Розділ 4: Фінансове планування та встановлення цілей

Цілі навчання:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This chapter delves into the essential aspects of financial planning and goal setting, exploring how philanthropy, credit management, budgeting, financing education, and choosing financial institutions play integral roles in achieving financial stability and contributing to the community.

Financial planning and goal setting are cornerstone practices for achieving financial independence and security. This section emphasizes the importance of SMART goals, the pursuit of financial independence, and the critical steps in creating and implementing a financial plan.

Малюнок: 6 Steps For Prioritizing Financial Goals

опис:

The figure illustrates the six essential steps for prioritizing financial goals. These steps are:

- List down your Needs First: Differentiate between essential needs and wants.

- Save for Emergencies: Establish an emergency fund to handle unexpected financial challenges.

- Focus on Retirement: Prioritize retirement savings, especially in countries without a social security structure.

- Get the Right Insurance: Ensure protection against significant financial setbacks, especially if you have dependents.

- Pay-off High Interest Debt: Address debts with high interest rates before focusing on savings.

- Set Money Aside for Long-term and Short-term goals: After addressing high-interest debt, start saving for other significant goals.

Ключові висновки:

- Differentiating between needs and wants is crucial for effective financial planning.

- An emergency fund acts as a safety net for unforeseen financial challenges.

- Retirement should be a top priority, especially in the absence of social security.

- Insurance provides a safety net against significant financial setbacks.

- Addressing high-interest debt can free up cash flow and pave the way for savings.

- Prioritize needs over wants when setting aside money for long-term and short-term goals.

Застосування інформації:

Understanding and implementing these steps can provide a structured approach to financial planning. By prioritizing needs over wants and focusing on essential goals like retirement and emergency funds, individuals can ensure financial stability. This knowledge is invaluable for investors and those learning about investing, as it offers a roadmap to financial security and growth.

4.1 SMART Goals in Financial Planning

SMART goals—Specific, Measurable, Achievable, Relevant, Time-bound—provide a framework for setting clear, attainable financial objectives. By defining goals that meet these criteria, individuals can create actionable plans with a higher likelihood of success.

- Specific: Clearly define what you want to achieve. For example, instead of saying “save money,” specify “save $5,000 for an emergency fund.”

- Measurable: Ensure that your goal is quantifiable to track progress, such as saving a certain amount by a specific date.

- Achievable: Your goal should be realistic, considering your current financial situation and resources.

- Relevant: Choose goals that are important to you and align with your long-term financial aspirations, such as saving for retirement or paying off debt.

- Time-bound: Set a deadline to keep yourself accountable, like saving $5,000 within one year.

Example: Emma sets a SMART goal to pay off her $10,000 student loan within five years by making monthly payments of $167, adjusting her budget to allocate the necessary funds.

4.2 Financial Planning and Decision-Making

Financial planning involves setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals and making informed decisions regarding education, career, and personal finances.

- Education and Career Choices: Decisions about education and career paths have profound effects on income potential and job opportunities, underscoring the importance of strategic planning.

- Life Stages: Financial decisions vary across different life stages, impacting income, savings, and investment opportunities.

Here are examples illustrating how these decisions can impact financial wellbeing at various life stages:

Young Adulthood (Ages 18-29)

Financial Decisions: This stage often involves choosing a career path or pursuing higher education. Decisions about student loans, starting salaries, and the commencement of retirement savings are pivotal.

- Example: Sofia decides to pursue a degree in software engineering. She takes out student loans to finance her education, knowing that her potential income in the tech industry could justify this initial debt. She also starts a small Roth IRA with part-time job earnings to take advantage of compound interest.

Early Midlife (Ages 30-44)

Financial Decisions: Individuals in this stage may focus on buying a home, starting a family, and climbing the career ladder. These years are crucial for solidifying savings habits, investing in children’s education, and increasing retirement savings.

- Example: At 35, Michael and Joanne buy their first home, taking on a mortgage. They also begin saving for their children’s college funds through a 529 plan. Michael seeks a promotion at work to increase his income, directing the additional earnings into their retirement accounts.

Late Midlife (Ages 45-59)

Financial Decisions: This period often involves preparing for retirement, helping aging parents, and reassessing investment portfolios for risk. Maximizing retirement contributions and considering long-term care options become more pressing.

- Example: Diane, at 50, realizes she needs to boost her retirement savings. She starts maxing out her 401(k) contributions and opens an IRA to catch up. With her parents facing health issues, she also investigates long-term care insurance for them and herself.

Retirement (Ages 60+)

Financial Decisions: In retirement, managing living expenses with a fixed income, withdrawing from retirement accounts strategically, and estate planning are key focuses. Decisions about downsizing, relocating for retirement, and gifting to heirs or charities also come into play.

- Example: At 65, Raj retires and decides to downsize to a smaller home, reducing his living expenses. He carefully plans withdrawals from his retirement accounts to minimize taxes and ensure his savings last. He also updates his will and considers establishing a charitable fund.

Across Life Stages

Financial Impact: The examples demonstrate how financial decisions evolve, impacting income, savings, and investment strategies throughout life.

- Young Adulthood: Establishing credit, managing student debt, and starting to save early can set the foundation for financial stability.

- Early Midlife: Homeownership, family planning, and career development play significant roles in shaping financial futures, emphasizing the importance of balancing near-term expenses with long-term savings and investments.

- Late Midlife: Preparing for retirement becomes paramount, with a focus on maximizing savings, managing investment risks, and considering healthcare and long-term care needs.

- Retirement: Managing withdrawals and income sources to maintain a desired lifestyle, alongside estate planning, highlights the culmination of lifelong financial planning and decision-making.

4.3 Pursuing Financial Independence

Financial independence is achieved when you have sufficient wealth to live on without needing to work actively for basic necessities. It’s about gaining the financial freedom to make choices that allow you to enjoy your life fully.

Strategies for Financial Independence:

- Investing Wisely: Build a diversified investment portfolio to generate passive income over time.

- Controlling Debt: Avoid high-interest debt and pay off existing debts to free up more of your income.

- Living Below Your Means: Adopt a lifestyle that allows you to save and invest a significant portion of your income.

Example: Sarah prioritizes financial independence by contributing regularly to her retirement accounts, maintaining an emergency fund, and living frugally to ensure she can eventually live off her investments without needing to work.

4.4 Creating and Implementing a Financial Plan

A comprehensive financial plan serves as a roadmap for achieving your financial goals, encompassing income management, budgeting, savings, investments, and risk management.

Prioritizing Goals

Identify and rank your financial goals based on their importance and the timeline for achieving them. This prioritization helps focus your efforts on what matters most.

Example: Jack ranks buying a home as his top priority, followed by saving for retirement and setting up a college fund for his children.

Developing a Timeline

For each goal, establish a timeline that specifies when you aim to achieve it. Short-term goals might be achievable within a year, medium-term goals within one to five years, and long-term goals may take more than five years.

Example: Mia plans to save for a down payment on a house in three years, setting aside a fixed amount each month towards this medium-term goal.

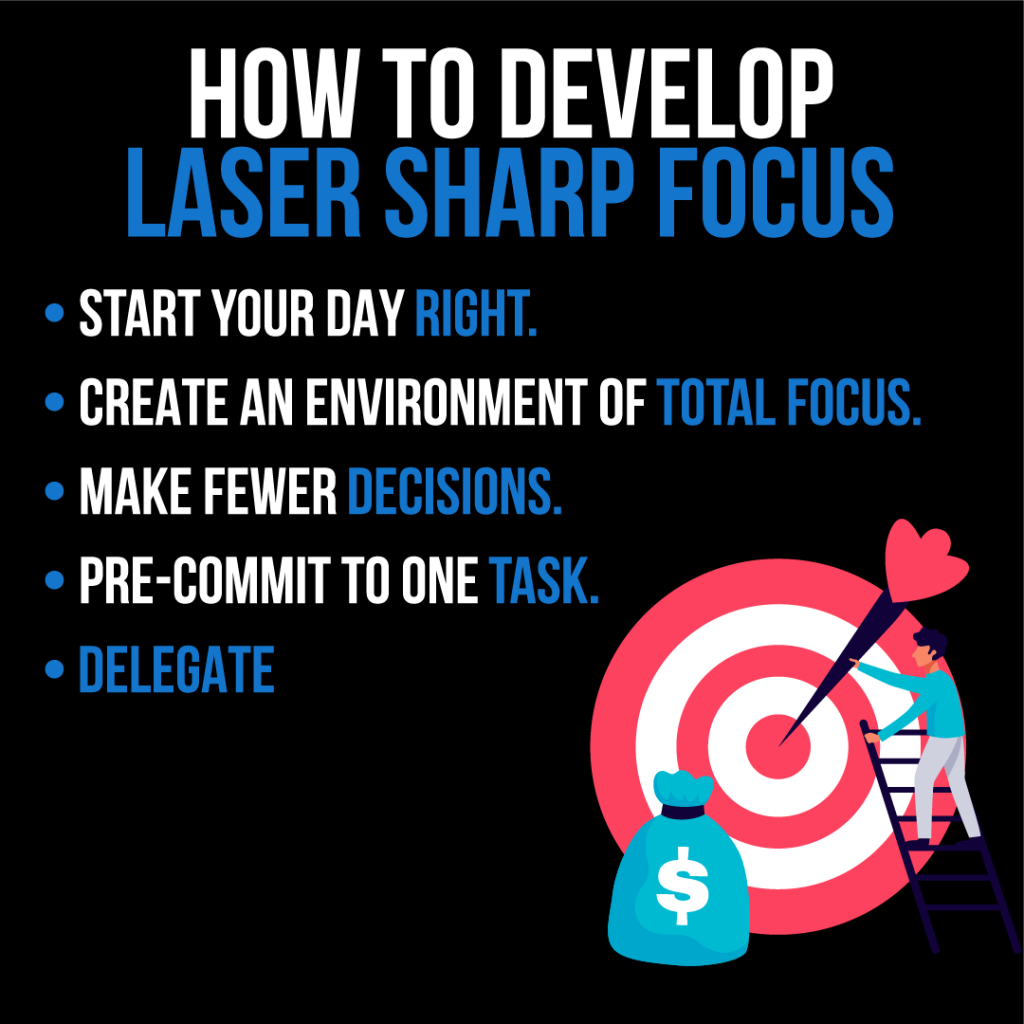

Малюнок: Gantt Chart Overview

опис:

The article from Amplify discusses the use of a Gantt chart as a tool for visualizing and planning one’s financial journey towards stability. A Gantt chart is a bar chart that represents a schedule of tasks over time, helping to organize and prioritize financial goals.

Ключові висновки:

- А Gantt chart is a practical tool for mapping out financial goals and the steps needed to achieve them.

- It helps in visualizing tasks and timelines, making the process of reaching financial stability less daunting.

- The chart should reflect realistic timelines and budgets, aligning with one’s income and expenditure to set achievable goals.

Застосування інформації:

By using a Gantt chart, individuals can create a clear and actionable financial plan. This method allows for tracking progress towards goals like debt repayment or saving for a house. Regularly referring to and updating the chart can keep individuals motivated and on track with their financial objectives. It’s a visual aid that can be particularly useful for those who are new to financial planning or who benefit from seeing their goals laid out in a structured format.

4.5 Monitoring Progress

Regularly review your financial plan to monitor progress towards your goals. Adjustments may be needed due to changes in income, expenses, or personal circumstances.

Example: Every six months, Carlos reviews his savings progress and adjusts his budget to stay on track for his goal of starting a small business.

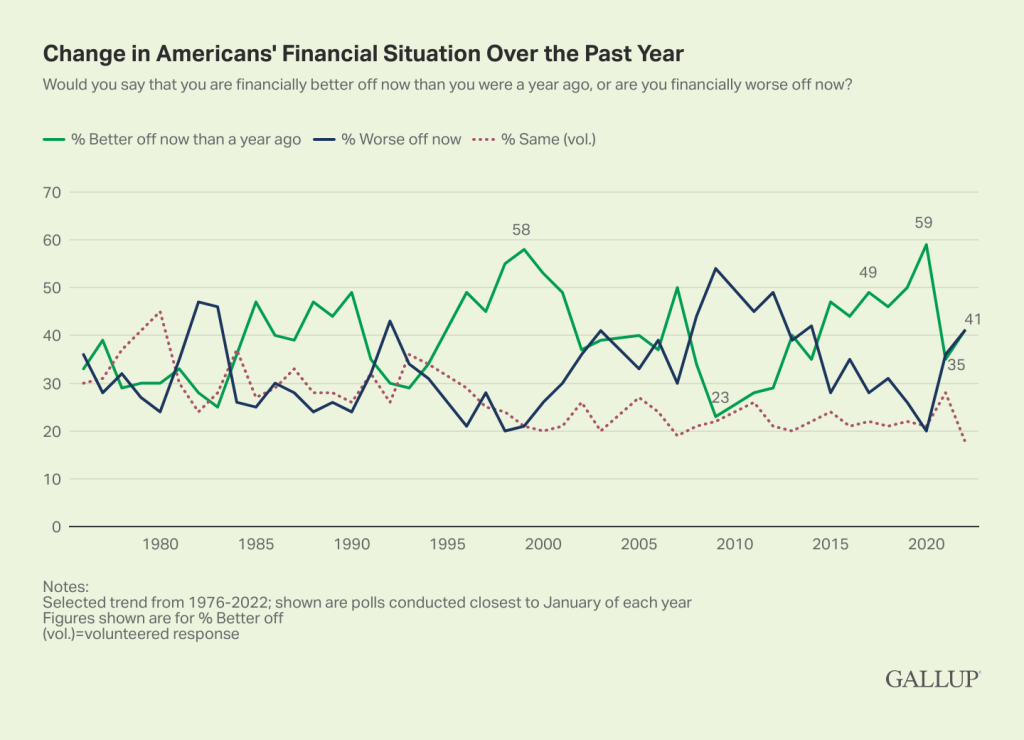

Малюнок: Change in Americans’ Financial Situation Over the Past Year

опис:

The graph depicts the change in Americans’ financial situation over several years, specifically focusing on whether they felt “better off” or “worse off” compared to the previous year. The data spans from 1980 to 2022, with a notable peak in 2020 where a record-high 59% reported feeling better off. The graph shows fluctuations over the years, with recent data indicating that 41% of U.S. adults feel they are better off financially than a year ago, a slight increase from 35% in January 2021.

Ключові висновки:

- record-high 59% of Americans felt they were financially better off in January 2020, just before the onset of the coronavirus pandemic.

- January 2021, only 35% felt they were better off, reflecting the financial impact of the pandemic.

- As of 2022, 41% of Americans believe they are financially better off than the previous year, indicating a slight recovery.

The graph also highlights periods of economic downturns, such as the early 1980s, early 1990s, and the period from 2008 to 2012, where more Americans felt they were financially worse off.

Застосування інформації:

This data provides insights into the financial sentiments of Americans over several decades, reflecting economic conditions, global events, and policy changes. For investors and financial analysts, understanding these trends can offer valuable context when making investment decisions or forecasting economic shifts. Recognizing the factors that influence public sentiment can also guide policymakers in addressing economic challenges and ensuring financial stability for citizens.

4.6 Philanthropy and Charitable Giving

Philanthropy involves donating money, time, or resources to charitable causes for the satisfaction of helping others and supporting community development. Individuals often choose to donate to organizations whose missions align with their values or address issues close to their hearts.

Example: A list of charitable organizations might include a local food bank, an animal shelter, and a literacy program. Donors might give to the food bank to combat hunger, support the animal shelter out of love for animals, and contribute to the literacy program to help improve education in their community.

Charitable Giving

Motivations and Benefits:

Donating to charitable and non-profit organizations can provide personal fulfillment, support causes or services one values, and make a positive impact on the community. Benefits include emotional satisfaction, potential tax deductions, and contributing to meaningful change.

Example: A person might donate to a local animal shelter due to a love for animals and a desire to support animal welfare, gaining personal satisfaction and a sense of community contribution.

Researching Charitable Organizations:

When researching organizations to donate to, it’s important to verify their legitimacy, financial health, and impact. This can be done through platforms like Charity Navigator or the Better Business Bureau. Steps include checking the charity’s spending ratio, transparency, and direct impact on its cause.

4.7 Credit Reports and Scores

Credit reports and scores are critical tools used beyond lending decisions. They may influence employment opportunities, housing options, and insurance premiums, reflecting an individual’s financial reliability.

- Employment: A higher credit score can signal to employers a candidate’s reliability and responsibility, potentially affecting hiring decisions.

- Financial Benefits: Good credit can lead to lower interest rates on loans and credit cards, and more favorable terms from insurers and landlords.

4.8 Budgeting for Financial Goals

A budget is a plan for managing income and expenses, allowing individuals to achieve financial goals through strategic allocation toward needs, wants, savings, and philanthropy.

- Adjusting for Emergencies:

Incorporating emergency funds into a budget ensures readiness for unexpected expenses, safeguarding against financial disruptions. - Budgeting Tools:

Utilizing tools like apps or spreadsheets can simplify tracking spending and savings, making it easier to reach financial goals.- Example: Mint is a popular budgeting tool that connects with your bank accounts, credit cards, loans, and investments to provide a comprehensive view of your financial status. It automatically categorizes transactions, helping users track spending, set budgets, and identify areas where they can cut back to reach financial goals more efficiently. The app also offers personalized insights, bill tracking, and savings suggestions, making it easier to manage finances and work towards financial objectives.

- Example #2: After tracking expenses, Maya realizes she can allocate more towards her savings goal by reducing dining out.

4.9 Financing Post-Secondary Education

Financing education often involves a combination of scholarships, grants, student loans, work-study programs, and savings. Understanding and accessing these resources can significantly reduce the burden of education costs.

- FAFSA: The Free Application for Federal Student Aid is crucial for assessing eligibility for federal aid, scholarships, and work-study programs.

- Community College: Attending a community college for the first two years before transferring to a four-year institution can significantly reduce the total cost of education.

- Community colleges typically have lower tuition rates, and students can save on room and board by living at home.

- For example, if the annual cost at a community college is $3,500 compared to $20,000 at a four-year university, students can save over $30,000 in tuition alone for the first two years, not including potential savings on housing and other expenses.

- Example #2: Alex applies for scholarships and plans to attend a community college for two years to minimize student loan debt, understanding the long-term benefits of lower education costs.

- Scholarships: Money awarded based on merit, such as academic achievement, athletic skills, or community involvement, that does not need to be repaid.

- Institutional Scholarships: Many colleges offer their own scholarships based on various criteria. Visit the school’s financial aid website or office.

- Private Scholarships: Organizations, companies, and foundations offer scholarships based on academic merits, hobbies, and personal interests. Websites like Fastweb and Scholarships.com can help identify these opportunities.

- Institutional Scholarships: Many colleges offer their own scholarships based on various criteria. Visit the school’s financial aid website or office.

- Grants: Need-based financial aid that does not require repayment, often provided by federal and state governments.

- Student Loans: Borrowed money for education that must be repaid, with interest. Federal student loans often offer lower interest rates and more flexible repayment options compared to private loans.

- Work-Study Programs: Federally or institutionally funded programs that allow students to work part-time while attending school to earn money for education expenses.

- Savings and Personal Funds: Money saved by the student or their family specifically for education expenses.

Each option has its advantages and implications for long-term financial well-being.

Real-Life Scenario: A student pursuing a career in engineering researches scholarships available for STEM fields, applies for federal student loans with an understanding of the interest rates and repayment terms, and works part-time to minimize debt.

4.10 Community Support and Corporate Responsibility

Philanthropic, charitable, and entrepreneurial organizations play crucial roles in community development. Supporting organizations aligned with personal values enhances community welfare and quality of life.

- Philanthropy involves the donation of money to causes aimed at improving societal welfare and quality of life. It’s often associated with large-scale donations by wealthy individuals or foundations.

- A person might donate to an environmental charity because they’re passionate about climate change.

- A person might donate to an environmental charity because they’re passionate about climate change.

- Volunteer service is the act of offering time and skills to support a cause without financial compensation. It directly impacts community development through hands-on work.

- Charities are organizations that conduct philanthropic activities to meet specific societal needs. They rely on donations and volunteers to operate.

While philanthropy focuses on financial contributions and charities manage those funds to implement projects, volunteer service provides the manpower. Each plays a distinct role in fostering community development across cultures.

- Corporate Governance: Researching companies with policies supporting the common good can guide responsible investing and purchasing decisions.

4.11 Corporate Governance Supporting the Common Good and Human Rights

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. Companies with governance policies that support the common good and human rights often:

- Prioritize Sustainable Practices: They incorporate environmental sustainability into their business models, reducing their carbon footprint and promoting conservation.

- Ensure Fair Labor Practices: These companies adhere to fair labor standards, including equitable wages, safe working conditions, and respecting workers’ rights to unionize.

- Promote Diversity and Inclusion: They commit to diversity in hiring, fostering inclusive work environments that respect and celebrate differences.

- Engage in Community Development: They invest in local communities through philanthropy, volunteer initiatives, and economic development projects.

- Uphold Ethical Standards: They maintain high ethical standards in their operations, including transparency in financial reporting and integrity in their dealings with stakeholders.

приклад: Patagonia, Inc., known for its environmental activism, uses sustainable materials and practices, supports global conservation efforts, and ensures its supply chain reflects its commitment to ethical and fair labor practices. Its corporate governance model exemplifies a commitment to the common good and human rights.

4. 12 Choosing Financial Institutions

Selecting financial institutions that align with personal and family goals is crucial for long-term financial planning. Evaluating the benefits and drawbacks of different financial products and services ensures that choices support overall financial objectives.

Developing a plan involving various financial institutions might include:

- Using a credit union for lower interest rates on loans and personalized customer service.

- Choosing a credit union for its lower fees and community-focused services aligns with Sarah’s goal of buying a home within five years.

- Choosing a credit union for its lower fees and community-focused services aligns with Sarah’s goal of buying a home within five years.

- Investing with an online brokerage for lower fees and a wide range of investment options.

- Opening a high-yield savings account at an online bank for emergency funds.

- Long-term Planning: Developing a plan that leverages the strengths of various financial institutions can optimize savings, investments, and loan strategies, paving the way for achieving significant goals like college education and retirement.

4. 13 Benefits and Drawbacks of Financial Products

- Banks offer reliability and a full range of services but might have higher fees and lower interest rates on savings.

- Credit Unions provide lower fees and better interest rates but might have fewer branches and ATMs.

- Check-cashing stores offer convenience but at a high cost.

- Product warranty insurance provides protection against future product failures but can be expensive relative to the value it provides.

4.14 Estate Planning and Legal Responsibilities

Understanding estate planning and the legal aspects of financial actions ensures the protection of assets and supports responsible community membership.

- Estate Planning Documents: Wills, durable power of attorney, and healthcare proxies are essential for managing personal and family affairs, highlighting the importance of early planning.

- Will: Specifies how your assets should be distributed after your death.

- Durable Power of Attorney: Authorizes someone else to make financial or legal decisions on your behalf if you become incapacitated.

- Living Will: Outlines your wishes regarding medical treatment if you’re unable to communicate those decisions yourself.

- Health Care Proxy: Appoints someone to make healthcare decisions for you if you’re unable.

4.15 Consequences of Breaking Employment or Financial laws

Breaking federal and/or state employment or financial laws can lead to severe consequences for both individuals and entities involved. These laws are designed to maintain fairness, transparency, and integrity in the workplace and the financial system. Here are the primary consequences of such violations:

- Legal and Financial Penalties

Violators can face substantial fines and legal penalties. For example, companies that breach labor laws may be required to pay back wages, damages to affected employees, and hefty fines imposed by regulatory bodies. Similarly, financial fraud or insider trading can result in multimillion-dollar fines to both the individuals involved and the corporations they represent.

- Criminal Charges and Imprisonment

Serious violations, especially those involving fraud, embezzlement, or other forms of financial malfeasance, can lead to criminal charges. Convictions in such cases may result in imprisonment. For instance, individuals found guilty of insider trading can face significant jail time, highlighting the legal system’s effort to deter such behavior.

- Civil Lawsuits

Affected parties, such as employees, customers, or shareholders, may file civil lawsuits seeking compensation for damages incurred due to the violation. This can lead to costly legal battles, settlements, or court-ordered compensation, further financially burdening the offending party.

- Reputational Damage

Violations of employment and financial laws can severely damage the reputation of individuals and businesses. Reputational harm can lead to lost business, difficulty in attracting quality employees, decreased investor confidence, and a lower stock price for publicly traded companies. The long-term impact on a business’s brand and market position can be devastating and sometimes irreversible.

- Operational Restrictions or Closure

Regulatory bodies may impose operational restrictions on businesses that violate laws. These can include revoking licenses, limiting business activities, or, in extreme cases, ordering the closure of the business. For example, a financial institution found guilty of money laundering practices might face restrictions on its operations or even be forced to cease operations.

- Increased Scrutiny and Monitoring

Businesses and individuals found in violation of laws may be subjected to increased scrutiny by regulatory agencies. This can include more frequent audits, monitoring of business practices, and reporting requirements. The increased oversight can lead to higher operational costs and further limit the entity’s ability to conduct business as usual.

- Loss of Professional Licenses

Individuals in regulated professions (e.g., law, accounting, healthcare) who violate laws may face disciplinary actions, including the suspension or revocation of their professional licenses. This can effectively end their careers in their respective fields.

Example: In a notable case, Enron Corporation’s fraudulent practices led to its bankruptcy, criminal charges against company executives, and significant regulatory reforms in corporate governance and accounting practices. The Sarbanes-Oxley Act was enacted in response to this and similar scandals to protect investors from the possibility of fraudulent accounting activities by corporations.

4.16 Cross-Cultural Perspectives on Financial Behaviors

Financial planning is shaped not only by individual values and goals but also by cultural attitudes, assumptions, and behaviors surrounding money. In different cultures, norms related to saving, spending, charitable giving, and even discussions about money vary widely.

For instance, in some cultures, it’s common for multiple generations to live together and pool resources, which influences how financial goals are set and shared. In contrast, other cultures emphasize individual financial independence and early wealth accumulation. Understanding these interrelationships can deepen one’s awareness of how culture influences financial decisions, and it encourages respect and adaptability in global financial interactions.

застосування: Compare how attitudes toward saving and investing differ between a collectivist culture (e.g., Japan or India) and an individualist culture (e.g., the U.S. or Canada). Discuss how these differences might affect family financial planning, charitable giving, or budgeting practices.

4.17 A Deeper Look at Estate Planning and Legal Implications

Estate planning includes more than having a general understanding of legal documents. Knowing the specific components і state implications is essential for ensuring one’s wishes are honored and legal issues are minimized for surviving family members.

Main Components of a Simple Will:

- Executor designation: Appoints someone to carry out the instructions of the will.

- Beneficiaries: Lists who will inherit assets.

- Guardianship provisions: Identifies caregivers for minor children.

- Asset distribution: Details how possessions and finances will be divided.

Dying Without a Valid Will (Intestate): If someone dies without a will, their assets are distributed based on state laws (called intestacy laws). These laws typically prioritize spouses and children but can vary by jurisdiction. The process can be lengthy and may not reflect the deceased’s actual wishes.

Durable Power of Attorney and Healthcare Proxy: These documents allow a trusted person to make financial or medical decisions if you are incapacitated. A Living Will outlines specific medical treatments you do or do not want.

4.18 Understanding the U.S. Financial System and Financial Institutions

While individual financial planning is crucial, having a basic understanding of the nation’s financial system enhances decision-making. The U.S. financial system includes:

- Banks and credit unions (traditional financial services)

- Financial markets (e.g., stock and bond markets)

- The Federal Reserve System, which manages the money supply and interest rates through monetary policy

For example, the Federal Reserve influences interest rates by adjusting the federal funds rate, which can affect everything from student loans to mortgage rates.

застосування: If the Federal Reserve lowers interest rates, borrowing becomes cheaper, encouraging people to take out loans or invest in business expansion. Conversely, saving may become less attractive due to lower returns.

4.19 Performing Core Banking Tasks

Being financially literate also means knowing how to perform everyday banking tasks:

- Reconciling an account: Compare your records with bank statements to ensure no errors.

- Writing a check: Still relevant in some situations; it’s vital to fill it out accurately to avoid fraud.

- Verifying account accuracy: Regularly review transactions for unauthorized activity and report issues promptly.

Practice Task: Simulate reconciling a bank statement using a budgeting app or spreadsheet, and identify any inconsistencies.

4.20 Collaborative Financial Planning

Financial decisions are often more effective when made collaboratively. Sharing financial goals with trusted individuals—like family members, financial advisors, or accountability partners—can increase the likelihood of success.

Benefits of Collaborative Planning:

- Encourages consistent progress through accountability

- Allows pooling of resources (e.g., shared family savings goals)

- Provides multiple perspectives on goal prioritization

Приклад: Siblings might collaborate on a shared goal of purchasing a property for their aging parents, combining their financial resources and setting clear milestones for saving and budgeting.

Висновок

This chapter outlines how effective financial planning, understanding credit implications, strategic budgeting, mindful philanthropy, and careful selection of financial institutions contribute to achieving personal financial goals and supporting broader community welfare.

Ключова інформація про урок:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.