Sura ya 1: Utangulizi wa Fedha za Kibinafsi

Lesson Learning Objectives:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

1.1 Understanding Personal Finance

Personal finance is how you manage your money to meet both your daily needs and your long-term goals. Every financial choice — big or small — affects your financial well-being, from how you spend on food to how you plan for retirement.

Managing your personal finances involves making smart decisions about earning, budgeting, saving, investing, borrowing, and protecting your money. These choices evolve over your lifetime as your goals, responsibilities, and circumstances change. For example, a high school student might focus on saving for college, while an adult may be saving for a home or retirement. People with children may need to prioritize insurance and educational savings, while others without dependents might allocate more to travel or investing.

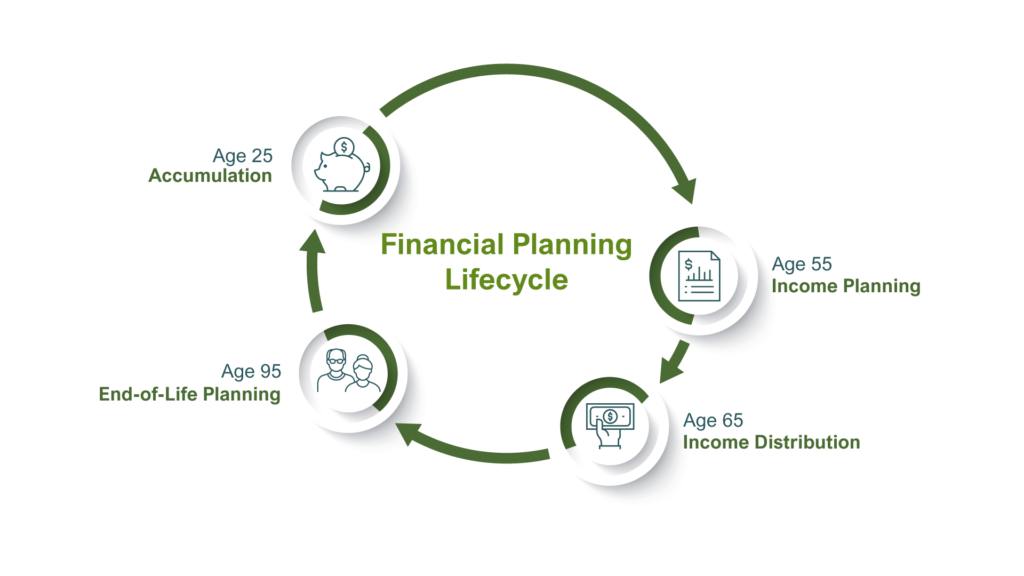

Kielelezo: The Financial Lifecycle

Maelezo:

This chart shows the different financial stages a person typically goes through in their life. It maps a person’s income na expenses from their early career to retirement, dividing the journey into a wealth accumulation phase (when you save money) and a wealth distribution phase (when you spend your savings). The graph illustrates that income generally rises during your career and then stops at retirement, showing the need to save for the future.

Mambo muhimu ya kuchukua:

- Your financial life has two main stages: the wealth accumulation phase during your career and the wealth distribution phase during retirement.

- A person’s income usually increases during their working years and then stops or significantly decreases at retirement, while basic expenses often continue.

- The goal of financial planning is to save and invest the difference between your income and expenses during the accumulation phase to support yourself during the distribution phase.

Application of Information:

- Kuelewa financial lifecycle helps you create a clear, long-term investment plan that matches your age and financial situation.

- If you are in the accumulation phase, you can focus on growth-oriented investments to build your wealth.

- If you are approaching the distribution phase, you can adjust your strategy to focus on protecting your savings and generating a steady income for retirement.

Being financially informed allows you to reduce stress, make confident decisions, and enjoy greater freedom and stability.

1.2 Financial Planning and Budgeting for Life

Financial planning starts with evaluating your current financial situation, setting goals, and creating a budget. A budget is a spending plan that ensures you don’t spend more than you earn.

When you budget, you need to distinguish between needs na wants:

- Needs include essentials like housing, food, and healthcare.

- Wants are non-essential items like luxury brands, entertainment subscriptions, or the latest smartphone.

Prioritizing needs ensures you cover basic expenses before spending on extras.

Creating a realistic budget involves:

- Listing all sources of income (job, gifts, side gigs)

- Tracking monthly expenses

- Setting spending limits for each category

- Allocating money for savings

Budgeting helps you make thoughtful spending decisions and gives you control over your financial future.

1.3 Making Decisions: Costs, Trade-Offs, and Consequences

Every decision involves trade-offs. Choosing to spend $20 on a movie might mean you can’t add that amount to your savings. This trade-off is called an opportunity cost — what you give up to get something else.

A structured approach like the PACED model helps you make smarter decisions:

P – Identify the problem (e.g., “Should I buy a used car or lease a new one?”)

A – List alternatives

C – Choose criteria (e.g., cost, maintenance, insurance)

E – Evaluate alternatives using your criteria

D – Decide on the best option

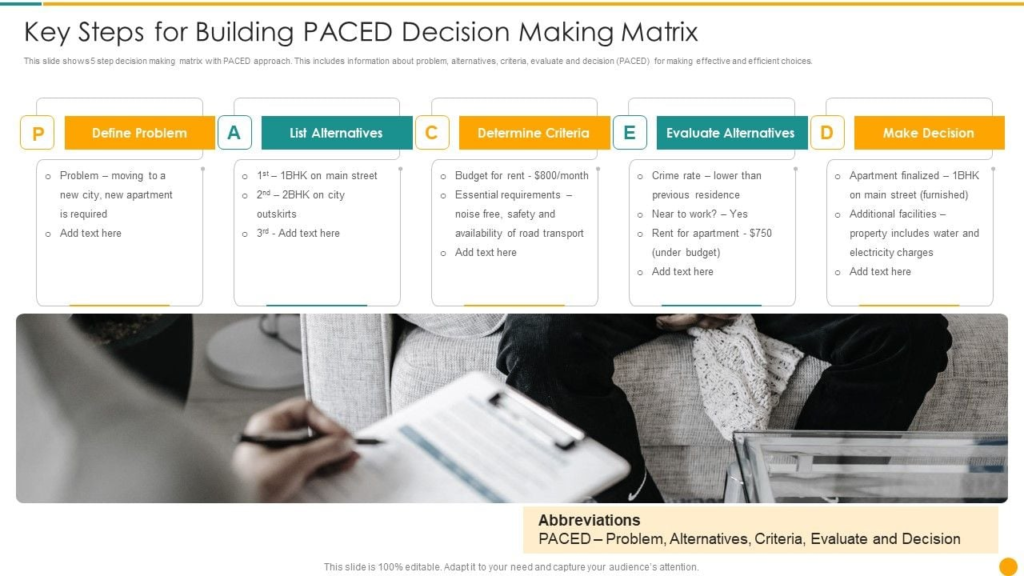

Kielelezo: Key Steps For Building PACED Decision Making Matrix

Maelezo:

This image displays the PACED model, a structured five-step framework used to make decisions in a clear and logical way. The model is an acronym for (P) Define the Problem, (A) List the Alternatives, (C) Establish the Criteria, (E) Evaluate the alternatives, and (D) Make a Decision. It provides a roadmap to follow when faced with a complex choice, ensuring all important aspects are considered.

Mambo muhimu ya kuchukua:

- The PACED model turns a complicated decision into a simple, step-by-step process that promotes rational thinking.

- The process requires you to first define the Problem, then brainstorm all possible Alternatives or choices.

- A critical step is selecting the Criteria, which are the standards or factors you care about most when making your choice.

- The final Decision is made only after a systematic Evaluation of how each alternative measures up against your chosen criteria.

Application of Information:

- Investors can use the PACED model to bring structure and logic to their investment decisions, helping to remove emotion from the process.

- For example, when deciding where to invest, you can use this framework to compare different stocks or funds based on Criteria like risk, fees, and potential returns.

- This methodical approach is useful for ensuring your final investment choice is the result of careful analysis and aligns with your personal financial goals.

Good financial decisions also consider marginal costs and marginal benefits:

- Marginal cost: The extra cost of one more unit or action

- Marginal benefit: The extra gain or value received

Mfano: Working 5 more hours this week may cost you time with friends but earn you $75. You must decide if the benefit outweighs the cost.

1.4 Lifestyle Choices and Financial Stability

Your choices about education, work, and lifestyle directly impact your finances. The career you choose, how much you work, and even where you live all affect your income, expenses, and opportunities.

Consider these:

- Career Path: Higher-demand jobs may offer higher pay, more security, and benefits like insurance and retirement plans.

- Work-Life Balance: Choosing part-time work may give you free time, but limit your income.

- Location: Living in a large city might bring higher income — but also higher rent and daily expenses.

Side Income: Freelancing or running a small business can increase your income and provide financial flexibility.

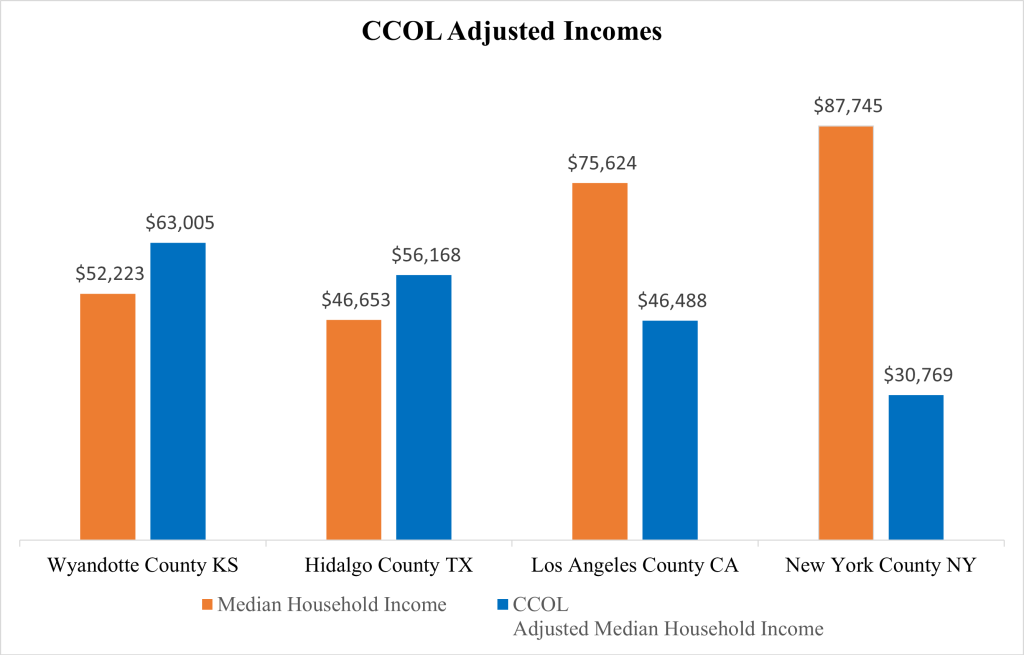

Kielelezo: Median Household Income and Cost of Living Index for Select U.S. Counties

Maelezo:

This bar chart compares two key financial metrics across four different U.S. counties: the median household income (the blue bars) and the Cost of Living Index (the orange bars). It visually shows how a high salary in one location, like New York County, can be offset by a very high cost of living. This helps to understand the difference between nominal income (the dollar amount you earn) and real income (what your money can actually buy).

Mambo muhimu ya kuchukua:

- A high income doesn’t automatically mean more wealth if it’s in a location with a high cost of living. For example, New York County has a high income but its cost of living is more than double the national average.

- Your purchasing power—what your money can actually buy—is determined by the relationship between your earnings and your expenses.

- There are large differences in income levels and living costs across different regions, which can significantly impact your financial well-being.

- A lower salary in a more affordable area may provide a better financial situation than a higher salary in an expensive one.

Application of Information:

- When evaluating a job offer or planning a move, you should always analyze the cost of living alongside the salary to understand your potential disposable income.

- This concept is crucial for creating an accurate personal budget and setting realistic savings goals that are tailored to your specific location.

- Understanding this data helps you make smarter financial decisions about where to live and work to maximize your long-term wealth and quality of life.

1.5 Responsible vs. Irresponsible Money Use

Being financially responsible means making decisions that match your goals and show accountability. This includes:

- Setting financial goals

- Sticking to a budget

- Avoiding unnecessary debt

- Saving regularly

- Using credit wisely

In contrast, irresponsible habits may include:

- Impulsive spending

- Relying on credit cards without repayment plans

- Ignoring savings

- Avoiding financial planning

Mfano: Spending $200 on clothes without planning could leave you unable to pay a $150 phone bill, leading to late fees or a service cut.

1.6 Net Worth and Building Financial Health

Your net worth reflects your overall financial health. It’s the value of what you own (assets) minus what you owe (liabilities).

Assets may include:

- Bank savings

- Vehicles

- Investments

- Property

- Valuables (jewelry, electronics)

Liabilities are:

- Credit card debt

- Student loans

- Mortgages

- Car loans

Mfano:

Assets | Amount |

Savings | $3,000 |

Car | $6,000 |

Laptop | $1,000 |

Liabilities | Amount |

Credit card debt | $1,200 |

Student loan | $4,000 |

Net Worth = $10,000 (assets) – $5,200 (liabilities) = $4,800

1.7 How the Economy Affects You

Even your personal choices are influenced by the global economy.

Important concepts to understand:

- Scarcity: Everyone faces limited resources — we must choose how to use time and money.

- Inflation: When prices rise, your money buys less. High inflation can make groceries, gas, and rent more expensive.

- GDP (Gross Domestic Product): Measures how much a country produces. A growing GDP often means more jobs and better pay.

- Business Cycle: Economies go through ups (expansions) and downs (recessions).

- Supply & Demand: If many people want a product, prices may rise. If supply increases and demand falls, prices drop.

Understanding these factors helps you:

- Adjust your budget for inflation

- Decide when to save or spend

- Choose the right time to invest

1.8 Financial Responsibility With and Without Dependents

When you live alone, your financial focus may be on education, travel, or saving. But with dependents — like children, elderly parents, or siblings — your financial goals shift.

Example Comparison:

Kategoria

No Dependents

With Dependents

Monthly Income

$2,000

$4,000

Housing

$800

$1,400

Groceries

$200

$600

Savings

$300

$400

Childcare

$0

$500

This shows how dependents change your priorities, requiring careful planning and responsibility.

1.9 Incentives and Their Impact on Financial Choices

People often respond to financial incentives:

- Rewards: Cash-back credit cards, employer retirement matches

- Penalties: Late fees, overdraft charges

- Behavioral nudges: Sales, loyalty discounts, limited-time offers

These incentives influence:

- What you buy

- How you save

- Where you work

- Whether you borrow or invest

Being aware of incentives helps you make choices based on your needs, not just what’s being offered.

- Rewards: Cash-back credit cards, employer retirement matches

1.10 Informed Financial Decision-Making Tools

To make smart financial choices:

- Compare your options (cost, benefits, risks)

- Use decision-making tools like a cost-benefit analysis table

- Plan ahead for unintended consequences

Example: Buying vs. Leasing a Car

Factor

Buy

Lease

Monthly cost

Higher upfront

Lower monthly

Long-term cost

Lower (you own it)

Higher (no equity)

Flexibility

Keep as long as you want

Must return after term

Choosing depends on your budget, driving habits, and future plans.

- Compare your options (cost, benefits, risks)

Hitimisho

Learning personal finance gives you power over your money and your future. Every decision — how you earn, spend, save, and invest — has short-term and long-term consequences. By applying financial knowledge and responsible habits, you build a stable foundation for whatever goals you set in life.

Habari Muhimu ya Somo:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.