2A. Maudhui ya Ulimwenguni: Aina za Uwekezaji wa Majengo

Lesson Learning Objectives:

- Understand the global landscape of real estate investments, including the diversity of property types from residential to commercial.

- Learn about global urban growth trends that increase demand for residential properties in major cities, influencing both price appreciation and rental potential.

- Explore the impact of short-term rental platforms like Airbnb on the global real estate market, offering investors opportunities for high returns, especially in tourist-favored locations.

- Recognize the role of luxury markets in major cities around the world and their influence on the real estate investment environment.

- Identify the key factors contributing to ROI in various real estate sectors, utilizing strategic investment approaches to maximize returns.

Types of Real Estate Investments

Globally, residential real estate remains one of the most popular forms of investment. It includes properties such as single-family homes, apartments, condominiums, and townhouses, all of which are intended for living purposes rather than business.

Key Global Trends:

- Urban Growth: As global populations migrate to urban centers, cities like New York, Tokyo, na Sydney have experienced rapid growth in demand for residential properties. This demand often leads to price appreciation and rental income potential for investors.

- Short-Term Rentals: Similar to Europe, the rise of platforms like Airbnb has made short-term rentals an attractive option for investors globally. In countries like Thailand na Mexico, foreign investors have taken advantage of low property prices and high tourism demand to generate income through short-term rentals.

- Luxury Market: In cities like Dubai na Los Angeles, luxury residential real estate is a significant part of the market. Investors can purchase high-end properties that attract wealthy tenants or buyers, though this market can be volatile and influenced by economic conditions.

Global Example of Residential Real Estate

An investor in Dubai might purchase a luxury apartment in an upscale neighborhood like Downtown Dubai to rent out to expatriates or tourists. With high rental yields and tax-free investment returns, Dubai has become a hot spot for global investors in the residential real estate sector.

Kielelezo: Real Estate Investment and ROI Dynamics

Maelezo:

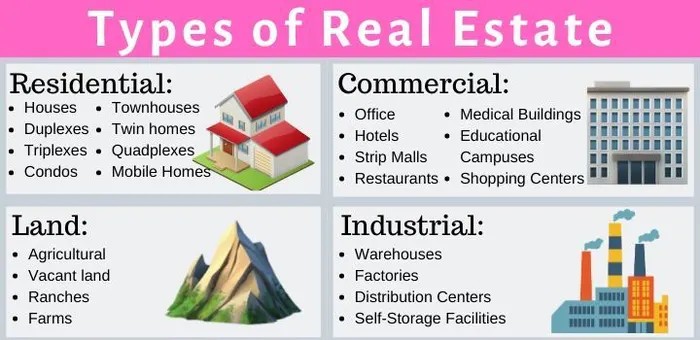

The image encapsulates the concept of real estate investment with a specific focus on ROI (Return on Investment). Given the context, the visual may illustrate the different types of real estate investments and their corresponding ROI potentials.

Mambo muhimu ya kuchukua:

- Investment Diversity: Real estate offers varied avenues like residential, commercial, industrial, and REITs (Real Estate Investment Trusts).

- ROI Metrics: Different real estate sectors might exhibit varying ROI percentages, guiding investors on which sectors potentially yield higher returns.

- Market Dynamics: The influence of market conditions, location, and property type on ROI is likely emphasized.

- Mikakati ya Uwekezaji: Insights into strategies that have historically delivered higher ROI in the real estate domain might be highlighted.

- Comparative Analysis: A side-by-side analysis of ROI from different real estate sectors gives investors a clear picture of where they might want to invest.

Application of Information:

Discerning the ROI potential of various real estate sectors empowers investors to make informed decisions tailored to their financial objectives and risk appetite. By understanding the sectors that historically provide higher returns, investors can strategically allocate their resources to maximize gains. Combining this knowledge with an understanding of market trends, property valuations, and regional growth potentials further enhances the decision-making process for real estate investments.

2A.2 Commercial Real Estate

Commercial real estate investment globally involves purchasing property for businesses, whether it’s office buildings, shopping centers, warehouses, or hotels. It tends to offer higher returns than residential properties due to the potential for long-term rental contracts and higher rental income.

Key Global Trends:

- Emerging Markets: In countries like India na Brazil, emerging markets present opportunities for commercial real estate investments as their economies grow and demand for office and retail space increases.

- Technology Hubs: Areas like Silicon Valley in the U.S. and Bangalore in India have seen a surge in demand for office space due to the growth of the tech industry. Investors in these regions can benefit from long-term leases with tech companies.

- Globalization of Commercial Real Estate: International investors are increasingly looking to diversify by investing in commercial properties across different countries. Cities like Singapore na Hong Kong attract global investors due to their strong business environments and favorable investment laws.

Global Example of Commercial Real Estate

An investor might purchase office buildings in Manhattan, New York, which is home to many global corporations. With long-term corporate leases and a stable demand for office space, the potential for high returns is significant, though property prices and taxes are also high.

Kielelezo: Global REIT Growth Over Time

Maelezo:

This figure shows the growth and adoption of Real Estate Investment Trusts (REITs) globally over time. It categorizes countries into different colors based on the timeline of REIT introduction, ranging from regions with no REITs to those that adopted REITs between 1960 and 2023. Darker colors indicate more recent adoption (2000–2023), while lighter shades represent earlier adoption. For example, the United States introduced REITs in the 1960s, while Asian countries like China and India adopted REITs more recently. The map also labels individual countries and highlights regions such as Europe, Asia, and North America with significant REIT development, providing a visual understanding of the global spread of REIT markets.

Mambo muhimu ya kuchukua:

- REIT markets have grown significantly since the 1960s, starting in the U.S. and expanding worldwide.

- Developed countries like the U.S., Canada, and parts of Europe were early adopters of REITs, reflecting their advanced financial systems.

- Emerging markets in Asia and the Middle East have adopted REITs more recently, indicating growing investment opportunities in these regions.

- The global spread of REITs demonstrates their increasing importance as a tool for real estate investment and portfolio diversification.

- Countries highlighted in dark purple represent new entrants to the REIT market, such as China and India, showcasing potential for growth and investment.

Application of Information:

This data is useful for investors and learners to understand the historical growth and future potential of REITs globally. Investors can analyze regions with emerging REIT markets for new opportunities or focus on established markets for stability. This data also emphasizes the importance of geographical diversification in real estate investing, helping users build well-rounded investment portfolios.

Habari Muhimu ya Somo:

- Residential real estate remains a staple investment globally, with demand escalating in urban centers due to migration and economic development.

- Short-term rentals have transformed investment strategies, providing lucrative opportunities, especially in areas with high tourist traffic.

- The luxury real estate market offers high-value investments but requires careful consideration of market volatility and economic conditions.

- Commercial real estate presents higher returns through long-term leases and is influenced by economic growth in emerging markets and technology hubs.

- Real Estate Investment Trusts (REITs) are growing globally, providing a vehicle for investors to participate in real estate markets with varying levels of maturity and stability.

Taarifa ya Kufunga

Real estate investment remains a lucrative global venture, driven by urbanization, the popularity of short-term rentals, and the allure of luxury properties. Understanding these factors helps investors make informed decisions to optimize their portfolios across different real estate markets.