Local: Plano de Negociação

Objetivos de aprendizagem da lição:

- Understand the Importance of Risk Tolerance: Learn how MiFID II and risk profiling methods assess an investor’s capacity to handle risk and ensure that investments match the investor’s goals, experience, and financial situation.

- Explore MiFID II Regulations: Understand the suitability e appropriateness assessments required by MiFID II, which help ensure that financial products match the investor’s risk preferences, especially for conservative investors.

- Identify Preferences of Conservative Investors: Learn about the preservação de capital, stable income, e low volatility preferences common among conservative European investors, particularly in countries like Germany and Switzerland.

- Learn About Investment Vehicles for Conservative Investors: Discover the types of investments that are attractive to conservative investors, including government bonds, dividend-paying stocks, low-risk ETFs, e real estate investment trusts (REITs).

- Understand the Cultural Influence on Risk Tolerance: Explore how cultural factors in Europe, such as preferences for saving over investing, influence the tolerância de risco of investors in different countries, from Alemanha para Itália e Espanha.

Introdução

A well-structured plano de negociação is essential for successful stock and ETF investing. It serves as a blueprint that outlines your investment objectives, strategies, and risk management techniques, ensuring that you stay disciplined and make informed decisions in both rising and falling markets. This chapter will guide you through creating a comprehensive trading plan, covering everything from defining your goals to managing risks and regularly reviewing your portfolio.

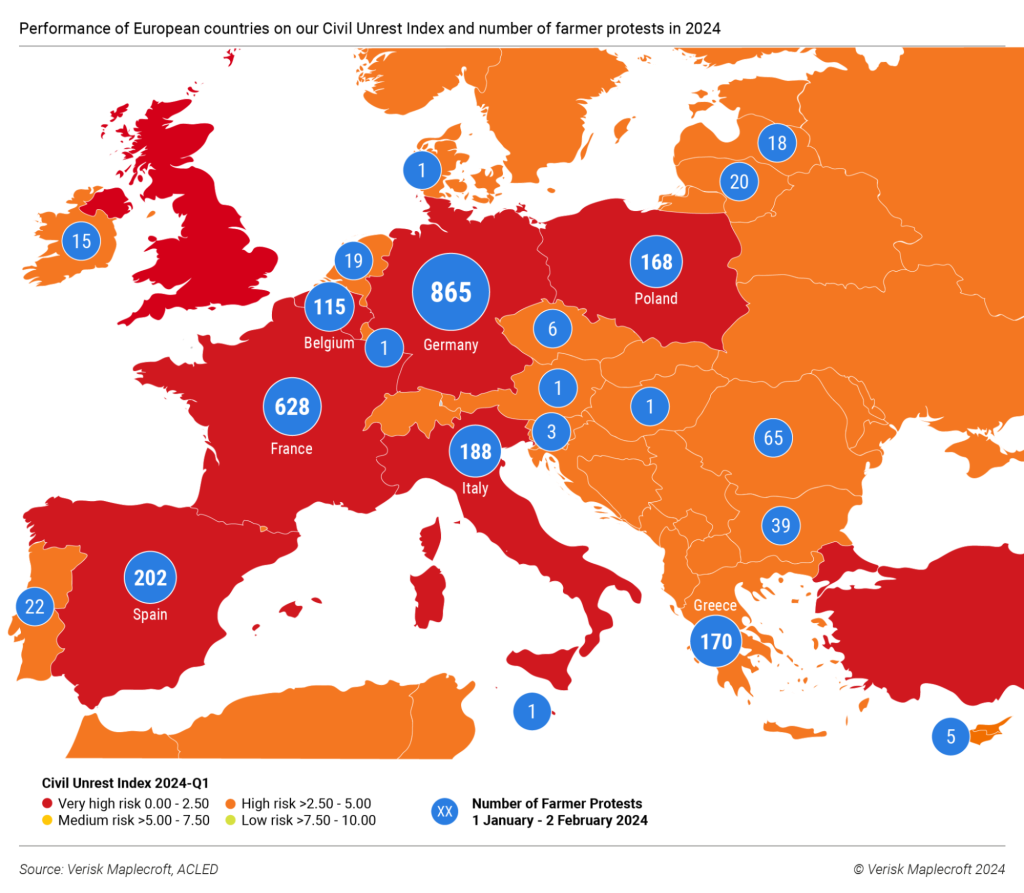

Figura: Developing Your Trading Plan

Descrição:

This diagram outlines the essential components of a well-structured trading plan. It includes Timeframe, defining whether the trading style is day trade, swing trade, or position trade; Gerenciamento de riscos, setting a 1-3% capital risk limit per trade; Conditions, which determine whether the market is ranging or trending; Markets, specifying options, equity, futures, or forex; Entries, identifying potential pullbacks, breakouts, or crossovers; Stops, including percentage loss limits or stops based on market structure; and Targets, which could be fixed or trailing stops.

Principais vantagens:

- Timeframes help determine trading styles and align with personal availability.

- Gestão de riscos is critical to preserve capital and manage losses.

- Market conditions guide strategy adjustments (ranging vs. trending).

- Entry strategies define when to enter trades based on technical patterns.

- Stops and targets provide clear exit criteria to manage risks and lock in profits.

Aplicação de informações:

This trading plan framework is useful for traders aiming to develop a clear and consistent trading strategy. By following this structured plan, traders can make informed decisions, limit potential losses, and adapt strategies based on different market conditions. The framework is suitable for all traders, from beginners to experienced investors, as it encourages disciplined trading practices.

18.1 Introduce EU-Specific Methods for Assessing Risk Tolerance

In the European Union, assessing tolerância de risco is a crucial first step in building a trading plan, especially given the traditionally conservative approach many European investors take. European regulations, such as MiFID II, play an important role in shaping the methods used to assess investor profiles, ensuring that financial products match the investor’s risk capacity and preferences. For conservative investors in Europe, risk tolerance is often centered around capital preservation, income stability, and the avoidance of high volatility.

MiFID II and Risk Profiling

Under MiFID II, European financial institutions are required to conduct comprehensive suitability assessments to determine a client’s risk tolerance. This involves evaluating the investor’s financial knowledge, experience, investment goals, and capacity to absorb potential losses. MiFID II ensures that conservative investors are not exposed to overly risky products and that their portfolios reflect their preference for stability and lower risk.

- Suitability Tests: Financial advisors conduct these tests to understand how much risk an investor is willing to take, considering factors such as time horizon, investment objectives, and financial situation.

- Appropriateness Assessments: These are designed to ensure that the products offered align with the investor’s risk tolerance. For conservative investors, this might mean recommending more secure investment vehicles like government bonds, dividend-paying stocks, or conservative ETFs.

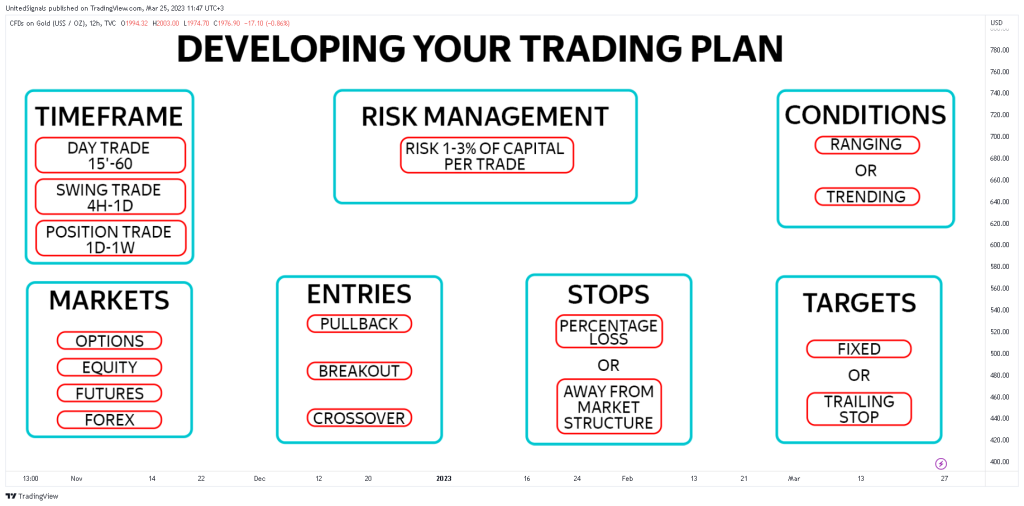

Figura: Position under MiFID II

Descrição:

This flowchart provides a detailed overview of how firms and clients interact under MiFID II (Markets in Financial Instruments Directive II) regulations. It differentiates firms based on whether they are performing MiFID business or not, and outlines the requirements for suitability e appropriateness tests depending on the product’s complexity. Firms offering listed shares, bonds, or UCITS without derivatives do not need to perform appropriateness tests, while more complex instruments, such as derivatives or investment trusts, require a test to ensure clients understand the risks involved. This chart helps visualize the pathway firms must follow to comply with MiFID II.

Principais vantagens:

- Firms are categorized into those performing MiFID business and those exempt.

- Suitability tests are mandatory for advising or managing firms.

- Appropriateness tests are required for complex instruments to ensure the client understands risks.

- Listed shares and bonds without derivatives are considered non-complex, requiring no appropriateness test.

Aplicação de informações:

This flowchart is valuable for firms and compliance officers who need to navigate MiFID II regulations. Understanding when suitability e appropriateness tests are required helps firms provide clear client communication and ensures that investors are aware of the risks associated with more complex financial products. It is a critical tool for maintaining regulatory compliance in the European financial market.

Conservative European Investor Preferences

European investors, particularly in countries like Alemanha, Switzerland, e the Netherlands, tend to favor conservative investment strategies. These strategies focus on long-term wealth preservation, low volatility, and stable returns. Conservative investors often prioritize the following:

- Capital Preservation: Protecting the initial investment is a key priority, with a preference for less risky assets such as government bonds or blue-chip stocks that offer steady returns.

- Stable Income: Dividend-paying stocks, fixed-income products, e low-risk ETFs are popular among conservative investors. These provide a reliable income stream without the high volatility seen in growth-oriented stocks.

- Low Volatility: Many European investors seek to minimize exposure to volatile markets, preferring assets that offer steady, predictable returns. Real estate investment trusts (REITs) e utility stocks are often included in conservative portfolios for this reason.

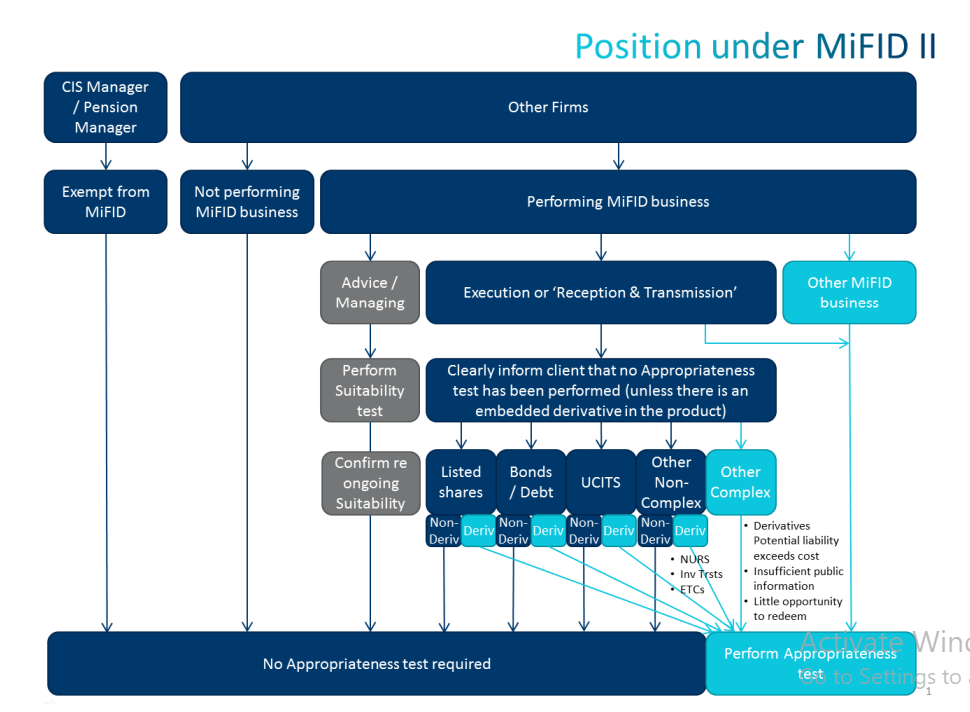

Figura: Conservative Portfolio

Descrição:

This pie chart illustrates the asset allocation of a conservative investment portfolio. It is primarily focused on preservação de capital while generating moderate returns. The largest allocation is to fixed interest investments at 40%, followed by Australian shares at 30%. Cash holdings make up 15% of the portfolio, while international shares e property are allocated 10% and 5%, respectively. This diversified approach aims to reduce risk and maintain stable returns over time, balancing between income generation and minimal exposure to more volatile assets.

Principais vantagens:

- Fixed interest is the largest component, representing 40% of the portfolio, aiming for stable income.

- Australian shares make up 30%, providing some exposure to equity growth.

- Cash holdings at 15% ensure liquidity e safety.

- International shares e property add diversification, albeit with smaller allocations (10% and 5%, respectively).

Aplicação de informações:

This conservative portfolio example helps investors understand how to allocate assets when their goal is capital preservation with low to moderate growth. Investors seeking steady returns with minimal volatility may consider similar allocations. It emphasizes the importance of a diversified approach, reducing risk while still participating in equity markets and maintaining liquid assets for flexibility.

Popular Conservative Investment Options in the EU

For conservative European investors, there are several options that cater to their risk profile, ensuring low volatility and steady returns:

- Government Bonds: Bunds (German government bonds) e gilts (UK government bonds) are popular among European investors for their safety and reliability. These bonds offer modest returns but are considered safe, particularly in times of market uncertainty.

- Dividend-Paying Stocks: Established European companies like Nestlé, Unilever, e TotalEnergies offer stable dividends and low volatility, making them attractive to conservative investors seeking consistent income.

- Low-Risk ETFs: Broad European market ETFs such as those tracking the Euro Stoxx 50 ou FTSE 100 provide diversification across multiple sectors, reducing risk while providing exposure to well-established companies.

- Real Estate and REITs: European real estate, particularly in stable markets like Alemanha e França, is a key focus for conservative investors. REITs offer a way to invest in income-generating real estate without the need for direct ownership.

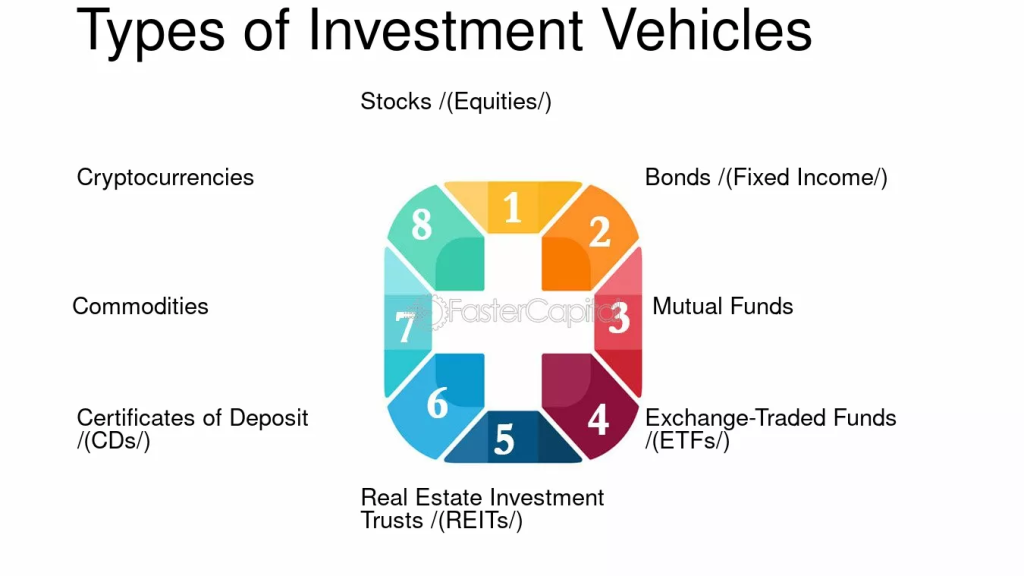

Figura: Types of Investment Vehicles

Descrição:

This figure presents the eight primary types of investment vehicles that investors can use to build a diversified portfolio. These vehicles range from stocks (equities), which represent ownership in companies, to bonds (fixed income), which are debt securities offering regular interest payments. Fundos mútuos e exchange-traded funds (ETFs) pool money from multiple investors to invest in diversified assets. Fundos de investimento imobiliário (REITs) offer exposure to real estate, while certificates of deposit (CDs) are time-bound deposit accounts with guaranteed returns. Mercadorias include tangible goods like gold or oil, and cryptocurrencies represent digital assets like Bitcoin and Ethereum. Each vehicle carries different risk levels, return potential, and investment characteristics.

Principais vantagens:

- Stocks (Equities) represent ownership in a company and offer the potential for high returns but also come with higher volatility.

- Bonds (Fixed Income) provide renda estável through interest payments, typically with menor risco than equities.

- Fundos mútuos e ETFs offer investors an opportunity to invest in a diversified collection of assets, reducing individual risk.

- REITs allow investors to gain exposure to the real estate market without directly buying property.

- CDs are among the safest options, offering fixed returns over a specified term.

- Mercadorias e cryptocurrencies provide diversification benefits but can be highly volatile.

Aplicação de informações:

Understanding these investment vehicles helps investors select suitable options based on their tolerância de risco, investment horizon, e metas financeiras. By using a combination of these vehicles, investors can achieve diversificação, balancing potential returns with gerenciamento de riscos across different asset classes. This knowledge enables investors to craft a well-rounded portfolio that aligns with their objectives.

Cultural Influence on Risk Tolerance in Europe

Cultural factors also influence the risk tolerance of European investors. In Alemanha, for example, there is a strong cultural preference for saving over investing, leading to more conservative investment strategies. Similarly, Swiss investors prioritize financial security and low-risk assets, while countries like Espanha e Itália tend to balance conservative strategies with moderate risk.

This cultural emphasis on caution and stability means that European investors often favor secure, long-term investments over speculative or volatile assets, aligning with their conservative risk profiles.

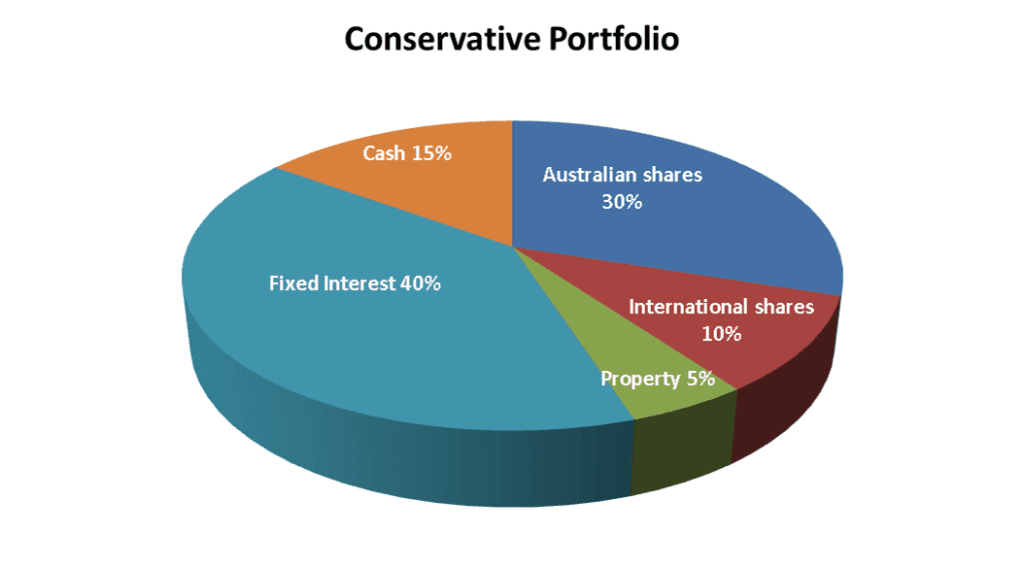

Figura: Performance of European countries on the Civil Unrest Index and number of farmer protests in 2024

Descrição:

This map shows the Civil Unrest Index e farmer protests in Europe from January 1 to February 2, 2024. The Civil Unrest Index categorizes risk levels into three groups: very high risk (0.00 – 2.50), high risk (>2.50 – 5.00), e medium risk (>5.00 – 7.50), with darker red representing higher risk. Blue circles indicate the number of farmer protests across countries. Germany has the highest number of protests (865), followed by France (628) and Italy (188), suggesting significant unrest in these regions. Conversely, some countries like Sweden, Norway, e Finland have relatively fewer protests, indicating lower levels of civil unrest.

Principais vantagens:

- Alemanha, França, e Itália are experiencing high levels of farmer protests, correlating with high civil unrest risks.

- Southern Europe, including Espanha e Greece, also shows a significant number of farmer protests.

- Northern European countries have relatively fewer farmer protests, suggesting lower civil unrest in early 2024.

- O Civil Unrest Index visually depicts regions with elevated social risks through color coding, emphasizing regions with urgent attention.

Aplicação de informações:

This data can help investors and policymakers understand which countries are experiencing social and political instability, affecting potential investment risks. Knowledge of civil unrest trends aids in gerenciamento de riscos, guiding investment decisions in sectors sensitive to social stability, such as agriculture e imobiliária. For those studying geopolitical risks, this map illustrates the importance of regional social dynamics in Europe.

Conclusão

Assessing risk tolerance in the European market requires a deep understanding of both MiFID II regulations and the conservative preferences of many European investors. By focusing on capital preservation, stable income, and low volatility, European investors can align their portfolios with their long-term financial goals. Popular conservative investment options, including government bonds, dividend-paying stocks, and low-risk ETFs, provide stability while adhering to the risk-averse nature of many European investors. Cultural influences, coupled with regulatory frameworks, ensure that conservative investors in Europe are well-protected and positioned for steady, reliable returns.

Principais informações da lição:

- MiFID II regulations require financial institutions to conduct suitability assessments to determine an investor’s tolerância de risco. This ensures that the financial products recommended match the investor’s knowledge, goals, and ability to absorb losses.

- Conservative European investors typically prioritize preservação de capital, stable income, e low volatility. They often favor investments like government bonds, dividend-paying stocks, e low-risk ETFs that provide predictable returns without significant risk.

- Suitability and appropriateness tests under MiFID II ensure that investors are not exposed to overly risky financial products. For conservative investors, these tests often result in more secure, stable investments, such as government bonds or blue-chip stocks with strong dividends.

- Investment vehicles like REITs, títulos, e dividend stocks cater to the preferences of conservative investors by offering renda estável e preservação de capital. These investment options provide stability and protection from market volatility.

- Cultural factors heavily influence the tolerância de risco of European investors. For instance, in Alemanha, there is a strong cultural focus on saving rather than speculating, leading to more conservative investment strategies. In contrast, Itália e Espanha may incorporate slightly higher risk in their investment approaches.

Declaração de encerramento:

Risk tolerance plays a critical role in building an investment portfolio, especially in the EU market. By understanding how regulations like MiFID II work alongside investor preferences and cultural factors, you can make informed decisions about the types of investments that align with your personal risk profile.