Local (European-Specific) Content : REITs in Europe

Objetivos de aprendizagem da lição:

- Understand what REITs are and how they allow individuals to invest in real estate without owning property, especially through stock exchanges like Euronext Paris and London Stock Exchange.

- Learn about REIT regulations in Europe, including country-specific rules like required income distribution in France and the U.K., which make REITs tax-efficient investment options.

- Distinguish between public and private REITs, understanding their accessibility, liquidity, and risk levels, and how they cater to different types of investors.

- Compare Equity REITs and Mortgage REITs, identifying how each earns income—whether through rent or interest—and what types of properties or loans they are involved in.

- Explore the benefits and drawbacks of investing in REITs in Europe, evaluating factors like income, liquidity, tax treatment, and sensitivity to market changes to determine if REITs align with your investment goals.

9.1 Introduction to REITs in Europe

UM Real Estate Investment Trust (REIT) is a company that invests in income-producing real estate, such as residential, commercial, and industrial properties. In Europe, REITs offer investors the opportunity to invest in real estate without directly owning physical properties. REITs are traded on major European stock exchanges, such as Euronext Paris e London Stock Exchange, providing liquidity similar to stocks.

REIT Regulations in Europe

In Europe, REITs are governed by specific country regulations that define how they must operate. For example, in France, REITs are known as Sociétés d’Investissement Immobilier Cotée (SIIC), and they must distribute at least 85% of their rental income to shareholders. In the U.K., REITs are required to distribute 90% of their rental income. These regulations make REITs a tax-efficient investment option for those seeking exposure to the real estate market.

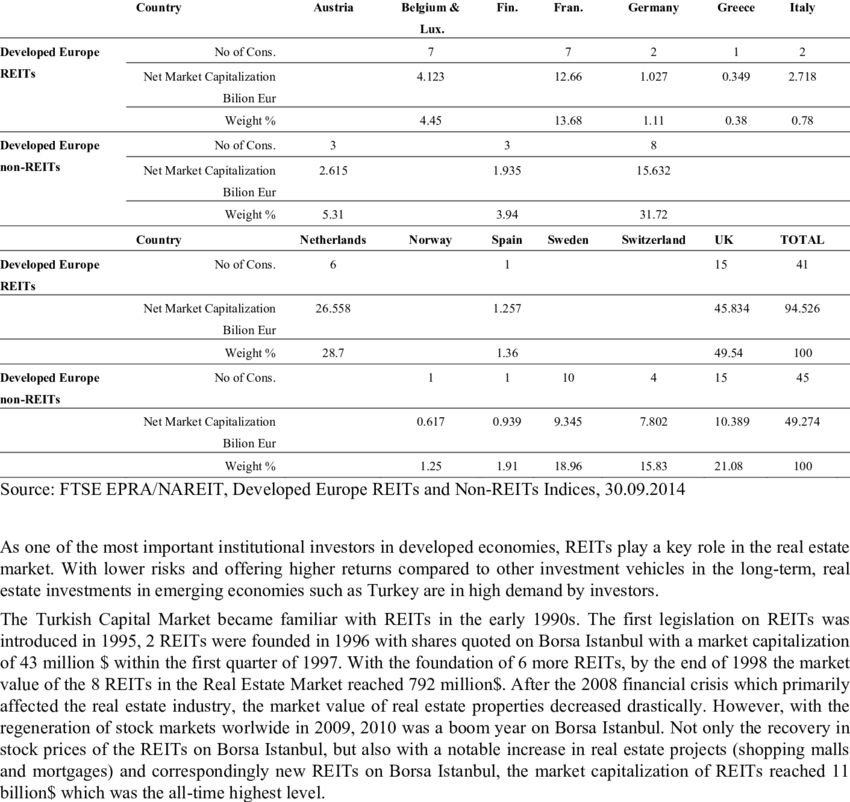

Figura: Country Breakdown of REITs in Europe

Descrição:

This figure provides an analysis of the Fundos de Investimento Imobiliário (REITs) e non-REITs in developed European countries. It shows the number of companies in each category, their net market capitalization in billion Euros, and their percentage weight within the total market. Countries like the United Kingdom e Netherlands dominate the REIT market, while countries such as Spain e Switzerland hold significant portions of the non-REIT sector. It also highlights the growing importance of REITs in real estate investments due to their higher returns and lower risks compared to non-REIT alternatives.

Principais conclusões:

- United Kingdom leads the REIT market with 15 REITs, representing 49.54% of the total REIT market capitalization in Europe.

- Netherlands follows with only 6 REITs but contributes 28.7% to the REIT market due to the large size of its real estate investments.

- Spain and Switzerland dominate the non-REIT sector, holding 18.96% e 15.83% of the non-REIT market, respectively.

- REITs were introduced in the 1990s across Europe and have shown consistent growth, particularly after the 2008 financial crisis, when real estate markets began recovering.

- Countries like Austria e Greece have minimal REIT market presence, indicating room for development and investment growth.

Application of Information:

This data is highly useful for investors as it highlights the regions and countries with the most active REIT markets, providing insights into where to focus investments for higher returns and stability. It also helps policymakers e market analysts identify potential growth areas in the REIT and non-REIT sectors. Understanding the breakdown between REITs and non-REITs can guide learners in analyzing real estate market dynamics and diversifying their portfolios effectively. Real estate developers can use this data to target lucrative markets for expansion or collaborations.

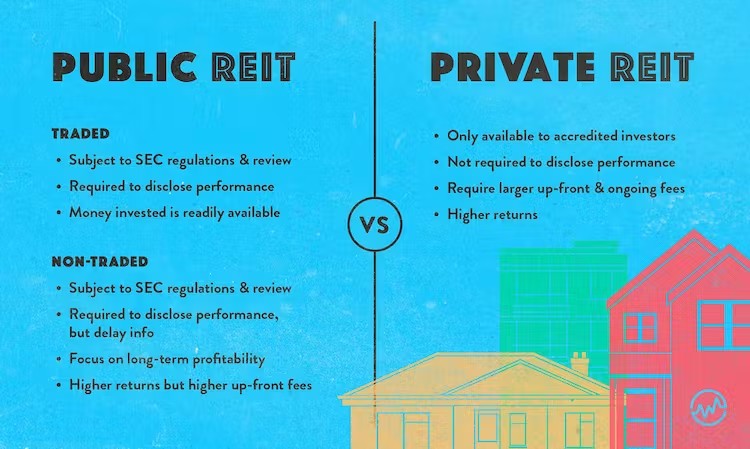

9.2 Public vs. Private REITs in Europe

Public REITs

Public REITs in Europe are listed on major stock exchanges and are accessible to the general public. Investors can buy and sell shares in European REITs like British Land ou Unibail-Rodamco-Westfield on exchanges like London Stock Exchange ou Euronext Paris. Public REITs offer transparency, liquidity, and ease of access to real estate investments.

Private REITs

Private REITs in Europe are not publicly traded and are typically available to accredited or institutional investors. These REITs often focus on niche markets or specific real estate sectors, such as luxury residential properties em France ou commercial properties em Germany. Private REITs can offer higher returns but come with higher risk and lower liquidity.

Figura: The REIT Landscape: An Introduction

Descrição:

This infographic provides a beginner-friendly overview of Real Estate Investment Trusts (REITs), highlighting their purpose, types, and the advantages they offer to investors.

Principais conclusões:

- REIT Purpose: Learn how REITs allow individuals to invest in large-scale real estate operations, which were previously accessible only to wealthy investors.

- REIT Varieties: Get to know the different kinds of REITs, including those that invest in properties (equity REITs) and those that invest in mortgages (mortgage REITs).

- Investor Advantages: REITs are known for providing regular income streams, tax advantages, and a way to invest in real estate without owning physical property.

Application of Information:

An understanding of REITs is invaluable for those looking to diversify their investment portfolios beyond traditional stocks and bonds. The visual serves as an entry point, piquing interest and inviting further exploration. Financial educators, real estate experts, or investment platforms can leverage such an image to demystify REITs, laying the groundwork for deeper discussions or analyses. Whether it’s for educational webinars, articles, or presentations, the image offers a concise yet comprehensive overview of the REIT landscape.

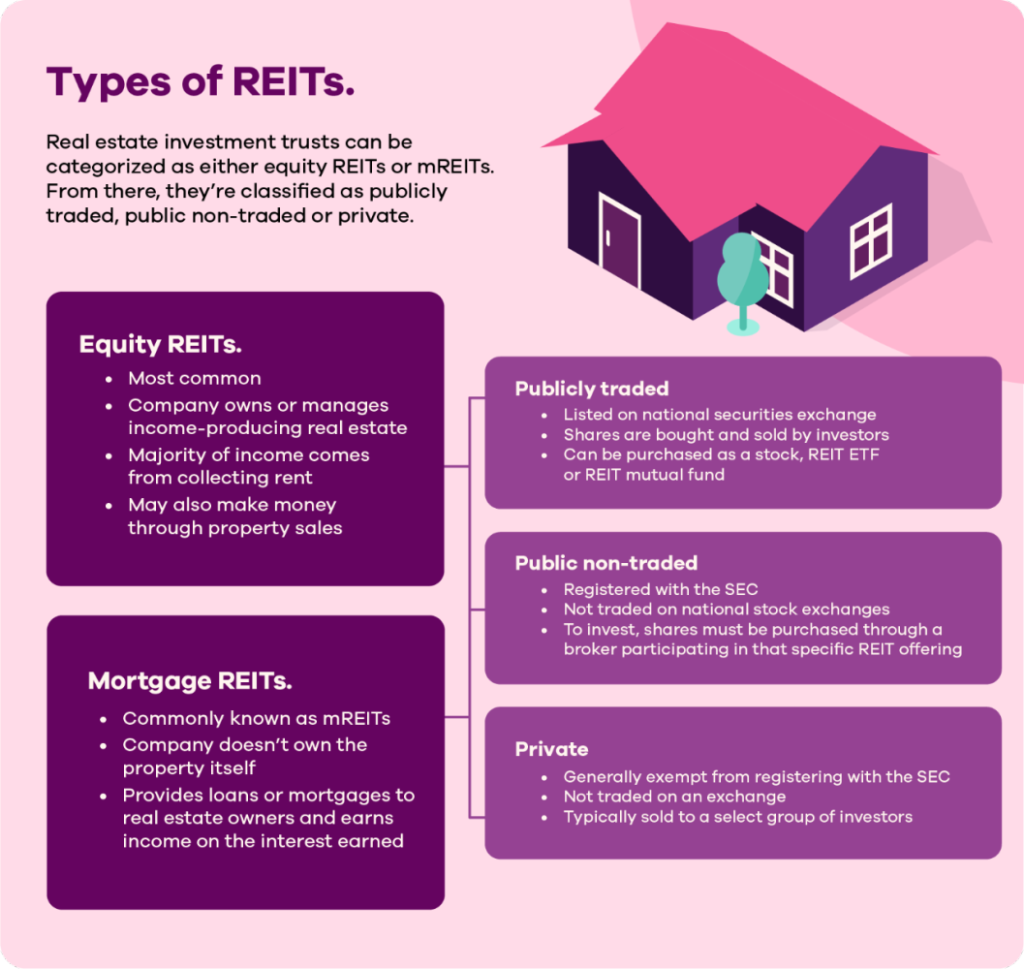

9.3 Equity vs. Mortgage REITs in Europe

Equity REITs

Equity REITs are the most common type of REIT in Europe. These REITs own and operate income-generating properties such as shopping centers, office buildings, and apartments. In cities like Paris e Amsterdam, equity REITs invest in high-demand commercial and residential properties. Investors earn income through rent collection and property value appreciation.

Mortgage REITs

Mortgage REITs (mREITs) invest in property debt rather than directly owning properties. In Europe, mortgage REITs are less common but still present in countries like Ireland e Spain, where they provide financing for property owners. These REITs generate income from the interest on mortgages and mortgage-backed securities.

Figura: Types of REITs

Descrição:

This figure categorizes Fundos de Investimento Imobiliário (REITs) into Equity REITs e Mortgage REITs (mREITs), based on their operations and income sources. Equity REITs focus on owning or managing income-generating properties and derive their income from rent and property sales. On the other hand, Mortgage REITs provide loans or mortgages and earn interest income. Additionally, REITs are divided into publicly traded, public non-traded, e private categories based on their trading mechanisms and accessibility, with publicly traded REITs being the most accessible through stock exchanges and private REITs reserved for select investors.

Principais conclusões:

- Equity REITs are the most common type, focusing on properties and earning income from rent and sales.

- Mortgage REITs provide loans or mortgages and generate income through interest, without owning the properties themselves.

- Publicly traded REITs are listed on stock exchanges and easily bought and sold like stocks or ETFs.

- Public non-traded REITs are not listed on exchanges and require purchases via brokers, offering limited liquidity.

- Private REITs are not publicly available and are generally restricted to institutional investors or specific high-net-worth groups.

Application of Information:

Understanding these REIT categories allows investors to tailor their portfolios to their investment goals and risk tolerance. Equity REITs may be ideal for those seeking steady rental income, while Mortgage REITs are suitable for income from interest. Differentiating between publicly traded, non-traded, and private REITs helps investors assess liquidity e accessibility, enabling informed decisions about their investments. This information is especially helpful for learning about real estate investments and diversifying portfolios.

9.4 Benefits and Drawbacks of Investing in REITs in Europe

Benefits:

- Liquidity: Public REITs in Europe offer high liquidity, allowing investors to buy and sell shares on stock exchanges, providing more flexibility compared to direct property ownership.

- Regular Income: European REITs must distribute a significant portion of their income to shareholders, offering consistent dividends, which can be higher than those from regular stocks.

- Tax Efficiency: REITs in Europe benefit from favorable tax treatment, making them a tax-efficient way to invest in real estate. In France e Germany, REIT dividends are often taxed at lower rates.

- Diversificação: REITs allow investors to gain exposure to a variety of real estate sectors, such as retail, office, residential, and industrial properties, which helps diversify their portfolio.

Drawbacks:

- Market Volatility: REITs traded on European exchanges are subject to stock market fluctuations, making them more volatile than direct real estate investments.

- Interest Rate Sensitivity: REITs are sensitive to changes in interest rates. Rising interest rates in countries like the U.K. ou Italy can increase borrowing costs, affecting REIT profitability.

- Limited Control: Investors in REITs have no direct control over the properties or the decisions made by the REIT managers, which can impact returns.

- Dividend Taxation: In some European countries, REIT dividends may be taxed at higher rates compared to other investment income, reducing the overall return on investment.

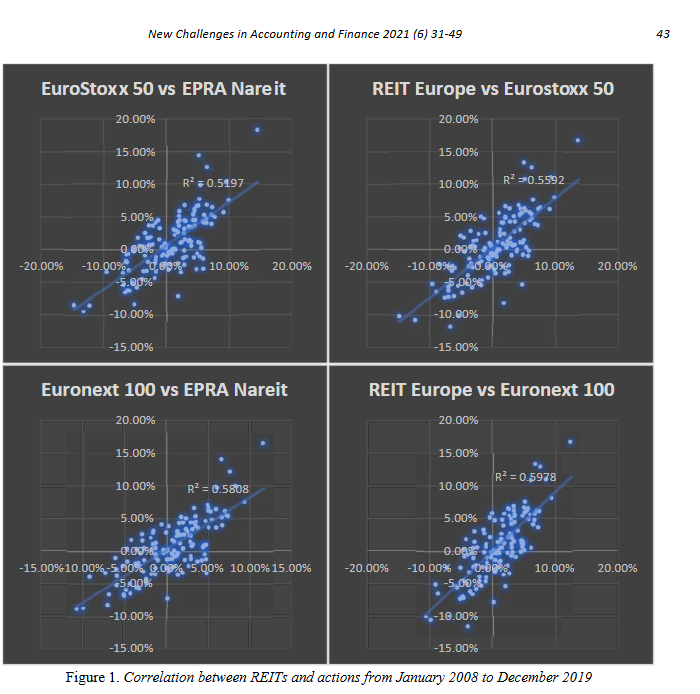

Figura: Correlation between REITs and indices (January 2008–December 2019)

Descrição:

This figure shows the correlation between European Real Estate Investment Trusts (REITs) and key financial indices over the period from January 2008 to December 2019. The scatterplots compare the returns of the EuroStoxx 50, Euronext 100, and their respective REIT counterparts such as EPRA Nareit Europe. Each chart includes an R² value indicating the strength of the correlation. Higher R² values suggest a stronger linear relationship between REIT performance and general market indices, reflecting the degree of movement REITs share with these indices.

Principais conclusões:

- Positive correlations: REITs show a positive relationship with general market indices, but the correlation is not perfect, highlighting partial diversification benefits.

- R² values indicate that around 50–59% of REIT movements are explained by the indices, suggesting REITs partially track broader market trends while retaining unique characteristics.

- Market-specific performance: Different indices (e.g., EuroStoxx 50 and Euronext 100) exhibit similar levels of correlation with REITs, indicating consistent behavior across major European markets.

- Diversification potential: The scatterplots confirm that REITs do not fully mirror equity markets, providing an opportunity for portfolio diversification.

- Stability across time: Correlations remained consistent during the analyzed period, including the 2008 financial crisis recovery phase, showing REITs’ resilience.

Application of Information:

The data highlights the importance of incorporating REITs into diversified portfolios, especially for investors seeking exposure to real estate markets while balancing broader equity market risks. The R² values help assess how much REIT performance depends on the broader market, enabling investors to estimate potential risks and returns. These insights are valuable for those constructing portfolios with a mix of equity and real estate investments to optimize risk-adjusted returns.

Informações importantes da lição:

- REITs in Europe are companies that invest in real estate and are traded on stock exchanges, offering liquidity and ease of access similar to stocks. This allows individuals to invest in real estate markets without owning or managing properties directly.

- REIT regulations vary by country, with France (SIIC) and the U.K. requiring REITs to distribute a large portion of rental income to shareholders, creating a tax-efficient income stream for investors.

- Public REITs are listed on major exchanges and offer transparency and liquidity, while Private REITs cater to accredited investors, often offering higher potential returns but with lower liquidity and greater risk.

- Equity REITs are the most common and generate income from rent and property appreciation, while Mortgage REITs earn income from interest on loans and are more common in countries like Ireland and Spain.

- REITs offer benefits such as regular income, diversification, e favorable tax treatment, but they also come with risks like market volatility, interest rate sensitivity, e limited investor control over property decisions.

Declaração de Encerramento

REITs provide a unique gateway into real estate investing without the need to manage physical property. Understanding the different types, markets, and risk factors associated with REITs in Europe empowers investors to diversify their portfolios and pursue reliable income opportunities.