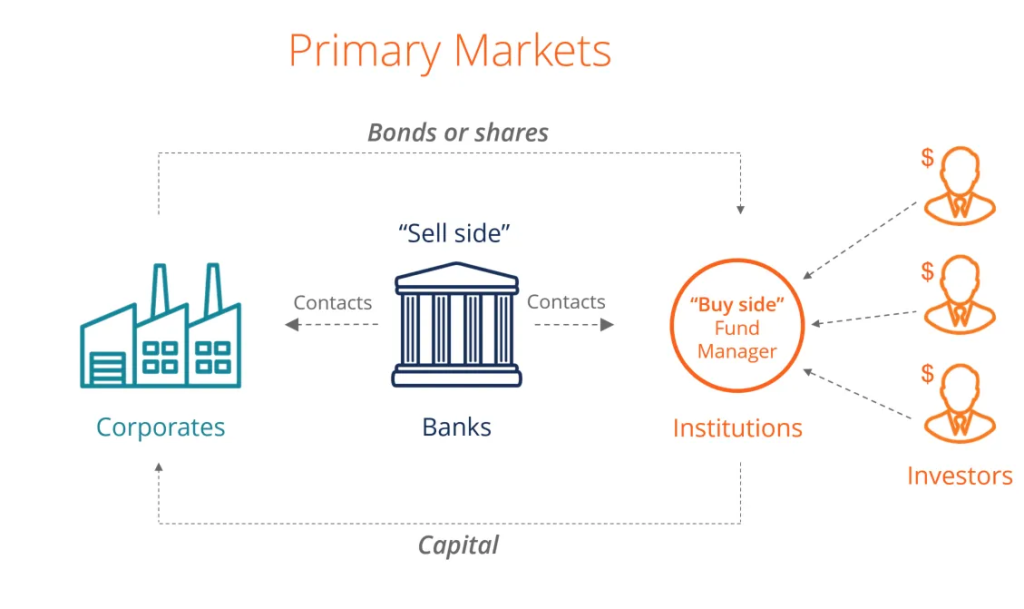

Paveikslėlis: Primary Markets

Aprašymas:

This diagram represents the flow of bonds or shares in primary markets, where corporates issue new securities. The “sell side” (banks) facilitates the issuance process and distributes securities to the “buy side”, including fund managers, institutions, and investors. The diagram emphasizes the roles of banks in connecting corporations with capital providers, managing the flow of securities, and establishing contacts between issuers and buyers.

Svarbiausios išvados:

- Primary markets are where new securities are issued for the first time.

- Banks play a crucial role as intermediaries on the sell side, helping corporations issue securities to investors.

- Fund managers, institutions, and individual investors represent the buy side, purchasing securities to gain returns.

- The process involves direct contact between corporations, banks, and investors, ensuring a smooth flow of capital.

Informacijos taikymas:

Understanding primary markets helps investors learn how securities are created and distributed. This knowledge is useful for evaluating the role of intermediaries like banks in facilitating capital flow. It also aids in identifying investment opportunities at the initial offering stage, where securities are typically priced lower before entering secondary markets.

B. Focus on General Success Strategies in Stock Investing Applicable Worldwide

To succeed in stock investing, it’s essential to build a strong foundation based on research, discipline, and understanding of key investment principles.

Globally, investors can follow several core strategies to increase their chances of success, regardless of the specific market they are participating in.

- Diversifikacija: One of the most important strategies is diversifying your portfolio. This means investing in a range of different companies and sectors to reduce the risk of loss. For example, if one industry experiences a downturn, other sectors in your portfolio may continue to perform well, balancing the overall risk.

- Long-Term Focus: Successful stock investors often take a long-term approach to investing. Rather than reacting to short-term market fluctuations, they remain focused on the broader performance of their investments over time. Markets naturally rise and fall, but the long-term trend often shows growth for strong companies.

- Research and Analysis: Doing thorough research on companies before investing is crucial. Investors should understand the financial health of a company, its growth potential, and the industry it operates in. This can include looking at financial statements, earnings reports, and broader economic indicators.

- Rizikos valdymas: Every investment carries some risk, but understanding and managing that risk is key. Setting clear financial goals and understanding how much risk you are comfortable with can guide your decisions. For instance, newer investors may want to start with less risky assets, like blue-chip stocks, which are large, well-established companies known for stable performance.

- Regular Review: Successful investors review their portfolios regularly to ensure their investments are still aligned with their financial goals. This doesn’t mean checking the stock market daily, but rather assessing performance periodically and adjusting as necessary.

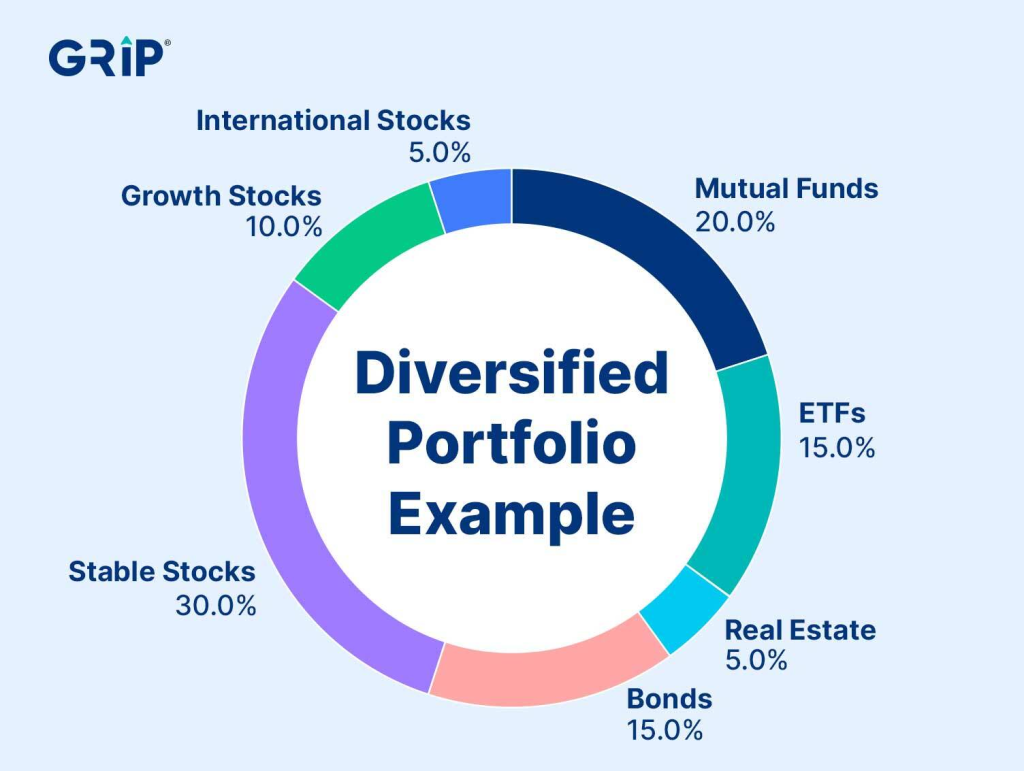

Paveikslėlis: Diversified Portfolio Example

Aprašymas:

This chart shows an example of a diversified investment portfolio, indicating how funds can be allocated across different asset types. The portfolio consists of stable stocks (30%), mutual funds (20%), obligacijos (15%), ETF (15%), augimo akcijos (10%), international stocks (5%), and nekilnojamasis turtas (5%). The distribution aims to balance risk and potential returns by investing in various asset classes.

Svarbiausios išvados:

- Diversifikacija spreads investment risk across different asset classes.

- Stable stocks form the largest component (30%), aiming for consistent returns.

- Mutual funds ir ETF (15% each) offer broad market exposure with managed risk.

- Obligacijos provide fixed income, representing 15% of the portfolio, helping to mitigate risk.

- Real estate, growth stocks, and international stocks add growth potential but come with higher risk.

Informacijos taikymas:

Investors can use this example to understand how to create a balanced portfolio that reduces risk while aiming for steady returns. Diversifying across multiple assets helps protect against the volatility of any single asset class. This strategy is crucial for long-term investing and for maintaining financial stability during market fluctuations.

C. Understanding Stock Market Principles

While the specific structure of stock markets may vary from one region to another, the core principles that drive stock markets are consistent across the globe. One of the fundamental concepts to understand is that stock market investing is not a game of chance but a calculated effort based on knowledge, research, and risk management.

- Market Fundamentals: The stock market operates on the basic principle of supply and demand. When more investors want to buy a stock than sell it, the price goes up, and when more people want to sell than buy, the price goes down. Understanding this flow helps investors anticipate market movements and act accordingly.

- Rizikos valdymas: Every investment involves risk, but successful investors know how to manage that risk. The key is understanding your personal rizikos tolerancija—the amount of risk you’re willing to take. Diversifying your portfolio and setting clear financial goals can help mitigate risks. For example, investing in both stable, well-established companies (low risk) and newer, high-growth companies (higher risk) creates a balanced portfolio.

- Market Indicators: Investors rely on various market indicators to gauge market health. These include stock indexes, such as the S&P 500 arba DAX, and economic reports that provide insights into the broader economy. Keeping an eye on these indicators can help you make informed decisions about when to buy or sell stocks.

- Behavioral Factors: Emotions like fear and greed can heavily influence market behavior. It’s important for investors to remain calm and not make decisions based solely on short-term market volatility. Successful investing requires patience, discipline, and the ability to focus on long-term goals rather than short-term fluctuations.

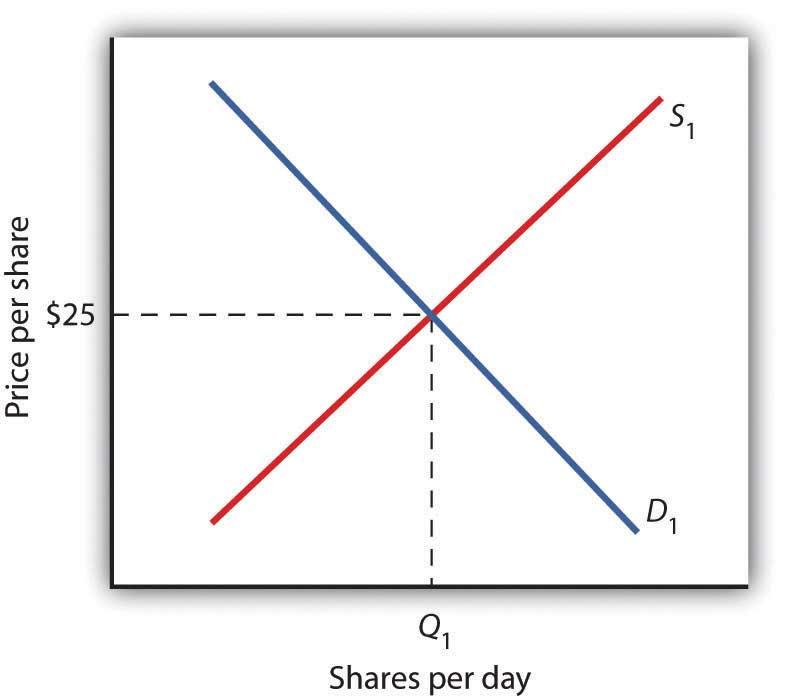

Figure: Equilibrium Price of Intel Corporation Stock Shares Based on Demand and Supply

Aprašymas:

This graph demonstrates the equilibrium between supply (S1) ir demand (D1) for shares in the market. The x-axis represents the quantity of shares per day (Q1), while the y-axis indicates the price per share. At the point where the supply and demand curves intersect, the equilibrium price is $25 and the equilibrium quantity is Q1.

Svarbiausios išvados:

- Equilibrium is reached where supply and demand curves intersect.

- The equilibrium price is set at $25 per share.

- The equilibrium quantity is indicated as Q1 shares per day.

- Changes in supply or demand can shift the equilibrium point, affecting both the price and quantity.

Informacijos taikymas:

Understanding supply and demand equilibrium helps investors predict price movements based on market conditions. If demand increases or supply decreases, the equilibrium price is likely to rise, signaling potential investment opportunities. Conversely, if demand falls or supply increases, prices may drop, suggesting a possible sell-off strategy.

Pagrindinė pamokos informacija:

- Understanding basic financial concepts and the functionality of stocks is crucial for anyone starting in finance. It provides a foundation for exploring more complex financial instruments and markets.

- The primary market plays a critical role in the financial system by allowing companies to issue new securities to investors, facilitated by banks. Knowing this helps investors identify opportunities to buy securities at potentially lower initial prices.

- Diversifikacija ir long-term focus are key strategies in stock investing that help manage risk and optimize returns. Implementing these strategies can significantly enhance the stability and growth of an investment portfolio.

- Risk management is essential in investing; understanding and managing your risk tolerance can guide investment decisions, helping maintain a balance between potential returns and acceptable risk levels.

- Market indicators ir equilibrium concepts are fundamental to understanding how stock markets operate. Knowledge of these can aid in making informed decisions about when to buy or sell stocks based on anticipated market movements.

Baigiamasis pareiškimas:

Grasping these fundamental financial concepts and investment strategies not only empowers you to manage your investments more effectively but also prepares you to navigate the complexities of the global financial landscape confidently and successfully.