Global: Understand Your Investment Goals and Risk Tolerance

Lesson Learning Objectives:

- Define Your Investment Goals and Risk Tolerance: Learn how to identify your investment goals, whether focused on long-term growth, income generation, or a mix of both. Assessing your risk tolerance will help determine how much risk you’re willing to take on to achieve those goals.

- Choose the Right Investments for Your Goals: Understand how to select investments such as stocks, ETFir bonds that align with your goals and risk tolerance, using the right mix for your strategy.

- Diversify Your Portfolio: Discover the importance of diversifikacija across asset classes, sectors, and regions to reduce risk and ensure your portfolio is well-rounded for both short-term stability and long-term growth.

- Develop Entry and Exit Strategies: Learn how to create strategies for buying ir selling investments based on both technical ir fundamental analysis to manage risk and maximize returns.

- Establish Risk Management Techniques: Explore effective risk management strategies, including stop-loss orders, position sizing, and other techniques to protect your investments from significant losses.

A. Understand Your Investment Goals and Risk Tolerance

The first step in creating a trading plan is to define your investment goals and assess your risk tolerance. Your goals could be focused on long-term growth, short-term profits, or a combination of both, and they will influence your investment strategy and asset allocation.

- Long-term growth: If your primary goal is building wealth over time, you might focus on a portfolio of stable stocks and ETFs with growth potential.

- Income generation: For those seeking regular income, dividend-paying stocks and bond ETFs may be more suitable.

- Risk tolerance: Assess how much risk you’re willing to take on. Younger investors may have a higher risk tolerance, while those nearing retirement might prioritize capital preservation.

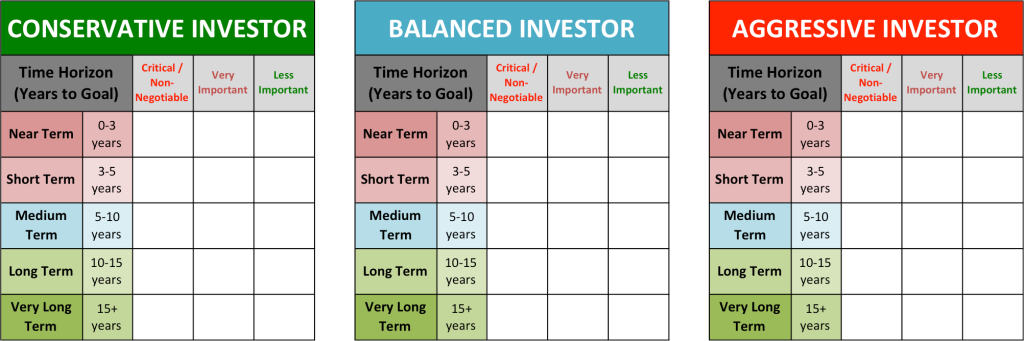

Paveikslėlis: Conservative, Balanced, and Aggressive Investors’ Time Horizons

Aprašymas:

This figure categorizes investment strategies based on three types of investors—Conservative, Balancedir Aggressive—along with the time horizons associated with their investment goals. Each category includes timeframes ranging from near term (0-3 years) to very long term (15+ years). The figure also differentiates between the importance of goals for each horizon, labeling them as Critical/Non-Negotiable, Very Important, or Less Important. This helps illustrate how different investors prioritize goals based on their risk tolerance and financial objectives.

Svarbiausios išvados:

- Conservative investors prioritize short-term safety, focusing on near-term and short-term goals.

- Balanced investors spread their focus across all time horizons, aiming for a mix of risk and stability.

- Aggressive investors focus on long-term growth, with higher risk tolerance for long-term and very long-term goals.

- The chart helps identify which timeframes are critical arba less important for each type of investor.

- Understanding these distinctions aids in creating a personalized investment plan.

Application of Information:

Investors can use this framework to align their strategies with their financial goals and risk tolerance. By identifying their investment type (conservative, balanced, or aggressive), users can develop a tailored portfolio that matches their priorities, helping them make informed decisions about timeframes and risk management. This is useful for both financial planning ir goal setting.

B. Choosing the Right Investments: Stocks and ETFs

Once you’ve defined your goals and risk tolerance, the next step is selecting the right stocks ir ETF to match your strategy.

- Stocks: Choose individual stocks based on company fundamentals, growth prospects, and valuation. Consider sectors like technology for growth, or consumer staples for stability.

- ETF: ETFs provide instant diversification by holding a basket of assets, and they are an excellent option for those seeking broad market exposure with lower risk. Choose sector-specific, market-cap-weighted, or international ETFs based on your investment objectives.

Key considerations:

- Growth stocks vs. value stocks.

- Broad market ETFs (e.g., S&P 500) vs. sector-specific ETFs (e.g., technology or healthcare).

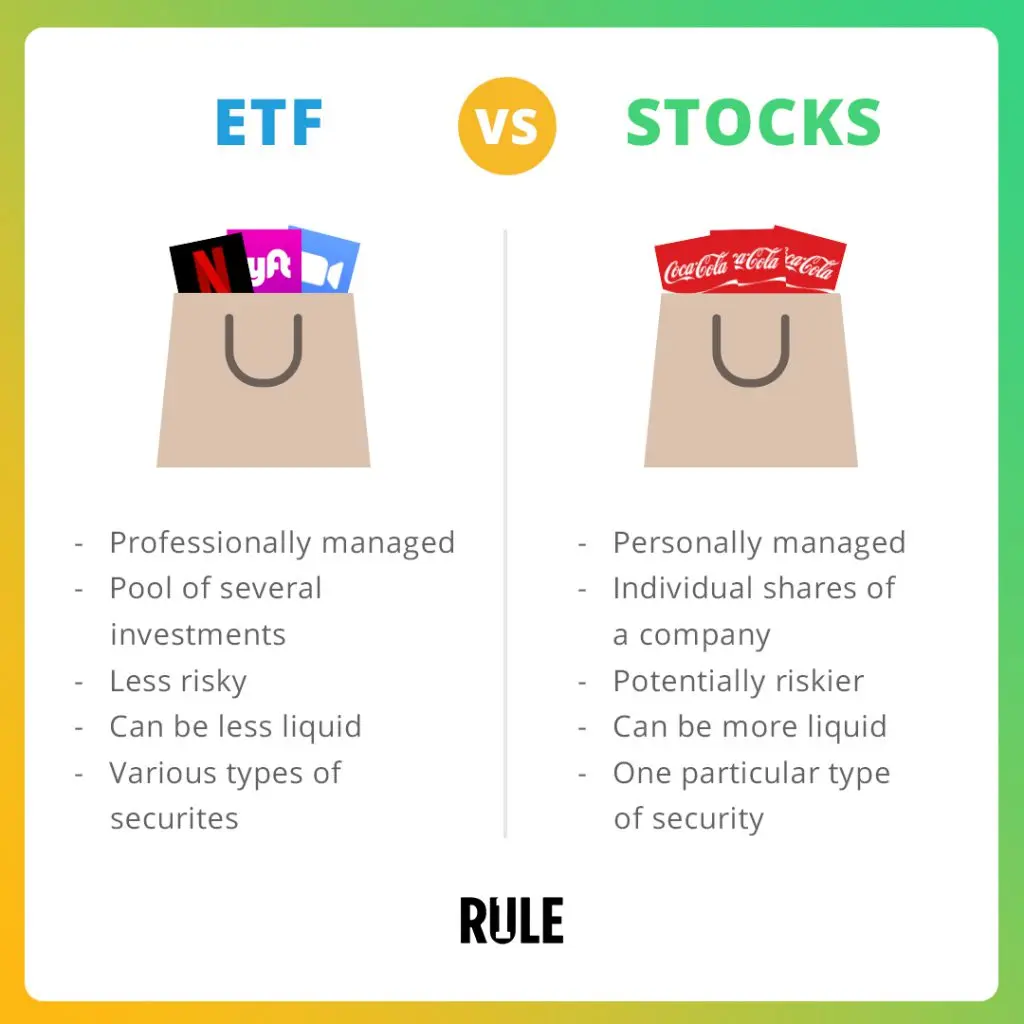

Paveikslėlis: ETF vs. Stocks

Aprašymas:

This figure contrasts ETF (Exchange-Traded Funds) with stocks in terms of management, risk, liquidity, and investment scope. ETFs are described as being professionally managed, consisting of a pool of several investments, making them less risky but potentially less liquid. In contrast, stocks represent individual shares of a company that are personally managed, can be more liquid, and generally carry higher risk as they represent a single investment.

Svarbiausios išvados:

- ETF provide a diversified investment option as they contain various securities, making them less risky.

- Stocks represent ownership in a single company, leading to higher risk but possibly greater returns.

- ETFs are professionally managed, while stocks require personal management and decision-making.

- Likvidumas differs; stocks are typically more liquid, while ETFs may vary depending on market conditions.

Application of Information:

Understanding the differences between ETFs and stocks helps investors choose the right investment strategy based on their risk tolerance, liquidity needsir management preference. ETFs may be better for diversifikacija and lower risk, while stocks can be suitable for those seeking direct exposure to specific companies and willing to accept higher risks. This knowledge is vital for making informed decisions in personal finance and stock investing.

C. Diversification

Diversifikacija is a key component of any trading plan and helps reduce risk by spreading investments across different asset classes, sectors, and regions. A diversified portfolio ensures that your overall performance isn’t overly dependent on any single investment or market condition.

- Asset class diversification: Balance your portfolio with a mix of stocks, bonds, commodities, and real estate to manage risk.

- Sector diversification: Invest across multiple industries such as technology, healthcare, and financials to mitigate the impact of downturns in any single sector.

- Geographic diversification: Include international stocks and ETFs to capture global growth and protect against country-specific risks.

D. Entry and Exit Strategies

Having a clear plan for entry ir exit strategies is crucial to managing your portfolio.

- Entry strategies: Define when you will buy a stock or ETF, whether based on technical analysis (e.g., price patterns, moving averages) or fundamental analysis (e.g., earnings reports, P/E ratios).

- Exit strategies: Establish your conditions for selling investments. These may include reaching a specific profit target, hitting a stop-loss level to limit losses, or reacting to changes in the company’s or market’s outlook.

Using stop-loss orders ir take-profit orders can automate the process and help you stick to your plan without emotional interference.

E. Regular Portfolio Review and Rebalancing

A trading plan should include regular portfolio reviews to ensure that your investments continue to align with your goals and risk tolerance. Over time, market conditions and investment performance can cause your portfolio’s allocations to shift, so rebalancing is necessary to bring them back in line with your original strategy.

- Review frequency: Consider reviewing your portfolio quarterly or semi-annually to assess performance and make adjustments.

- Rebalancing: If certain assets, such as stocks, outperform others, your portfolio may become overexposed to equities. Rebalancing involves selling some of those assets and buying others (e.g., bonds or cash) to maintain your desired risk profile.

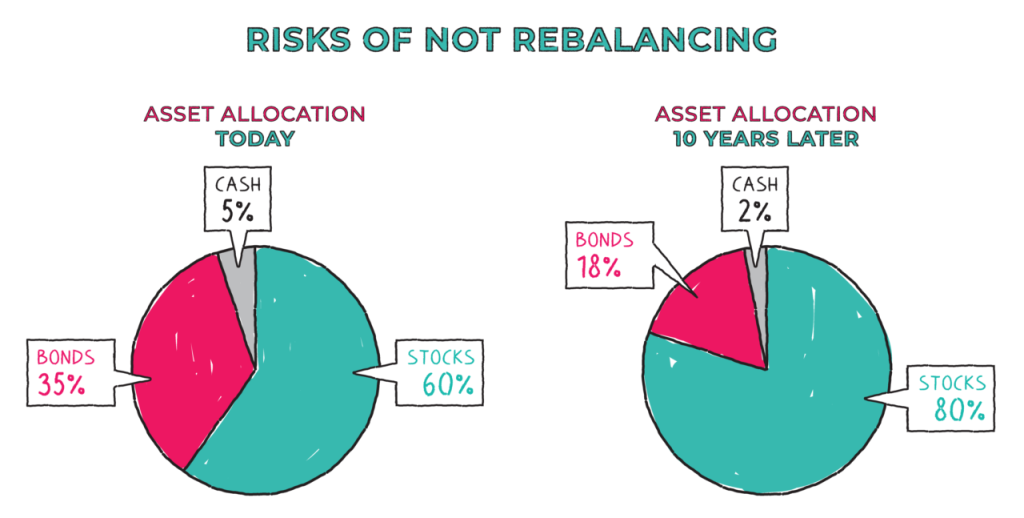

Paveikslėlis: Risks of Not Rebalancing

Aprašymas:

The figure illustrates the potential changes in asset allocation over a 10-year period if an investor does not rebalance their portfolio. On the left, the initial asset distribution consists of 60% stocks, 35% bondsir 5% cash. Over time, without rebalancing, the portfolio’s allocation shifts to 80% stocks, 18% bondsir 2% cash, as shown on the right. This shift demonstrates the growing dominance of stocks, increasing the portfolio’s risk ir volatility due to the overexposure to stocks.

Svarbiausios išvados:

- Rebalancing is essential to maintain a desired level of risk and asset mix.

- Over time, without rebalancing, portfolios can become overly concentrated in one asset class, particularly stocks.

- A higher concentration in stocks increases the potential for higher returns but also exposes the investor to greater risk.

- Rebalancing helps to ensure that the portfolio aligns with the investor’s original risk tolerance ir investment goals.

Application of Information:

Investors can use this knowledge to ensure their portfolios are regularly rebalanced to maintain the intended risk exposure. Rebalancing helps manage risk, ensures diversifikacija, and aligns the portfolio with long-term investment goals. Without rebalancing, the portfolio may become more volatile, affecting its stability and potentially leading to unexpected losses.

F. Risk Management

Effective risk management is a critical part of your trading plan. While investing in stocks and ETFs comes with inherent risks, there are strategies you can employ to limit potential losses and protect your capital.

- Diversifikacija: As previously mentioned, spreading your investments across asset classes and sectors reduces the impact of a downturn in any one area.

- Position sizing: Limit the amount of capital allocated to any single stock or ETF to prevent one investment from disproportionately affecting your portfolio.

- Stop-loss orders: Set automatic sell orders to protect against significant losses, ensuring you don’t hold onto losing investments for too long.

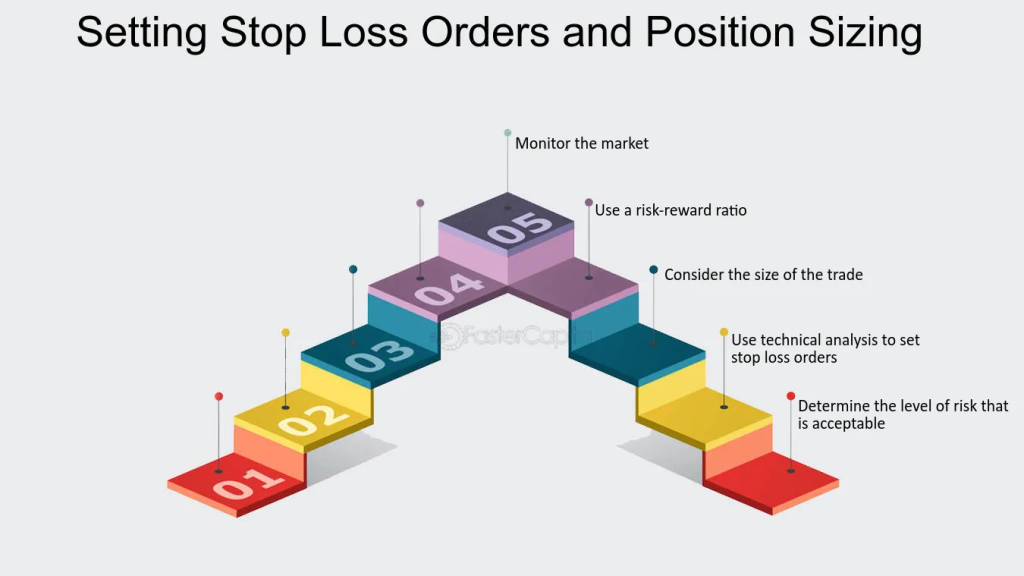

Paveikslėlis: Setting Stop Loss Orders and Position Sizing

Aprašymas:

The figure presents a five-step process for effectively setting stop loss orders and determining position sizing in trading. The steps start from determining the acceptable risk level (step 1), using techninė analizė to set stop losses (step 2), considering trade size (step 3), applying a risk-reward ratio (step 4), and finally, monitoring the market (step 5). This visual representation aims to help traders understand the sequential steps necessary for managing risk and maintaining balanced positions in the market.

Svarbiausios išvados:

- Step-by-step approach: This visual emphasizes the importance of a structured method for setting stop losses and sizing positions.

- Acceptable risk level: Identifying how much risk to tolerate is the foundation for effective position management.

- Technical analysis: Utilizing charts and trends can guide the placement of stop losses to minimize potential losses.

- Risk-reward ratio: Helps traders weigh potential returns against risks, aiding in decision-making.

- Ongoing monitoring: Continuous observation ensures that strategies adapt to changing market conditions.

Application of Information:

This information is useful for traders to develop a disciplined risk management strategy. By following these steps, investors can better control potential losses while striving for consistent returns. The process ensures a systematic approach, minimizing emotional decision-making and helping traders maintain balance and consistency in their trades.

G. Continuing Education

Markets evolve, and staying informed is essential to maintaining and refining your trading plan. Commit to continuous education to improve your investment strategies and adapt to new trends and market conditions.

- Stay updated on market trends: Follow financial news, attend webinars, and read industry reports to keep track of global and sector-specific trends.

- Learn new strategies: Explore different investment approaches, such as technical analysis, fundamental analysis, and alternative asset classes like commodities or cryptocurrencies.

- Engage with financial communities: Join forums, attend investment seminars, or subscribe to newsletters to exchange ideas and insights with other investors.

Išvada

A well-thought-out trading plan is the foundation of successful stock and ETF investing. By understanding your investment goals ir risk tolerance, choosing the right investicijos, implementing diversifikacija, and regularly reviewing and adjusting your portfolio, you can stay disciplined and achieve long-term financial success. Additionally, focusing on risk management and continuously educating yourself ensures that you remain adaptable and well-prepared to navigate the ever-changing market environment.

Pagrindinė pamokos informacija:

- Defining your investment goals ir risk tolerance is the first step in creating a trading plan. Your goals will guide your investment strategy, while assessing risk tolerance ensures that you choose the right assets to match your comfort with potential losses.

- Conservative, balanced, and aggressive investors each have different time horizons and priorities. Conservative investors focus on short-term safety ir capital preservation, while aggressive investors prioritize long-term growth and are more willing to take on risk.

- ETF provide a diversified investment option with lower risk, while stocks allow for direct exposure to individual companies, offering potentially higher returns but at greater risk. Understanding the differences helps you select the right strategy based on your risk profile and investment goals.

- Diversifikacija across asset classes, sectorsir geographies helps manage risk. A diversified portfolio reduces your dependence on any single investment, providing stability and mitigating losses during market downturns.

- Entry and exit strategies are essential to managing your trades effectively. Setting clear guidelines for when to buy and sell based on techninė analizė arba fundamentals helps you make rational decisions and avoid emotional reactions to market fluctuations.

Baigiamasis pareiškimas:

A well-structured trading plan is key to achieving financial success. By defining your goals, selecting the right investments, diversifying your portfolio, and employing risk management strategies, you can navigate the markets with confidence and discipline. Continuous learning helps you adapt and improve your approach to changing market conditions.