Chapter 13: Retirement Planning (USA)

课程学习目标:

介绍: Retirement planning in the United States involves understanding the multifaceted sources of retirement income and the role of Social Security in retirement planning. This chapter explores key aspects of retirement planning, including Social Security, other income sources, and strategies to ensure financial stability during retirement.

- Understand Social Security: Learn about Social Security funding, the benefits provided, and how to maximize your monthly benefit amounts based on retirement age and earnings history.

- Diversify Retirement Income: Explore various sources of retirement income, including employer-sponsored retirement plans, personal investments, and continued employment earnings, to build a stable financial future.

- Plan for Retirement: Gain insights into effective retirement planning strategies, such as starting to save early, maximizing employer contributions, and understanding the benefits and limitations of Social Security.

- 寻求专业建议: Understand the importance of consulting with financial advisors to optimize your retirement strategy and protect against potential fraud.

Retirement planning in the United States involves understanding the multifaceted sources of retirement income and the role of Social Security in retirement planning. Here’s an exploration of key aspects related to retirement planning in the U.S., including Social Security and other income sources.

A. Understanding Social Security

Social Security Funding: Social Security is funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Both employees and employers contribute to this fund, which then provides benefits to retirees, disabled individuals, and survivors of deceased workers.

Benefits Provided: Social Security offers a safety net to retirees, providing a monthly income based on their earnings during their working years. The amount of benefit received depends on the age at retirement and the individual’s earnings record.

Example Activity: Design a promotional flyer highlighting the benefits of Social Security. The flyer could illustrate how early retirement at 62 might result in lower benefits compared to full retirement age benefits, and how delaying benefits up to age 70 can increase the monthly benefit amount. Include visuals or charts to display the difference in benefits for various income levels.

B. Diversifying Retirement Income

图标题: Strategies to Save for Retirement

来源: 杂七杂八的傻瓜

- Save 15% a year: Aiming to save at least 15% of your income annually.

- Save for the biggest expenses: Prioritize saving for significant expenses that will occur during retirement.

- Save more than 15% a year: If possible, save more than the recommended 15% to build a more substantial retirement fund.

- Maximize your retirement accounts: Take full advantage of retirement accounts like 401(k)s and IRAs.

- Invest for the long-term now: Focus on long-term investments to grow your retirement savings.

- Take advantage of catch-up contributions: If you are age 50 or older, make catch-up contributions to your retirement accounts.

- Budget for a long retirement: Plan your savings considering a long retirement period.

- Get help with retirement planning: Seek professional advice to ensure you are on the right track towards a secure retirement.

要点:

- Saving a substantial portion of your income annually is crucial for a comfortable retirement.

- Long-term investment and maximizing retirement account contributions can significantly grow your retirement fund.

- Budgeting for a long retirement and getting professional retirement planning advice can help ensure financial security during retirement.

应用: These strategies provide a structured approach towards saving for retirement. By following these guidelines, individuals can work towards building a substantial retirement fund that will support them during their retirement years. It’s essential to start saving and investing early, take advantage of retirement accounts, and consider seeking professional advice to ensure a well-planned and financially secure retirement.

Different Sources of Retirement Income:

- Social Security: A foundational source of income for many retirees, providing benefits based on your earnings history.

- Employer-sponsored Retirement Plans: Such as 401(k)s and pensions, which are crucial for building a retirement nest egg.

- Personal Investments: Including IRAs, stocks, bonds, and other investment vehicles.

- Continued Employment Earnings: Part-time work or consulting in retirement can supplement income.

Multiple Income Sources in Retirement: Relying solely on Social Security may not be sufficient for a comfortable retirement. A diversified income strategy incorporating employer-sponsored plans and personal investments can offer a more stable financial future.

Employer-Sponsored Retirement Plans: Participating in these plans is critical. Many employers offer a match to your contributions, which is essentially free money for your retirement fund. Maximizing your contribution to receive the full employer match can significantly impact your retirement savings.

Average Social Security Benefit: As of recent data, the average monthly Social Security benefit for retired workers is about $1,543. However, this amount varies based on your earnings history and the age you begin to collect benefits.

C. Planning for Retirement

To ensure a comfortable retirement, it’s essential to:

- Start saving early to take advantage of compound interest.

- Diversify your retirement income sources to reduce risk and increase financial security.

- Understand the benefits and limitations of Social Security and plan accordingly to maximize your benefits.

- Engage in employer-sponsored retirement plans and strive to contribute enough to get the full employer match.

- Consider personal investments and savings plans like IRAs to build additional retirement savings.

结论

Retirement planning in the USA should include a comprehensive strategy that combines Social Security, employer-sponsored plans, personal investments, and possibly continued employment earnings. Understanding how Social Security is funded and the benefits it provides is crucial, as is the importance of diversifying retirement income to ensure financial stability in your golden years.

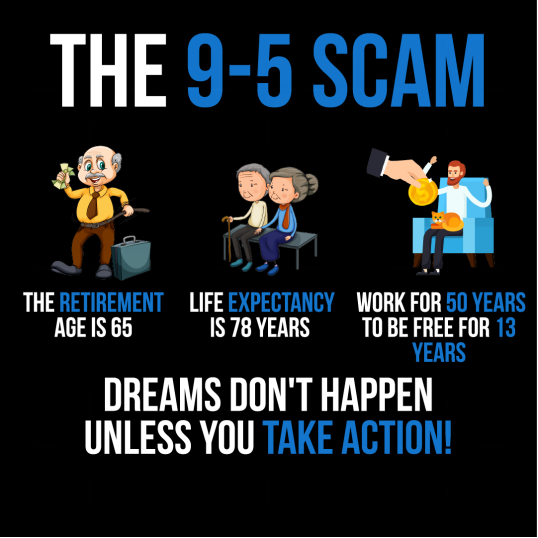

数字: The infographic titled “The 9-5 Scam” presents a critical view of traditional work life. It points out that with a life expectancy of 78 years and a retirement age of 65, one would work for 50 years only to be free for 13 years. The message “Dreams don’t happen unless you take action!” suggests that relying solely on a 9-5 job may not be the most effective path to fulfilling one’s dreams. This visual is a call to action for individuals to take proactive steps towards their goals, possibly implying the pursuit of alternative income streams or early retirement strategies. For practical use, users should consider their long-term life and financial goals and explore various ways to achieve them beyond the conventional employment paradigm.

资料来源:自定义信息图

Figure: A symbolic representation of retirement savings with a golden egg nestled securely, suggesting the importance of building a financial nest egg for the future. Source:

来源: Shutterstock

Having a well-thought-out retirement plan helps you build a nest egg that will provide financial security and peace of mind during your retirement years.

主要课程信息:

结语: Retirement planning in the USA should include a comprehensive strategy that combines Social Security, employer-sponsored plans, personal investments, and possibly continued employment earnings. Understanding how Social Security is funded and the benefits it provides is crucial, as is the importance of diversifying retirement income to ensure financial stability in your golden years.

- Social Security: Funded through payroll taxes, Social Security provides a monthly income based on your earnings history. Early retirement at 62 results in lower benefits compared to full retirement age, while delaying benefits up to age 70 can increase the monthly amount.

- Diversifying Retirement Income: Relying solely on Social Security may not be sufficient. A diversified income strategy, including employer-sponsored retirement plans, personal investments, and continued employment, can offer greater financial security.

- Employer-Sponsored Retirement Plans: Participating in these plans, such as 401(k)s, is essential. Maximize your contributions to receive the full employer match, significantly impacting your retirement savings.

- Planning for Retirement: Start saving early, engage in employer-sponsored plans, and consider personal investments like IRAs. Seek professional advice to navigate the complexities of retirement planning and avoid potential fraud.