Conseils de gestion des risques pour constituer un portefeuille d’actions

Objectifs d'apprentissage clés :

Introduction: This section provides insightful tips on building a stock portfolio with effective risk management strategies. It covers understanding risk tolerance, the importance of diversification, regular portfolio reviews, and the utilization of investment tools to limit potential losses.

- Understand Risk Tolerance: Grasp the concept of risk tolerance and why it’s crucial to tailor your investments according to your financial goals and comfort with uncertainty.

- Learn the Importance of Diversification: Discover why spreading investments across various assets can protect your portfolio from major losses.

- Master Regular Portfolio Reviews: Recognize the importance of timely assessments and adjustments to maintain alignment with your investment goals.

- Familiarize with Investment Tools: Equip yourself with tools like stop-loss orders to limit potential losses.

- Develop an Investment Plan: Understand the significance of a well-structured investment roadmap and how it can steer your decisions in volatile markets.

Chiffre: A close-up of a person’s hand placing wooden blocks in a row, symbolizing the structured approach to risk management. The image underscores the meticulous and strategic nature of managing risks in business and finance.

Source: iStockPhoto

14.1 Understand Your Risk Tolerance

Risk tolerance is the degree of uncertainty you are willing to take on to achieve your investment objectives. Your risk tolerance will depend on your financial goals, your time horizon for meeting each of these goals, and your emotional comfort with uncertainty. Understanding your risk tolerance can help guide you in making decisions about what stocks to include in your portfolio and how much of your total investment to allocate to each one.

14.2 Diversify Your Portfolio

Diversification is a risk management strategy that involves spreading investments across different types of assets and sectors to reduce exposure to any one particular investment. By having a diverse portfolio, you can mitigate the risk of a single asset or group of assets dramatically dropping in value.

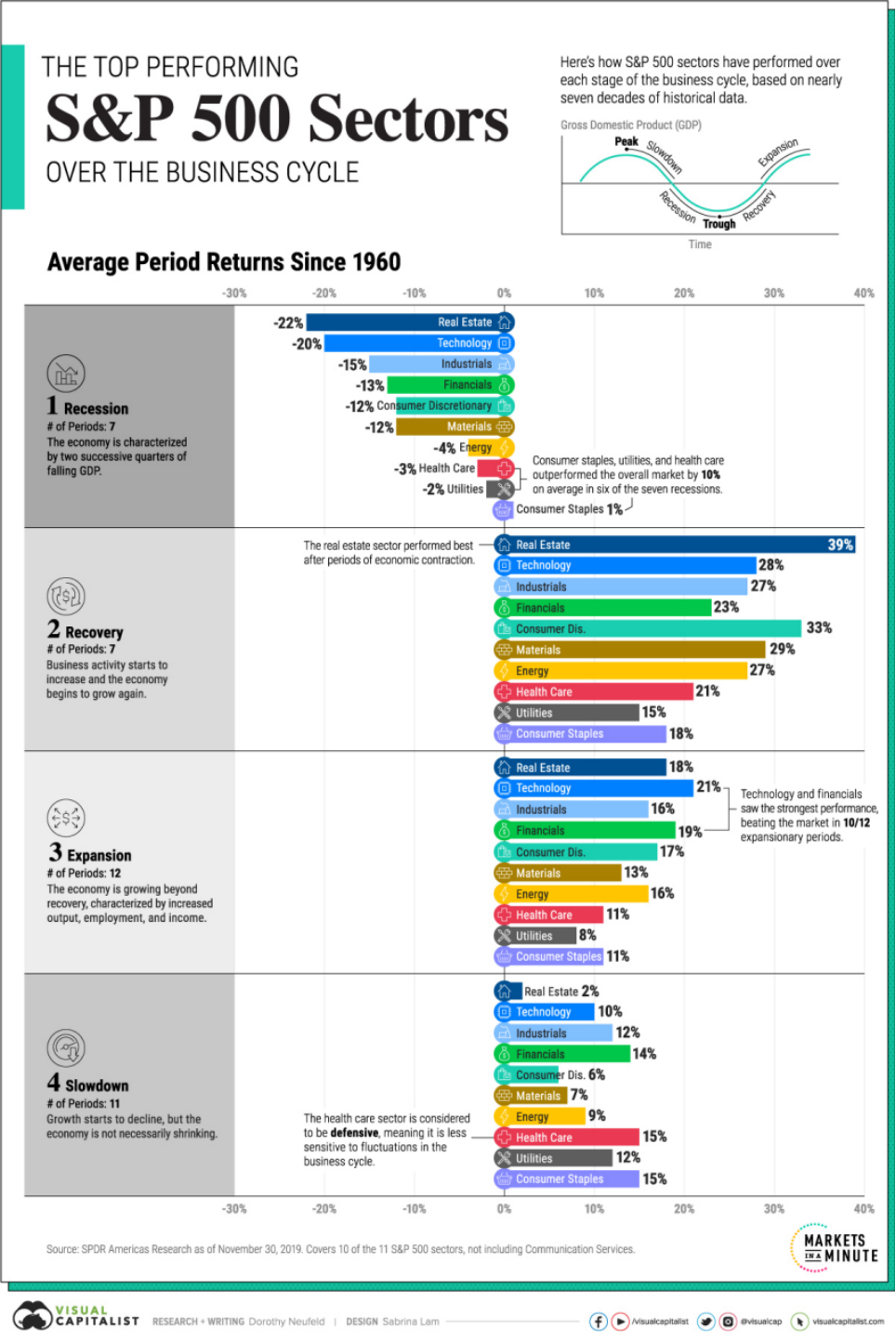

Figure title: Performance of S&P 500 Sectors Over the Business Cycle

Source: Capitaliste visuel

Description: The figure highlights the importance of diversifying a portfolio by illustrating how various sectors of the S&P 500 perform across different phases of the business cycle.

Points clés à retenir:

- Recession Phase:

- Secteurs les plus performants: Real estate, technology, industrials, financials, consumer discretionary, and materials.

- Recession Phase:

-

- Market Recovery:

- Secteurs les plus performants: Real estate, technology, industrials, financials, consumer discretionary, materials, energy, health care, and utilities.

- Market Recovery:

-

- Expansion Phase:

- Secteurs les plus performants: Technology, real estate, industrials, financials, consumer discretionary, energy, health care, among others. These sectors see growth, albeit at a slower rate compared to the recovery phase.

- Expansion Phase:

- Contraction/Slow Down:

- Secteurs les plus performants: Consumer staples, utilities, healthcare, and energy tend to outperform.

Application: Understanding the cyclical performance of sectors can be pivotal for investors aiming to maximize returns and minimize risks over time. By strategically diversifying their portfolios based on insights about sectoral performance during different business cycle phases, investors can potentially reap the benefits of both capital appreciation and downside protection.

14.3 Regularly Review Your Portfolio

Regular reviews of your portfolio will help ensure it remains aligned with your investment goals. Over time, some investments may become too risky, while others may become too conservative. Regular reviews will help you make necessary adjustments and rebalance your portfolio back to your desired risk level.

14.4 Use Stop-Loss Orders

UN stop-loss order is a tool that automatically sells an asset when it reaches a certain price. This can help limit your losses on a specific investment. While it doesn’t guarantee protection against loss, it can help manage risk by providing a plan for when things don’t go as anticipated.

Figure title: Understanding Stop-Loss Orders

Source: Le fou hétéroclite

Description: The figure provides a clear visualization of the stop-loss order mechanism in stock trading. A stop-loss order is a predefined sell order set at a specific price below the current market price to limit potential losses on an investment.

Points clés à retenir:

1.Buying at $50:

An investor purchases a stock at a market price of $50.

2. Setting a Stop-Loss at $45:

The investor decides to set a stop-loss order at $45, which is 10% below the purchase price.

3.Activation:

If the stock price declines and reaches $45, the stop-loss order is triggered, and the stock is sold automatically at that price or a price close to it, thereby capping the potential loss to 10%.

Application: A stop-loss order acts as a safety net for investors, ensuring they don’t hold onto declining stocks for too long. This tool can be crucial in mitigating potential losses in volatile market conditions or when investors can’t actively monitor their portfolios.

14.5 Understand the Companies You Invest In

Investing in a company without understanding its business model, financials, or the industry it operates can be risky. A comprehensive understanding of the company can give you a clearer picture of its potential risks and rewards.

Category:

Things to Consider:

Company Leadership

Evaluate the experience, past performance, and reputation of the CEO and executive team.

Products/Services

Understand the company’s main products or services and their market acceptance. Evaluate their innovation and future relevance.

Financial Health

Look at the company’s balance sheet, income statement, and cash flow statement. Check ratios like debt-to-equity, current ratio, and return on equity.

Concours

Understand the company’s competitive position. Identify its main competitors and analyze their strength and weaknesses.

Market Conditions

Examine the overall health of the market sector and the economy. Consider factors like customer demand, governmental regulations, and geopolitical events.

Chiffre: This chart provides a structured approach to evaluating a company for investment purposes. It breaks down the evaluation process into six main categories: Leadership, Products/Services, Financial Health, Competition, Market Conditions, and Sources. Under each category, specific points to consider are listed. For instance, under “Leadership,” it suggests evaluating the experience, past performance, and reputation of the CEO and executive team. Similarly, under “Financial Health,” it recommends looking at the company’s balance sheet, income statement, and cash flow statement, among other financial metrics.

Source: Custom Chart

Description:

The infographic serves as a comprehensive guide for potential investors, detailing the key areas they should focus on when considering a company for investment. It emphasizes the importance of understanding the leadership’s track record, the market acceptance of the company’s products or services, its financial stability, the competitive landscape, and the prevailing market conditions. Additionally, it provides references to sources like Investopedia for deeper insights into topics like financial health.

Points clés à retenir:

- Leadership: Evaluate the credentials, past achievements, and reputation of the company’s leadership.

- Products/Services: Understand the market acceptance of the company’s offerings and their future potential.

- Financial Health: Analyze the company’s financial statements and key ratios to gauge its financial stability.

- Concours: Identify the company’s main competitors and assess their strengths and weaknesses.

- Market Conditions: Consider the broader market dynamics, including customer demand and regulatory environment.

Application:

For anyone looking to invest in a company, this infographic serves as a step-by-step guide to ensure a thorough evaluation. By following this structured approach, investors can make more informed decisions, minimizing risks and maximizing potential returns. Whether you’re a novice investor or a seasoned professional, this guide can be a valuable tool in your investment toolkit.

Quote title: Warren Buffet on Investment Understanding

Source: ScrollDroll

14.6 Keep Emotions in Check

Investment decisions should be based on careful analysis, not emotions. Fear and greed can lead to poor decisions, such as panic selling or excessive risk-taking. Remaining disciplined and sticking to your investment plan can help manage emotional investing.

14.7 Have a Clear Investment Plan

A well-defined investment plan will outline your financial goals, how much risk you are willing to take to achieve them, and how you plan to reach them. This plan will guide your investment decisions and help you avoid making rash decisions in response to market fluctuations.

14.8 Implement Dollar-Cost Averaging

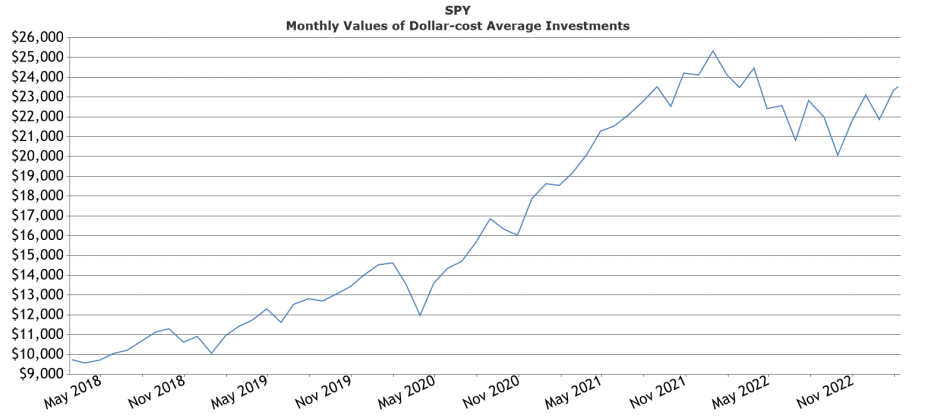

Dollar-cost averaging involves regularly investing a fixed amount of money. This strategy can reduce the risk of investing a large amount in a single investment at the wrong time. By spreading out your purchases, you can mitigate the effects of short-term price volatility.

Figure title: The Concept of Dollar Cost Averaging

Source: US Bank

Description: The visual elucidates the strategy of dollar cost averaging, which involves consistent investment of a fixed dollar amount at regular intervals. This approach lets investors purchase more shares when prices are low and fewer shares when prices are high.

Points clés à retenir:

- Consistency: Dollar cost averaging promotes a disciplined investment approach, regardless of market conditions.

- Reduces the impact of market volatility: This strategy can lower the average cost per share over time, cushioning against short-term market fluctuations.

- Automatic and straightforward: For many investors, it’s easier to invest fixed amounts at regular intervals than trying to time the market.

- Mitigation of “timing the market” risks: Investors don’t need to predict the best time to invest, reducing the risk of making poor timing decisions.

Application: Dollar cost averaging is particularly beneficial for novice investors who might be hesitant about entering the market. By adopting this strategy, they can start investing without the stress of market timing and gradually build their portfolio. Seasoned investors also find this approach helpful in maintaining discipline and reducing the emotional aspect of investing.

Figure title: Numerical Illustration of Dollar Cost Averaging

Source: PlanMember

Description: This table showcases the practical application of dollar cost averaging by delineating how a regular contribution, say $100, buys varying amounts of shares at fluctuating prices. The grey column indicates share prices that oscillate, whereas the blue column displays a consistently rising share price. The resultant total shares owned and their values differ based on these pricing dynamics.

Points clés à retenir:

- Regular investments lead to varied purchases: The same $100 can buy more shares when the price is low and fewer when it’s high.

- Two scenarios: One where share prices are inconsistent (gray column) and another where they’re steadily climbing (blue column).

- Profitability: Even if the stock undergoes fluctuation, if its final price exceeds the average cost, the investment yields a profit.

- Risk Mitigation: Spreading purchases over time can potentially decrease the impact of purchasing at a market high.

Application: Dollar cost averaging allows individuals to bypass the intricacies of market prediction and offers a systematic and disciplined investment approach. For investors, this method can serve as a buffer against the whims of market volatility, ensuring that they don’t put all their money in at an inopportune moment. By spreading the investment over a period, they can potentially reduce the average cost per share, setting a foundation for potential long-term gains.

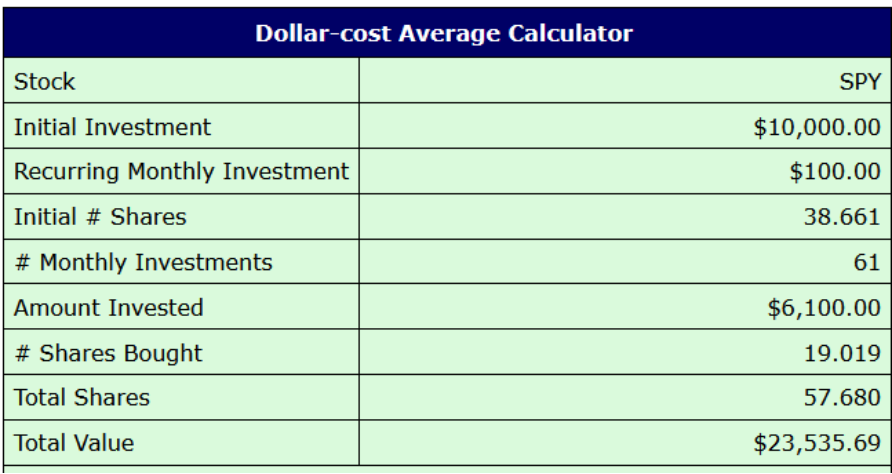

It can be hard to know what to do in the stock market. It may never seem like the right time to invest. However, it’s important to note that the concept of constantly investing, also known as dollar cost averaging, has been proven to be successful.

For example, if you started investing with 10,000 dollars in the S&P500 index, and decided from there you would contribute 100 dollars a month to buying more from Jan 2018 to Feb 2023.

According to this website you can test out,

Source: Buy Upside

you would have the following return:

Chiffre: This infographic is a “Dollar-cost Average Calculator” for the stock “SPY”. It provides a detailed breakdown of investments, including an initial investment of $10,000.00, a recurring monthly investment of $100.00, and the number of shares bought over time. By the end of the period, with 61 monthly investments, the total value of the investments stands at $23,535.69.

Conseil: Dollar-cost averaging is a strategy where an investor divides up the total amount to be invested across periodic purchases to reduce the impact of volatility on the overall purchase. This infographic provides a clear example of how this strategy can work over time, especially with consistent monthly investments. It’s a useful tool for those looking to understand the benefits of consistent investing over time, regardless of market conditions.

Titre de la figure : Dollar-cost Average Calculator (2/2018 – 2/2023) for Stock SPY

Source: Buy Upside

Description:

The calculator shows the following details:

- Initial Investment: $10,000.00

- Recurring Monthly Investment: $100.00

- Initial Number of Shares Bought: 40.569

- Number of Monthly Investments: 60

- Total Monthly Investments: $6,000.00

- Number of Monthly Shares Bought: 18.834

- Total Investments: $16,000.00

- Total Shares: 59.403

- Final Value: $23,278.18

- Total Gain or Loss: $7,278.18

- Percent Gain or Loss: 45.49%

Points clés à retenir:

- Dollar-cost averaging (DCA) is a strategy where a fixed amount of money is invested in a particular investment on a regular schedule, regardless of the price.

- The DCA strategy resulted in a 45.49% gain over the period from 2/2018 to 2/2023 for the stock SPY.

- The total gain from the investments is $7,278.18 with a final value of $23,278.18 from a total investment of $16,000.00.

Application: Investors can use this calculator to understand how dollar-cost averaging could potentially work for them over a specified time period. By inputting different values and time frames, investors can see how changing their investment amounts or frequency can impact their returns. This can be a useful tool for planning long-term investment strategies and understanding the potential benefits of dollar-cost averaging.

14.9 Keep Some Cash Reserves

Keeping a portion of your portfolio in cash can provide you with the flexibility to act on potential investment opportunities as they arise. It can also serve as a buffer against market downturns, reducing the need to sell investments at a loss to cover living expenses or meet other financial needs.

14.10 Learn from Your Mistakes

Every investor makes mistakes. What’s important is to learn from them. If an investment doesn’t go as planned, analyze what went wrong and how you can avoid making the same mistake in the future. This could involve adjusting your investment strategy, improving your analysis techniques, or managing your emotions better.

Conclusion:

Risk management is essential for successful investing. By understanding your risk tolerance, diversifying your investments, regularly reviewing your portfolio, and having a clear investment plan, you can help protect your assets and achieve your financial goals. Other strategies, such as using stop-loss orders, understanding your investments, controlling your emotions, implementing dollar-cost averaging, keeping cash reserves, and learning from your mistakes, can also help you manage risk effectively.

Points clés à retenir:

Déclaration finale : Effective risk management is the linchpin of successful stock portfolio building. This section imparts valuable tips and strategies to manage risks adeptly, ensuring your portfolio remains resilient amidst market volatilities and aligns with your financial aspirations.

- Gestion des risques: Understanding your individual risk threshold and making decisions accordingly is vital in achieving financial goals.

- Diversification: Spreading investments reduces exposure to significant losses from any single asset, acting as a safety net for your portfolio.

- Routine Portfolio Review: Ensuring your portfolio aligns with your financial aspirations through timely reviews and adjustments is crucial for long-term success.

- Investment Tools: Tools like stop-loss orders offer an automated way to protect against unexpected investment downturns, acting as a safety guard.

- Informed Decisions: Prioritize research and understanding companies before investing, and avoid emotional decision-making to navigate the stock market effectively.