الفصل التاسع: أساسيات الاستثمار

أهداف تعلم الدرس:

- Sources of Investment Income:

- Understand the primary sources of income from investments, including interest, dividends, and capital gains.

- Understand the primary sources of income from investments, including interest, dividends, and capital gains.

- Types of Investments:

- Learn about different investment options such as stocks, bonds, mutual funds, index funds, ETFs, real estate, and commodities.

- Learn about different investment options such as stocks, bonds, mutual funds, index funds, ETFs, real estate, and commodities.

- Investment Risk and Return:

- Grasp the relationship between risk and return, the importance of diversification, and how to compare investment performance to market benchmarks.

Understanding Income from Investments

- Interest: Money earned from deposit accounts or bonds. Interest is paid at a predetermined rate for the use of the funds deposited or loaned.

- Consider a bond that pays 5% annual interest on a $10,000 investment, yielding $500 in interest income per year.

- Dividends: Payments made to shareholders out of a corporation’s earnings. Dividends provide a return to shareholders for their investment in the company’s equity.

- If you own 100 shares of a company that pays an annual dividend of $1 per share, you receive $100 yearly.

- Capital Gains: The profit realized when an investment is sold for more than its purchase price. Capital gains are a form of income from the increase in value of the investment over time.

- Buying a stock at $100 and selling at $150 results in a $50 capital gain per share.

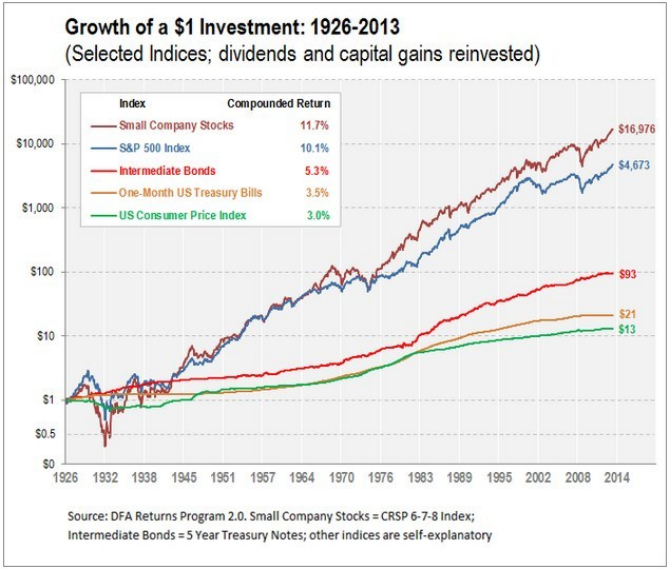

عنوان الشكل: نمو استثمار $1: 1926-2013

مصدر: جرانيت هيل كابيتال

وصف: يوضح الرسم البياني نمو استثمار $1 خلال الفترة من 1926 إلى 2013 عبر مؤشرات الاستثمار المختلفة، مع إعادة استثمار الأرباح والمكاسب الرأسمالية. وتشمل المؤشرات أسهم الشركات الصغيرة، ومؤشر S&P 500، والسندات المتوسطة، وأذون الخزانة الأمريكية لشهر واحد، ومؤشر أسعار المستهلك الأمريكي. ويسلط الرسم البياني الضوء على النمو المتفوق لأسهم الشركات الصغيرة، والتي ارتفعت إلى ما يقرب من $17000 بحلول نهاية عام 2013، متجاوزة المؤشرات الأخرى.

الماخذ الرئيسية:

- نمو فائق لأسهم الشركات الصغيرة: ارتفع استثمار $1 في أسهم الشركات الصغيرة في عام 1926 إلى ما يقرب من $17000 بحلول نهاية عام 2013.

- مؤشر ستاندرد آند بورز 500: يُظهر نموًا ثابتًا على مر السنين، على الرغم من أنه ليس واضحًا مثل أسهم الشركات الصغيرة.

- السندات المتوسطة وأذونات الخزينة: عرضت نموًا ثابتًا ولكن أكثر تواضعًا مقارنة بالأسهم.

- مؤشر أسعار المستهلك الأمريكي: بمثابة مقياس للتضخم، مما يدل على تناقص القوة الشرائية للدولار مع مرور الوقت.

طلب: ويسلط الرسم البياني الضوء على إمكانات النمو على المدى الطويل للأسهم، وخاصة أسهم الشركات الصغيرة، على الرغم من الانكماش الدوري في السوق. ومع ذلك، فإنه يسلط الضوء أيضًا على أهمية التنويع، حيث توفر فئات الأصول المختلفة ملفات تعريف مختلفة للمخاطر والعائد. بالنسبة للمستثمرين، فإن فهم أنماط النمو التاريخية يمكن أن يوفر السياق عند اتخاذ قرارات التخصيص، مع التركيز على أهمية المحفظة المتوازنة التي تمثل إمكانات النمو وتحمل المخاطر.

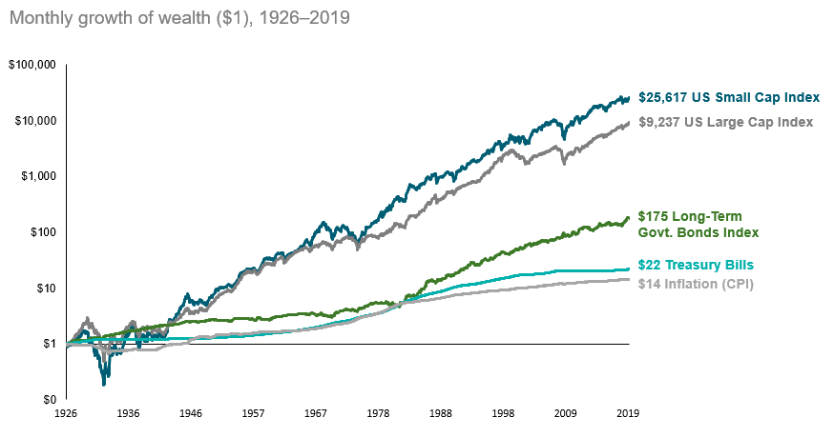

عنوان الشكل: النمو طويل المدى لـ $1: الأسهم مقابل السندات مقابل التضخم

مصدر: دارو لإدارة الثروات

وصف: يعرض الرسم البياني مسار نمو استثمار $1 على مدى فترة ممتدة، مقارنة أداء الأسهم والسندات والتضخم. ويؤكد الرسم البياني على إمكانات النمو الكبيرة للأسهم على المدى الطويل، متجاوزة السندات والتضخم.

الماخذ الرئيسية:

- أداء الأسهم يتفوق على المدى الطويل: على مدى فترات طويلة، قدمت الأسهم تاريخيا عوائد أعلى من السندات وتجاوزت التضخم.

- السندات توفر الاستقرار: While bonds may not offer the same growth potential as stocks, they provide stability and income, especially during volatile market conditions

- التأثير التآكلي للتضخم: ويؤكد الرسم البياني تناقص القوة الشرائية للدولار مع مرور الوقت بسبب التضخم.

التنويع هو المفتاح: يمكن للمحفظة المتوازنة التي تتكون من الأسهم والسندات أن تساعد في تخفيف المخاطر وتحقيق النتائج المالية المرجوة.

طلب: الرسم البياني بمثابة شهادة على أهمية التنويع في المحافظ الاستثمارية. في حين أن الأسهم توفر إمكانات النمو، إلا أنها تأتي مع تقلبات أعلى. ومن ناحية أخرى، توفر السندات الاستقرار ويمكن أن تكون بمثابة حاجز أثناء فترات الركود في السوق. بالنسبة للمستثمرين، فإن فهم الأداء التاريخي لفئات الأصول هذه يمكن أن يوجه قرارات التخصيص، مما يضمن وجود مزيج يتماشى مع قدرتهم على تحمل المخاطر وأهدافهم المالية.

Types of Investments and Their Purpose

شكل: يوضح الرسم البياني "الأنواع الخمسة لفئات الأصول" التي يتم تضمينها عادة في المحفظة الاستثمارية. هؤلاء هم:

- حقوق الملكية: تشمل الأسهم وصناديق المؤشرات والصناديق المتداولة في البورصة (ETFs) وصناديق الاستثمار المشتركة.

- السندات: تمثل الإقراض للحكومة أو الشركة.

- السلع: ومن أمثلتها الذهب والنفط الخام والذرة والماشية والفضة.

- العقارات: يمكن أن يكون هذا منزلًا أو شققًا أو صناديق الاستثمار العقاري (REITs) أو أرضًا.

- النقد: يشير هذا إلى الأموال الموجودة في الحسابات المصرفية أو النقود الورقية المادية.

يعد الرسم البياني بمثابة أداة تعليمية للأفراد الذين يتطلعون إلى فهم الأنواع المختلفة من الأصول التي يمكنهم الاستثمار فيها. وللاستخدام العملي، يجب على المستثمرين التفكير في تنويع محافظهم الاستثمارية عبر فئات الأصول هذه لتوزيع المخاطر وإمكانية العائد، بما يتماشى مع أهدافهم الاستثمارية. وتحمل المخاطر.

المصدر: رسم بياني مخصص

Stocks: Equity investments that offer ownership in a corporation. Stocks have the potential for high returns but come with higher risk. For example, buying shares in Apple Inc. gives you a fractional ownership stake.

Figure: Illustration of a bull symbolizing a rising stock market, indicating a Bull Market Signal for global trading.

مصدر: صراع الأسهم

- Bonds:

Figure: A visual concept of bonds investment, highlighting corporate bonds within the banking and finance market.

مصدر: صراع الأسهم

Debt investments where the investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a variable or fixed interest rate. Bonds are generally considered safer than stocks but offer lower potential returns. A U.S. Treasury bond is a loan to the government expected to be repaid with interest.

- Mutual Funds:

Figure: An investment consultant in a formal suit presenting a fund performance report with graphs on a laptop screen.

مصدر: صراع الأسهم

Investment programs funded by shareholders that trade in diversified holdings and are professionally managed. Investing in a Vanguard mutual fund diversifies your risk across numerous stocks or bonds.

- Index Funds: Type of mutual fund with a portfolio constructed to match or track the components of a market index, offering broad market exposure with low operating expenses.

- Exchange-Traded Funds (ETFs):

Figure: A visual representation of an ETF (Exchange Traded Fund) in the stock market, symbolizing investment and financial concepts.

مصدر: صراع الأسهم

Similar to mutual funds but traded on stock exchanges like individual stocks, such as the SPDR S&P 500 ETF They offer liquidity and low costs.

- Real Estate:

Figure: A conceptual photo of a house model on a balanced scale, symbolizing the equilibrium in real estate decisions.

مصدر: صراع الأسهم

Investing in property, either directly by purchasing real estate or indirectly through Real Estate Investment Trusts (REITs).

- Money Markets and Annuities: Money markets provide a safe place for short-term investment. Annuities are financial products that offer a guaranteed income stream.

Tax Implications and Expenses

Investments are subject to different tax rates, affecting their after-tax returns. Understanding the tax treatment of interest, dividends, and capital gains is essential for evaluating the true cost of credit and the actual return on investments.

The expenses of buying, selling, and holding financial assets, such as management fees, commissions, and expense ratios, directly impact the investment’s rate of return.

Stocks, Bonds, Mutual Funds, Index Funds, and ETFs: The income from these investments can be taxed in various ways. Dividends from stocks and mutual funds may qualify for lower tax rates, while interest from bonds is usually taxed as ordinary income. Capital gains from selling these investments are taxed either as short-term (ordinary income rates) if held for less than a year, or as long-term (reduced rates) if held longer.

Stocks: Capital gains tax applies if stocks are sold at a profit, with rates depending on the holding period.

Bonds: Interest income is taxed at ordinary income rates.

صناديق الاستثمار: Taxes apply on both dividends received and capital gains distributions.

العقارات: Income from rental properties is taxed as ordinary income, but investors can deduct expenses and depreciation. Selling real estate can result in capital gains tax.

Money Markets and Annuities: Interest from money market accounts is taxed as ordinary income. Annuities offer tax-deferred growth, but withdrawals are taxed as ordinary income, and premature withdrawals may incur additional penalties.

السلع: Profits from selling commodities, like gold or oil, are taxed as capital gains. Special rules, like those for collectibles, may apply, leading to potentially higher tax rates.

Investment Risk and Return

- The relationship between risk and return is fundamental to investing. Generally, higher-risk investments offer the potential for higher returns, while lower-risk investments offer more modest returns.

- A “blue-chip” stock, being from a large, well-established company, generally offers lower risk and return compared to a speculative Internet start-up company, which might offer high returns but also carries a high risk of loss.

- Investing in a “blue chip” stock like Johnson & Johnson might offer more stable returns and lower risk compared to a volatile internet start-up, reflecting the trade-off between risk and potential return.

- Investing in a “blue chip” stock like Johnson & Johnson might offer more stable returns and lower risk compared to a volatile internet start-up, reflecting the trade-off between risk and potential return.

- تنويع across different types of financial assets can reduce investment risk, ensuring that a portfolio isn’t overly dependent on the performance of a single investment.

- Owning businesses in both the suntan lotion and umbrella markets, for example, can provide stability regardless of the weather, unlike owning two suntan lotion businesses, which would suffer in poor beach weather.

- An investor owning businesses in complementary seasonal industries (e.g., a ski resort and a beach resort) diversifies revenue sources, reducing overall business risk compared to owning two ski resorts.

Benchmarking Investment Performance

Comparing to a Benchmark:

Investors frequently benchmark the performance of their portfolios against established market indices, such as the S&P 500, to gauge their investment strategies’ effectiveness. For instance, an investor with a portfolio primarily consisting of large-cap stocks might use the S&P 500 as a benchmark to assess whether their investment choices are outperforming, matching, or underperforming the broader market’s performance.

Understanding Benchmark Indices:

Popular benchmark indices include the S&P 500 (large-cap stocks), the Dow Jones Industrial Average (30 significant U.S. companies), and the NASDAQ Composite (tech-heavy index). By comparing these indices’ performance, investors can understand various market segments’ trends. For example, if the NASDAQ Composite performs significantly better than the S&P 500 in a given year, it may indicate a strong performance in the technology sector.

Advantages of ETFs Tracking Market Indices:

Exchange-Traded Funds (ETFs) that track market indices offer several advantages over actively managed mutual funds or individual stock and bond investments. Firstly, they provide diversification, reducing the risk associated with investing in single stocks or sectors. For example, an ETF tracking the S&P 500 provides exposure to 500 different companies across various industries. Secondly, ETFs generally have lower expense ratios than actively managed funds, making them a cost-effective option for investors. Finally, ETFs offer liquidity and flexibility, as they can be bought and sold like stocks throughout the trading day.

Practical Example:

Consider an investor evaluating between an actively managed mutual fund with a 1% annual fee and an S&P 500 index ETF with a 0.03% fee. Over 20 years, the difference in fees can significantly impact the net return, especially if the mutual fund fails to consistently outperform the S&P 500 index. Additionally, the ETF provides broad market exposure, mitigating the risk of underperformance due to poor stock selection or sector downturns in the actively managed fund.

Short-term vs. Long-term Investments

Shorter-term investments, like savings accounts or short-term bonds, generally offer lower rates of return compared to longer-term investments like stocks or long-term bonds. This reflects the greater uncertainty and potential for growth over longer periods.

Influence of Economic Factors on Investment Prices

Interest rates, economic conditions, and government policies can all impact the value of financial assets. For instance, an increase in interest rates often leads to a decrease in the current value of bonds.

The government provides critical oversight to ensure fair and transparent markets and protect investors. For example, accurate information about a company’s financial health is essential for making informed investment decisions.

An interest rate hike can decrease the market value of existing bonds as new bonds issue at higher rates, making the old bonds less attractive in comparison.

Modern Financial Technology in Investing

- The rise of digital currencies, robo-advising, and discount brokerage firms facilitated by financial technology has democratized access to financial markets, offering new ways to invest but also presenting unique challenges and risks.

Investment Accounts

Retirement accounts (401(k), IRA), education savings accounts (529 plans), and taxable investment accounts each serve specific investment goals, offering various tax advantages and implications.

- حسابات التقاعد (e.g., 401(k), IRA) offer tax advantages to encourage saving for retirement. 401(k) and IRAs: Facilitate retirement savings with tax advantages. A Roth IRA, for instance, offers tax-free growth and withdrawals.

- Education Accounts (e.g., 529 plans) provide tax-free growth for educational expenses. 529 Plans: Savings plans for future education expenses, offering tax benefits.

- Taxable Accounts offer flexibility but lack specific tax advantages. Each account type has its own set of rules, benefits, and limitations, influencing investment choices.

Decision-Making in Investing

- Investors’ risk tolerance, influenced by personal factors and life circumstances, guides their investment choices and strategies. Understanding one’s investment profile is crucial for building a portfolio aligned with individual goals and risk tolerance.

- The government’s role includes ensuring transparency and fairness in financial markets, enabling investors to make informed decisions based on accurate company data.

- A retiree might prioritize stability and income, favoring bonds or dividend-paying stocks, whereas a young, single person might pursue growth through higher-risk investments.

Managing Investment Expenses and Understanding Returns

- Awareness of the costs associated with investments, such as fees and taxes, and their impact on returns, is vital for effective investment management.

- The costs of managing investments, such as management fees for mutual funds (expense ratios), commissions for buying/selling stocks, and operational costs, all decrease the net return to the investor.

- For example, a mutual fund with a 1% expense ratio will reduce your investment’s return by 1% annually, which can compound significantly over time, reducing the total accumulated amount. Buying a mutual fund with a 1% expense ratio means you pay $10 annually for every $1,000 invested, directly reducing your return. If the fund’s market performance yields a 7% return, the actual return to the investor is 6% after expenses.

Market Dynamics and Investment Pricing

The prices of financial assets in markets are set by the collective actions of buyers and sellers. An increase in perceived risk for a bond, for example, will likely cause its price to drop as buyers demand a higher yield for assuming greater risk, affecting both the seller’s proceeds and the buyer’s future returns.

Financial Literacy and Professional Advice

- Navigating the complexities of investing often requires professional advice. Selecting the right financial advisor involves considering factors like expertise, experience, fees, and investment philosophy.

- When choosing a financial advisor, consider their credentials (CFP®, CFA), experience, fee structure, and investment philosophy. Transparent communication about fees and investment strategies is crucial.

The Importance of Being Informed

- Being an informed investor involves continuous learning and staying updated on market conditions, regulatory changes, and new investment opportunities. This proactive approach helps in making informed decisions that align with long-term financial goals.

Digital Currency as an Investment

الشكل: صورة مقربة لعملة بيتكوين (BTC) المشفرة جنبًا إلى جنب مع العديد من الرموز المميزة للعملات البديلة، مما يمثل المشهد المتنوع للعملات الرقمية.

مصدر: صراع الأسهم

Digital currencies, like Bitcoin, are volatile investments affected by market demand. They offer opportunities for speculation, privacy in transactions, and international payments without traditional banking fees, but they also carry significant risk due to their volatility and regulatory uncertainties.

Investment Strategies and Principles

- Developing a long-term investment strategy can leverage the power of compound interest, significantly impacting wealth accumulation over time.

- Diversifying investments across asset classes (stocks, bonds, real estate) reduces risk and can lead to more stable returns.

By understanding these fundamental aspects of investing, including the mechanisms of returns, regulatory frameworks, and strategic considerations like risk tolerance and diversification, investors are better equipped to make informed decisions that align with their financial goals and risk appetite.

معلومات الدرس الرئيسية:

- Income from Investments:

- Interest, dividends, and capital gains are the main sources of investment income, each with different risk and return profiles.

- Interest, dividends, and capital gains are the main sources of investment income, each with different risk and return profiles.

- Types of Investments:

- Stocks offer high potential returns with higher risk, bonds provide more stability with lower returns, and mutual funds, index funds, and ETFs offer diversified investment options.

- Real estate and commodities present additional investment opportunities with their own unique risks and returns.

- Risk and Return:

- Higher-risk investments generally offer higher potential returns, while lower-risk investments provide more stable returns.

- Diversification across different types of investments can reduce overall portfolio risk.

- Comparing your investments to benchmark indices like the S&P 500 helps gauge their performance.